Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Russia may be poised to make a notable shift in its precious metals strategy, with silver potentially emerging as a key asset in the country’s expanding State Fund.

According to a report released by Interfax this week and cited by Bloomberg, Russia’s Draft Federal Budget outlines plans to significantly bolster its holdings in precious metals over the coming years. Notably, the budget includes plans to acquire gold, platinum, palladium, and, for the first time, silver. The inclusion of silver in the State Fund's acquisition strategy marks a departure from recent trends. While central banks around the globe, particularly Russia, have set records in gold purchases following international sanctions, silver has largely remained off their radar. This latest development suggests that silver’s role in Russia’s financial strategy may be evolving. Source: The Jerusalem Post

Food for thoughts

Russian President Vladimir Putin in response to Russia’s declining birth rate, has launched an unusual initiative: encouraging Russians to have s*x during their work breaks... Source: The Times Of India

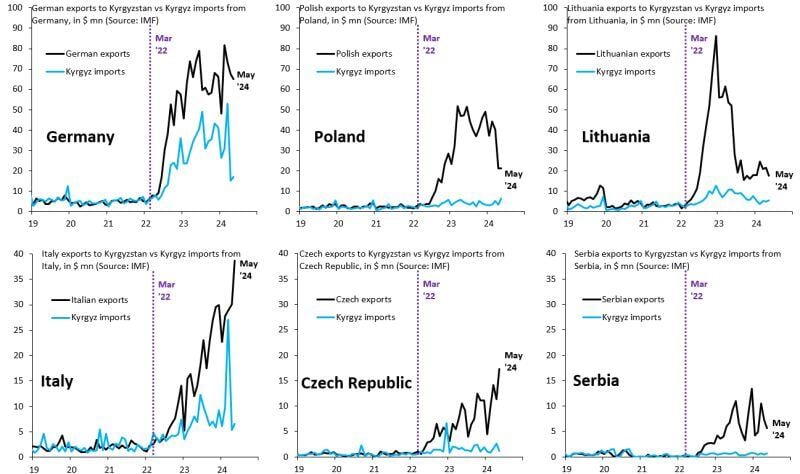

From the moment Russia invaded Ukraine, Europe was supposed to halt exports to Russia

Instead, many EU countries have been sending flood of exports to Russia that's invoiced to Kyrgyzstan. Source: Robin Brooks

JUST IN: President Putin signs law legalising Bitcoin and crypto mining in Russia.

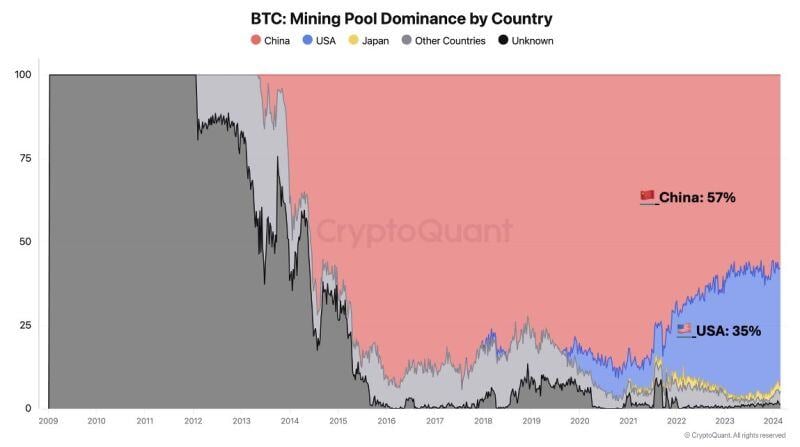

Russia seems to be acting to keep up with the US. Nation-level as Bitcoin FOMO is heating up. Their entry will boost the hash rate, strengthen network fundamentals, and diversify miner politics. Chinese mining pools control 57% of the BTC hash rate, while the 🇺🇸US has 35%. Source: Cryptoquant, Ki Young

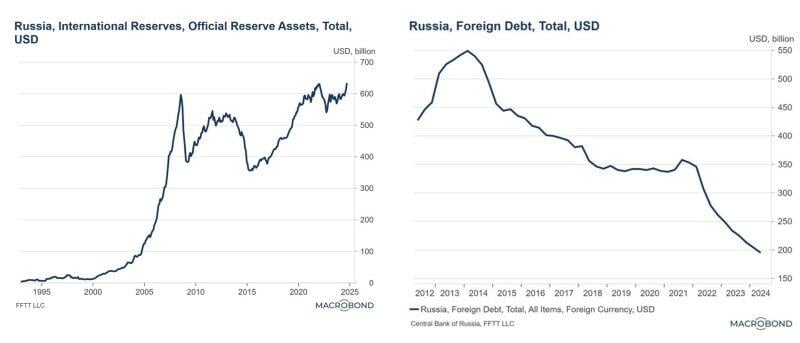

Oops... I missed this one... Russia's economy has defied sanctions in the two years since Moscow invaded Ukraine in February 2022

So much so that the World Bank is now classifying Russia as a "high-income country." On Monday 1st of July, the World Bank announced it has upgraded Russia from an upper-middle-income country to a high-income country, according to a report from the financial institution's economists. "Economic activity in Russia was influenced by a large increase in military-related activity in 2023," World Bank economists wrote in their report. Last year, Russians earned $14,250 per person on a gross national income basis. The World Bank's upgrade confirms reports from Russia that suggest the growth is primarily driven by wartime activities that generate demand for military goods and services, making some sectors winners in Russia's wartime economy. Russia's trade jumped by nearly 7% last year, while activities in the financial sector and construction grew by 6.6% and 3.6%, respectively. This boosted Russia's real GDP — which is economic growth adjusted for inflation — by 3.6%. The development has made some poor Russians better off financially, complicating any calculus over how to end the war.

Investing with intelligence

Our latest research, commentary and market outlooks