Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- macro

- equities

- Food for Thoughts

- sp500

- Central banks

- Bonds

- markets

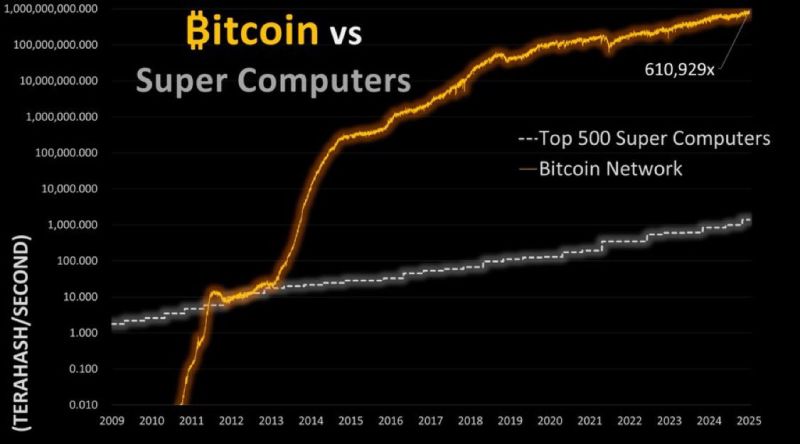

- bitcoin

- Asia

- technical analysis

- investing

- europe

- Crypto

- geopolitics

- tech

- gold

- performance

- Commodities

- AI

- nvidia

- ETF

- earnings

- Forex

- Real Estate

- oil

- banking

- magnificent-7

- Volatility

- nasdaq

- apple

- emerging-markets

- energy

- china

- Alternatives

- switzerland

- tesla

- trading

- sentiment

- russia

- Money Market

- assetmanagement

- UK

- ESG

- Middle East

- microsoft

- amazon

- ethereum

- meta

- bankruptcy

- Turkey

- Healthcare

- Industrial-production

- Global Markets Outlook

- africa

- brics

- Market Outlook

- Asset Allocation Insights

- Flash

- Focus

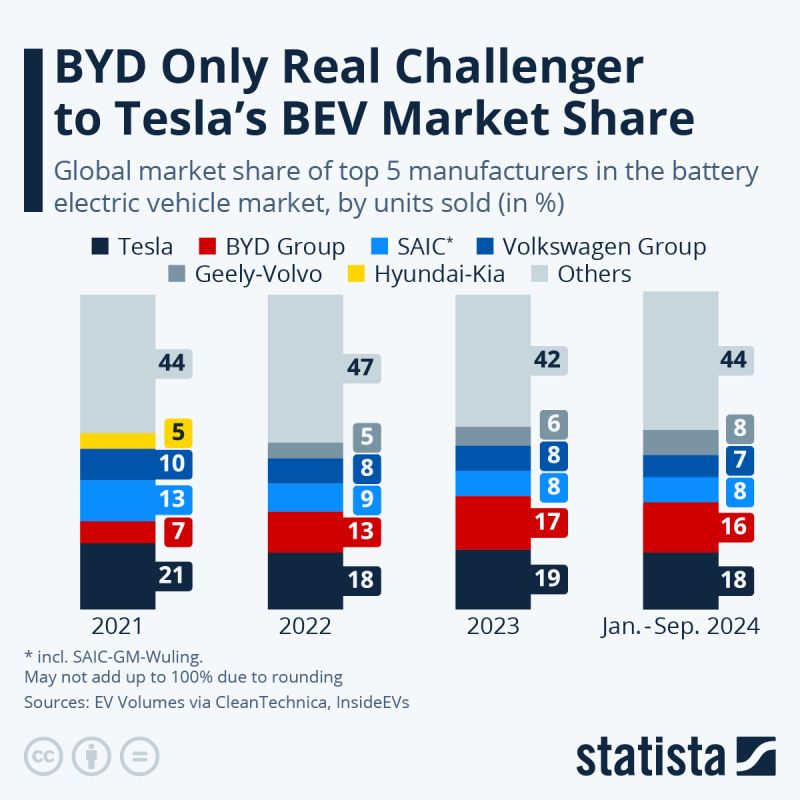

As of Sept. 2024, Tesla led global BEV market share at 18%, down from 19% in 2023, per EV Volumes.

BYD rose 9 points since 2021 but may shift focus to hybrids in 2025. Legacy automakers like VW and Geely held 7-8%. In 2023, 14M EVs sold, but 84% of cars were non-electric. Source: Statista

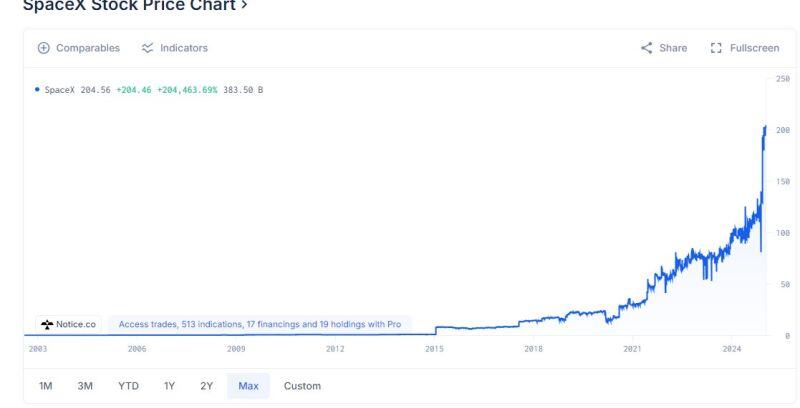

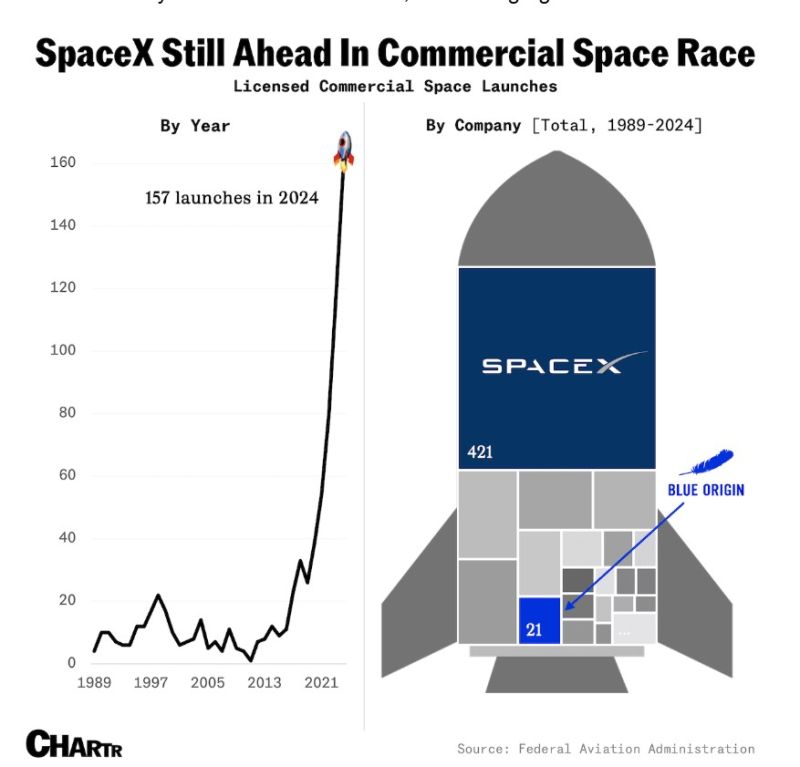

Musk’s company SpaceX is dominating the industry, responsible for a skyrocketing ~65% of the total licensed commercial launches in the US since its founding.

Blue Origin’s total launch count since its inception is only 16% of what SpaceX managed in 2024 alone. Source: Chartr

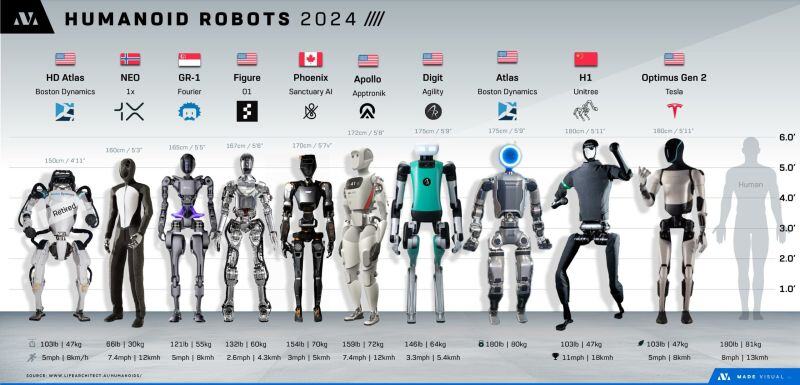

The Age of Robots is Here

(post on X by Lin @Speculator_io ) 👉 Humanoids $TSLA Tesla $XPEV Xpeng $XIACF Xiaomi $HYMTF Hyundai 👉 Logistics $SERV Serve Robotics $AMZN Amazon $SYM Symbotic $AUTO AutoStore 👉Robotics Software $NVDA NVIDIA $PTC PTC 👉 Sensors $OUST Ouster 👉 Healthcare Robotics $ISRG Intuitive Surgical $SYK Stryker $MDT Medtronic $ARAY Accuray 👉 Industrial Robotics $HON Honeywell $TER Teradyne $LECO Lincoln Electric 👉 Robotics Automation $ROK Rockwell Automation $ABBN ABB $ZBRA Zebra Technologies $CGNX Cognex $PATH UiPath $PEGA Pegasystems 👉 Defense Robotics $AVAV AeroVironment $KTOS Kratos $LMT Lockheed Martin $NOC Northrop Grumman $BA Boeing $GD General Dynamics 👉 Consumer & B2B Robotics $IRBT iRobot $XIACF Xiaomi $RR RichTech Robotics 👉 Specialized Robotics $OII Oceaneering $FARO FARO Technologies

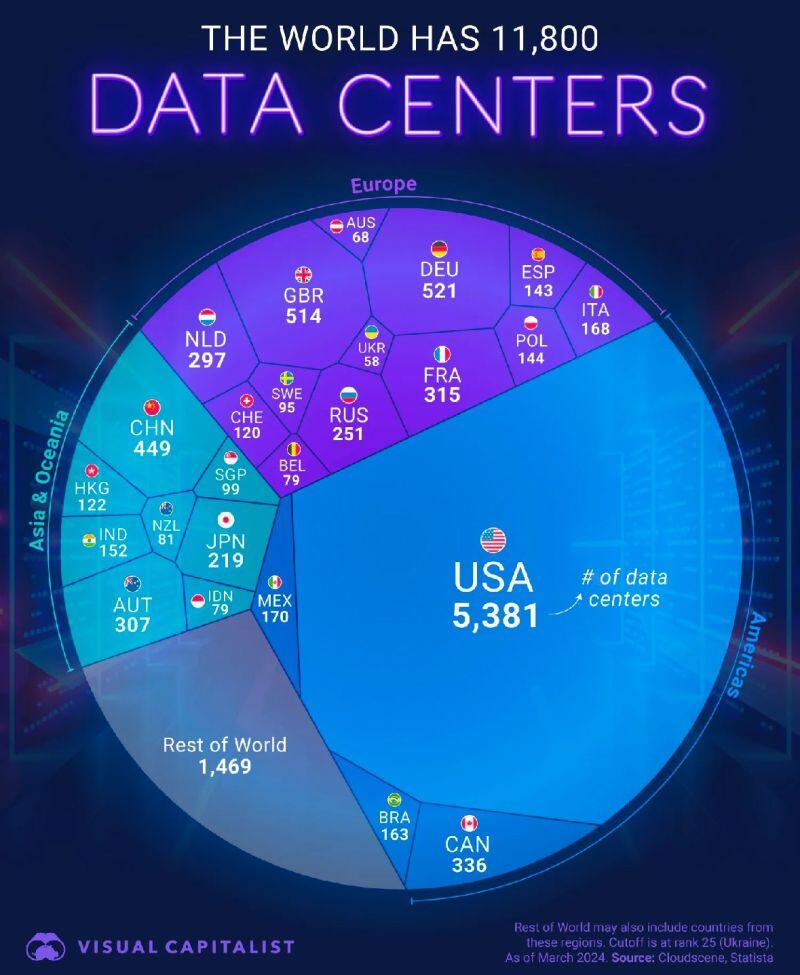

President-elect Donald Trump on Tuesday announced a $20 billion FOREIGN investment to build new data centers ACROSS THE UNITED STATES, according to CNBC.

Emirati billionaire Hussain Sajwani, a Trump associate and founder of the property development company DAMAC Properties, is pledging “at least” that amount, the president-elect said at his Florida home Mar-a-Lago. “They may go double, or even somewhat more than double, that amount of money,” Trump said of Sajwani’s company. The “first phase” of the plan will take place in Texas, Arizona, Oklahoma, Louisiana, Ohio, Illinois, Michigan and Indiana, Trump said. Source: Stocktwits, CNBC

Investing with intelligence

Our latest research, commentary and market outlooks