Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- macro

- equities

- Food for Thoughts

- sp500

- Central banks

- Bonds

- markets

- bitcoin

- Asia

- technical analysis

- investing

- europe

- Crypto

- geopolitics

- tech

- performance

- gold

- Commodities

- AI

- nvidia

- ETF

- earnings

- Forex

- Real Estate

- oil

- banking

- magnificent-7

- Volatility

- nasdaq

- apple

- emerging-markets

- energy

- china

- Alternatives

- switzerland

- tesla

- trading

- sentiment

- russia

- Money Market

- assetmanagement

- UK

- ESG

- Middle East

- microsoft

- amazon

- ethereum

- meta

- bankruptcy

- Turkey

- Healthcare

- Industrial-production

- Global Markets Outlook

- africa

- brics

- Market Outlook

- Asset Allocation Insights

- Flash

- Focus

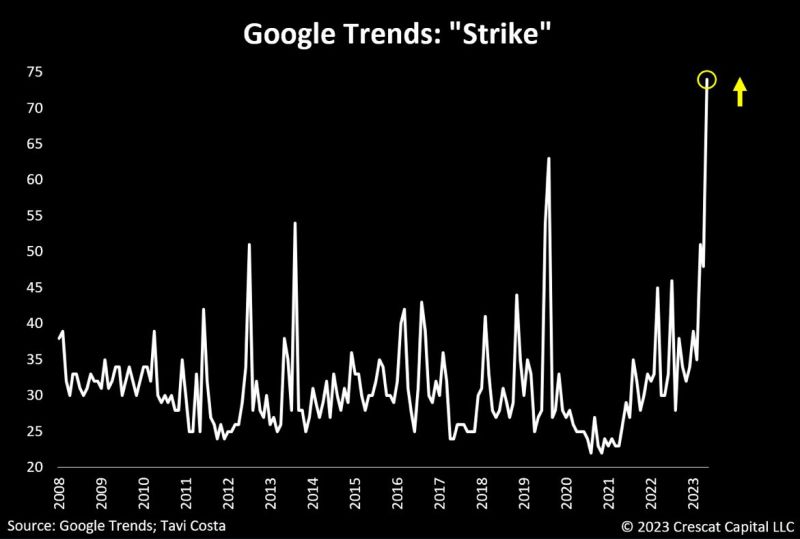

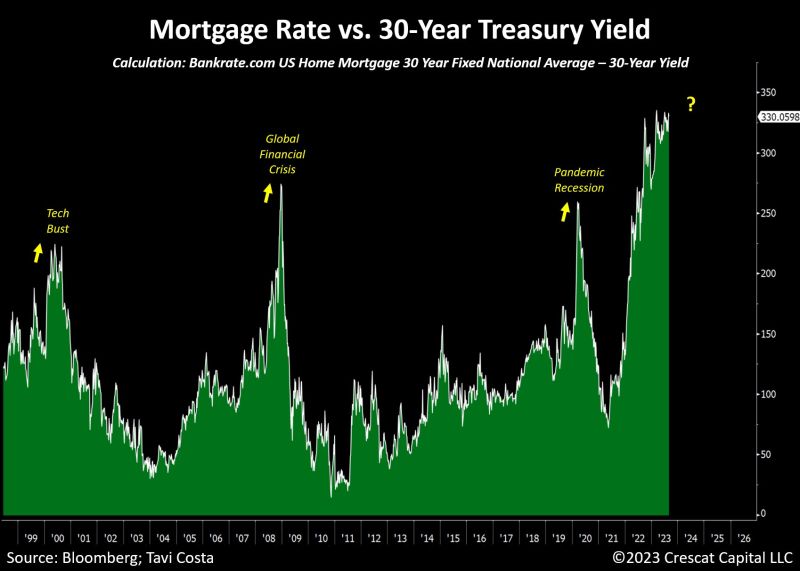

Is wage pressure in the US here to stay?

A highlighted by Tavi Costa, the word "strike" recently surged to record levels on Google trends. This surge implies a growing pressure among workers to secure improved compensation deals with their employers. Labor strikes are becoming a regular occurrence in society, reminiscent of their prevalence in the 1970s. The rising cost of living is placing significant pressure on wages to rise. Source: Crescat Capital, Google Trends

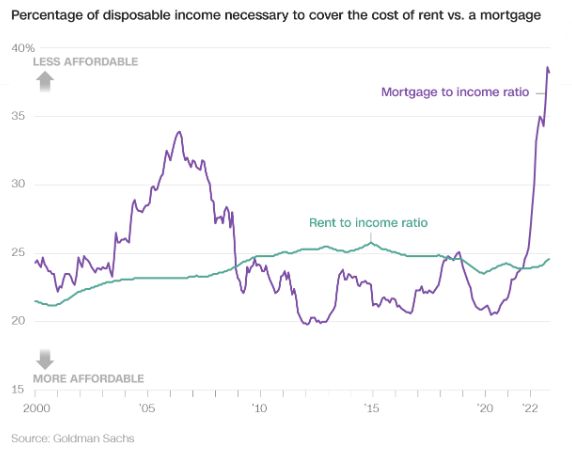

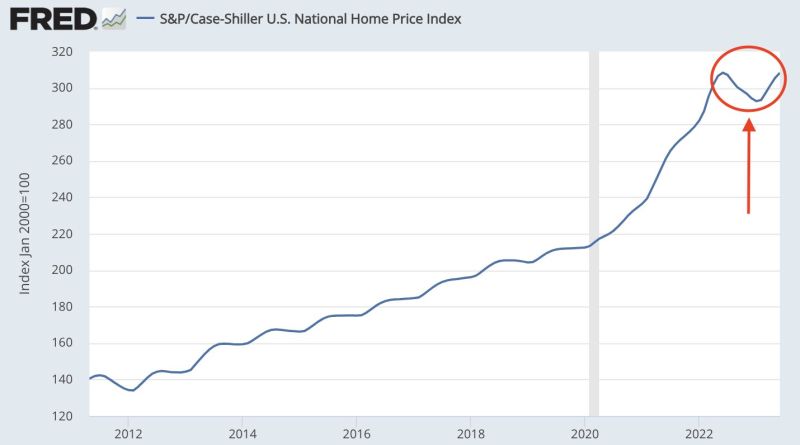

Despite surging mortage rates, US home prices are RISING to ALL-TIME-HIGHS

Higher rates are having an INVERSE effect on price. Rather than prices falling with higher rates, they are actually rising. Why is this happening? As explained by The Kobeissi Letter, as rates rise, existing home sales are falling, now down 16.6% at their lowest since 2010. Borrowers are locked-in to sub-3% mortgages and do not want to sell their homes to get a 2.5x higher rate. We need LOWER rates for LOWER prices... Truly a historic occurrence... Source: FRED, The Kobeissi Letter

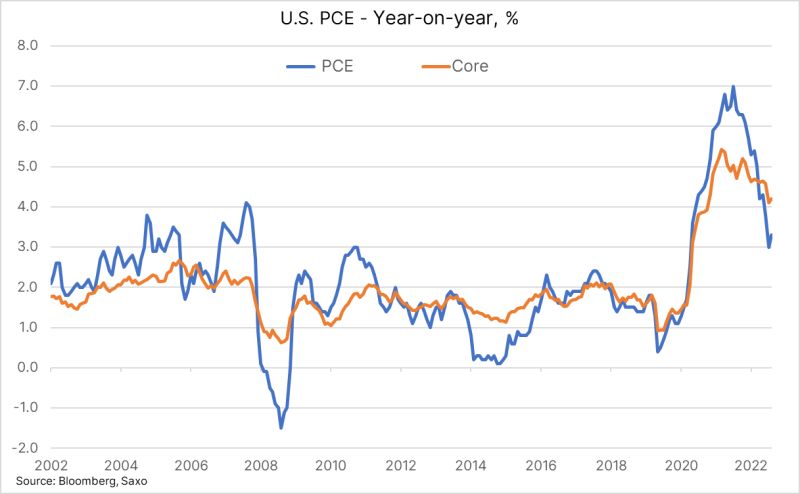

Disinflation pause?

Eurozone inflation remained stuck at 5.3% in Aug, higher than the 5.1% that economists expected. Core inflation, which excl volatile energy, food, alcohol & tobacco prices & closely watched by ECB as measure of underlying inflation, tumbled to 5.3% in Aug from 5.5% in July, matching expectations. Source: HolgerZ, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks