Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- macro

- equities

- Food for Thoughts

- sp500

- Central banks

- Bonds

- markets

- bitcoin

- Asia

- technical analysis

- investing

- europe

- Crypto

- geopolitics

- performance

- tech

- gold

- Commodities

- AI

- nvidia

- ETF

- earnings

- Forex

- Real Estate

- oil

- banking

- Volatility

- magnificent-7

- nasdaq

- apple

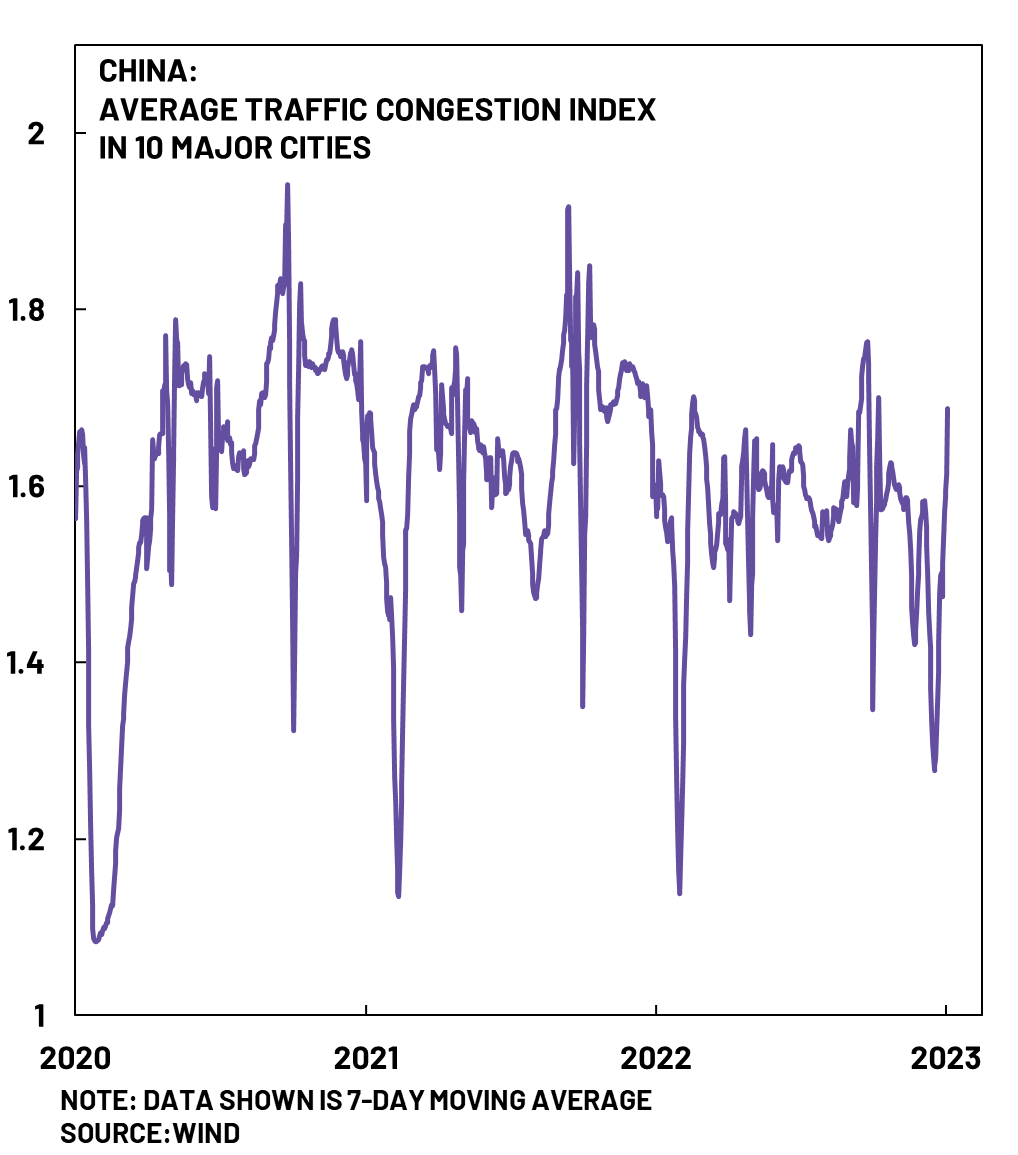

- china

- emerging-markets

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- russia

- Money Market

- assetmanagement

- UK

- ESG

- Middle East

- microsoft

- amazon

- ethereum

- meta

- bankruptcy

- Turkey

- Healthcare

- Industrial-production

- Global Markets Outlook

- africa

- brics

- Market Outlook

- Asset Allocation Insights

- Flash

- Focus

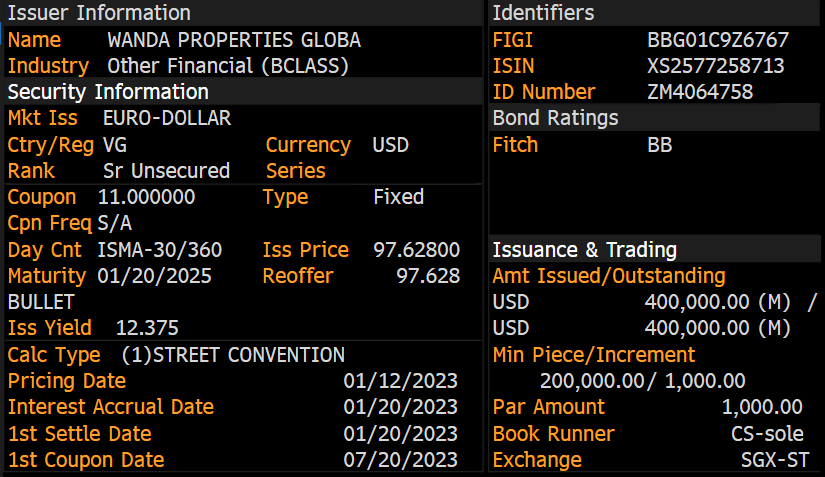

First USD-denominated bond issued by a Chinese property developer since September 2021!

New positive sign for the Chinese real estate sector? After 16 months of waiting, the dollar-denominated debt market has reopened for a Chinese property developer, Wanda Properties, without any guarantee from the Chinese government. This new issue was well received by investors as the book was oversubscribed four times. However, the majority of investors were from Asia (>80%) and while this news is positive for the sector (and its liquidity problem), it does not solve the problem of sales (demand) for now. Source : Bloomberg

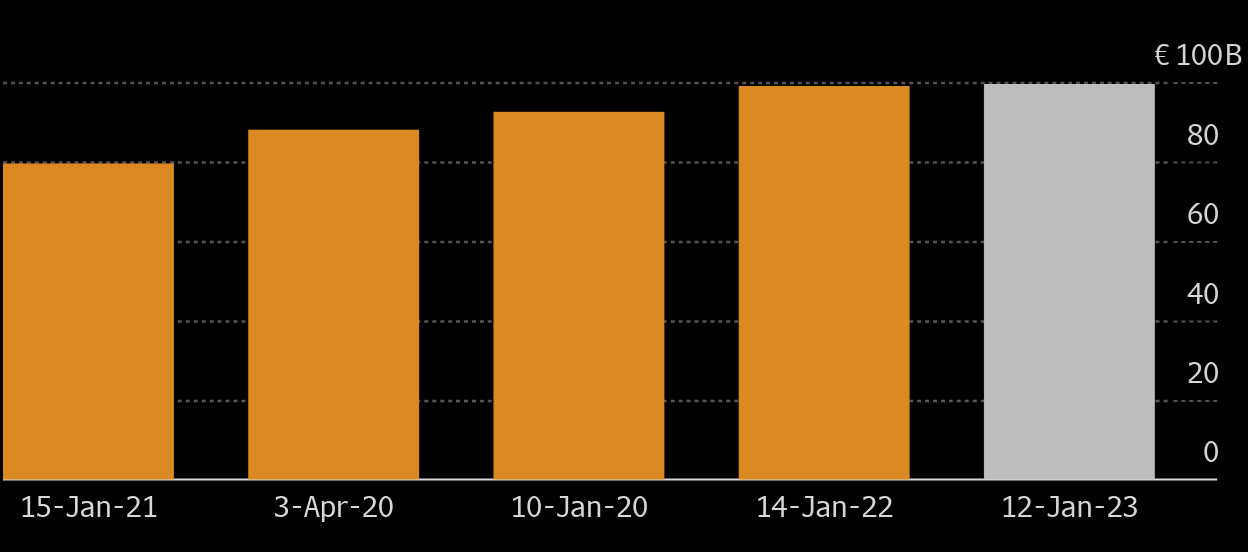

U.S. 3-month government bond yield hits new highs!

The yield on three-month U.S. T-Bill rose 8 basis points to 4.66 percent, its highest level since 2007. This reflects the latest comments from Fed members in favor of further increases in the federal funds rates. It is worth noting that the next FOMC meeting will be held on February 1 and the market is so far expecting a 25 basis point increase. Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks