Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- macro

- equities

- Food for Thoughts

- sp500

- Central banks

- Bonds

- markets

- bitcoin

- Asia

- technical analysis

- investing

- europe

- Crypto

- geopolitics

- performance

- tech

- gold

- Commodities

- AI

- nvidia

- ETF

- earnings

- Forex

- Real Estate

- oil

- banking

- Volatility

- magnificent-7

- china

- nasdaq

- apple

- emerging-markets

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- russia

- Money Market

- assetmanagement

- UK

- ESG

- Middle East

- amazon

- microsoft

- ethereum

- meta

- bankruptcy

- Turkey

- Healthcare

- Industrial-production

- Global Markets Outlook

- africa

- brics

- Market Outlook

- Asset Allocation Insights

- Flash

- Focus

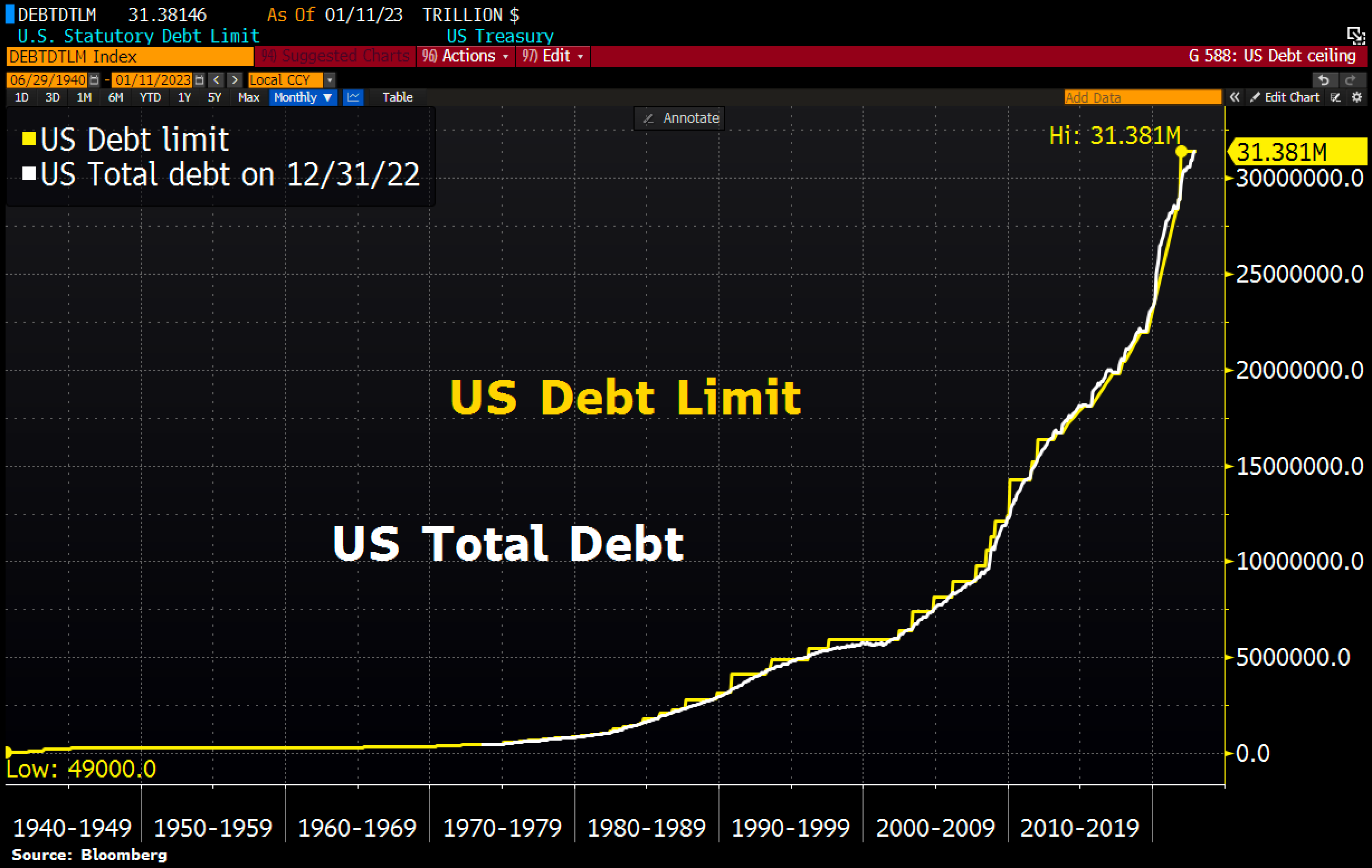

US will hit its debt limit Thursday, start taking steps to avoid default, Yellen warns Congress

Source: Bloomberg, HolgerZ

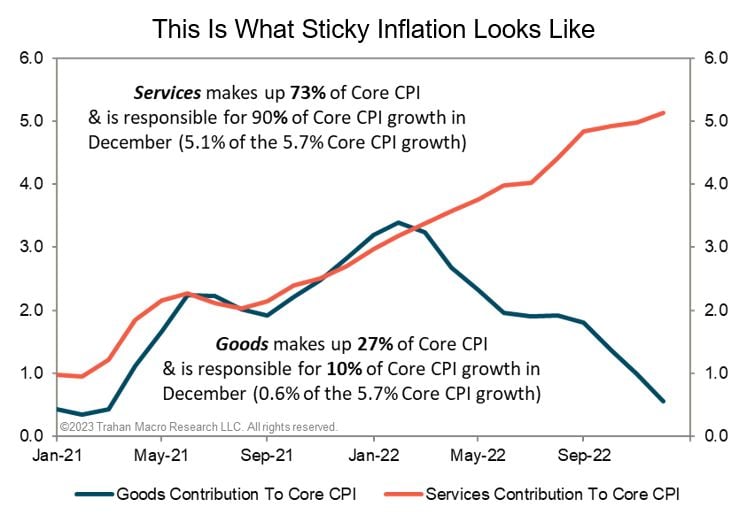

While inflation is cooling down, The Fed might need to keep tightening

While US inflation is materially lower from its peak, the chart below from Trahan Research shows why the Fed's job is probably NOT over. This chart shows the contribution of both Services and Goods inflation. Even if Goods CPI goes to 0% , Services inflation alone would still leave Core inflation above 5%. As long as core inflation stays above 5%, the Fed is unlikely to pivot.

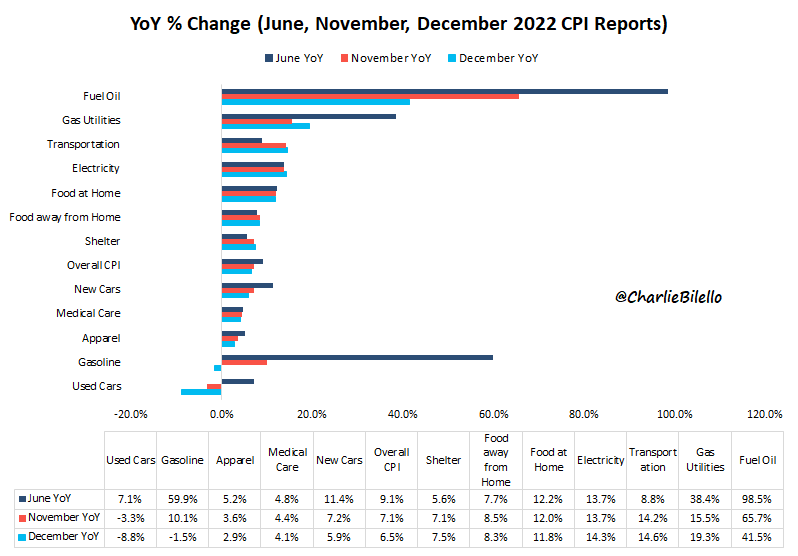

US CPI has moved down from a peak of 9.1% last June to 6.5% in December

What's driving that decline? Lower rates of inflation in New/Used Cars, Gasoline, Apparel, Medical Care, Food at Home, Gas Utilities, and Fuel Oil. Source: Charlie Bilello

U.S. 3-month government bond yield hits new highs!

The yield on three-month U.S. T-Bill rose 8 basis points to 4.66 percent, its highest level since 2007. This reflects the latest comments from Fed members in favor of further increases in the federal funds rates. It is worth noting that the next FOMC meeting will be held on February 1 and the market is so far expecting a 25 basis point increase. Source: Bloomberg

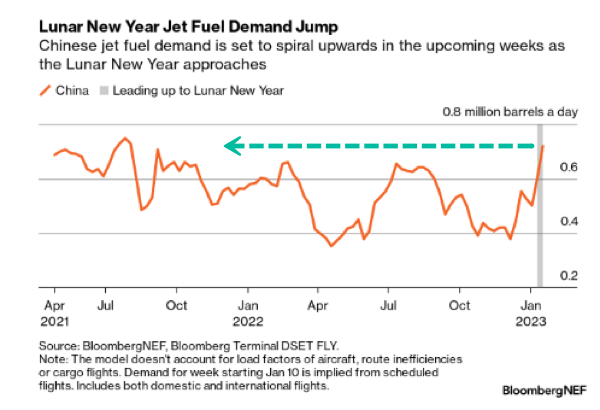

China Jet Fuel Demand Set To Soar Ahead Of Lunar New Year

China's oil demand could surge as it reopens after scraping zero Covid restrictions. Beijing's Covid curbs weighed on crude and refined products demand for three years. Soaring air travel demand ahead of the Lunar New Year is yet more evidence fuel demand is gathering steam. China's easing of border restrictions imposed almost three years ago has been a recent boon for air travel, domestically and internationally. There are no more mandatory quarantines for travelers arriving in China. BloombergNEF said jet fuel demand is rising in China ahead of the holidays. They noted that scheduled passenger flights for Jan 10 to 16 indicate jet fuel demand has reached about 0.61 million barrels per day (mbpd), rising 0.10 mbpd compared with a week earlier. Then by next week, jet fuel demand could increase to 0.72 mbpd. This would mark the highest demand for Chinese jet fuel in more than 1.5 years. Source: Bloomberg, www.zerohedge.com

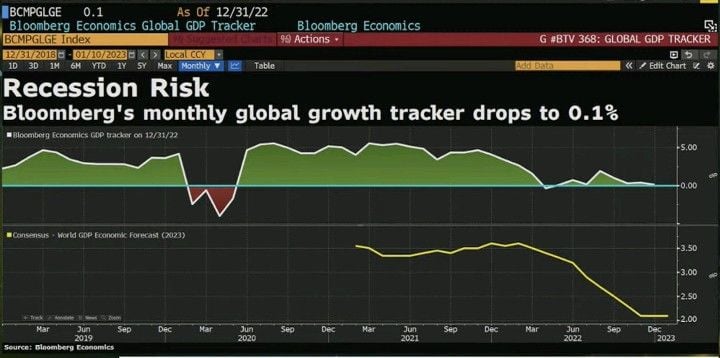

Recession risk - Bloomberg’s monthly global growth tracker drops to 0.1%

Bloomberg Economics Global GDP Tracker Source: Bloomberg TV

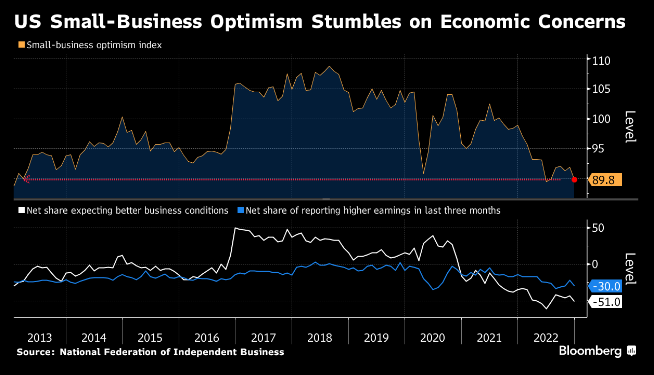

Another sign of economic growth softening in the US?

US Small-Business Optimism Falls to Second-Weakest Since 2013 - Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks