Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- macro

- equities

- Food for Thoughts

- sp500

- Central banks

- Bonds

- markets

- bitcoin

- Asia

- technical analysis

- investing

- europe

- Crypto

- geopolitics

- performance

- gold

- tech

- Commodities

- AI

- nvidia

- ETF

- earnings

- Forex

- Real Estate

- banking

- oil

- Volatility

- china

- magnificent-7

- nasdaq

- apple

- emerging-markets

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- russia

- Money Market

- assetmanagement

- UK

- ESG

- Middle East

- amazon

- microsoft

- ethereum

- meta

- bankruptcy

- Turkey

- Healthcare

- Industrial-production

- Global Markets Outlook

- africa

- brics

- Market Outlook

- Asset Allocation Insights

- Flash

- Focus

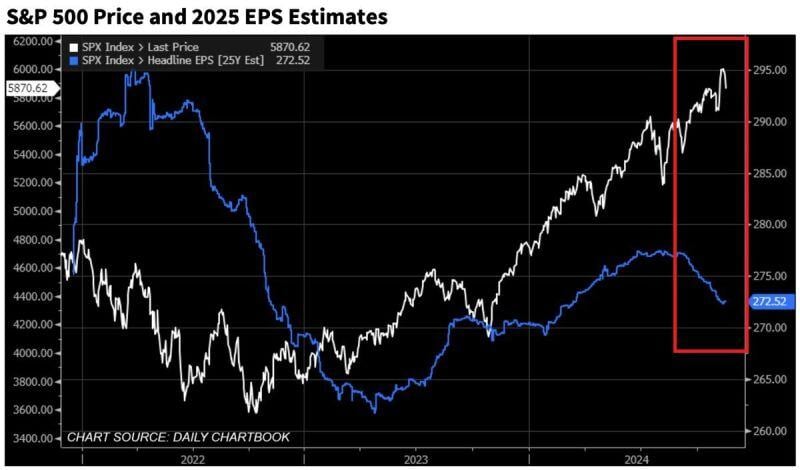

S&P500 earnings estimates for 2025 have rolled over and declined over the last few weeks.

At the same time, the S&P 500 continued to rise making valuations even more stretched (expensive). Will earnings estimates catch up or stocks fall? Source: Global Markets Investor

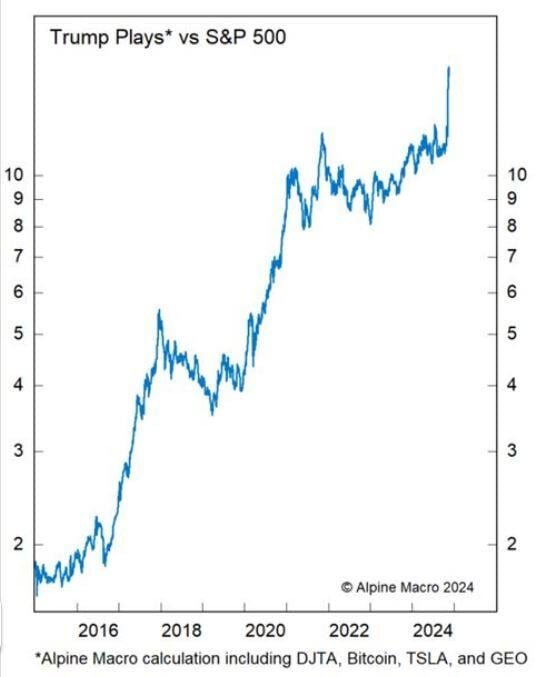

Here's the outperformance (vs. S&P 500) of a pure play Trump index created by Alpine Macro.

It owns DJTA, Bitcoin, Tesla and GEO equally-weighted

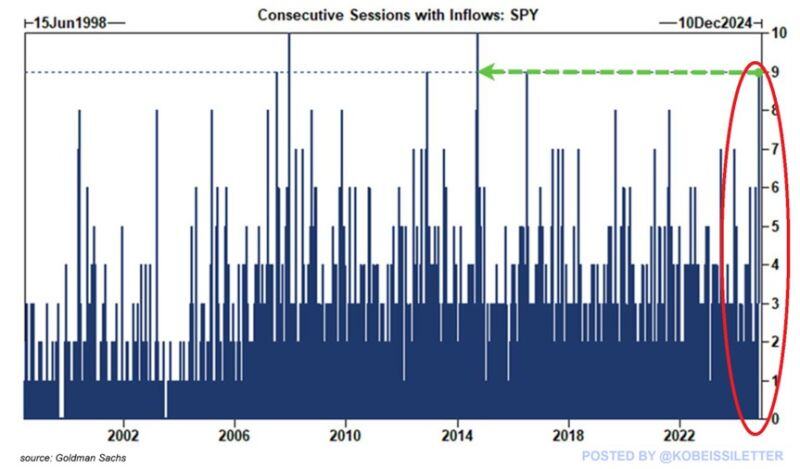

The S&P 500 ETF, $SPY, just saw 9 consecutive days of money inflows, the longest streak since 2014.

Investors have poured $18 billion into $SPY over these 9 days as post-election buying continues. Since 2000, $SPY has only seen 4 streaks with 9 to 10 straight days of inflows: in 2007, 2013, 2014, and 2016. Massive inflows supported the 5%+ run in the S&P 500 following the election. Over the last 13 months, the S&P 500 has now added more than $15 TRILLION of market cap. Source: The Kobeissi Letter, Goldman Sachs

The S&P 500 $SPY P/E Ratios Heat Map.

Besides Banks and Energy, everything is wildly overvalued. $SPY Source: Jesse Cohen @JesseCohenInv

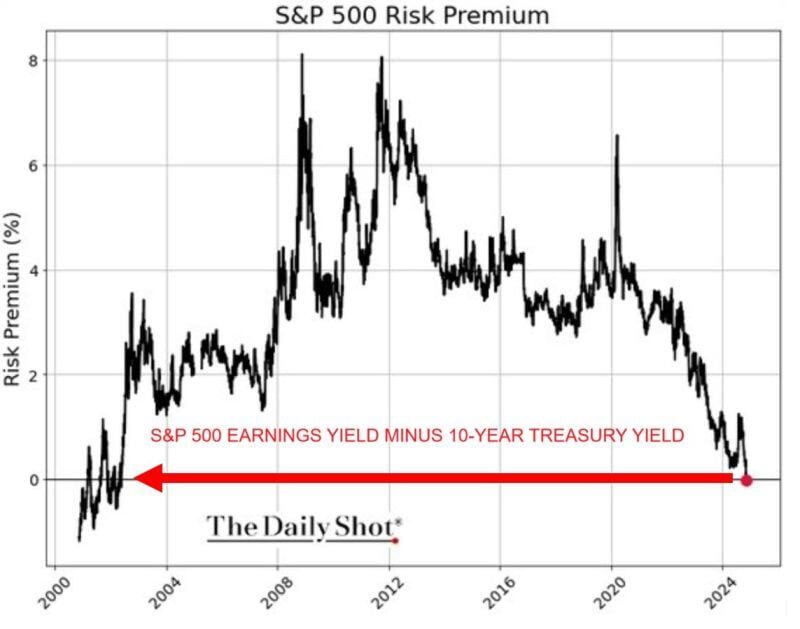

ARE US STOCKS OVERVALUED ⁉

☢ S&P 500 earnings yield FELL below the 10-year Treasury yield for the 1st time in 22 YEARS. ❗In other words, less risky (theoretically) 10-year Treasury is paying MORE than the S&P 500. ⚠This could imply lower than average forward returns for S&P 500. Source: The Daily Shot, Global Markets Investor

$SPY The S&P 500 had its best-performing week of 2024. Here are the top-performing stocks from last week: 👇🏻

Source: The Future Investors @ftr_investors

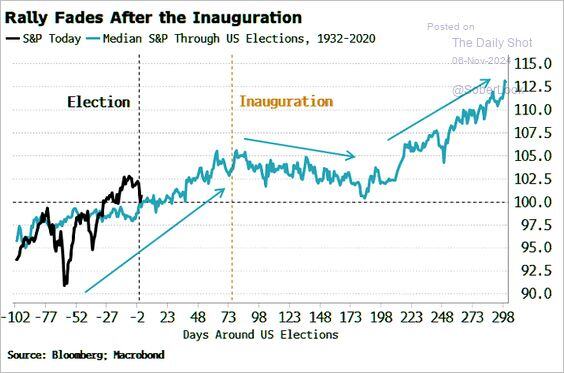

Following the election, the SP500 typically rallies through inauguration day before moderating.

Source: Bloomberg, Macrobond, Mike Zaccardi, CFA, CMT, MBA, The Daily Shot

Investing with intelligence

Our latest research, commentary and market outlooks