Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- macro

- equities

- Food for Thoughts

- sp500

- Central banks

- Bonds

- markets

- bitcoin

- Asia

- technical analysis

- investing

- europe

- Crypto

- geopolitics

- tech

- performance

- gold

- Commodities

- AI

- nvidia

- ETF

- earnings

- Forex

- Real Estate

- oil

- banking

- Volatility

- magnificent-7

- nasdaq

- apple

- emerging-markets

- china

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- russia

- Money Market

- assetmanagement

- UK

- ESG

- Middle East

- microsoft

- amazon

- ethereum

- meta

- bankruptcy

- Turkey

- Healthcare

- Industrial-production

- Global Markets Outlook

- africa

- brics

- Market Outlook

- Asset Allocation Insights

- Flash

- Focus

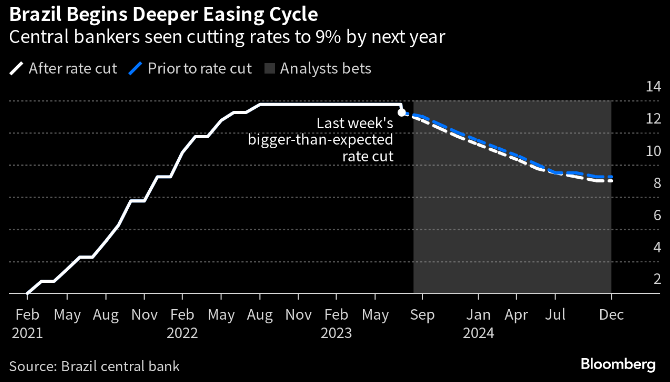

Brazil central bank says faster key rate cuts are Unlikely

“The Committee judges that there is low probability of an additional intensification in the pace of adjustment,” central bankers wrote in the minutes of their Aug. 1-2 meeting published on Tuesday.

Source: Brazil Central Bank, Bloomberg

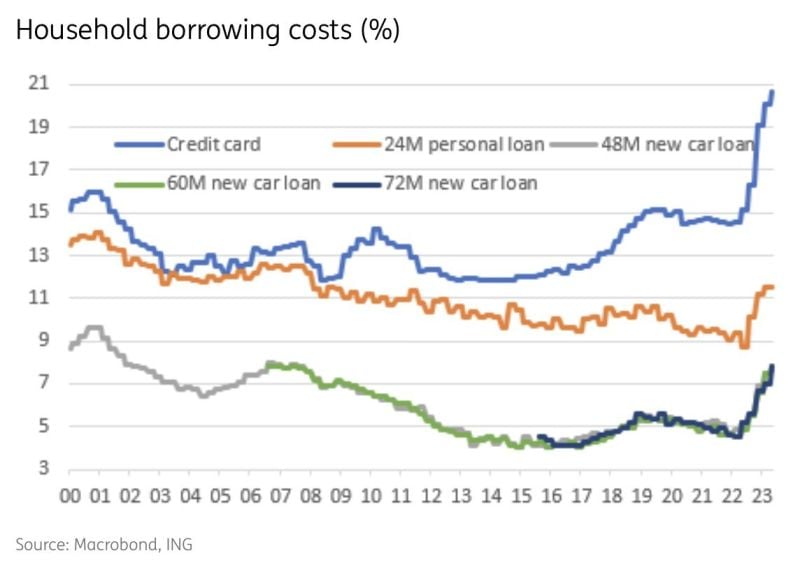

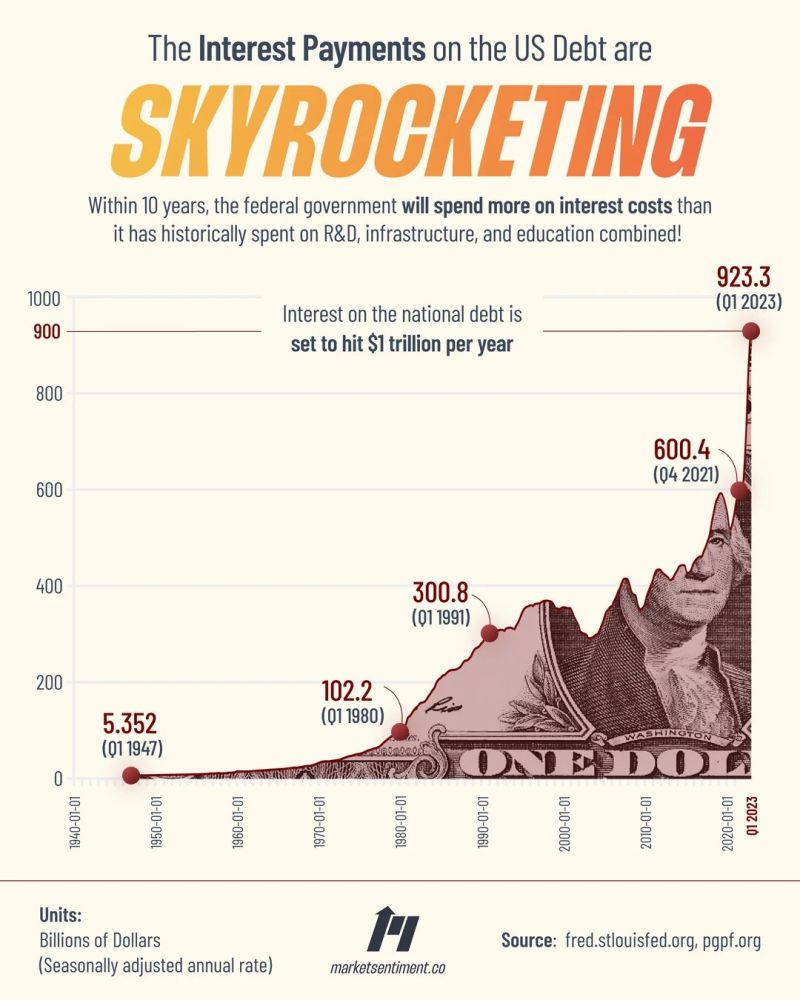

In the US, interest rates on household items are skyrocketing

In just 1 year, the average interest rate on credit card debt has gone from 14% to 21%+. New car loan rates went from 4% to 8% while used car loan rates are at 12%+. Mortgage rates are at a fresh high of 7.2%, up from 2.7% in 2021. Will the US consumer be able to absorb all these debt servicing costs? Source: The Kobeissi Letter, Macrobond, IN

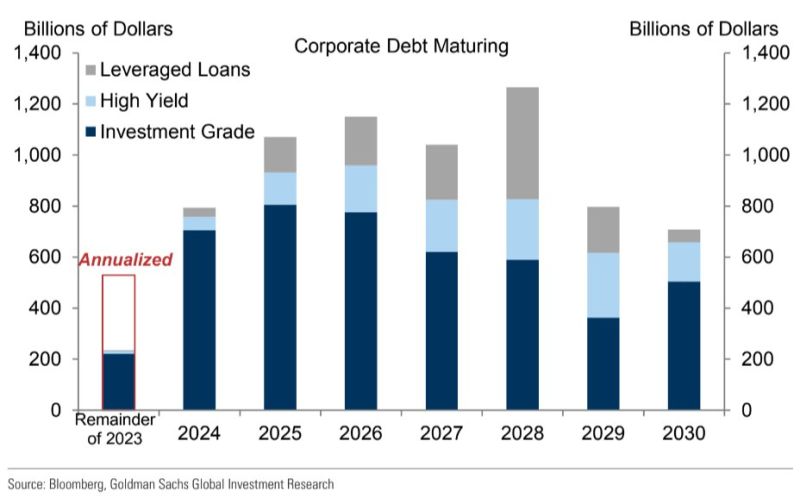

The lagging effects of higher interest rates ?

Yellow Corp. filed for bankruptcy and will remain shuttered after the trucking firm’s long-running financial woes (rising bond & loan payments) were compounded by a dispute with its labor force (wage inflation). The firm closes after nearly 100 years and leaves 30k employees jobless (this will likely be reflected in a lower payroll print for August). Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks