Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

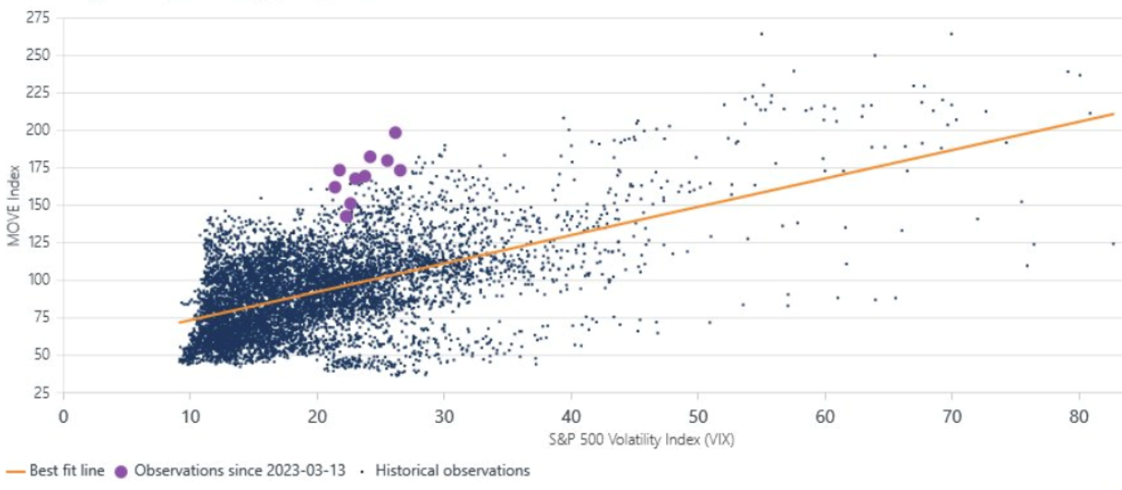

This is the first time the MOVE index has reached 200 with a VIX index below 40!

It is very rare that the volatility of the Treasury bond market (MOVE Index) is much higher than the volatility of the equity market (VIX Index)! The current level of the MOVE index should be accompanied by a VIX above 30 at least! How long will this dichotomy last? Source : Macrobond

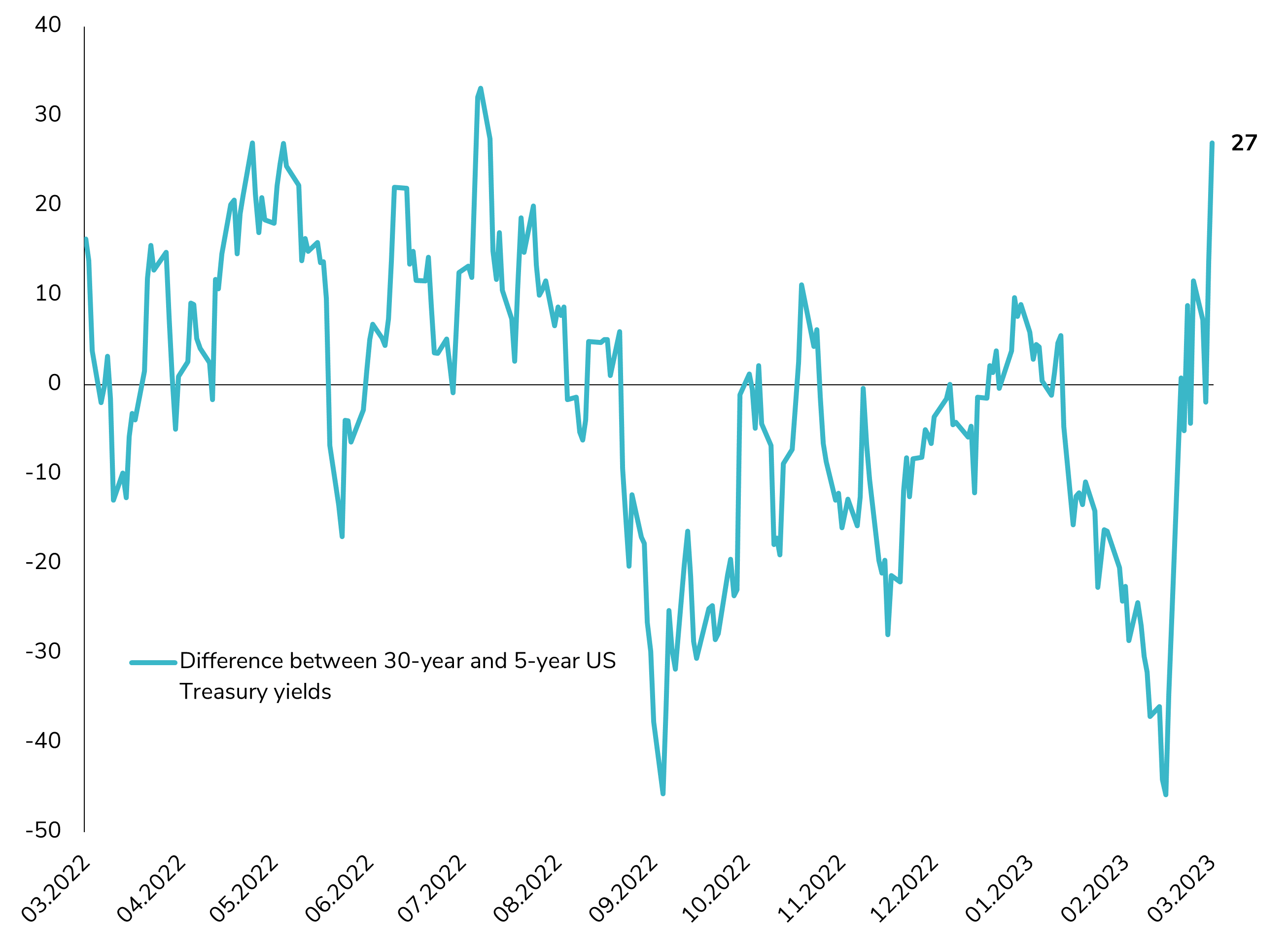

The spread between 30-year and 5-year US Treasury yields is positive again!

The difference between the 30-year and 5-year U.S. Treasury yields has risen sharply, which is another signal sent by the market regarding the FED's monetary policy (reduction by the end of the year?) and concerns about the current situation of the U.S. economy. It is interesting to note that the last time the US yield curve (30y-5y) was in negative territory before rising sharply was just before the internet crisis (2001) and the global financial crisis (2008)... More volatility ahead? Source: Bloomberg

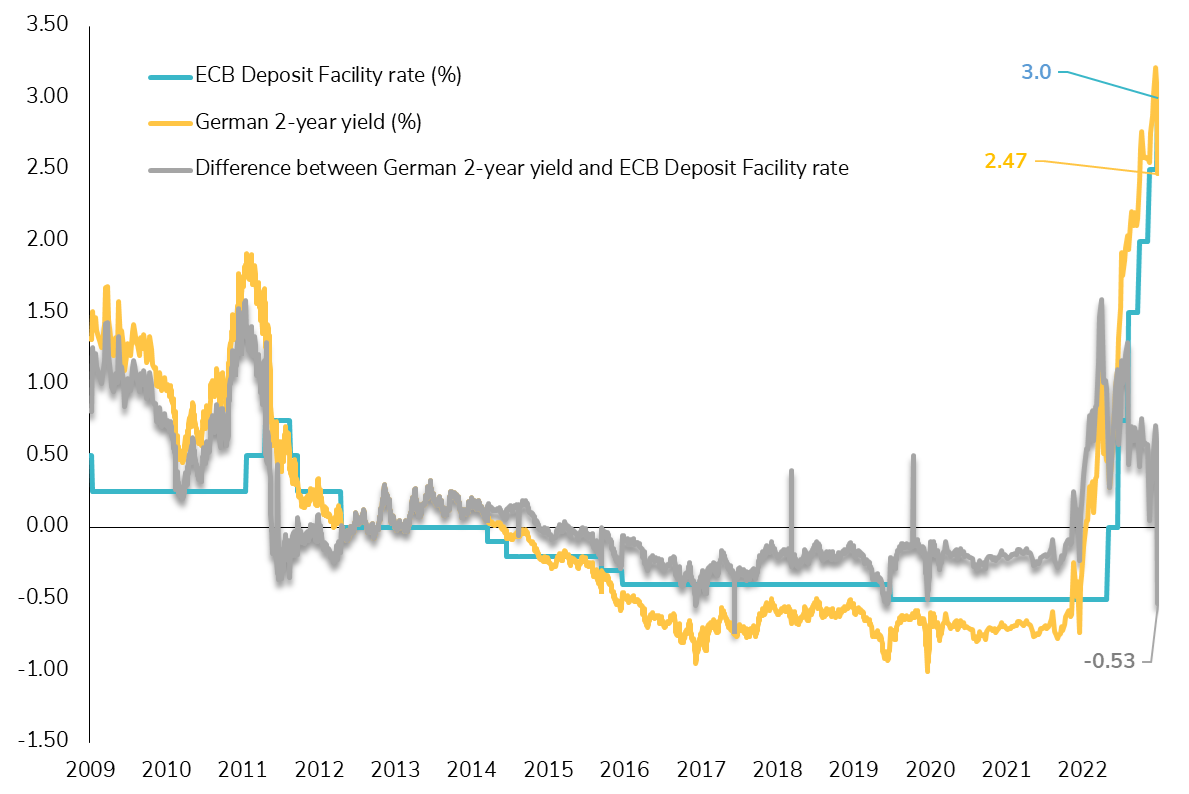

The European rate market sends a signal to the ECB!

For the first time in this rate hike cycle, the German 2-year yield is below the ECB deposit facility rate. Furthermore, the difference between the German 2-year yield and the ECB deposit facility rate is at its lowest level (-0.53%) since 2008. Another market signal of an ECB monetary policy mistake? Not sure, considering the current level of inflation in Europe. Source: Bloomberg

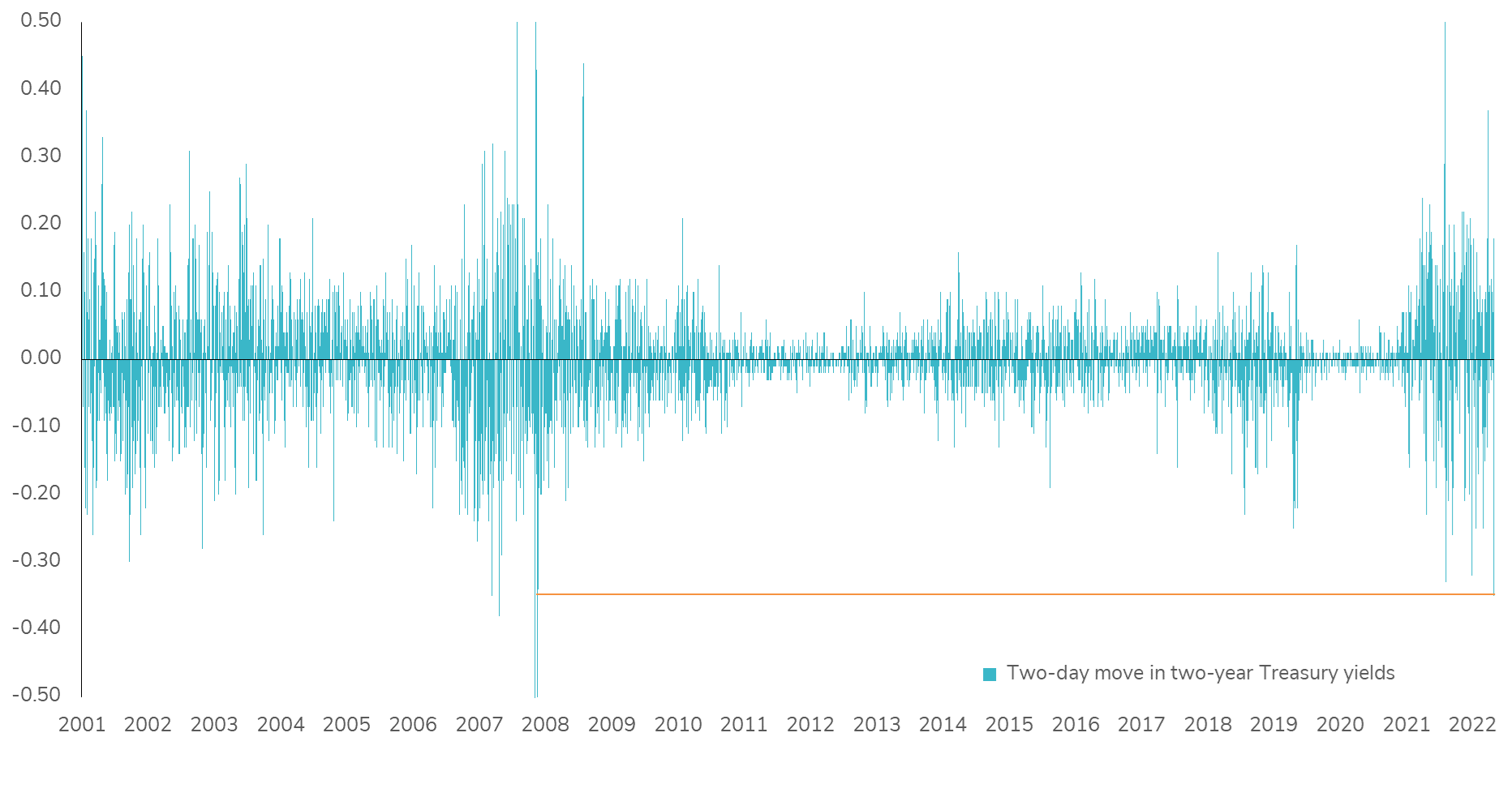

Highest interest rate volatility since GFC!

The MOVE index, which measures interest rate volatility, has reached its highest level since the Global Financial Crisis. Tensions are extreme in the bond market between the stress in the US financial system triggered by the collapse of the Sillicon Valley bank and inflation that remains high. Uncertainty around the next FED decision next week has rarely been so high and especially in opposite directions: hike, pause, cut, everything remains open. But how will the market react if the Federal Reserve does not raise rates when the CPI core services ex shelter index was released today at its highest level since September? Source : Bloomberg.

No Fed hike in March ? Seriously ??

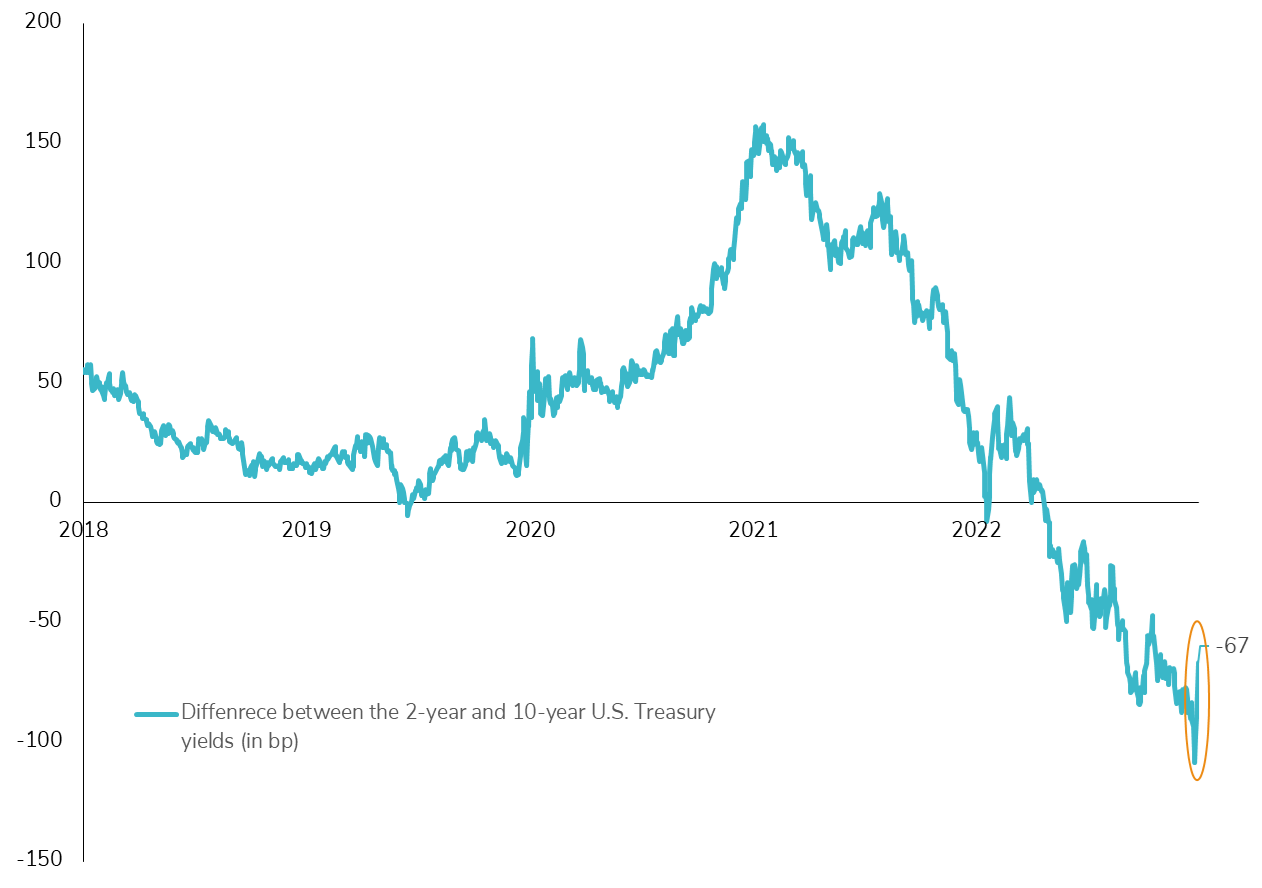

The U.S. Treasury market is repricing all of the weekend's news regarding the SVB story. The result is a massive steepening of the U.S. yield curve, where the front end has massively outperformed the back end. Goldman Sachs is the first bank to declare that the Fed will not raise rates at its March FOMC meeting. Is the Fed's pivot back? Source: Bloomberg.

Biggest two-day drop since 2008 for the 2-year US Treasury yield!

What a week for the Treasury market! Following the SVB story and the U.S. jobs report, the U.S. yield curve rallied sharply, with the front end leading the way. Indeed, the 2-year US Treasury yield has dropped nearly 50 bps (!) in two days. The reversal is significant => the market has now priced in an interest rate cut by year-end and is unlikely to get a 50 bps increase at the next FOMC meeting. The fear of a recession back on the agenda? Source: Bloomberg

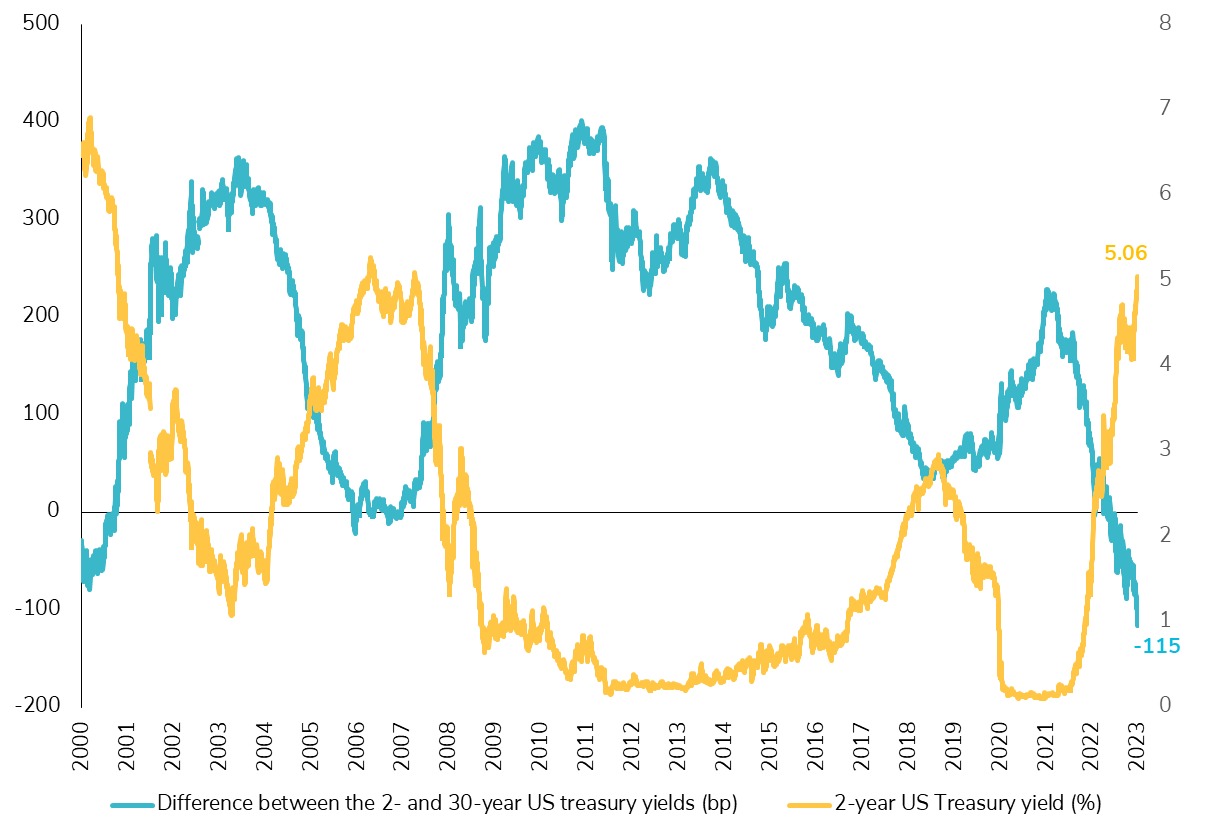

Fed Chairman Powell has tipped the US yield curve into an unknown zone!

Fed Chairman Powell shifted the U.S. Treasury yield curve into its steepest inversion ever after his hawkish remarks to Congress. He deliberately opened the door to a higher terminal rate and a 50 basis point increase at the March FOMC meeting! The market reaction was quite brutal, with the 2-year U.S. Treasury yield rising above 5% for the first time since 2007, while the spread between the 2-year and 30-year yields reached -115 basis points for the first time ever. It will be interesting to see if Powell confirms today his comments from yesterday before the House Financial Services Committee. Source: Bloomberg

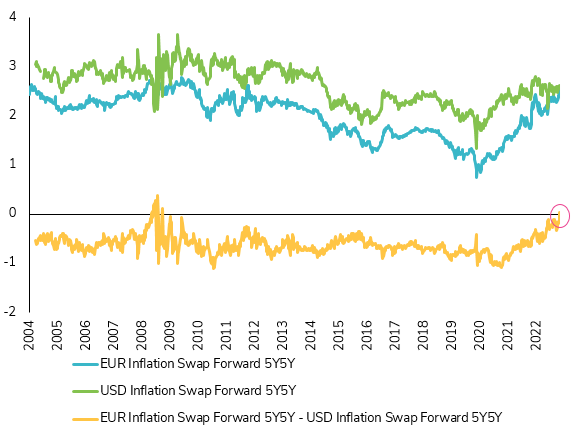

Another indicator shows that inflation is expected to be higher in EUR than in US in the medium term!

The 5y 5y forward inflation swap, an indicator of what the market expects inflation to be over the next decade, is rising faster in Europe than in the United States. In fact, markets seem to expect more inflationary pressure in Europe than in the U.S. over the medium term. This is quite significant because the last time this gap between inflation expectations in Europe and the US was in positive territory was in 2009! So more pressure on the ECB to continue tightening monetary policy! Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks