Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

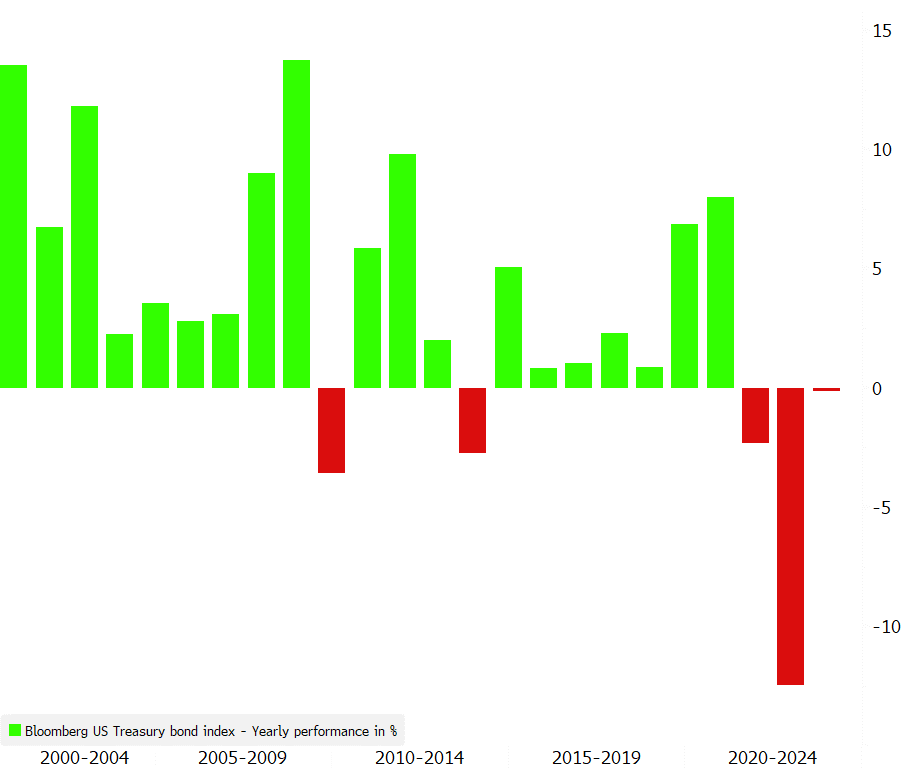

Highest default rate in the US High Yield market since september 2021!

There is some stress building in the U.S. high yield bond market, with the highest default rate since September 2021 occurring in January! While the default rate remains low (2.2% in January), U.S. high yield corporates are being downgraded at their fastest pace since 2020. A sign of future economic deterioration? Source: Bloomberg, Moody's.

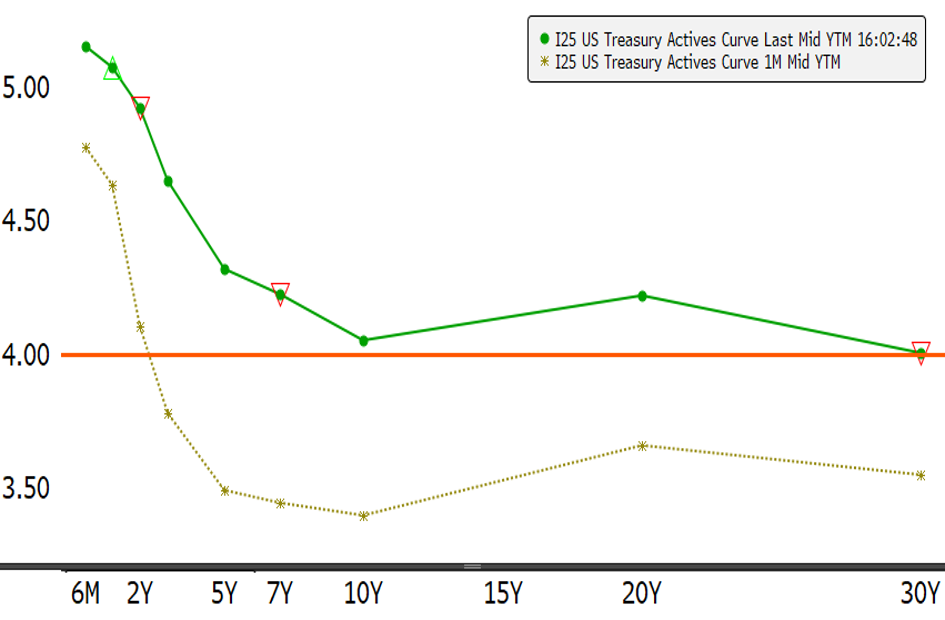

The entire US Treasury yield curve back above 4% !

What a change in one month! The 10-year U.S. Treasury yield has risen about 70 basis points in one month and the entire U.S. Treasury yield curve is now trading (each key rate) above 4%. Recent economic and inflation data has caused investors to revise their outlook on U.S. monetary policy. A terminal rate of 5.5% is now expected by September and no cut in 2023. Note that for the first time, fed fund futures prices are forecasting a higher rate for the March 24 futures contract than for the March 2023 contract. Source: Bloomberg

Long term inflation expectations higher in Europe than in US!

For the first time in more than 10 years, markets expect long-term inflation to be higher in the Eurozone than in the U.S. A direct result of the fact that the FED seems to be fighting inflation more aggressively than the ECB? Source: Bloomberg

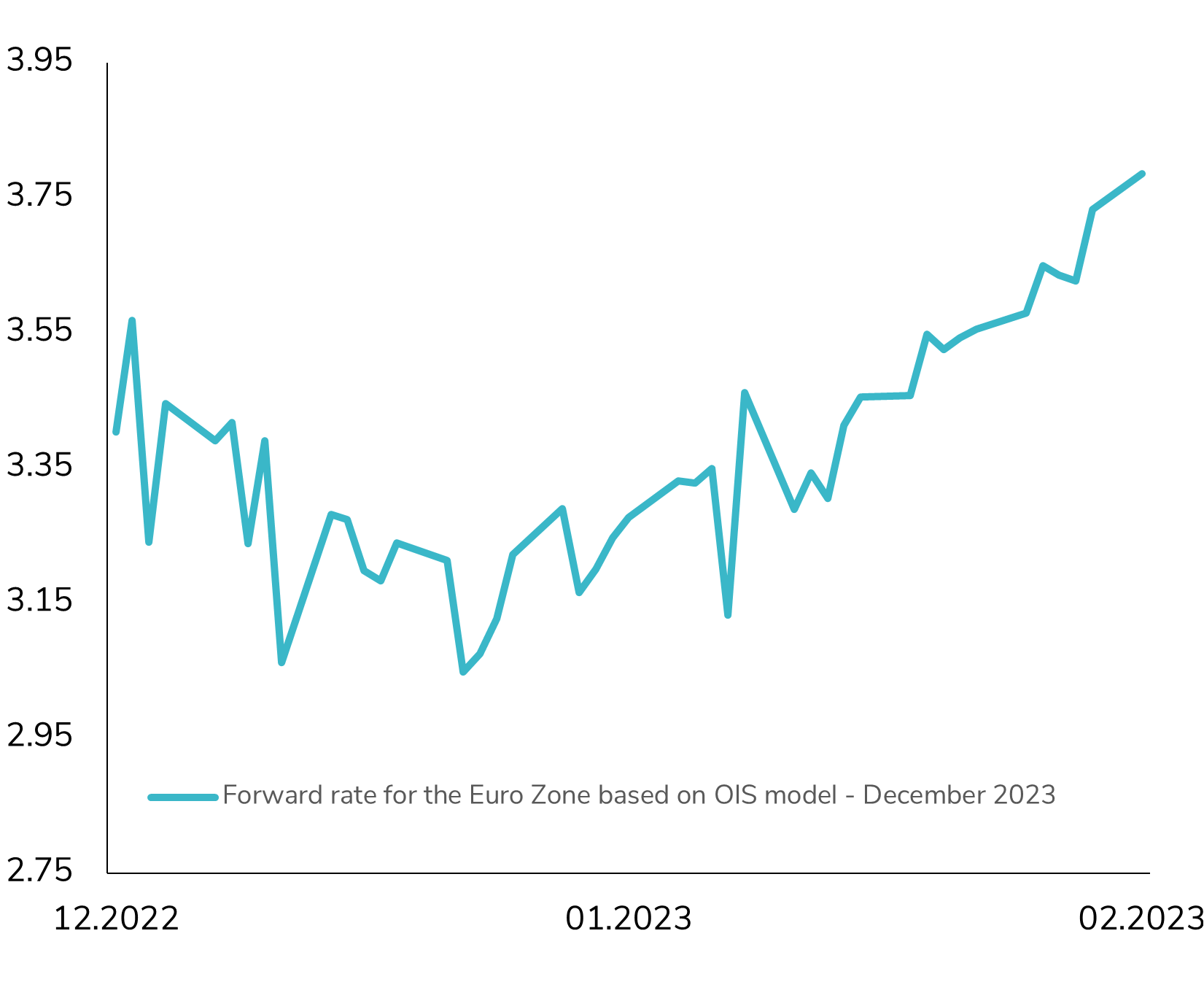

The market now expects the ECB to raise its key rate at the highest level ever!

As reflected in the European swap market, market participants expect the ECB to raise its key interest rates to a level never before seen. The terminal rate is expected to be close to 4%, up from 3.75% in the early 2000s. Interestingly, for the first time in this cycle, the markets believe that the terminal rate will be reached in 2024 (and not in 2023). Higher rates for longer? Source: Bloomberg.

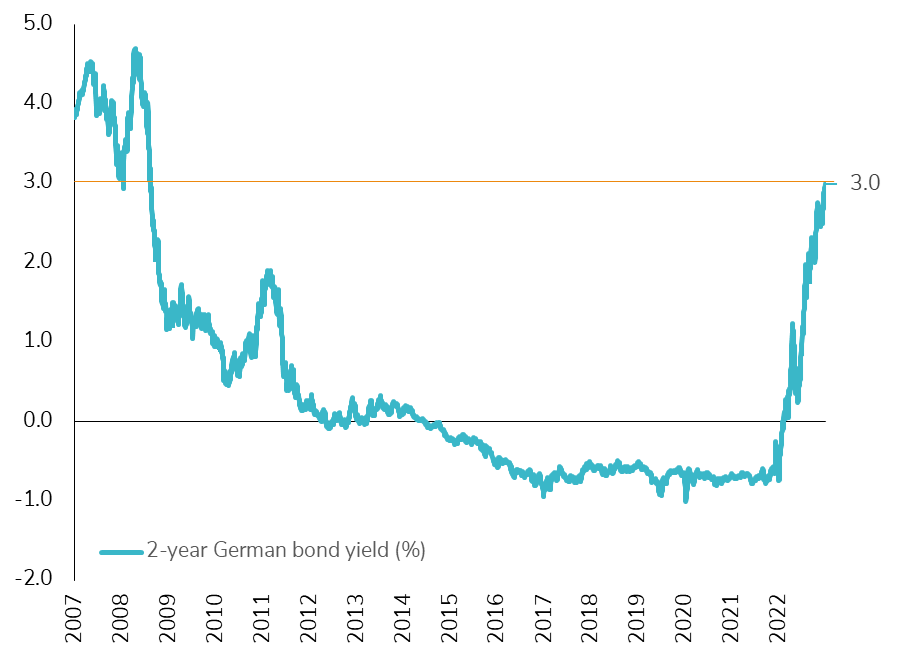

The yield on German 2-year bonds reached 3% for the first time since 2008!

While yesterday the Eurozone core CPI reached a new record of 5.3%, the German 2-year bond yield reached 3% for the first time since 2008! The ECB still has a lot of work (more than currently expected?) to do in tightening monetary policy to curb inflation, especially considering the minor impact (for now) of the Fed's monetary policy tightening on US inflation and the economy. Source: Bloomberg

Second largest daily outflow for a US high yield bond ETF!

One of the largest U.S. high-yield bond ETFs had a daily outflow of $1 billion (over 10% of assets under management) yesterday. The only time we've seen it was in June 2020. Capitulation? Source: Bloomberg

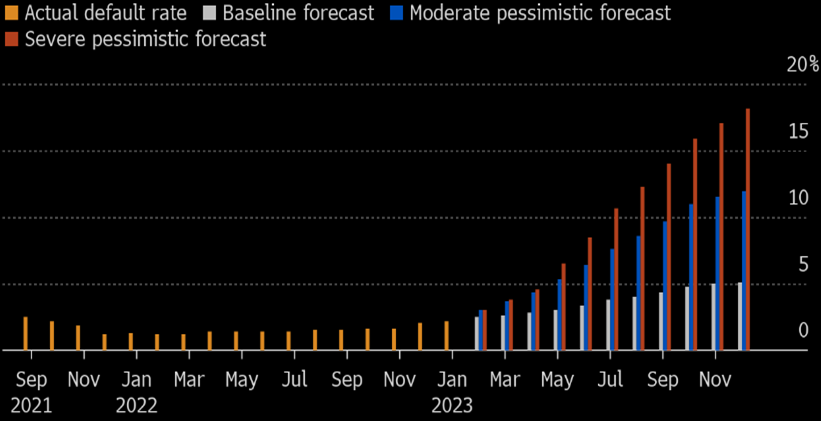

U.S. Treasury bond performance in 2023 turns negative!

For the first time in 2023, the year-to-date performance of U.S. Treasuries has turned negative (-0.14%). Yesterday, the U.S. Treasury yield curve shifted upward by about 15 basis points as the index has lost 2.6% in February so far. This sharp reversal is due to a stronger than expected resilience in the U.S. economy, which could trigger further tightening of U.S. monetary policy. Source: Bloomberg

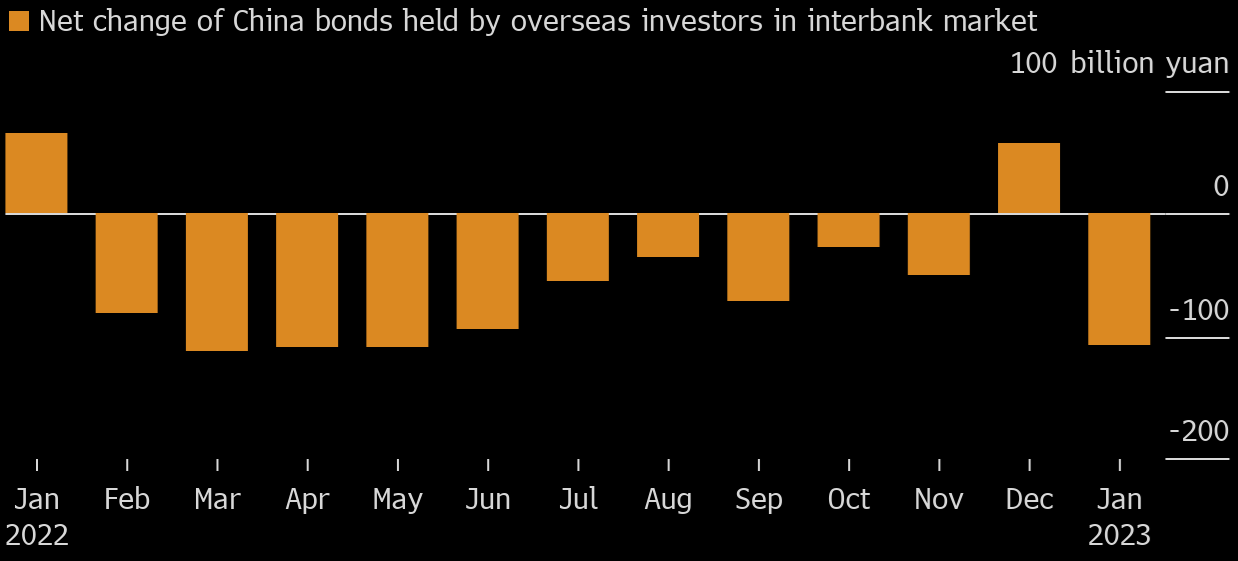

Chinese bond outflows are back!

While sentiment is positive on Chinese assets due to hopes of the economic impact of the reopening, the inflows of CNY bonds lasted only one month. In January, capital outflows resumed due to fears of accelerating inflation in Asia and particularly in China as its economy reopens. It should be noted that the PBOC (People Bank of China) is one of the few central banks to maintain an accommodating monetary policy since the beginning of the COVID. Source: Bloomberg.

Investing with intelligence

Our latest research, commentary and market outlooks

.png)