Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

European banks are apparently doing brilliant business in Russia…

In 2023, they paid 4 times more taxes to the Russian state than they did before the war in Ukraine... According to the FT, Deutsche Bank has increased its profits in Russia from €26mln before the war to €40mln in 2023, while Commerzbank has more than tripled its profits to €51mln. The German state holds a 15.8% stake in Commerzbank. Italian and Austrian banks are doing a killing as well… Western lenders have benefited from the imposition of sanctions on most of the Russian financial sector, which has denied access to the Swift international interbank payment system. That made international banks a financial lifeline between Moscow and the West. Source: FT, HolgerZ

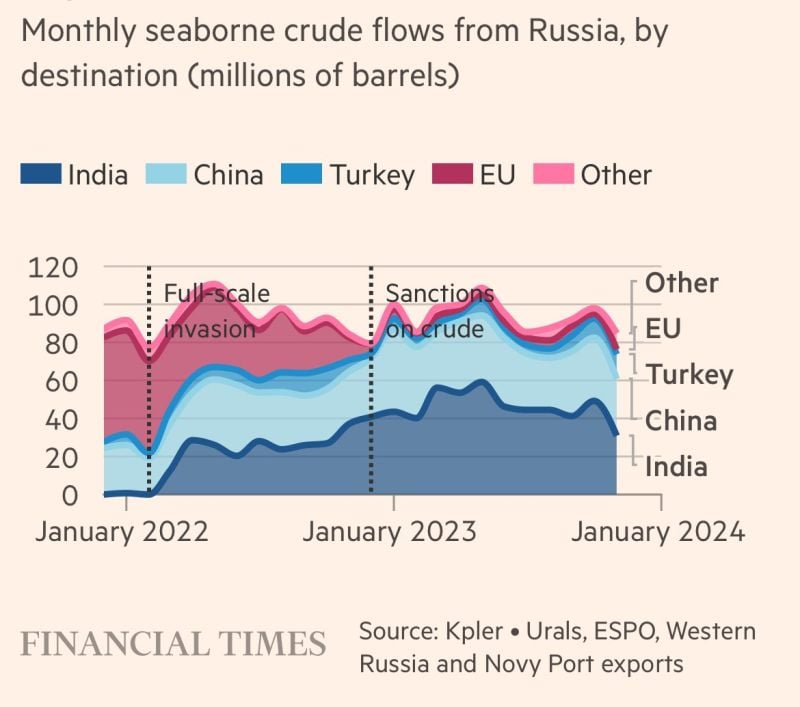

Russia replaced oil exports to the EU with exports to India and China

Source: FT

According to RT, Russia has conducted a major exercise aimed at testing its strategic nuclear forces, the Kremlin said on Wednesday

The drills focused on the simulated delivery of ‘a massive nuclear strike by the strategic offensive-oriented forces in response to a nuclear strike by a simulated enemy’. Note that gold and bitcoin both jumped on the news.

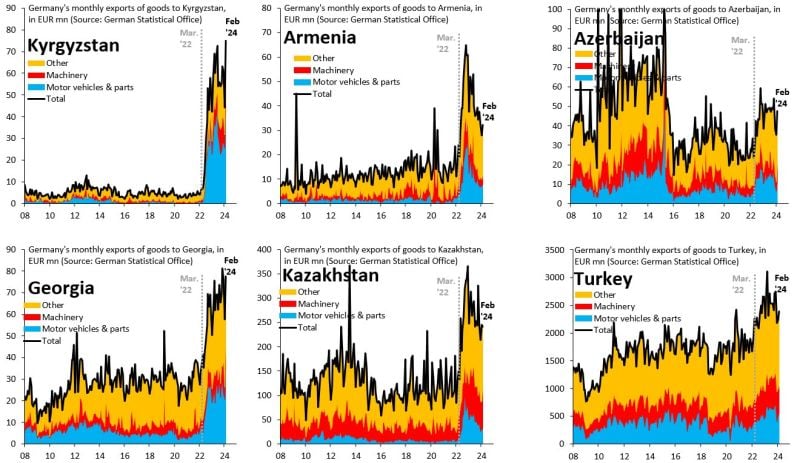

Robin Brooks tweet: "In the first 8 months of 2023, German exports to Kyrgyzstan were up 1400% from the same period in 2019

A lot of these goods - mostly cars and car parts - never ends up in Kyrgyzstan, but go directly or indirectly to Russia"

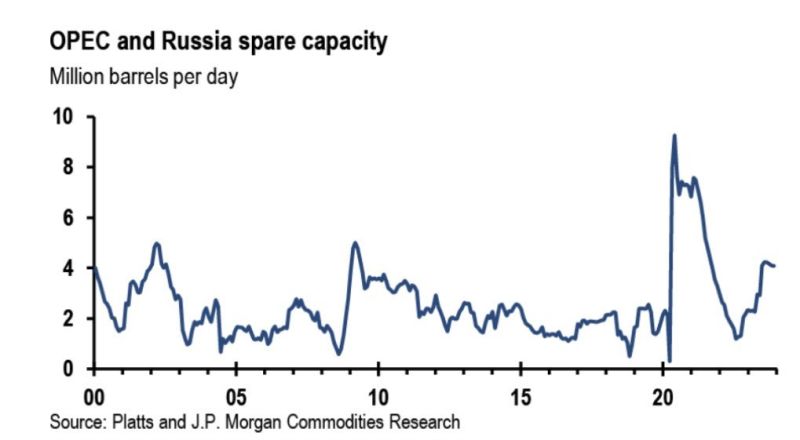

Oil is up 30% this quarter but is there more to come?

As tweeted by The Kobeissi Letter, Russia and 3OPEC are now cutting a massive 4 million barrels per day of crude oil production. This is the highest level of production cuts outside of recessions over the last two decades. As Saudi Arabia and Russia extend production cuts of 1.3 million barrels per day, supply is going to remain limited for a while. OPEC has proven multiple times over the last three years that they are committed to higher oil prices. Source: The Kobeissi Letter, JP Morgan

Oil, diesel crack sread soar after Russia bans diesel, gasoline exports

With Diesel prices already soaring, recently sending the diesel crack to 2023 highs and assuring that refiners have another blowout quarter, Russia just handed a gift to the Exxons of the world when it "temporarily banned" exports of the diesel in a bid to stabilize domestic supplies, adding pressure on already tight global fuel markets. “Temporary restrictions will help saturate the fuel market, that in turn will reduce prices for consumers” in Russia, the government’s press office said on its website. The "temporary" ban, which also applies to gasoline, comes into force today, Sept. 21, and doesn’t have the final date, according to the government decree, signed by Prime Minister Mikhail Mishustin. Source: www.zerohedge.com, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks