Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

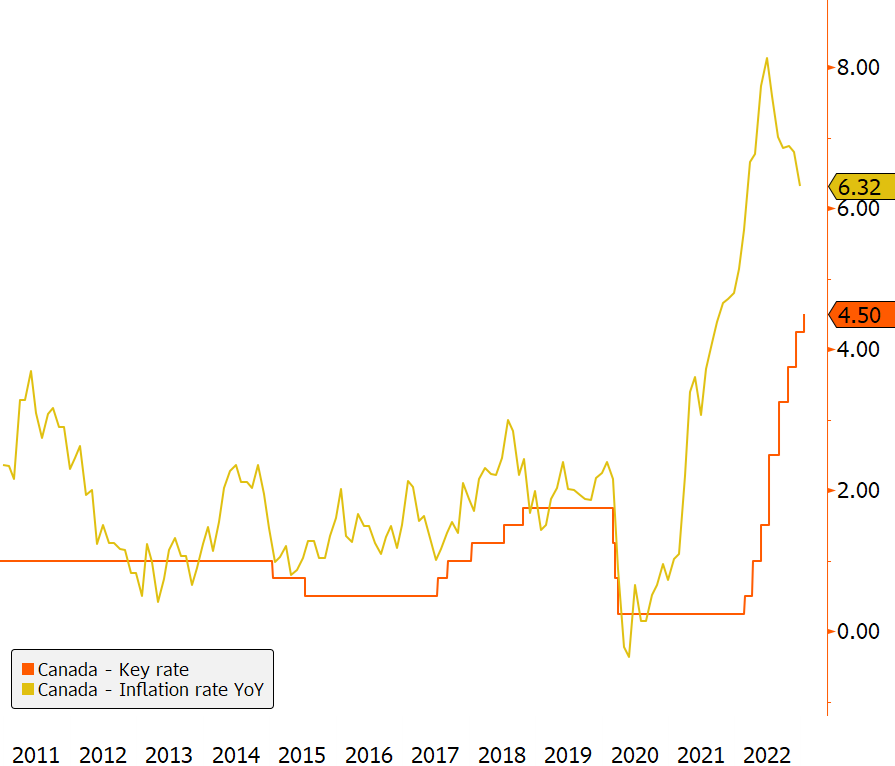

End of the tightening cycle for the Bank of Canada?

The Bank of Canada (BoC) raised its policy rate by 25bps to 4.5%, its highest level since 2008. Surprisingly, the central bank and its governor Tiff Macklem stated that the policy rate will be held at its current level unless economic data (#inflation) surprises on the upside. Source: Bloomberg.

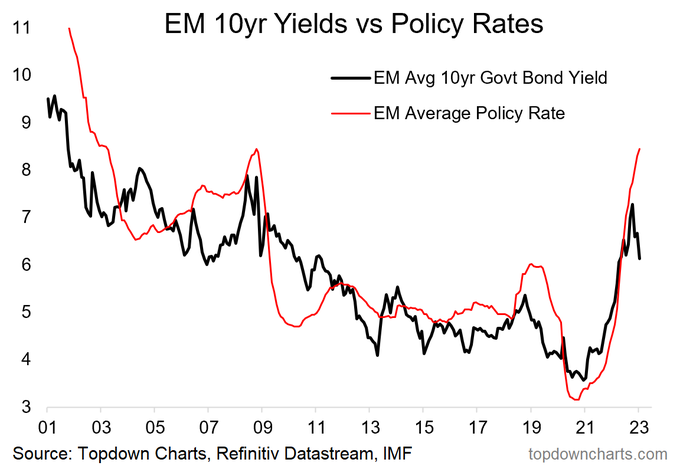

Time for emerging market central banks to pivot?

As the Citi Inflation Surprise Index for emerging markets (EM) turned negative for the first time since July 2020, the bond market appears to be hoping for a pivot from EM central banks (CBs). The end of policy tightening in EM is already visible, as the pace and magnitude of rate hikes by EM CBs has begun to slow. Source: Topdown charts.

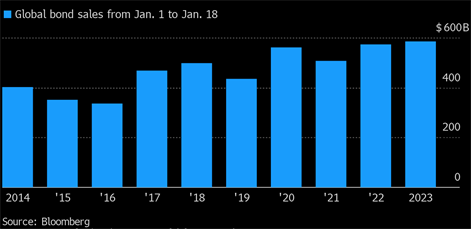

Global bond sales to record start!

In less than three weeks, governments and corporates raised nearly $600 billion in new financing, a record. This new record was helped by both the best start ever for global fixed income indices and the largest inflow into investment grade bonds in over a year. Source: Bloomberg

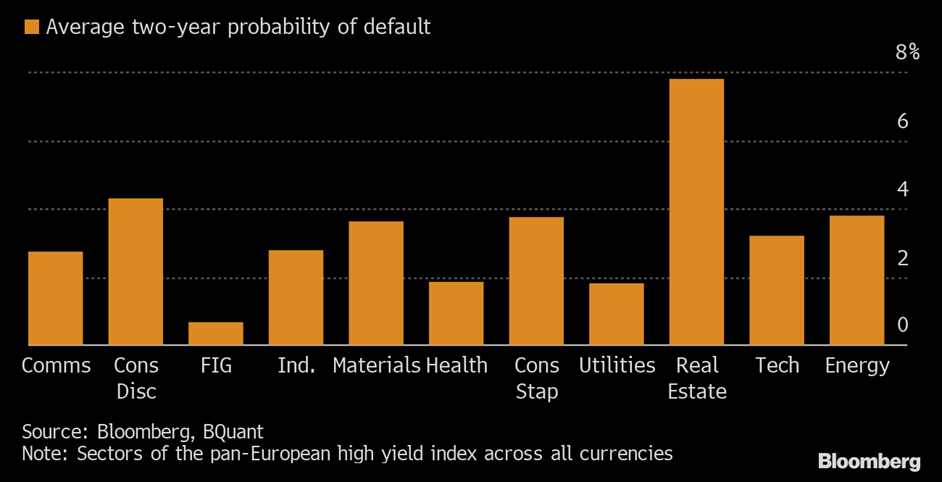

Real estate debts in Europe have the most concerns!

One of the main consequences of the sharp rise in interest rates is the level of damage it could have on the real estate sector. The European high yield market is already anticipating complicated months for the real estate sector with a cumulated default probability of 8% over the next two years , the highest of all sectors. Is the worst to come? Source: Bloomberg.

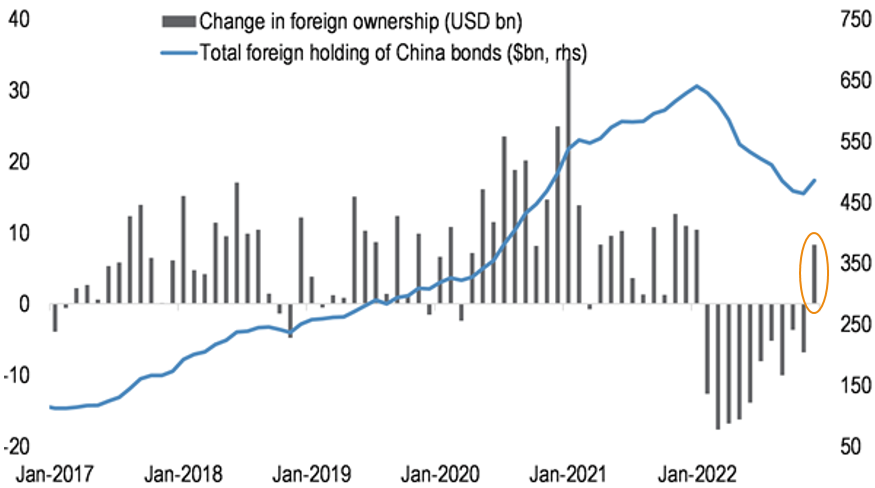

Foreign Investors are back in China bonds!

For the first time since January 2022, foreign investor flows into Chinese bonds returned to positive territory in December 2022, underscoring the region's supportive momentum. Despite this positive month, total foreign ownership declined in 2022 to a record $93 billion. Source: JPMorgan

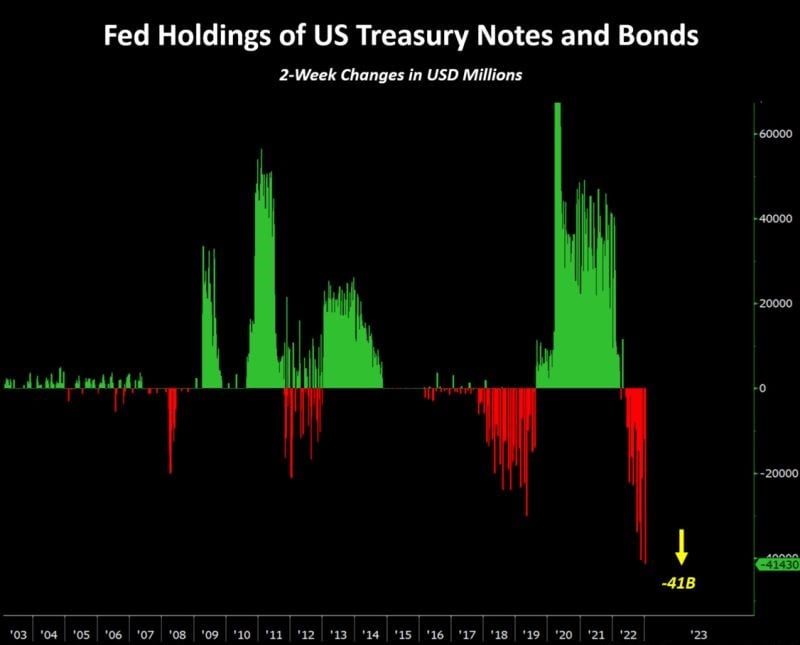

U.S. quantitative tightening is underway!

The amount of U.S. Treasury bonds held by the Federal Reserve (FED) has dropped by the largest amount ever (over $40 billion in two weeks). The reduction of the FED's balance sheet is in full swing. Source: Bloomberg, T.Costa

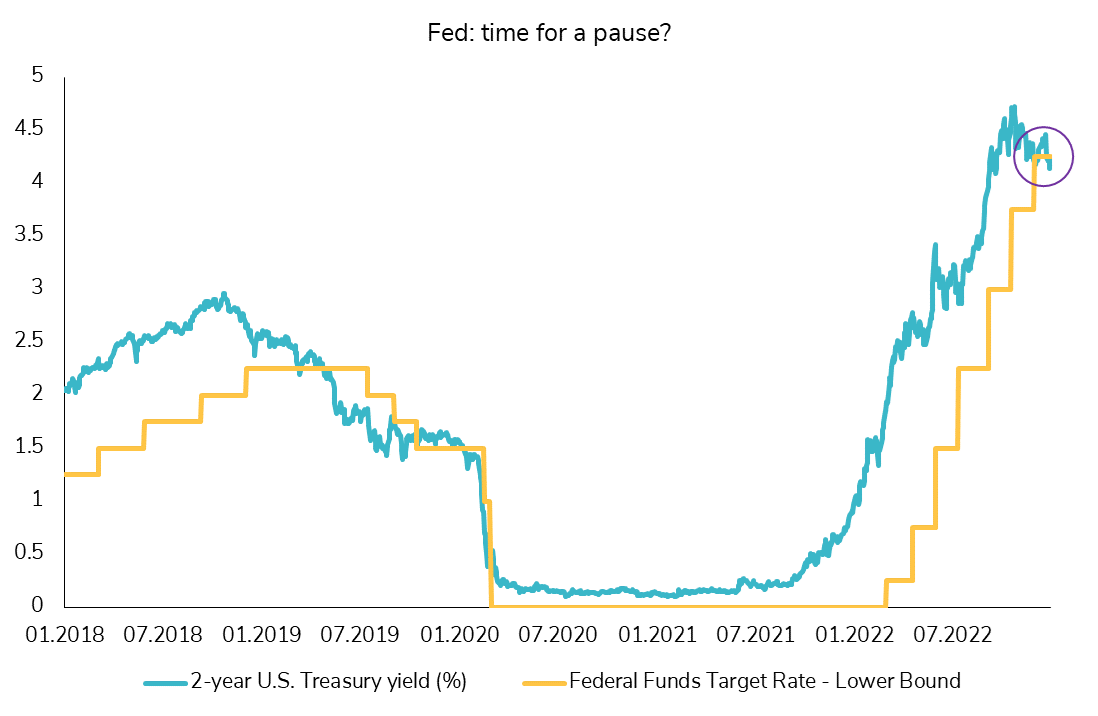

The Federal Reserve's hiking cycle: close to the end?

For the first time in this rate hike cycle, the 2-year U.S. Treasury yield is below the federal funds rate (lower bound). The market seems to be more and more convinced that this rate hike cycle of the US central bank will end soon.

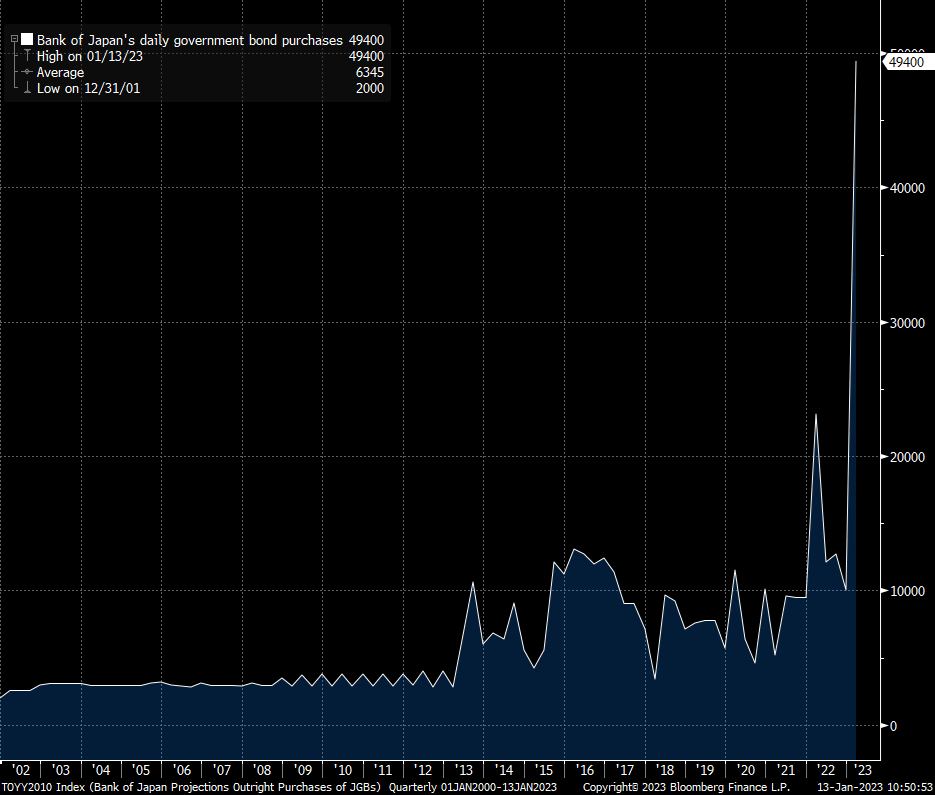

Bank of Japan's daily government bond purchases at an all-time high!

The Bank of Japan is buying huge amounts of government bonds in order to cap the yield on Japanese 10-year government bonds to 0.5%. Yesterday the BoJ bought 4.6 trillion yen and today it is close to 5t yen. Note that at the last meeting, the BoJ had decided on a 9t yen bond buying program ...per month! Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks