Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

EM Middle East Sovereign Bonds Impacted by the Israeli-Palestinian Conflict

Since the commencement of the Israel-Palestine conflict, the 5-year CDS (Credit Default Swap) for Middle East sovereign bonds has experienced a significant surge. 📈 Notably, the market's response doesn't reflect heightened concern. This is evident as US equities have continued to climb since the conflict's onset, while interest rates have surged back to previous highs. 📈📊 Thus far, the impact has primarily reverberated in the commodities market, with fluctuations affecting oil and gold prices. Additionally, the Middle East sovereign countries in the EM (Emerging Markets) segment have also felt the repercussions. 🛢️💰 Is the market right to be this complacent in the face of ongoing geopolitical tensions?

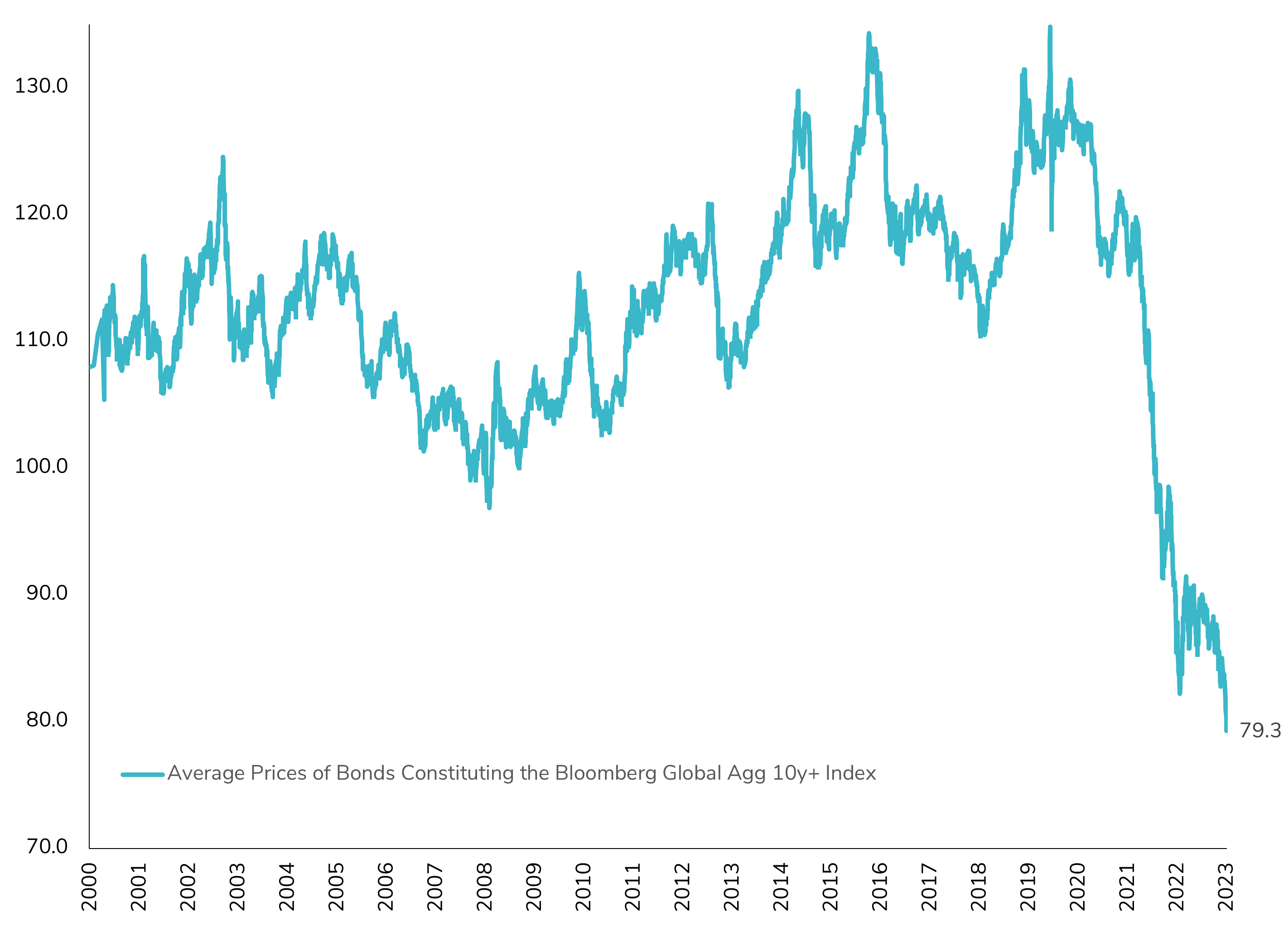

Long-Term Bond Prices Hitting Historic Lows in Global Aggregate Bonds Index: A Cautionary Tale of Convexity?

The average price of long-term bonds has recently reached historic lows, a significant development since the inception of the Bloomberg Global Aggregate Bonds Index in the early 2000s. If the "higher for longer" narrative materializes and persists, it carries substantial implications for bond investors, especially those with long-term bond holdings. This pertains to the convexity of long-term bonds, a crucial yet often underestimated aspect of fixed-income investments. Choosing to retain long-term bonds with reduced prices and the associated lower coupon payments may lead to overlooking the attractiveness of short-term bonds, which currently offer more technically appealing yields. This decision could potentially entail a nuanced opportunity cost in the short term, especially if the 'higher for longer' scenario (which implies a soft landing) persists. Source : Bloomberg

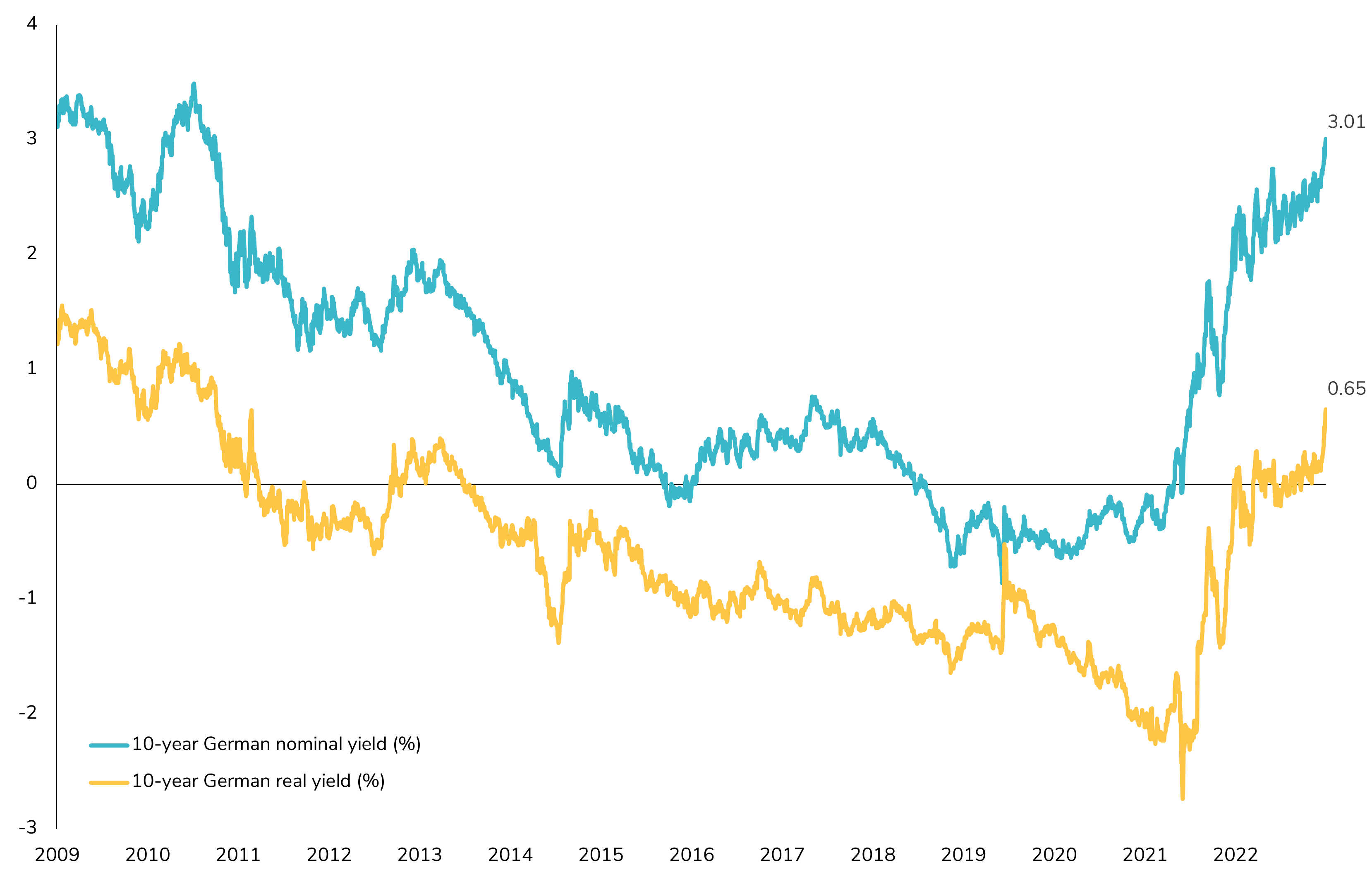

German Bond Yields Surge to 3%, Unseen Since 2011!

In sync with global bond markets, German bond yields are experiencing a significant surge, marking a noteworthy milestone. The 10-year German yield has ascended to a remarkable 3%, a level not witnessed since 2011. This notable surge is primarily rooted in the rise of real yields, clearly depicted by the yellow line on the charts. Interestingly, inflation expectations, measured by the breakeven rate, have remained steadfast since the beginning of 2023, with the 10-year German breakeven rate holding firm at 2.29%. Despite the enduring challenges in Europe's economic outlook, there have been noticeable improvements, albeit against the backdrop of economic strain. Over the summer, the Citi Economic Surprise Index for Europe has impressively rebounded, transitioning from a daunting -150 to a more manageable -50. This reflects positive developments amid the ongoing challenges. However, the persistent turbulence in the government bond market can be attributed to several factors. These include the synchronized reduction of balance sheets by most developed central banks, which directly impacts real interest rates and term premiums. Additionally, the narrative of "higher for longer" has prompted a recalibration of flows into the front end of the yield curve, driven by concerns about the long end's convexity potentially not performing well in this scenario. The current resilience of the US economy, coupled with uncertainties surrounding the potential for a second phase of rising inflation within a soft landing scenario and a larger fiscal deficit, adds further complexity to this landscape. Source : Bloomberg

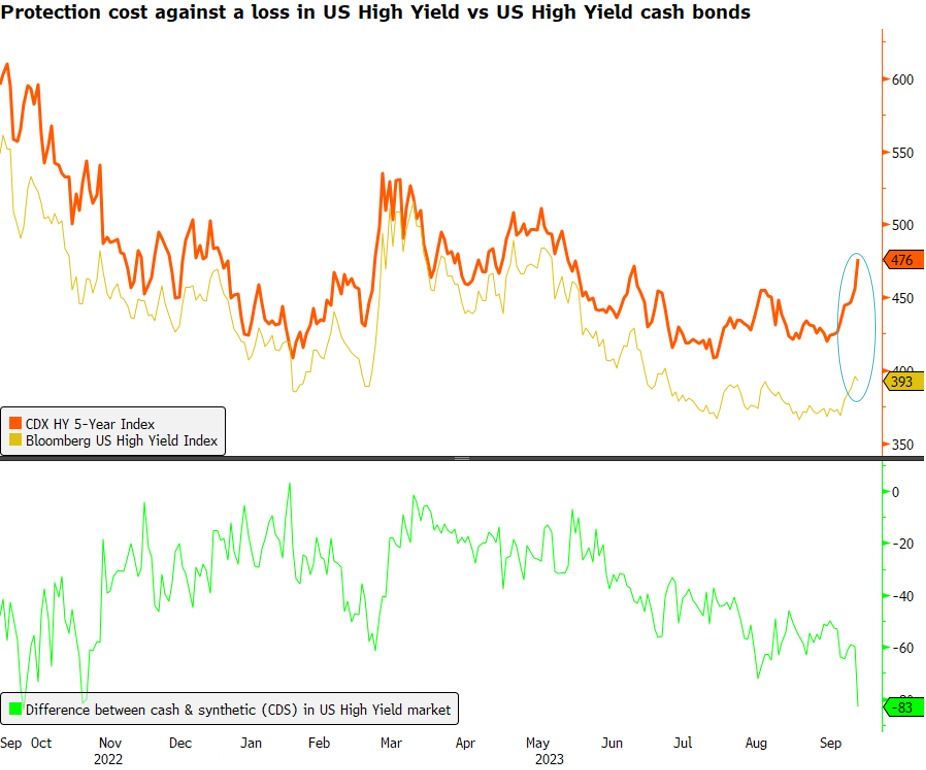

US HY: watch out for take-off!

The disparity between cash and synthetic in High Yield (HY) has recently hit levels not witnessed since October 2022. While HY credit spreads in the cash bond market appear more resilient in response to the rapid increase in real rates, the CDX HY index, comprised of 5-year CDS of HY companies, has expanded by over 60 bps in just two weeks. The question now is, how long will this disconnect between the two markets persist? Source: Bloomberg #HighYield #CreditMarkets #Finance #Investing

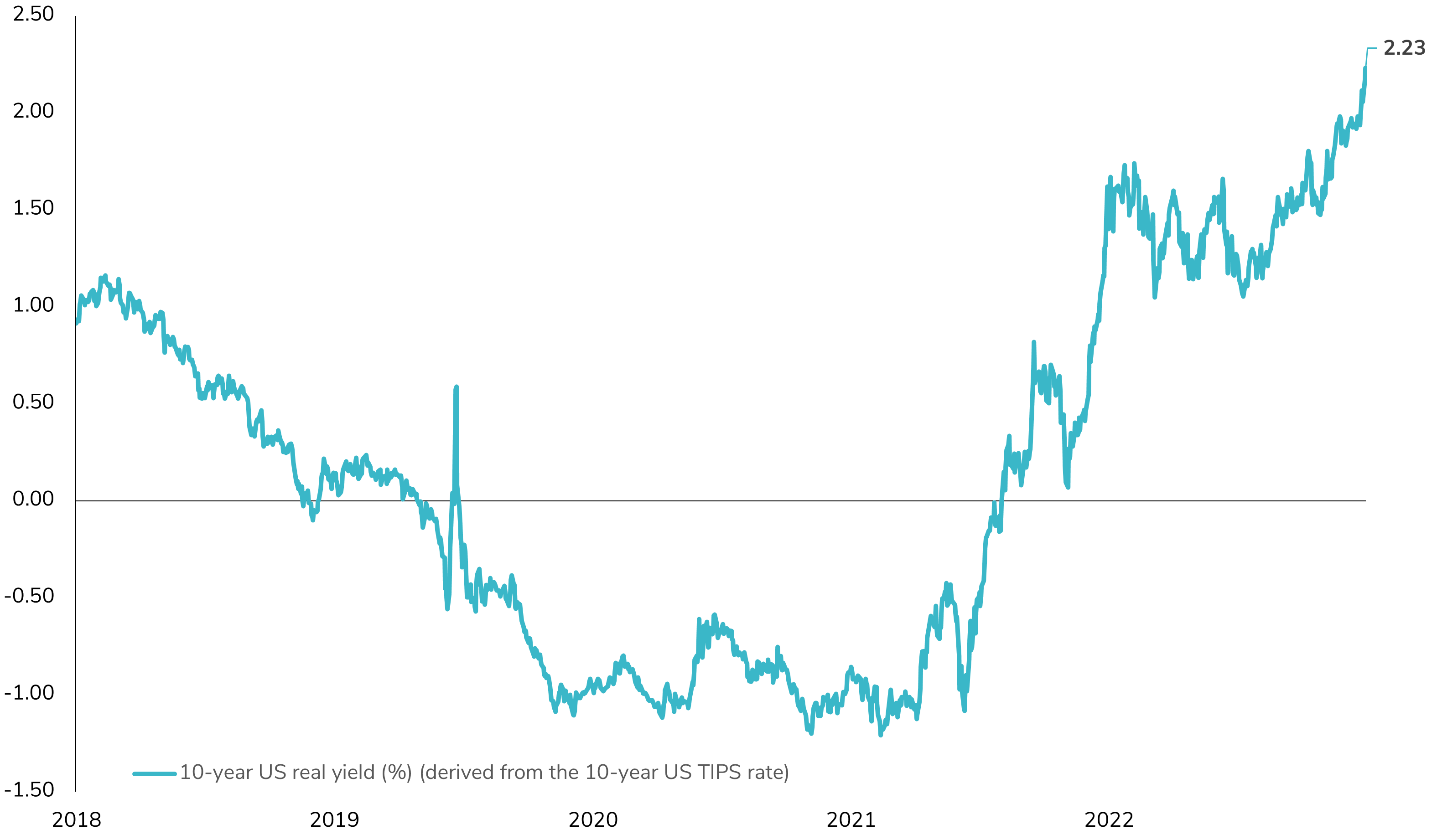

TIPS - A Revival in Focus!

Long-term U.S. Treasury Inflation Protection Securities (TIPS) have witnessed a significant double-digit decline since the start of 2022, despite the presence of high U.S. inflation. While the inflation-linked component has acted as a safety net, providing a cushion of around 10% over 20 months, the surge in the 10-year real rate from -1.0% to 2.2% over the same period has had a marked and negative impact on the total TIPS yield (-14%). Yet, the question lingers: Is now the opportune moment to contemplate TIPS? We are currently at a level of LT real rates (2.23%) not seen since 2008. Interestingly, TIPS exhibit a lower beta compared to U.S. Treasuries (currently standing at 0.8). This attribute becomes especially valuable in light of the considerable volatility in U.S. interest rates (with the MOVE index still >100). hould we delve into the realm of inflation-linked bonds, which constitute a global market valued at over $3.5 trillion? This consideration gains significance as uncertainties surrounding inflation persist, driven by factors like de-globalization, supply shocks, increased fiscal spending, and the ongoing transition to renewable energy sources. Source: Bloomberg

Rising Italian Yields and the Looming Debt Question: What Lies Ahead for Eurozone?

The 10-year Italian yield has reached its highest level since March, while the difference between the 10-year Italian and German yields is trading above 180bps for the first time since June. Beyond speculating on whether the ECB will raise interest rates to 4% or not, the significance of Italy's debt burden should be a fundamental concern, especially if they announce a new tightening of their monetary policy by ending reinvestments in their PEPP program or, worse still, making further disinvestments under the APP program.

Recent Developments in the AT1/CoCo Bond Market: ZKB Unexpectedly Skips an AT1 Call!

After the Credit Suisse turmoil, the AT1/CoCo bond market is witnessing intriguing dynamics as Zürcher Kantonal Bank (ZKB) takes an unexpected turn by choosing to bypass an AT1 call. In a landscape where banks are carefully navigating refinancing challenges, this move adds a new layer of complexity to the market. ZKB's decision to forego the AT1 call comes in the wake of Banco Santander's similar choice, signaling a trend toward cautious financial strategies in the face of fluctuating market conditions. These recent developments are shedding light on the intricate decision-making processes that banks are employing to balance their financial stability and growth prospects.

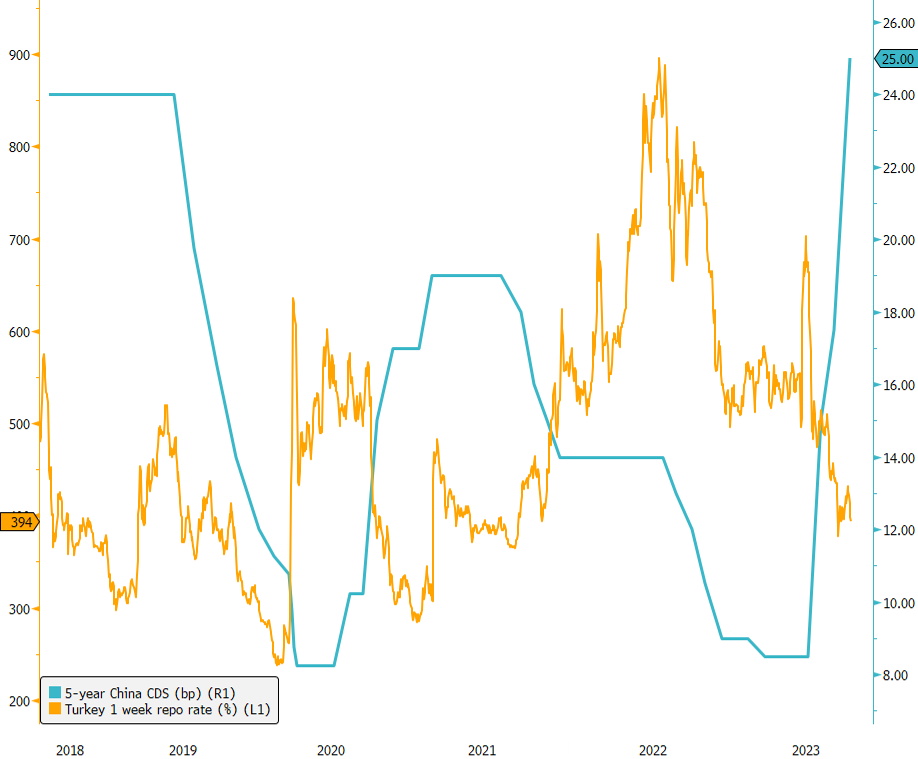

Turkey's Aggressive Rate Hike Triggers 5-Year CDS Drop!

The Turkey Central Bank has taken a significant step in its battle against inflation by implementing a supersized rate hike of 750bps, bringing rates to 25%. This move was unexpected, as the market had anticipated a more "modest" hike to 20%. Turkish fixed income assets have responded positively, with the Turkey 5-year CDS retreating below 400bps. Even Turkey's US Dollar-denominated bonds saw a boost from the news. With the Central Bank of Turkey adopting a more orthodox approach to its monetary policy, the question arises: can they successfully bring inflation back to reasonable levels? To provide context, the latest inflation figure for the month of July was at a staggering 47.8%... Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks