Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

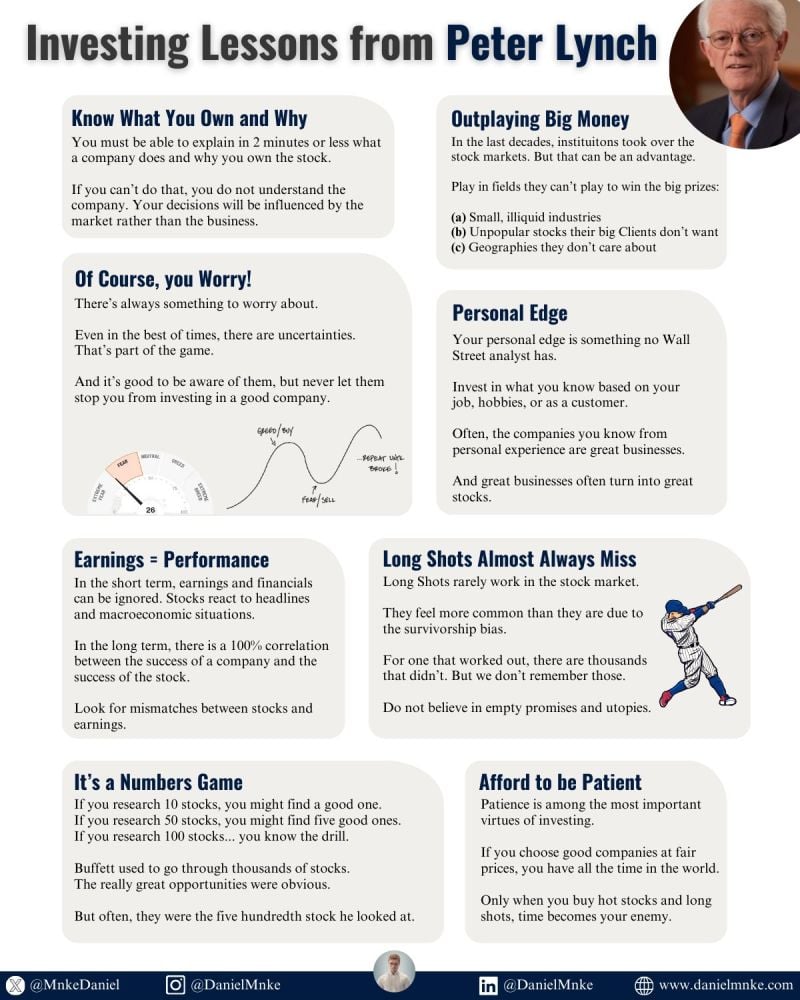

Investing lesson from Peter Lynch

Source: @MnkeDaniel on X

Since its inception in 1999, the Euro has lost 40% of its purchasing power.

To put this into perspective: 1 Euro today can only purchase about 60% of what it could back in 1999. Source: Relai 🇨🇭

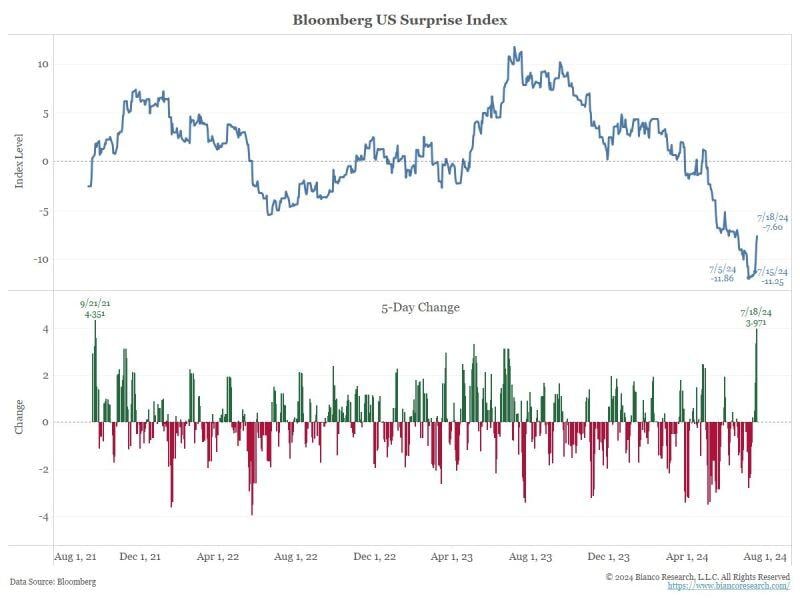

The most interesting question going into next week is whether the US economy is picking up.

Did it start with the release of the June data? Is this going to frustrate a September rate cut? The Bloomberg Surprise Index (see chart below) bottomed on July 5, the nonfarm payroll release date. Since then, it has been trending higher. The move higher over the last five days (one business week) has been the biggest since September 2021 (bottom panel). Source: Jim Bianco, Bianco Research

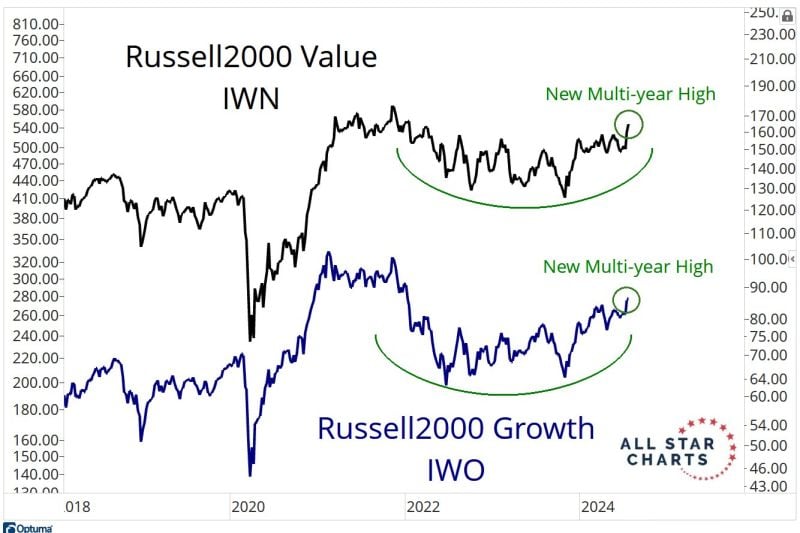

That was the highest weekly close in over 30 months for both Small-cap Growth and Small-cap Value

Source: J-C Parets

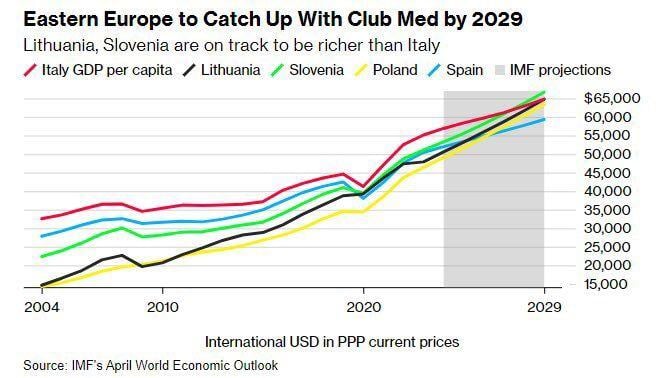

What is happening in Poland is nothing short of economic wonder.

Standard of living in Poland overtaking Spain and Italy within just one generation is amazing. Source: Michel A.Arouet, IMF

Investing with intelligence

Our latest research, commentary and market outlooks