Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- macro

- equities

- Food for Thoughts

- sp500

- Central banks

- Bonds

- markets

- bitcoin

- Asia

- technical analysis

- investing

- europe

- Crypto

- geopolitics

- tech

- performance

- gold

- Commodities

- AI

- nvidia

- ETF

- earnings

- Forex

- Real Estate

- oil

- banking

- magnificent-7

- Volatility

- nasdaq

- apple

- emerging-markets

- energy

- china

- Alternatives

- switzerland

- tesla

- trading

- sentiment

- russia

- Money Market

- assetmanagement

- UK

- ESG

- Middle East

- microsoft

- amazon

- ethereum

- meta

- bankruptcy

- Turkey

- Healthcare

- Industrial-production

- Global Markets Outlook

- africa

- brics

- Market Outlook

- Asset Allocation Insights

- Flash

- Focus

Egypt inflation soars to 37.4% y/y in August as higher food costs add to currency angst

Another month, another record inflation number. Consumer prices in Egypt rose 37.4% in August compared with a year earlier. This is the highest number since 2010 -- higher than even the levels reached after the 2016 currency crisis. Note that food costs were up 71.4%

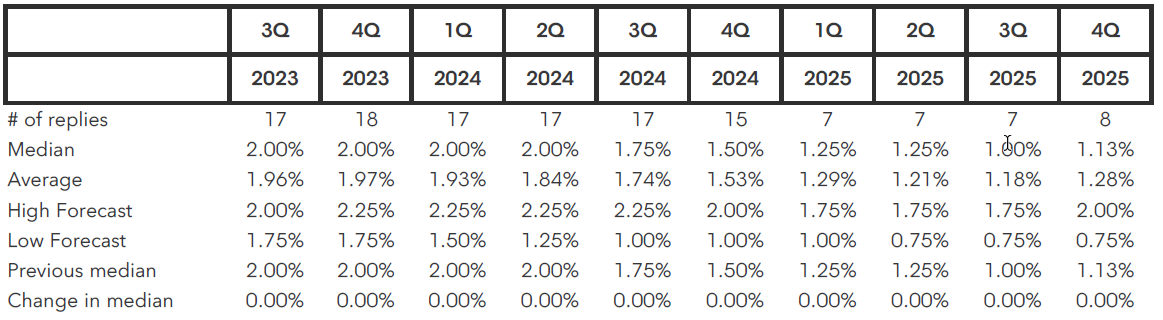

SNB Policy rate at 2.00% by end-Q3 2023 - Survey

The following table shows economists’ forecasts for Switzerland’s benchmark central bank rate as surveyed by Bloomberg News from Sept. 1st to Sept. 7th. All figures are as of the end of the quarter.

Current SNB Policy Rate: 1.75%

Sourcce: Bloomberg

In case you missed it...

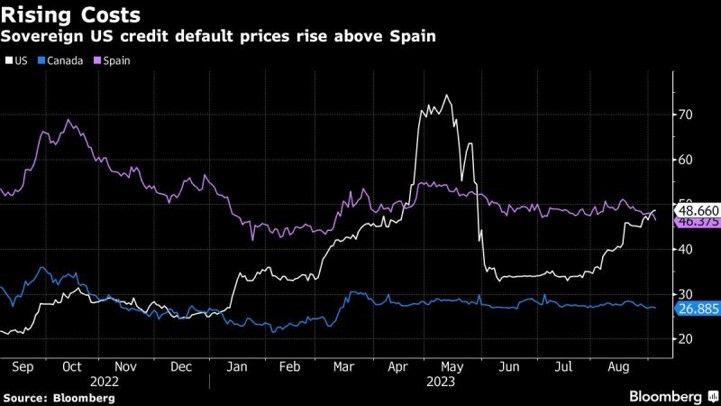

The credit default swap (CDS) prices for the US rose sharply during the small banks crisis back in spring, and then went down as the crisis subsided quickly. These prices have been rising steadily since early summer. US CDS are now above Spain, which is considered a higher risk country from a sovereign credit risk perspective. Source: Bloomberg

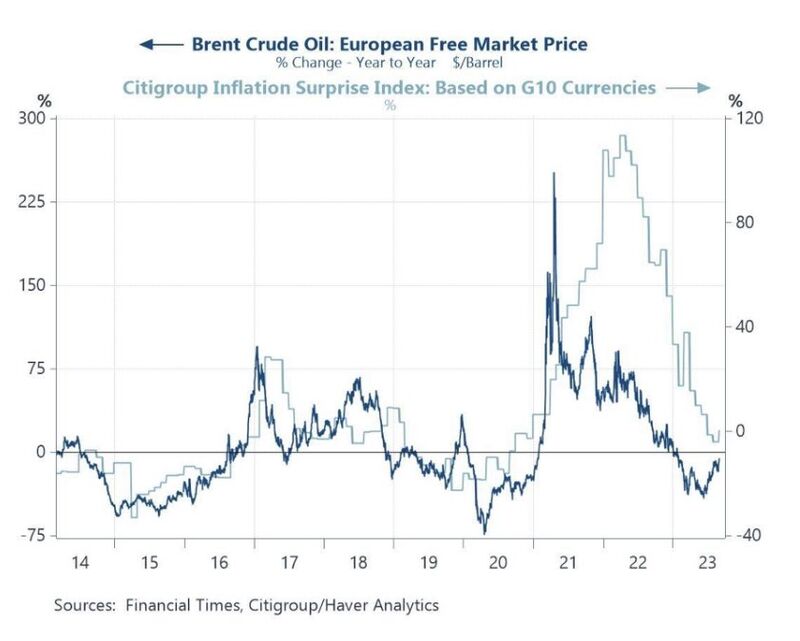

Brent oil vs. Citigroup global inflation surprises index

Oil price usually lead inflation 👇 The recent uptick in oil price will be probably not enough to materially change inflation surprises, but should oil continue to go up it would start to have an impact. Source: Michel A.Arouet

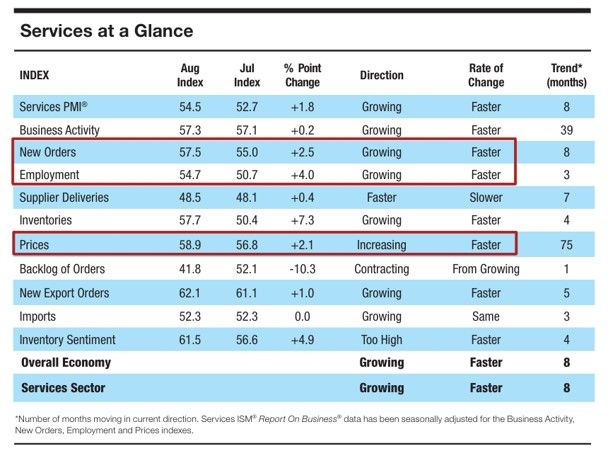

One key development of the week (beyond brent hitting $90) has been stronger than expected macroeconomic data - e.g the ISM services (see data table below from Markets & Mayhem)

Indeed what we are seeing in the last ISM Services PMI reading may not be the best news for the inflation situation: 1) New orders growing faster 2) Employment growing faster (from being nearly flat m/m) 3) Prices rising faster And the market reaction - stocks pulling back - means that good macro news is bad news for the market again. Indeed, while a growing economy supports rising corporate profits (which is a positive), a too strong economy would imply a more hawkish FED than it is currently anticipated by the market.

Investing with intelligence

Our latest research, commentary and market outlooks