Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

HolgerZ on German elections results 👇

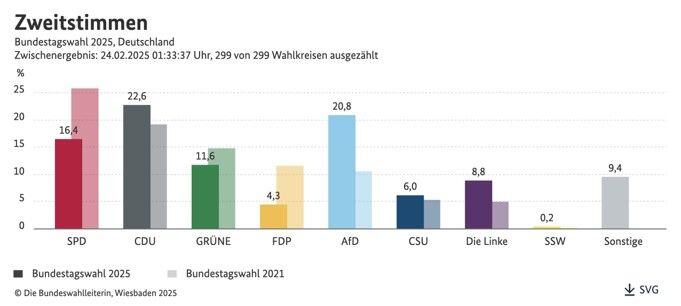

•🚨 CDU leader Friedrich Merz has emerged as the winner of a turbulent federal election. The CDU/CSU secured just 28.6% of the vote—its second-worst result in history. The SPD, expected to be the next coalition partner, collapsed to 16.4%, marking its weakest performance since World War II. Meanwhile, the far-right AfD doubled its support to 20.8%, and the Left Party also saw a significant surge, reaching 8.8%. 👉 The FDP and BSW failed to clear the 5% threshold and will NOT be represented in the Bundestag. W/just 45% of the vote, a CDU/CSU-SPD coalition is possible, avoiding the need to include the Greens, who dropped to 11.6%. 👉However, fringe parties now hold a blocking minority, making constitutional changes—such as setting up an off-budget defense or infrastructure fund or reforming the debt brake—dependent on concessions to them or impossible altogether.

German elections: the polls were spot on; no shocks, no surprises.

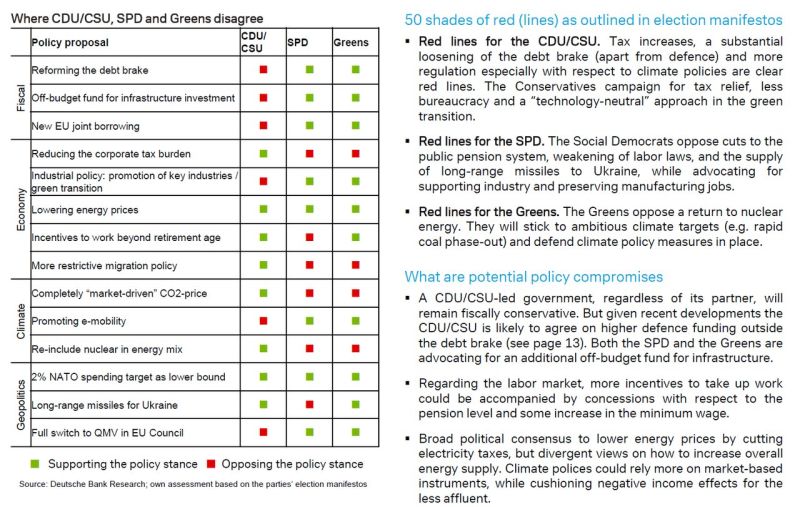

What does this mean for the new coalition government (most likely between CDU/CSU and SPD). Here is a handy primer from Deutsche Bank. Source: zerohedge, DB

EU SLAPS RUSSIA WITH NEW SANCTIONS

by Evan on X. As Trump’s administration hints at potential sanctions relief for Russia, the EU is doubling down with a fresh wave of restrictions, including a ban on Russian primary aluminum imports. Secretary of State Marco Rubio suggested that Europe will eventually have to join negotiations, stressing that “concessions on all sides” will be necessary to resolve the Ukraine conflict. Despite the shift in U.S strategy, EU leaders are holding firm, with Ursula von der Leyen insisting that the bloc remains committed to pressuring the Kremlin. Source: Euronews

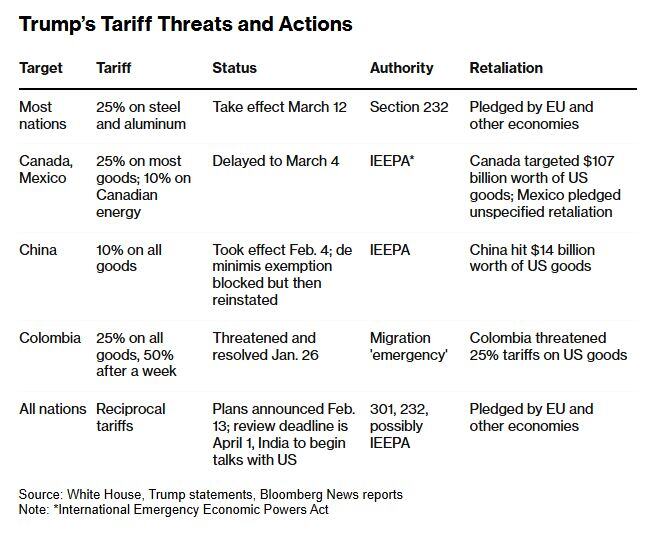

The US is being hard on Europe.

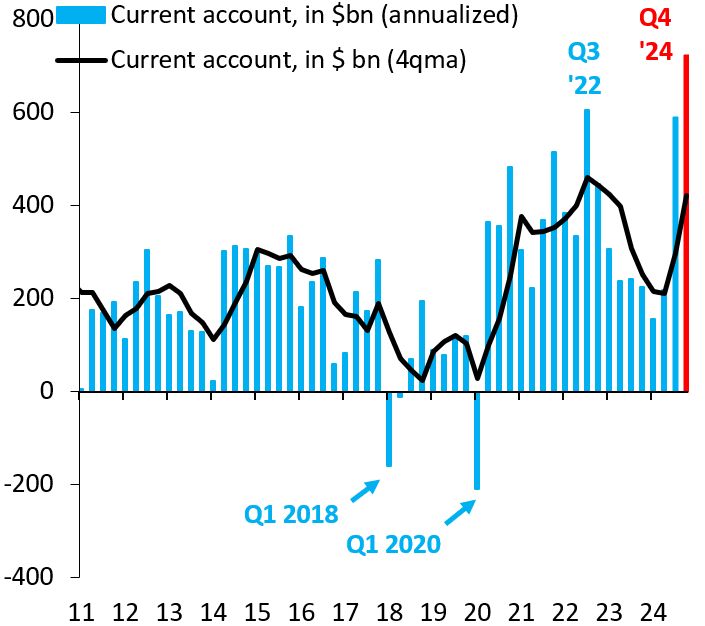

However, the true (economic) enemy for the US is not Europe but China. As shown on the chart below by Robin Brooks, China's current account surplus in Q4 '24 is the largest ever.

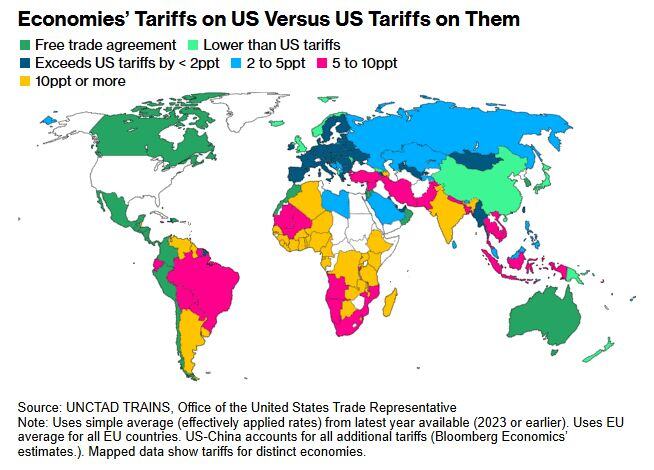

President Donald Trump has recently announced plans to implement "reciprocal tariffs"

aimed at addressing perceived trade imbalances between the United States and its trading partners. This policy intends to match the tariffs that other countries impose on U.S. exports by levying equivalent tariffs on imports from those nations. The goal is to promote fairness and encourage countries to reduce their tariffs on American goods. Source. Bloomberg, ChatGPT

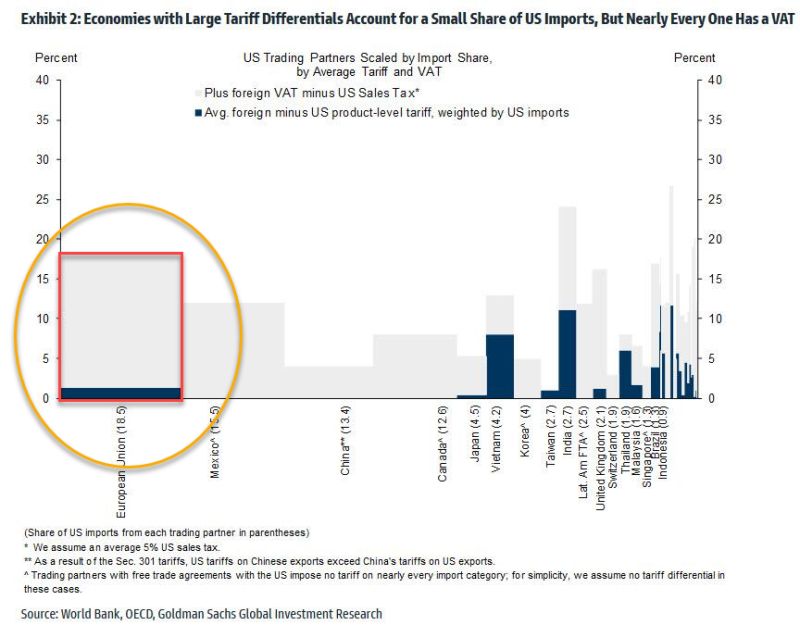

Trump will retaliate to VAT. This is potentially catastrophic for EU exporters

*TRUMP: VAT TAX WILL BE VIEWED AS A TARIFF *TRUMP: WILL CONSIDER COUNTRIES THAT USE VAT *TRUMP: PROVISIONS WILL BE MADE FOR NON-MONETARY TARIFFS The VAT response is notable because the tariff differential for the EU, for example, with and without VAT is massive and rises from just 2% (without VAT) to a whopping 18% with! And judging by Trump's comments, which said that the EU is "absolutely brutal" on trade, the inclusion of VAT is precisely meant to punish Europe. The chart below shows the amount that each country's VAT exceeds the US sales tax. And so, if indeed Trump imposes a reciprocal tariff policy also accounted for foreign VATs, it could add another 10% to the average US effective tariff rate. That could be catastrophic to exporters, and Deutsche Bank's George Saravelos agrees writing that if reciprocal tariffs are applied on a VAT basis, "European countries would be much higher on the list of impacted countries given high consumption taxes." Like Goldman, the DB strategist notes that the overall US tariff rate would increase by more than 10% Source: zerohedge

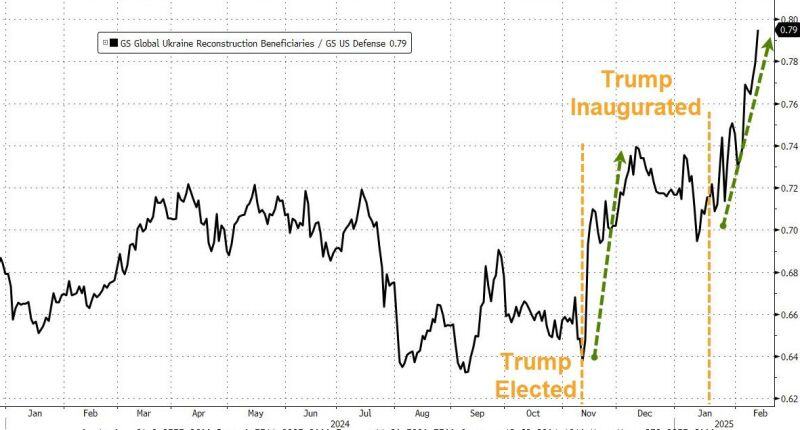

Goldman's basket of Ukraine reconstruction beneficiaries has dramatically outperformed defence stocks since Trump's election.

It's composed of industrials/infrastructure stocks. Source: www.zerohedge.com, Goldman

Investing with intelligence

Our latest research, commentary and market outlooks