Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

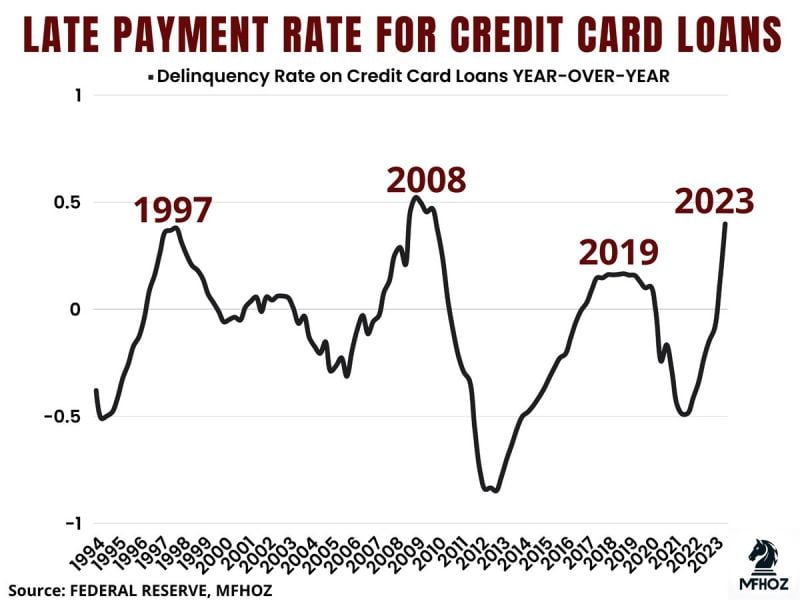

🟥 The delinquency rate for credit card loans in 2023 has risen sharply

Which, based on historical patterns, suggests that the economy might be heading towards a recession.

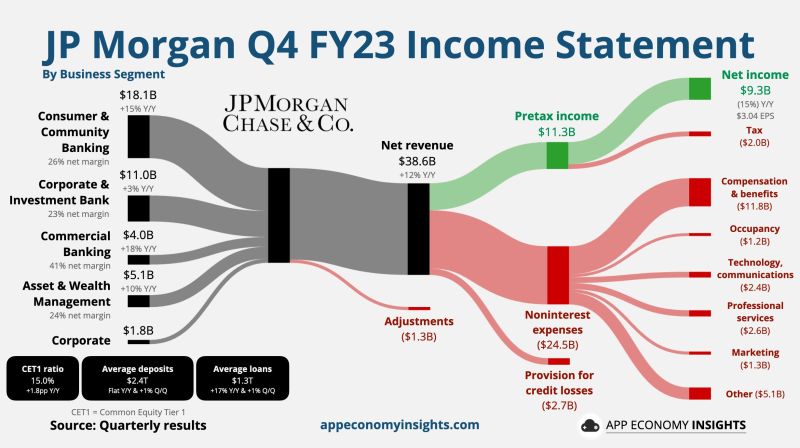

$JPM JP Morgan Chase Q4 FY23.

CEO Jamie Dimon: Deficit spending and supply chain adjustments “may lead inflation to be stickier and rates to be higher than markets expect." • Net revenue +12% Y/Y to $38.6B ($1.2B miss). • Net Income $9.3B. • Non-GAAP EPS: $3.97 ($0.37 beat). • CET1 ratio of 15.0%. • Expect FY24 NII of $90B (+1% Y/Y).

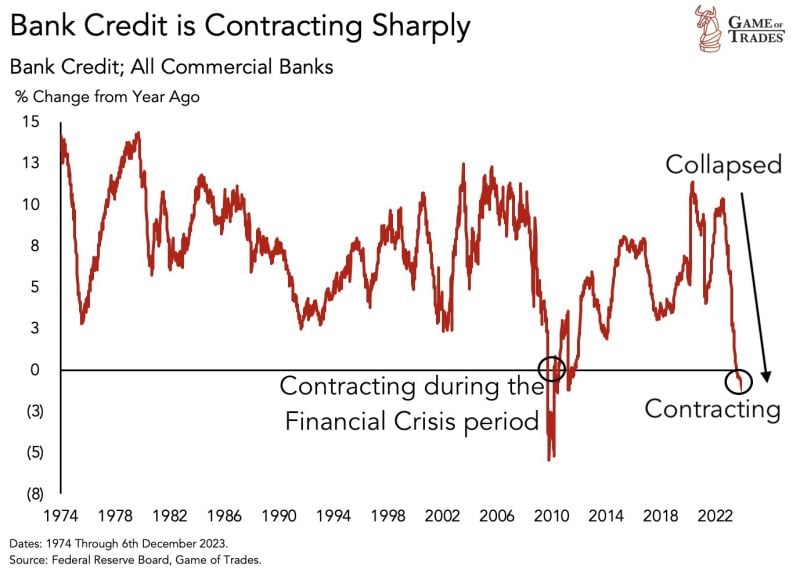

Bank credit is contracting sharply

This has only happened ONCE in the last 50 years. Source: Game of Trades

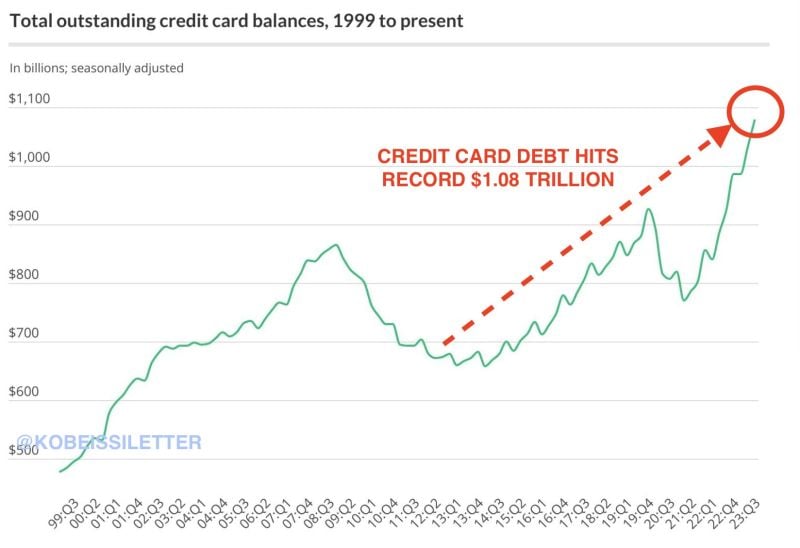

The average credit card interest rate right now has risen to 27.81%

And that's with U.S. credit card debt hitting new record highs north of $1,000,000,000,000 Source: Hedgeye

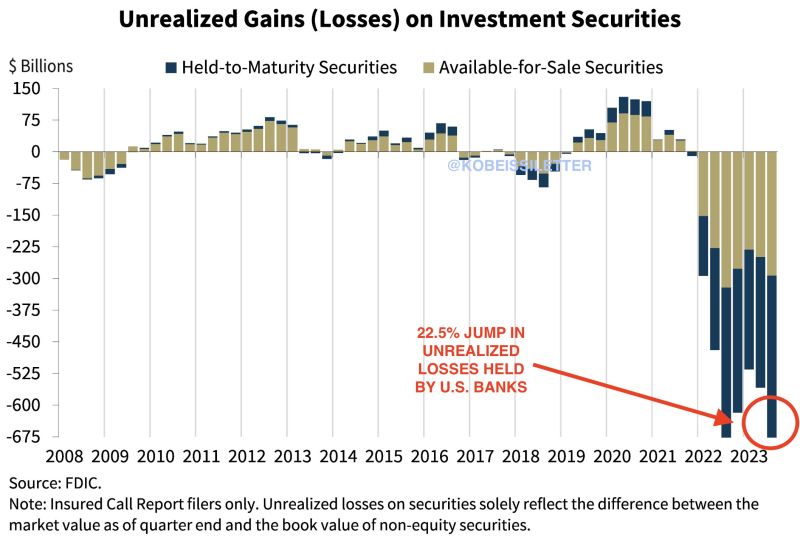

Is the US banking crisis really over?

Unrealized losses on investment securities held by US banks hit $684 billion in Q3, according to the FDIC. This marks a 22.5% jump compared to unrealized losses seen last year. The jump was primarily driven by rising mortgages rates reducing the value of mortgage-backed securities held by banks. Despite these challenges, the FDIC states that banks remain "well capitalized." This comes as usage of the Fed's emergency funding facility for banks hit another record high of $114 billion. Source: The Kobeissi Letter

As highlighted by The Kobeissi Letter >>> Buy Now Pay Later spending soars 20% compared to last year on Black Friday

It's also expected to jump 19% on Cyber Monday to a record $782 million. As excess savings in the US have gone from $2 trillion to zero, Americans are relying on debt more than ever. In other words, "deals" that are 20% off are being financed with credit card debt that has a 30% interest rate...

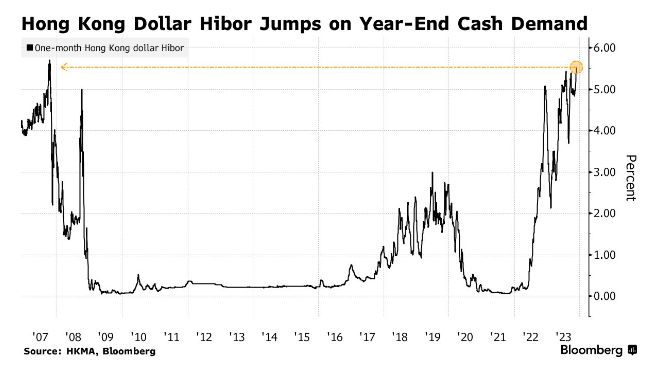

Hong Kong local bank rate (HIBOR) jumped to its highest level in 16 years

Source: Barchart, Bloomberg

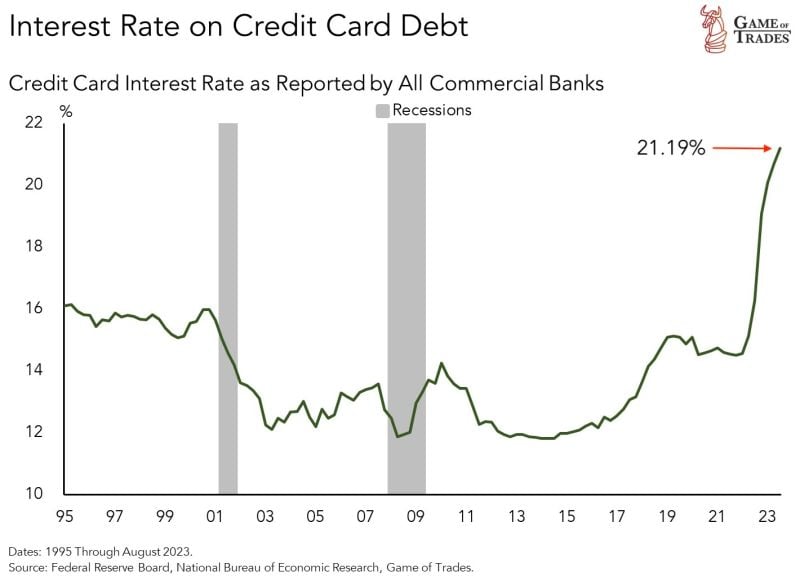

Interest rate on credit card debt has risen to 21.19%

To put this in perspective, this rate was at 14.56% in early 2022. That’s a 6% + jump in less than 2 years. Current levels have NEVER been seen in over 25 years. This is happening at a time when credit card debt has crossed the $1 trillion threshold. To make things worse, personal interest payments have crossed $500 billion. Source: Game of Trades

Investing with intelligence

Our latest research, commentary and market outlooks