Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Looming Threat to Japanese Bonds: A Setback for the Global Fixed-Income Rally?

Amidst the impressive year-end rally in the global fixed-income market, a significant development last night casts a shadow over this upward momentum. The yield on the Japanese 10-year bond surged by 12 basis points, driven by comments from BOJ Governor Kazuo Ueda and Deputy Governor Ryozo Himino, instigating a belief that change might unfold sooner than anticipated. The probability of the BOJ ending its negative rates policy this month skyrocketed to nearly 45%, as Himino's speech was perceived as relatively hawkish, amplifying the significance of the BOJ's December meeting to a live event. Adding to the market tension, the Japan 30-Year Bond Sale recorded its lowest bid-cover since 2015. Notably, the sharp steepening of the Japanese curve, from 20 bps in March to 80 bps at the end of October, coincided with a significant increase in US Treasury yields over the same period... Source: Bloomberg

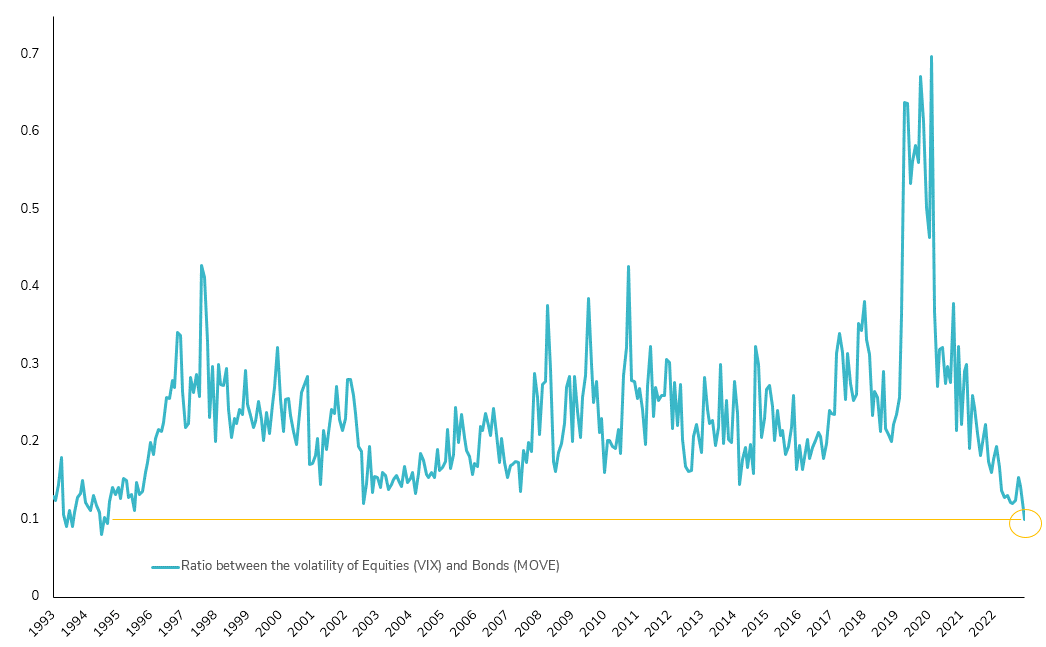

Record Low: Equity/Bonds Volatility Ratio Hits Unprecedented Levels!

The divergence between two widely recognized measures of volatility, the VIX index for Equity and the MOVE index for Rates, continues to be stark. In the U.S., equity volatility has reached new lows for 2023, while volatility in U.S. Treasuries remains persistently high. Calculating the ratio between the VIX and MOVE indexes reveals a significant trend—the lowest point since 1994/1995! Anticipate dynamic shifts in 2024! 📈 #MarketTrends #VolatilityAnalysis #Outlook2024

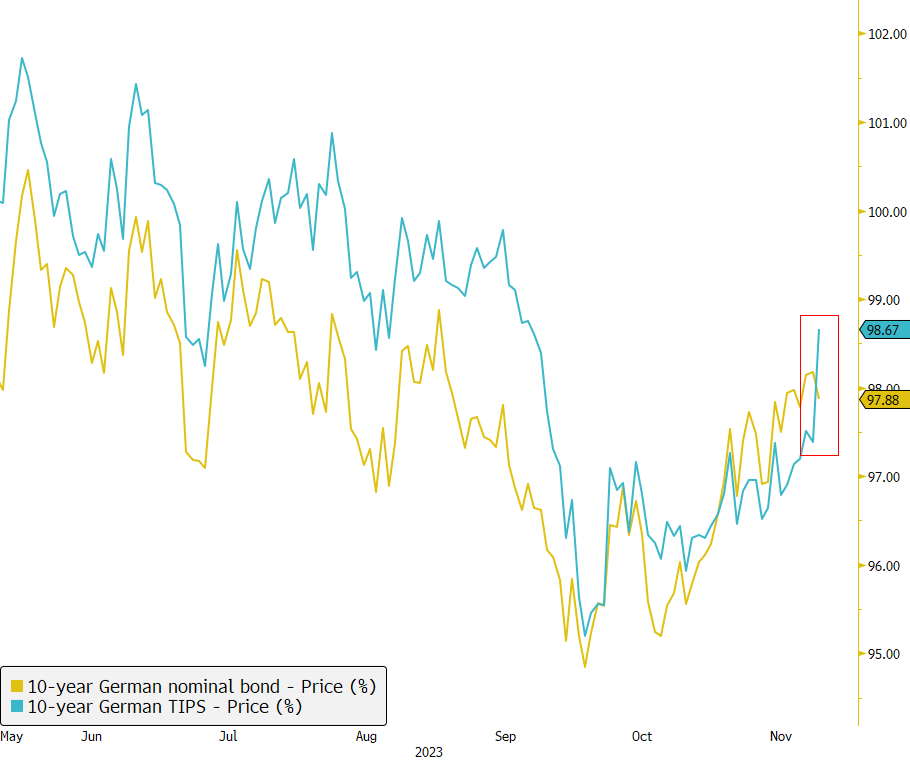

Market Moves: 10-Year German Inflation-Linked Bond Surges

Today witnessed a significant market shift as the 10-year German inflation-linked bond surged by more than 1%, juxtaposed with a 0.5% drop in the 10-year German nominal yield. This move can be attributed to the recent announcement from the German Federal Government to cease sales of inflation-linked bonds starting from 2024. Additionally, Germany's Lindner announced today to suspend the debt limit (#debtbrake) for 2023 following a budget ruling. Source: Bloomberg

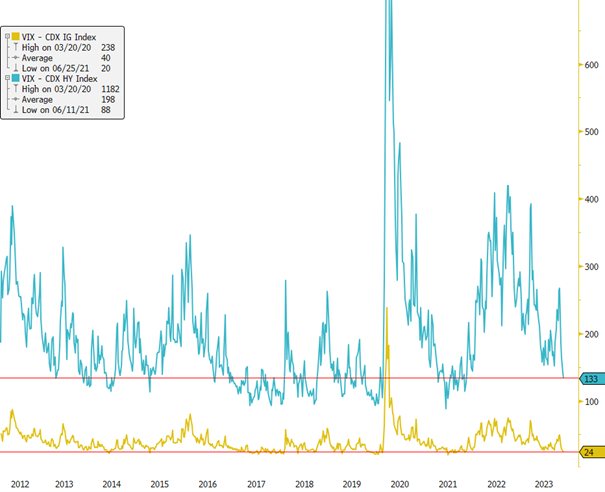

Record-Low Volatility in the US Credit Market! 📉🌐

Amidst ongoing rate volatility (MOVE index) showing a persistent high, albeit with a decreasing trend over the past two months, the volatility in credit markets has taken a different turn. Currently, volatility in US Investment Grade (IG) corporate bonds has reached levels not seen since 2021, hovering close to record lows. Additionally, the volatility in US High Yield (HY) has experienced a significant drop in the past month. With low volatility and tight credit spreads, the question arises: Is there still room to extract excess returns from the US credit market in 2024? 🤔 Source: Bloomberg #CreditMarkets #Volatility #FinanceInsights

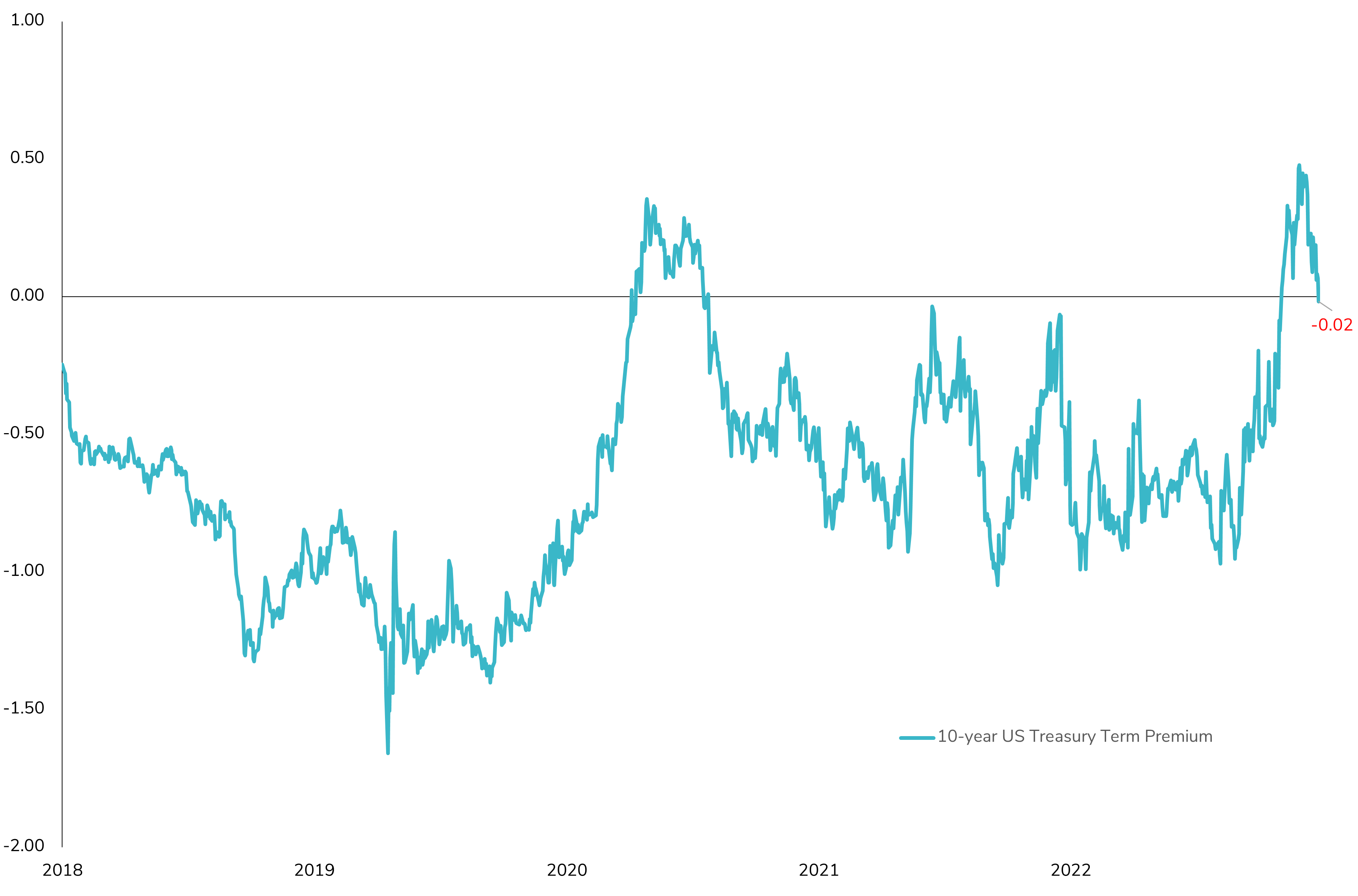

10-Year US Term Premium Dips Back into Negative Territory! 📉🔍

The term premium, a metric reflecting the additional yield demanded by investors for holding longer-term bonds rather than rolling over shorter-dated securities, turned negative last week. This shift could be interpreted as a signal that the market is anticipating a recession in the US in 2024, with rate cuts by the Federal Reserve (1% fully discounted already by the market). Given the recent rally of more than 50 basis points on the 10-year US Treasury yield and the term premium now in negative territory, coupled with still very high rate volatility, the question arises: Will the rally in long rates temporarily come to a halt? 🤔 Source: Bloomberg

The Global Fixed Income Landscape Regains Its Color! 📈🌐

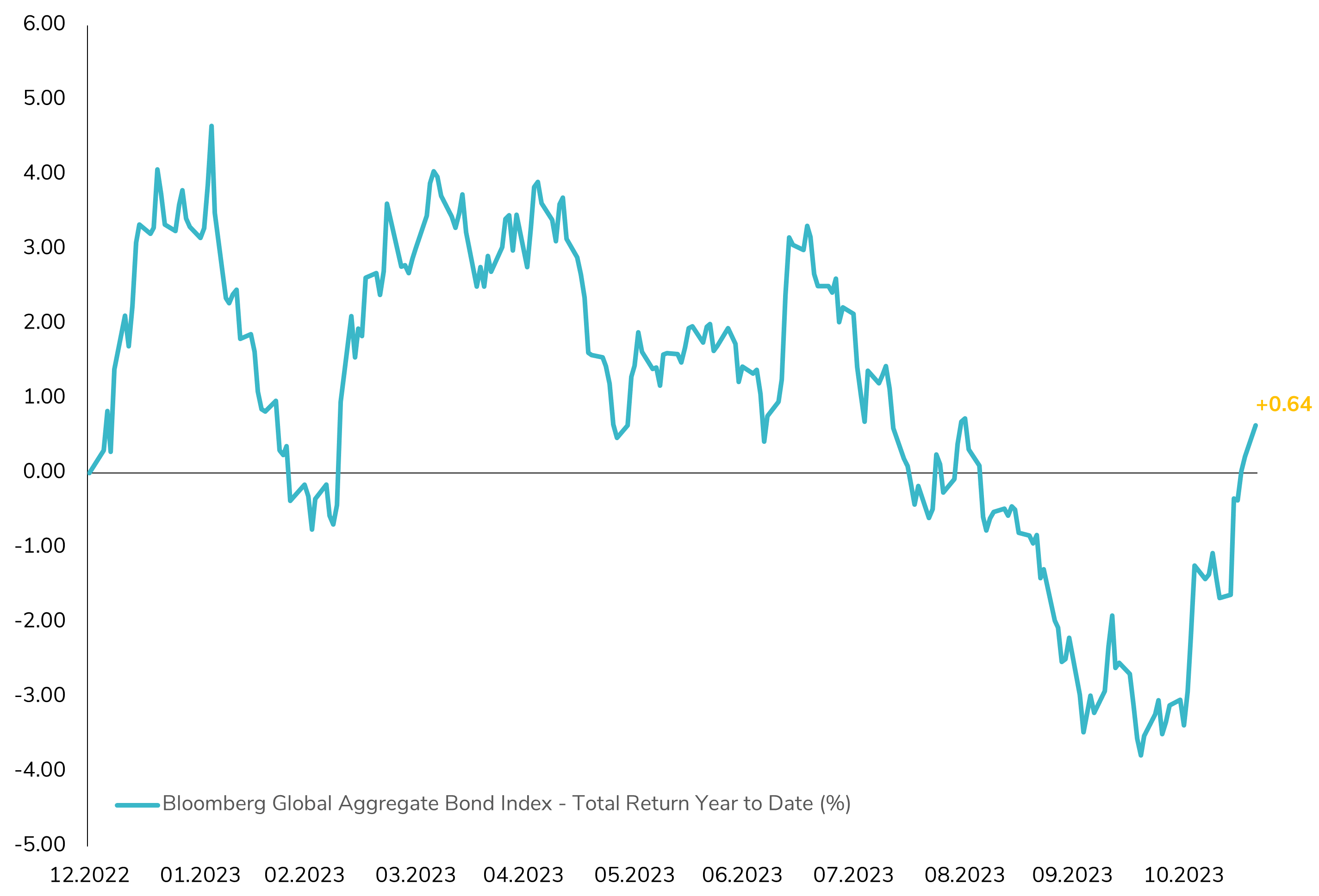

After a dip to -4% year-to-date just a month ago, the global fixed income investment universe is now on a sharp rebound, driven by improving inflation signals hinting at a potential rate peak by central banks (already materialized in some emerging market countries). The Bloomberg Global Aggregate Bond Index, a widely tracked and comprehensive global bond indicator, has returned to positive territory in 2023 since last week. This upturn signifies a positive development for fixed income investors who have navigated challenges over the past three years, with a cumulative total return of -20% since the end of 2020. Are we entering a sunnier future for fixed income investments? ☀️ Source: Bloomberg

Investor Repositioning on HY Revealed in Latest BoFA Credit Survey 🔄📈

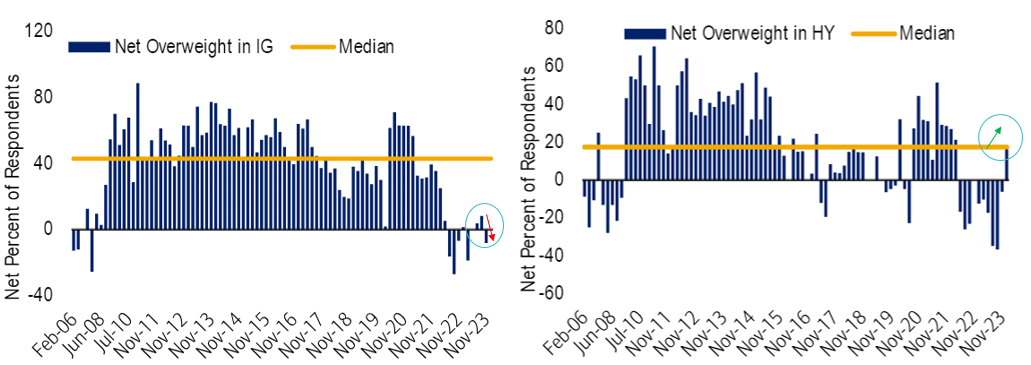

The recent BofA Credit Investor Survey reveals significant shifts in market sentiment. For Investment Grade (IG) investors, net positioning dropped to -8% net underweight in November from a +8% net overweight in September. Conversely, High Yield (HY) witnessed an uptick, reaching +18% net overweight in November, the highest since Jan-2022. Notably, HY investors are more optimistic about spreads, with the net share expecting wider spreads dropping significantly for the 3 and 6-month horizons. Delving deeper into investor positioning, the HY landscape presents a nuanced picture. The primary repositioning in November focused on the #frontend (1-3y) and #higherquality of the HY. Many asset allocators are embracing a barbell strategy, blending exposure to the intermediate/long end of high-quality corporate bonds or Treasuries with a portion invested in the front end of the US HY, enhancing the average yield. The goal is to navigate economic uncertainties by benefiting from the safety of high-quality fixed income and compensating for potential defaults in the HY space. Could this strategic approach push the HY-IG Yield Ratio lower, considering it already reaches post-GFC lows? #CreditMarkets #Investing #FinanceInsights 📊💼 Source: BoFA

Ford's Rise to Investment Grade Sparks Historic Shift in Junk Bond Market!

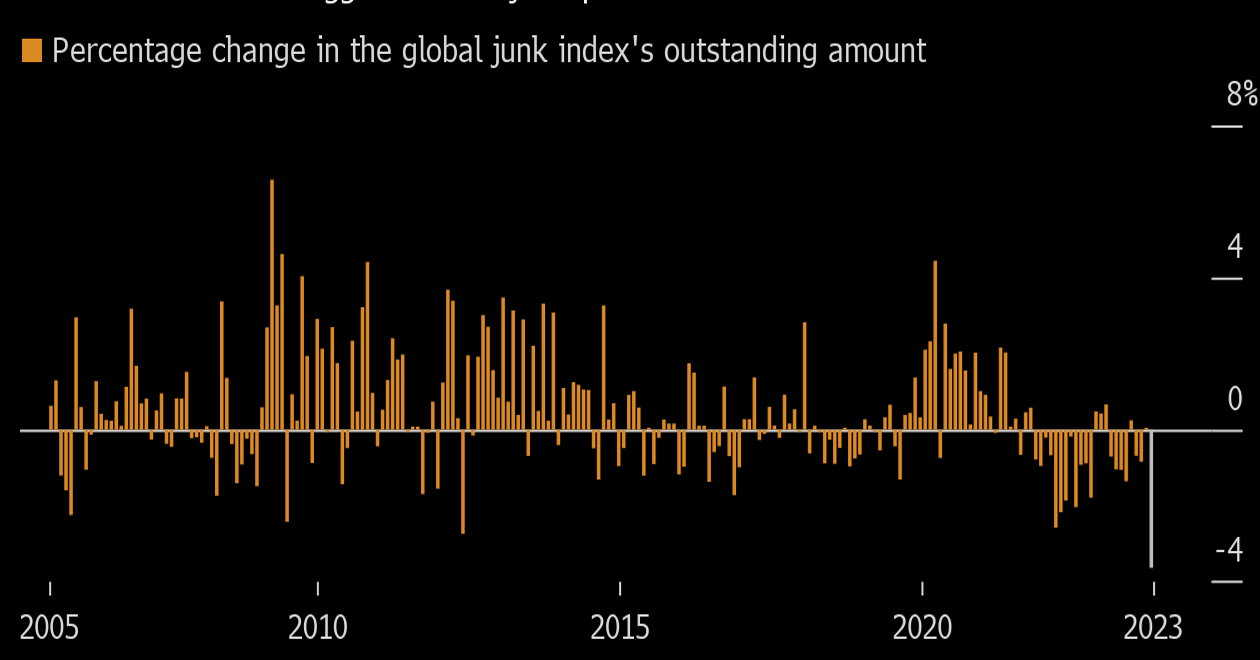

Ford's recent credit rating upgrade to Investment Grade status triggered a remarkable $46.8 billion exit from junk bond indexes, marking the most significant reduction in the global junk bond benchmark since 2005. This makes Ford the largest "rising star" in history. It underscores a transformation in corporate priorities, with a heightened focus on financial resilience amidst economic uncertainties. The trend of "fallen angels" descending into junk status has notably decelerated, and analysts anticipate more companies achieving investment grade status in the coming years. Source: Bloomberg #Finance #InvestmentGrade #JunkBonds 📉📊📈

Investing with intelligence

Our latest research, commentary and market outlooks