Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- macro

- equities

- Food for Thoughts

- sp500

- Central banks

- Bonds

- markets

- bitcoin

- Asia

- technical analysis

- investing

- europe

- Crypto

- geopolitics

- performance

- tech

- gold

- Commodities

- AI

- nvidia

- ETF

- earnings

- Forex

- Real Estate

- oil

- banking

- Volatility

- magnificent-7

- nasdaq

- apple

- china

- emerging-markets

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- russia

- Money Market

- assetmanagement

- UK

- ESG

- Middle East

- microsoft

- amazon

- ethereum

- meta

- bankruptcy

- Turkey

- Healthcare

- Industrial-production

- Global Markets Outlook

- africa

- brics

- Market Outlook

- Asset Allocation Insights

- Flash

- Focus

A reality check on Europe's energy shock: the French trade deficit

France's trade deficit in Dec. '22 was the widest in two decades when compared to the same month in previous years, a crude way to adjust for seasonality. Europe's energy shock is large and ongoing. Source: Robin Brooks

US existing home sales have been falling faster today than they did during the Great Financial Crisis

Source: Morgan Stanley

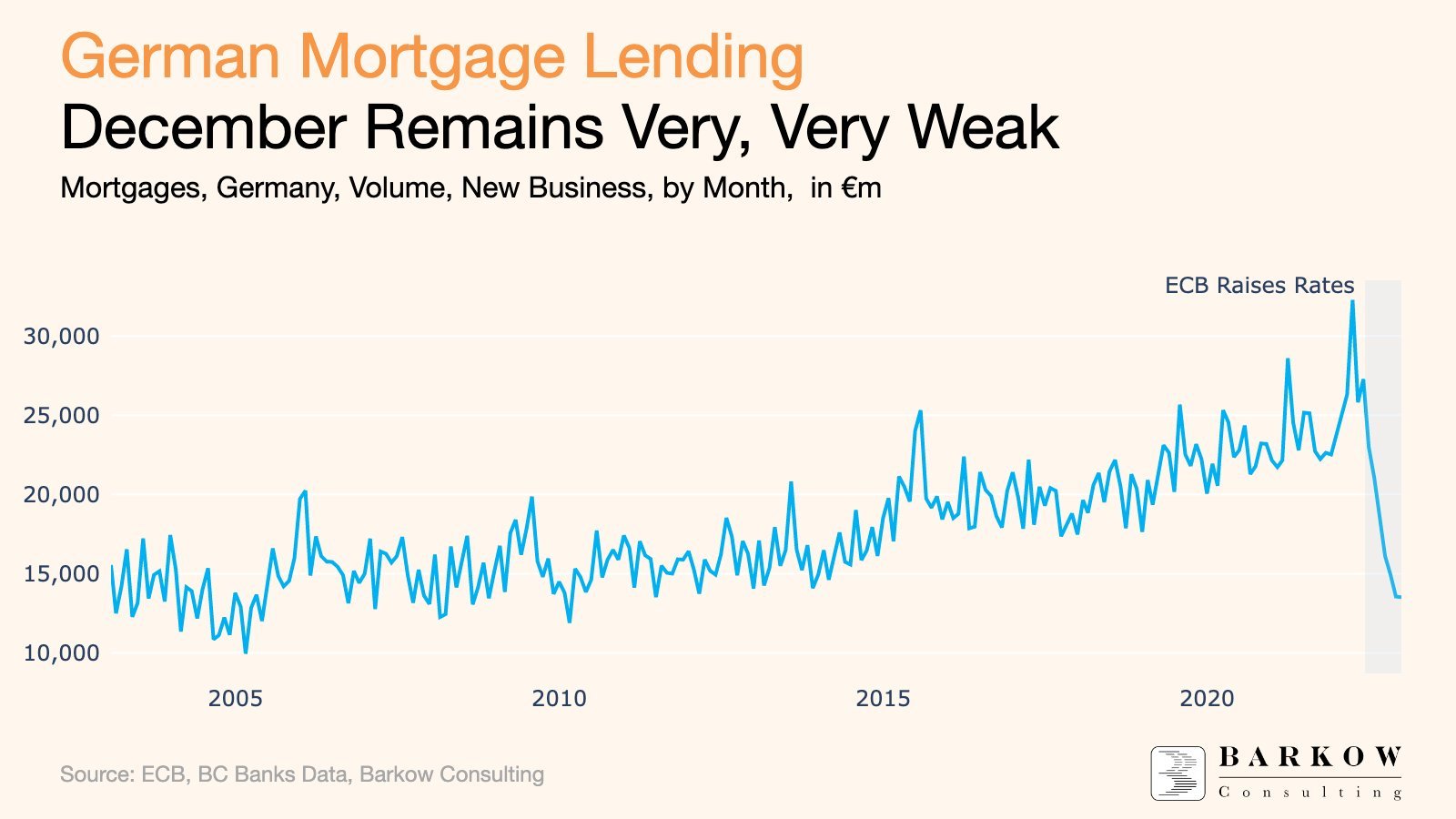

German housing market remains in a freeze

Mortgage lending was down 43% YoY in December, representing 4th negative record in a row since data records began in 2003. Compared with peak of €32.3bn from March 2022, the decline is almost 60%. Source: HolgerZ, Barkow consulting

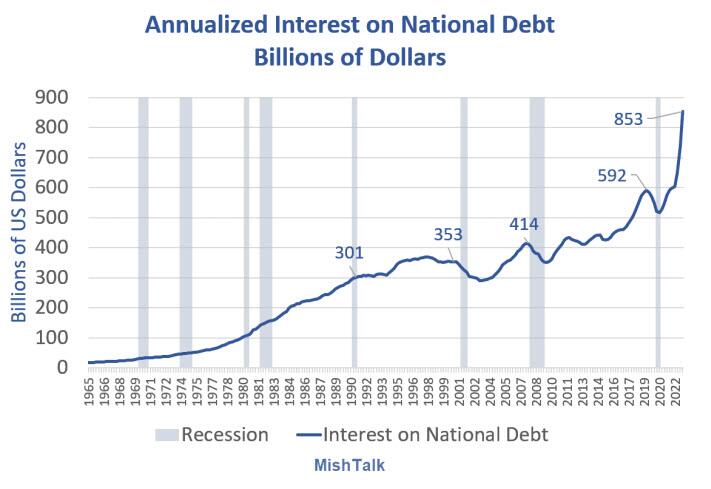

The annual interest rate payment on US Government Debt is $850 Billion and rising fast

At the current pace, interest on US government debt will soon hit one trillion dollars... Source: MishTalk.com, www.zerohedge.com

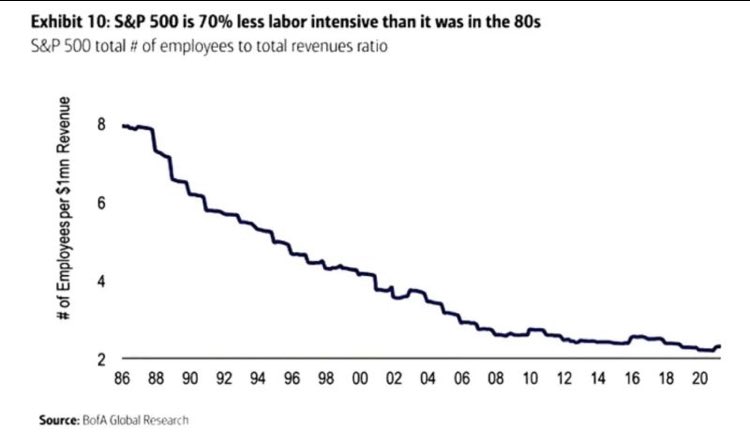

Disinflation in one chart

In the 90s, a company needed 8 employees to generate $1 million in revenues. Due to technology, now it needs 2. Source: MacroAlf

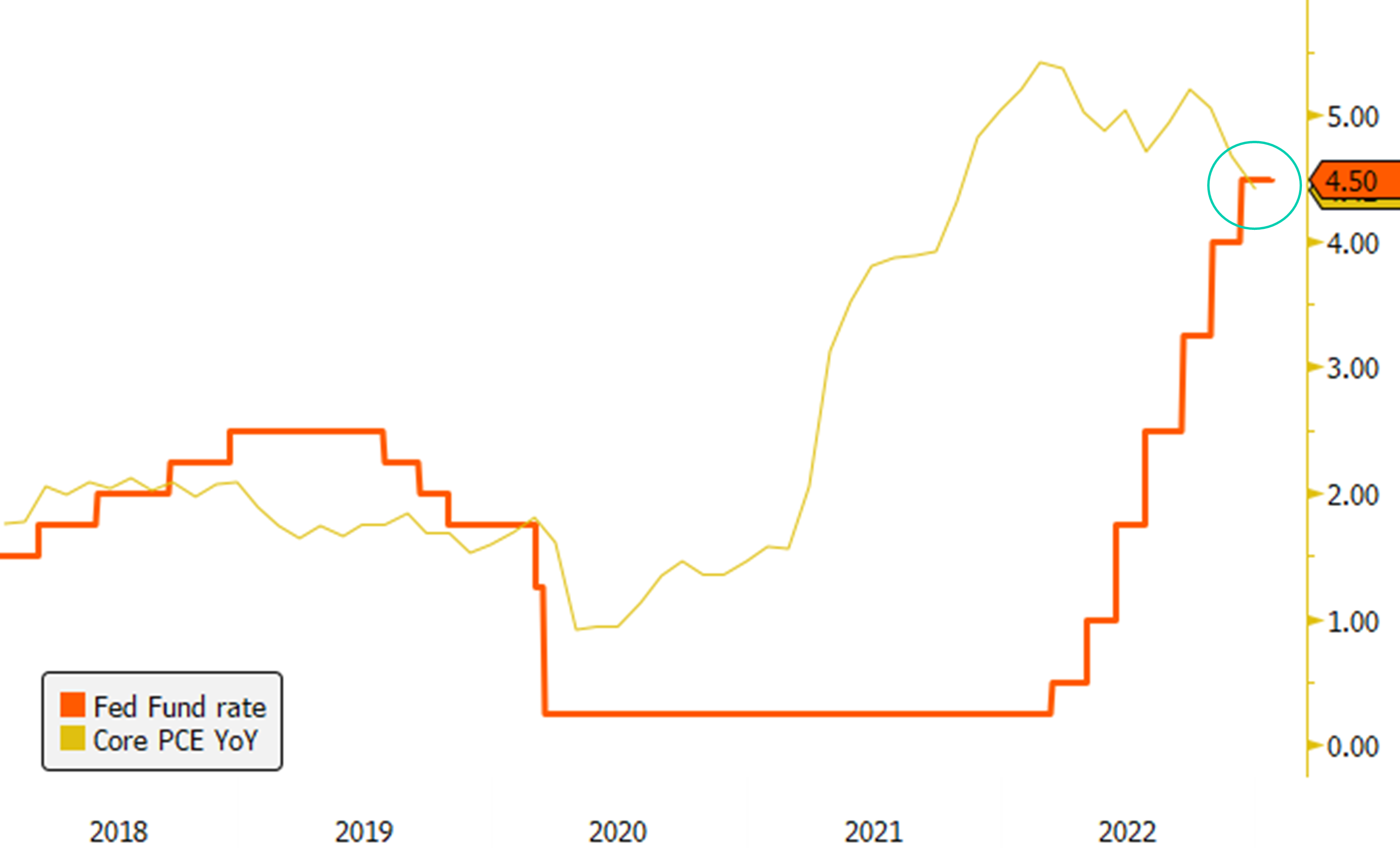

Fed fund rate above Core PCE for the first time since the pandemic!

For the first time since February 2020, Fed funds rates are positive in real terms as the Core PCE index came out at 4.4% (vs. 4.5% for the Fed funds rate). This bodes well for an imminent halt in rate hikes, unless the US economy surprises on the upside. Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks