Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- macro

- equities

- Food for Thoughts

- sp500

- Central banks

- Bonds

- markets

- bitcoin

- Asia

- technical analysis

- investing

- europe

- Crypto

- geopolitics

- tech

- gold

- performance

- Commodities

- AI

- nvidia

- ETF

- earnings

- Forex

- Real Estate

- oil

- banking

- magnificent-7

- Volatility

- nasdaq

- apple

- emerging-markets

- energy

- Alternatives

- china

- switzerland

- tesla

- trading

- sentiment

- russia

- Money Market

- assetmanagement

- UK

- ESG

- Middle East

- microsoft

- amazon

- ethereum

- meta

- bankruptcy

- Turkey

- Healthcare

- Industrial-production

- Global Markets Outlook

- africa

- brics

- Market Outlook

- Asset Allocation Insights

- Flash

- Focus

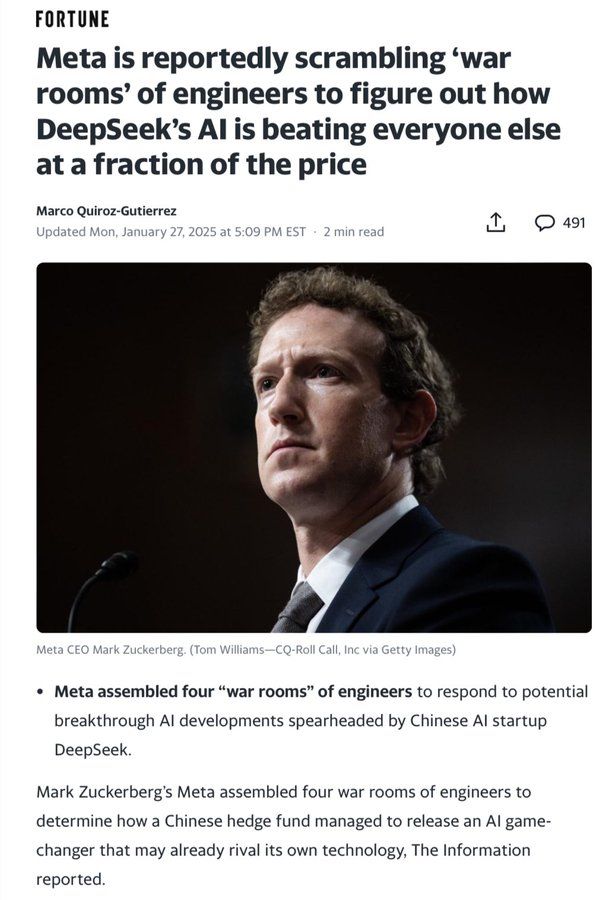

DeepSeek V3 ‘bullish’ for Nvidia, would buy on weakness, says Cantor Fitzgerald - Would you agree???

DeepSeek’s V3 large language model is “actually very bullish” for Nvidia (NVDA) and compute, despite “great angst” around the impact for compute demand and fears of peak spending on GPUs, Cantor Fitzgerald tells investors. The firm says DeepSeek’s advances mean artificial general intelligence is closer, and that work will continue on pre-training, post-training, and time-based inference/reasoning, and future investments in large-scale clusters will only accelerate, all of which is bullish for AI. The firm would buy shares of Nvidia on any potential weakness. Cantor has an Overweight rating and $200 price target on the shares. Source: Markets Insider

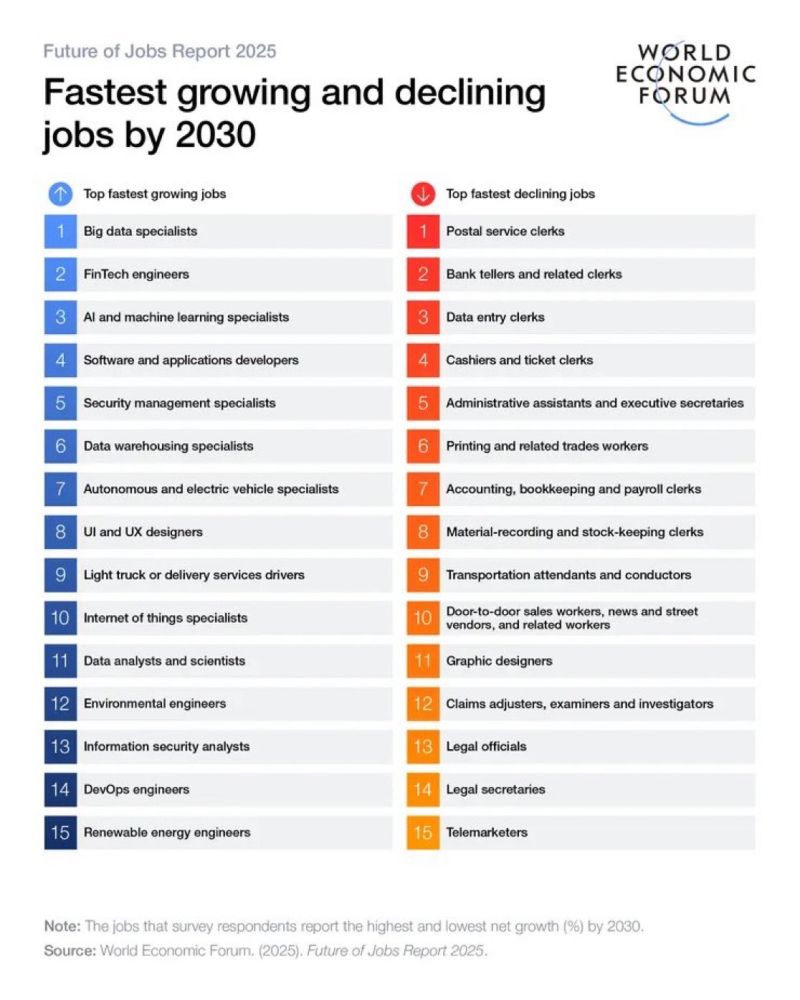

Investing in technology and specifically artificial intelligence (AI) also seemed to be front and center in the early days of the new administration.

President Trump signed an executive order to "make America the world capital in Artificial Intelligence." The order calls for agencies to craft policy to ensure U.S. dominance in AI. In addition, the new administration has proposed backing a private-sector investment of up to $500 billion to fund infrastructure for AI. The new venture, called Stargate, aims to build data centers – a huge need to support AI computing power – and potentially create up to 100,000 jobs. The investments in data centers and electricity are critical for the U.S. to maintain leadership and be a driver for AI technology and applications. The chart below shows the energy requirements measured in terawatt hours for U.S. datacenters is expected to rise over the coming years. Source: Edward Jones

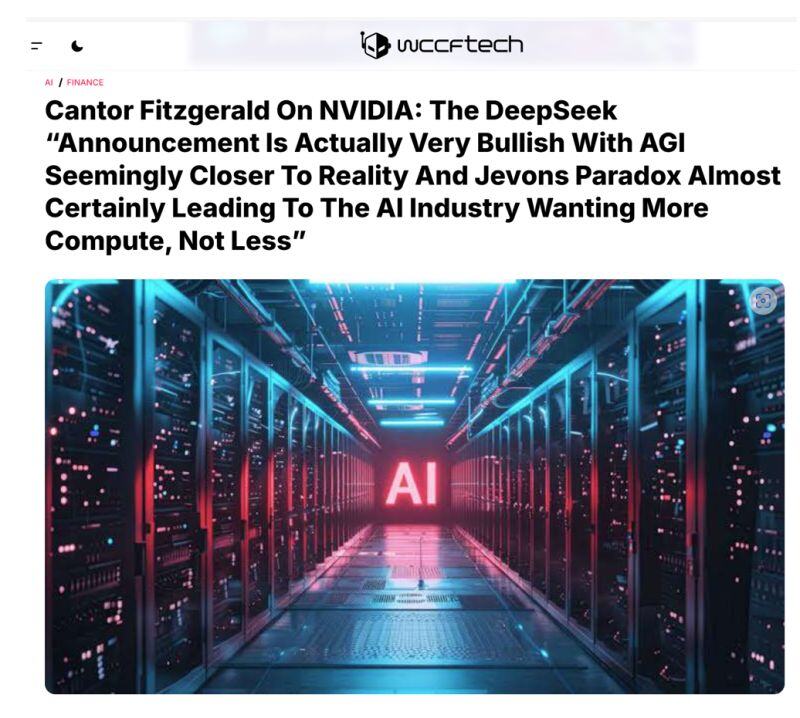

About DeepSeek founder Liang Wenfeng

>> Studies machine vision at Zhejiang University >> At 30 in 2015, launches High-Flyer quant hedge fund >> Makes a fortune (now $8B AUM) >> Wants to build “human” level AI as side hustle and pitches partners but they initially sceptical >> Buys 10,000 H800 chips in 2021 and brings over his top hedge fund employees (all have tons of experience squeezing juice out of Nvidia GPUs for the fund) >> Launched DeepSeek in 2023 and hires dozens of PhDs from top Chinese universities (Peking, Tsinghua and Beihang) >> Pays top top top salary for tech talent only matched by Bytedance in China…wants DeepSeek to be leading “local” company >> US export restrictions force DeepSeek team to get creative and they do, finding new training methods to make LLM models (V3, r1) competitive with OpenAI, Anthropic, Gemini, Grok, LLama etc at ~1/20th the cost >> Training costs not exactly apples-to-apples but novel methods and clear improvements in efficiency (also questions around copying other models, larger H-100 clusters they maybe can’t talk about and/or CCP support) >> Open sources and publishes methods (r1 reasoning paper has 200+ authors) >> DeepSeek just hit top of App Store *** FT: https://lnkd.in/e96ffxmU Source: Trung Phan @TrungTPhan on X, FT

Semiconductor fund managers after seeing 4 memes about DeepSeek on X.

Chip stocks are plunging overnight on the back of the DeepSeek story: 1. Arm, $ARM: -5.5% 2. Nvidia, $NVDA: -5.3% 3. Broadcom, $AVGO: -4.9% 4. Super Micro, $SMCI: -4.6% 5. Taiwan Semi, $TSM: -4.5% 6. Micron, $MU: -4.3% 7. Qualcomm, $QCOM: -2.8% 8. AMD, $AMD: -2.5% 9. Intel, $INTC: -2.0% DeepSeek is only story in town and it’s showing up in global markets this Monday

This billionaire can predict the future

He was an early investor in Facebook, Uber & Airbnb. And he just said, "AI will create more billionaires than the internet.” David Sacks’ 5 predictions on the future of wealth creation and why you should care (a thread on X by EmperorDino): 👉"The AI Gold Rush": AI will create more billionaires than the internet. Why? AI is not just a new technology, it's a force multiplier for every industry. The numbers back this up: NVIDIA's value jumped $1.5T in 12 months. AMD stock surged 400% since 2022. Sacks predicts: "The next trillion-dollar company will be an AI infrastructure play.” 👉 "The Rise of AI-First Startups": By 2025, most successful startup will be AI-native. Just like mobile killed web-only companies in 2010. AI will kill traditional software companies by 2026. 👉"AI Models Reaching PhD-Level Reasoning". Sacks recently revealed that OpenAI's AI models will soon achieve PhD-level reasoning abilities. This would be huge for the AI world. 👉 "The Death of Traditional VC": AI will revolutionize startup funding. Smart contracts + AI agents will: • Evaluate startups • Structure deals • Monitor performance Traditional VCs will become obsolete by 2027. 👉 "The Great Wealth Transfer" AI will create two classes: • Those who leverage AI • Those who compete with AI The wealth gap between these groups will be larger than the internet created. Time to pick a side. 🚀 Here's what Sacks is personally investing in: • AI agent platforms • AI infrastructure companies • Industry-specific AI solutions • Computing hardware startups His Craft Ventures fund deployed $850M in these sectors since 2023. Your action plan: 1. Build for the AI-first world 2. Learn AI infrastructure fundamentals 3. Focus on industry-specific problems 4. Learn skills that can't be replaced or automated The next decade of wealth creation starts now. Source: EmperorDino on X

Investing with intelligence

Our latest research, commentary and market outlooks