Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- macro

- equities

- Food for Thoughts

- sp500

- Central banks

- Bonds

- markets

- bitcoin

- Asia

- technical analysis

- investing

- europe

- Crypto

- geopolitics

- tech

- gold

- performance

- Commodities

- AI

- nvidia

- ETF

- earnings

- Forex

- Real Estate

- oil

- banking

- magnificent-7

- Volatility

- nasdaq

- apple

- emerging-markets

- energy

- Alternatives

- china

- switzerland

- tesla

- trading

- sentiment

- russia

- Money Market

- assetmanagement

- UK

- ESG

- Middle East

- microsoft

- amazon

- ethereum

- meta

- bankruptcy

- Turkey

- Healthcare

- Industrial-production

- Global Markets Outlook

- africa

- brics

- Market Outlook

- Asset Allocation Insights

- Flash

- Focus

🚨 GOOGLE SAYS QUANTUM TECH IS JUST 5 YEARS AWAY FROM REAL-WORLD IMPACT

Julian Kelly, Director of Hardware at Google Quantum AI: "We think we're about five years out from a real breakout... a practical application that you can only solve on a quantum computer." Following Google’s December breakthrough in quantum error correction, momentum is building fast. These supercomputers could soon tackle physics problems and generate data beyond the reach of today’s machines. Quantum computing is no longer a far-off dream — it’s becoming a near-term reality. Source: CNBC thru Mario Nawfal

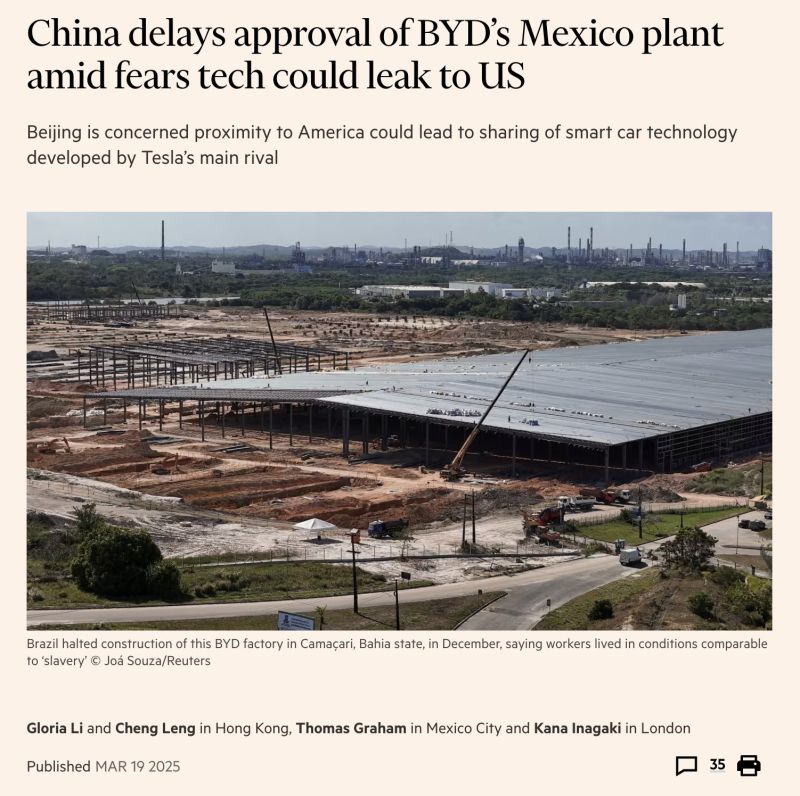

For years, the United States routinely accused China of technology theft.

Now, the opposite might happen: China is worried that the United States might steal technology from them. How the tables have turned. Source: Jostein Hauge @haugejostein

BREAKING: BYD unveils battery system that allows EVs to charge as fast as regular cars

Source: ns123abc (@NIK) on X

🔴 TRUMP & TSMC TO ANNOUNCE MASSIVE $100B U.S. CHIP INVESTMENT

Trump and TSMC, the world's largest contract chipmaker, are set to unveil a $100B investment in U.S. semiconductor manufacturing over four years. This expands on TSMC’s $65B Arizona site, which began mass production in 2024, and is fueled by the 2022 CHIPS Act’s $6.6B grant and tax incentives. With AI, smartphones, and military tech at stake, the move aims to counter Taiwan’s 90% grip on advanced chips. Source: WSJ thru Mario Nawfal on X

Investing with intelligence

Our latest research, commentary and market outlooks