Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- macro

- equities

- Food for Thoughts

- sp500

- Central banks

- Bonds

- markets

- bitcoin

- Asia

- technical analysis

- investing

- europe

- Crypto

- geopolitics

- tech

- performance

- gold

- Commodities

- AI

- nvidia

- ETF

- earnings

- Forex

- Real Estate

- oil

- banking

- magnificent-7

- Volatility

- nasdaq

- apple

- emerging-markets

- energy

- china

- Alternatives

- switzerland

- tesla

- trading

- sentiment

- russia

- Money Market

- assetmanagement

- UK

- ESG

- Middle East

- microsoft

- amazon

- ethereum

- meta

- bankruptcy

- Turkey

- Healthcare

- Industrial-production

- Global Markets Outlook

- africa

- brics

- Market Outlook

- Asset Allocation Insights

- Flash

- Focus

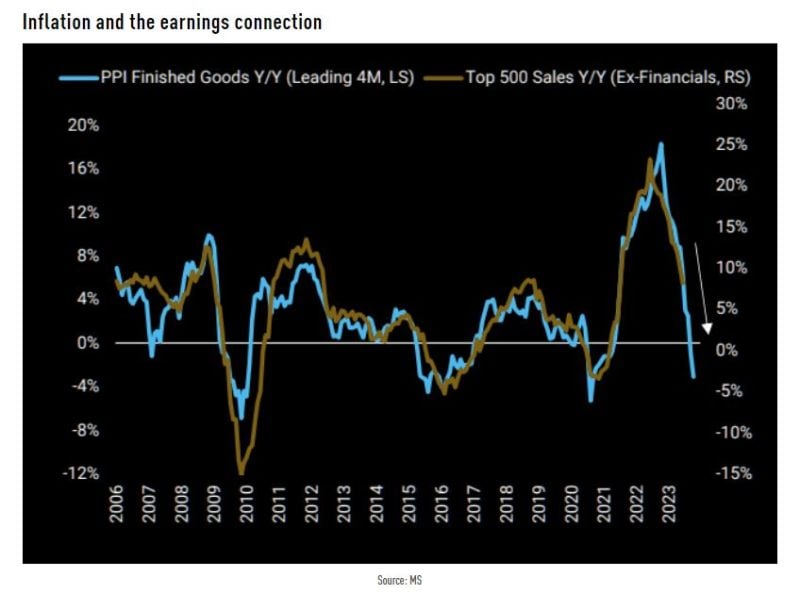

Inflation has been a boost to sp500 companies top-line growth

Now that inflation starts to cool down, could it work the otehr way around? here's the view from Morgan Stanley: "Our boom/bust framework would suggest inflation as it relates to corporate earnings (i.e., pricing) falls toward zero or even below. This is likely to have a significant impact on sales growth and, consequently, on earnings growth as negative operating leverage takes hold." Source: TME

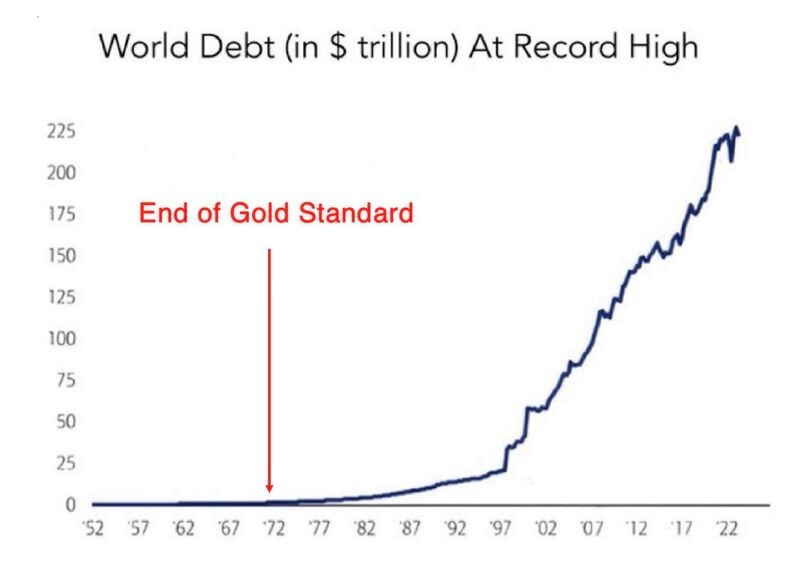

Total Global Debt is now estimated to be over $300 Trillion and has been rising exponentially since 1971

Source: TheBTCTherapist

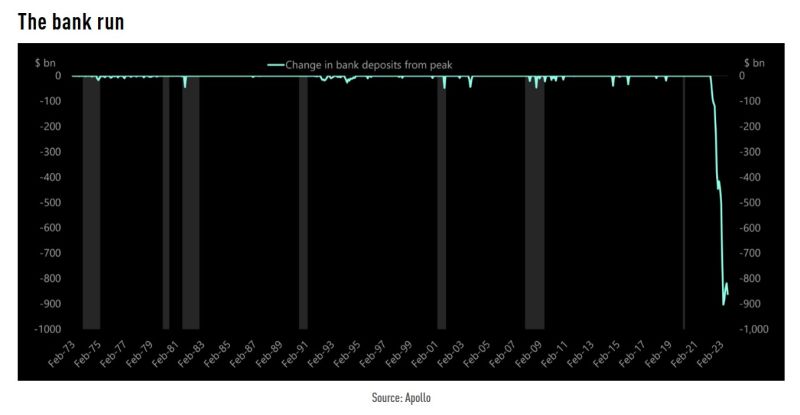

$862bn in deposits have left the banks since the Fed began to raise interest rates

Source: Apollo, TME

Trafigura says ‘fragile’ oil market may be prone to price spikes as higher interest rates and underinvestment squeeze the market according to a Bloomberg article

- The consensus view is for prices to remain near current levels, but the market is “more fragile than it looks,” Ben Luckock, the co-head of oil trading said in an interview at APPEC in Singapore. Brent crude is nearing $90 a barrel after OPEC+ heavyweights reduced supply — curbs that could continue further. - “One reason is underinvestment in new oil production,” he said on Monday. “Combined with higher interest rates, which make it more expensive to hold oil in storage, it means there isn’t much slack or flex in the system. Put all together, and you have a market that’s susceptible to price spikes.” - Oil options traders are showing confidence in the recent sustained surge in prices, bolstering wagers that crude will rally toward $100, even as questions remain over China’s outlook. However, Luckock and other attendees at the conference said it wasn’t all bad when it came to nation’s economy.

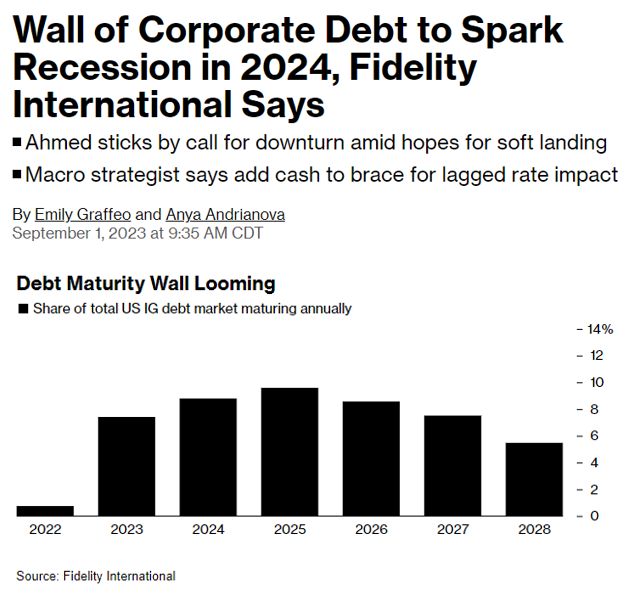

A wave of corporate debt refinancing over the next 6 months will spark a recession in 2024 warns Fidelity International

Source: Barchart, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks