Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- macro

- equities

- Food for Thoughts

- sp500

- Central banks

- Bonds

- markets

- bitcoin

- Asia

- technical analysis

- investing

- europe

- Crypto

- geopolitics

- tech

- performance

- gold

- Commodities

- AI

- nvidia

- ETF

- earnings

- Forex

- Real Estate

- oil

- banking

- magnificent-7

- Volatility

- nasdaq

- apple

- emerging-markets

- energy

- china

- Alternatives

- switzerland

- tesla

- trading

- sentiment

- russia

- Money Market

- assetmanagement

- UK

- ESG

- Middle East

- microsoft

- amazon

- ethereum

- meta

- bankruptcy

- Turkey

- Healthcare

- Industrial-production

- Global Markets Outlook

- africa

- brics

- Market Outlook

- Asset Allocation Insights

- Flash

- Focus

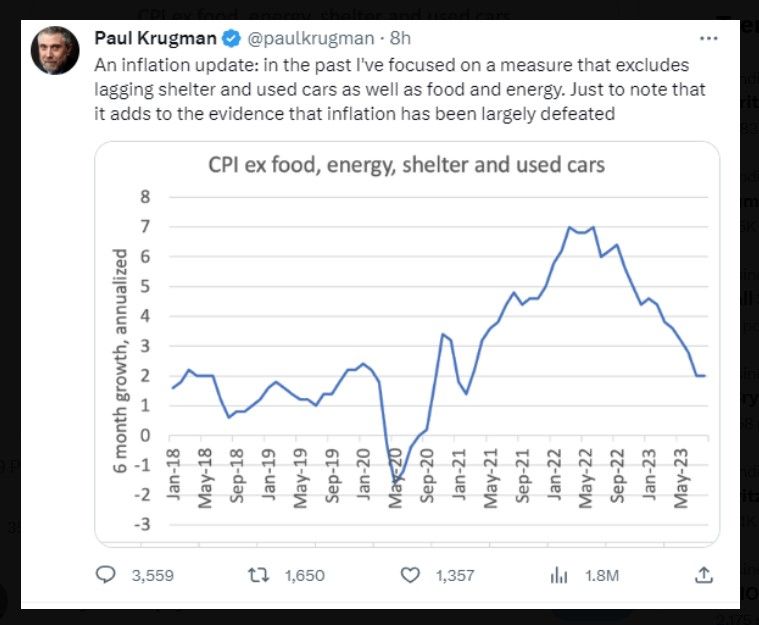

Translation: If you exclude everything you need in life, inflation has been vanquished!

Source: Barchart

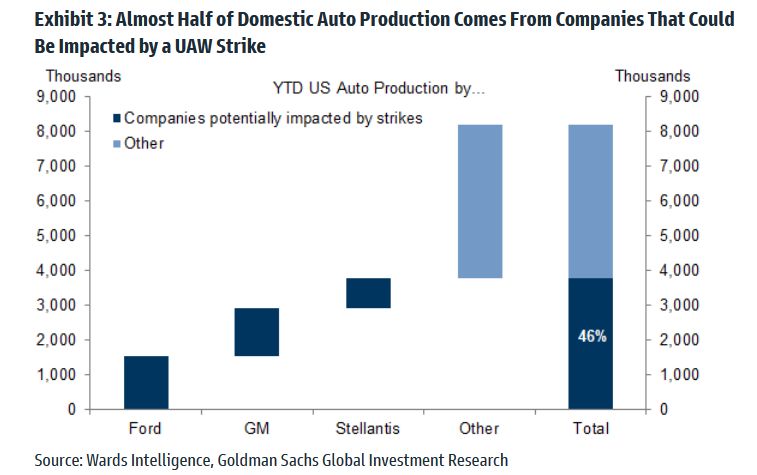

From Wall Street to Main Street (aka workers want a bigger piece of the cake) => UAW members go on strike at three key auto plants after deal deadline passes

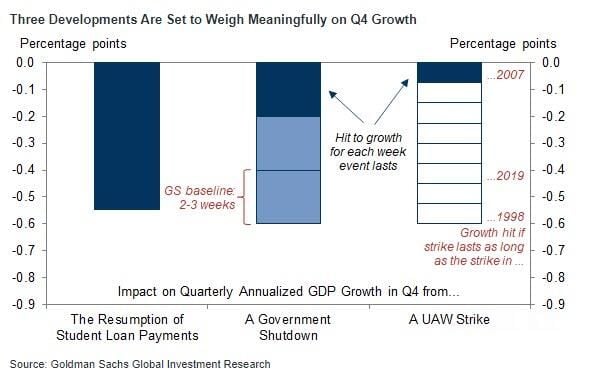

Half of US auto production is going offline tomorrow. - Thousands of United Auto Workers members went on strike at three key plants, after Detroit automakers failed to reach deals with the union by a Thursday night deadline. - The selected plants produce highly profitable vehicles for the automakers that largely continue to be in high-demand. About 12,700 workers – 5,800 at Stellantis, 3,600 at GM and 3,300 at Ford – will be on strike at the plants in total, the union said. The UAW represents about 146,000 workers across Ford, GM and Stellantis. Source: Goldman, CNBC

European Central Bank hikes rates to a record 4% as inflation risks outweigh economic gloom.

- The ECB just raised its key rates again today, by 25bp (main Refi rate at 4.50%, deposit rate at 4.00%) - Concerns around the underlying inflation dynamic appear to have overwhelmed the ongoing negative (and concerning) dynamic in Europe’s economic growth: "inflation continues to decline but is still expected to remain too high for too long. The Governing Council is determined to ensure that inflation returns to its 2% medium-term target in a timely manner. In order to reinforce progress towards its target, the Governing Council today decided to raise the three key ECB interest rates by 25 basis points." Source: Bloomberg

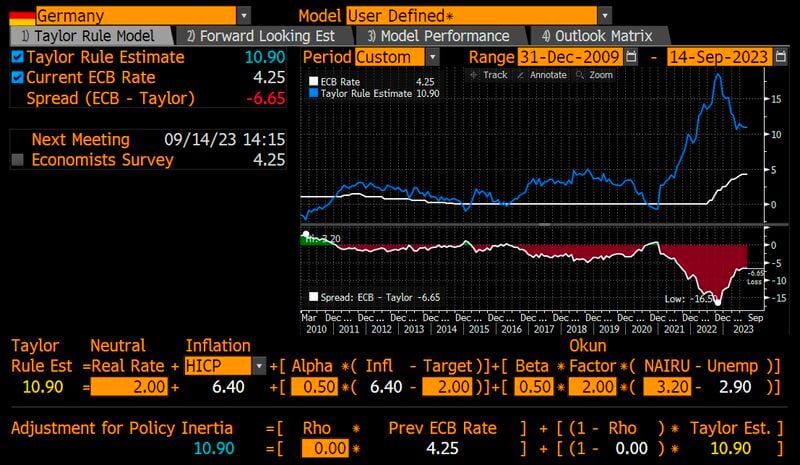

Today is ECB day

What is the Taylor rule telling us when it comes to theoretical interest rates based on German data? Key interest rate should be at 10.9%, so 6.6% higher than current rate, according to Taylor Rule with German inflation at 6.4% & unemployment below NAIRU. Howeverm the spread between Taylor Rule rate & ECB key rate is lower than it has been since 2021. This might suggest that hike cycle could soon come to an end. Source: Bloomberg, HolgerZ

US CORE CPI LITTLE HOTTER THAN EXPECTED => A FED PAUSE IS LIKELY BUT NO RATE CUT ANYTIME SOON

Consensus expected a reacceleration of Headline inflation (+0.6% MoM after +0.2% in July) and a stabilisation of “core” inflation (+0.2% MoM after +0.16% in July). Key actual numbers are the following: ON A SEQUENTIAL BASIS (MoM) Headline inflation numbers are in-line with expectations (+0.6%). That is the biggest MoM since June 2022 and the second straight monthly increase in CPI...The energy index rose 5.6% in August after increasing 0.1% in July. There was a big turn-around in airline fares. They rose 4.9% after dropping 8.1% in each of the previous two months. But the gasoline index dominated with an increase of 10.6 percent in August, following a 0.2% increase in the previous month.

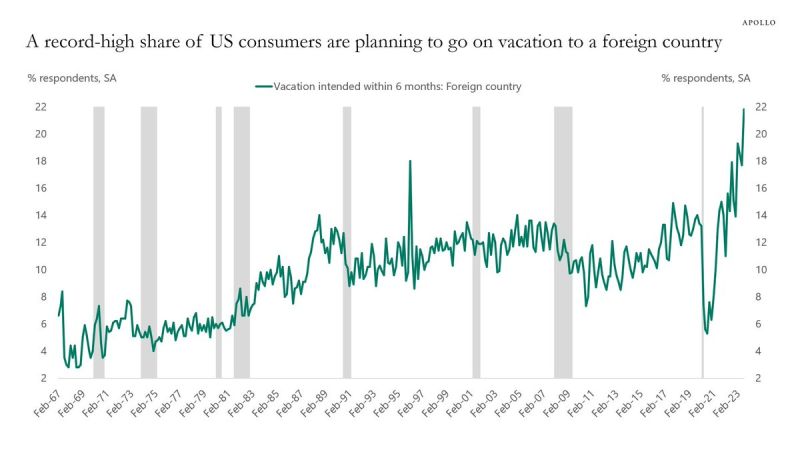

The continued strong demand for consumer services is why the Fed is unable to contain core inflation

According to Apollo, a record 22% of US consumers are planning to vacation in a foreign country. US households want to travel on airplanes, stay at hotels and eat out. The Kobeissi Letter: "That is why inflation in the non-housing service sector continues to be so high. No wonder credit card debt is skyrocketing". Source: The Kobeissi Letter, Apollo

Investing with intelligence

Our latest research, commentary and market outlooks