Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

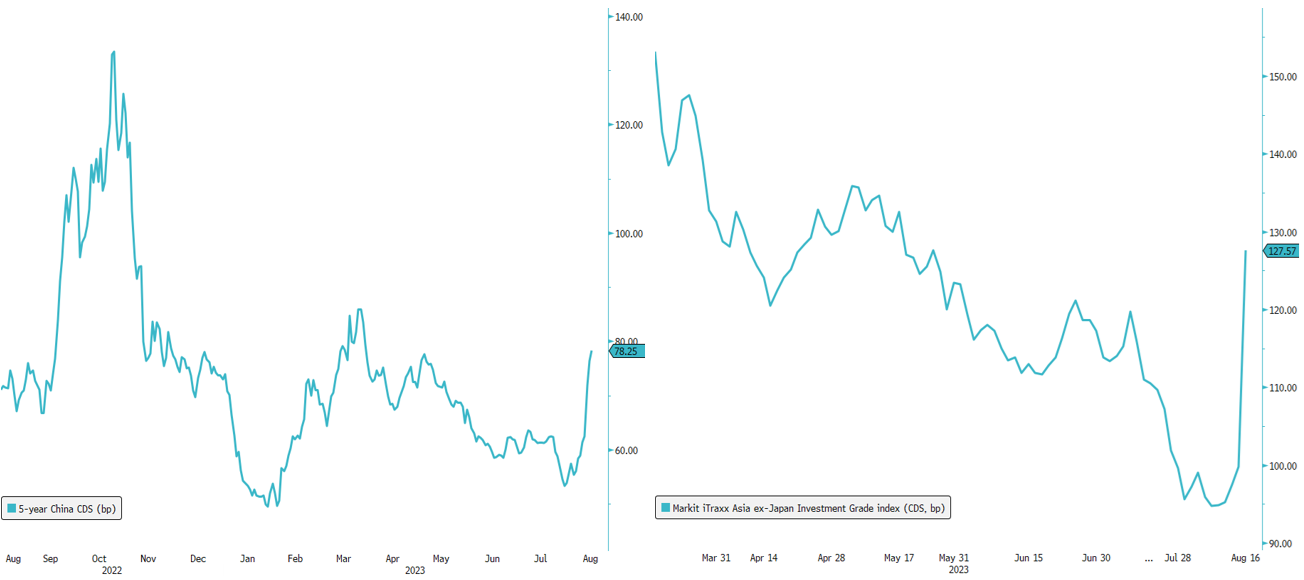

China's credit landscape under stress!

Ever since the shockwaves of the #CountryGarden upheaval, the Chinese credit landscape has been undergoing a seismic shift. The credit default swap (#CDS) market tells a compelling story - #China's 5-year CDS is on a relentless rise (+25bps), and the Markit iTraxx Asian ex Japan #InvestmentGrade index is soaring (+30bps). Foreign investors are strategically repositioning, swiftly #divesting their holdings in Chinese #assets, particularly on the domestic front. Can the #PBOC orchestrate the necessary #stimulus maneuvers to put an end to this spiral of uncertainty?

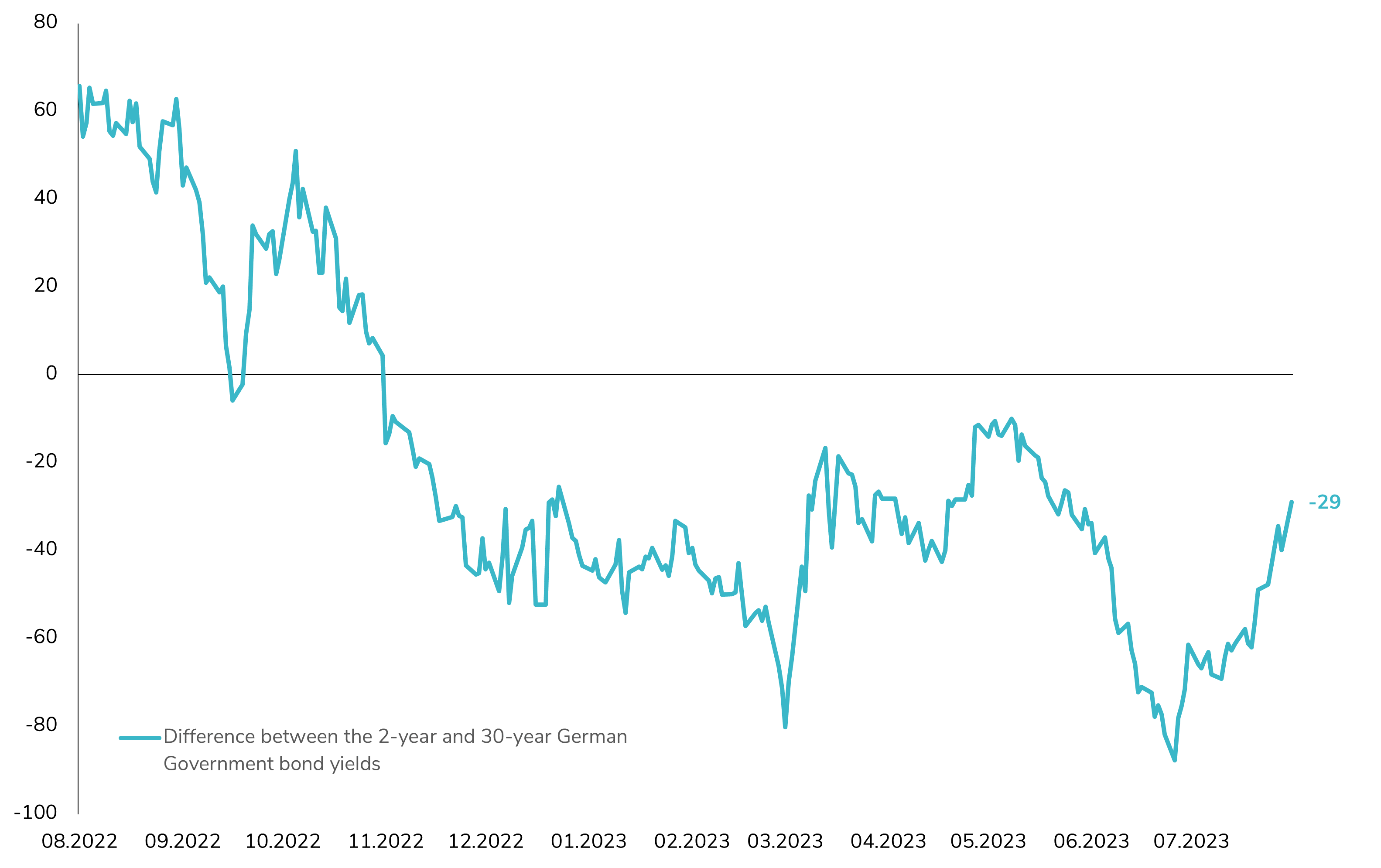

Why is the German Yield Curve Sharply Steepening?

The German yield curve has experienced an impressive steepening of almost 60bps in just one month! This significant movement can be attributed to several key factors that are driving the shift: Fundamentals and Economic Outlook: One of the primary drivers behind this steepening is the market's reassessment of the potential avoidance of a recession. There's a positive repricing of economic fundamentals, suggesting improved prospects for growth and stability. Additionally, there's growing concern about structural inflation running higher than initially expected. Notably, the German 5-year breakeven rate has surged to 2.63%, reaching its highest level since 2009, which has translated into higher long-term yields. Front-End Yield Curve Repricing: The recent decisions made by the European Central Bank (ECB) have also played a role in the steepening. Firstly, the ECB chose to no longer remunerate the bank's minimum reserve held at the central bank. Additionally, today's surprise decision by the Bundesbank's Executive Board further impacted the market. The decision was to remunerate domestic government deposits held with the Bundesbank at 0%, starting from 1 October 2023. Both of these developments could potentially increase demand for German short-term papers. Source: Bloomberg.

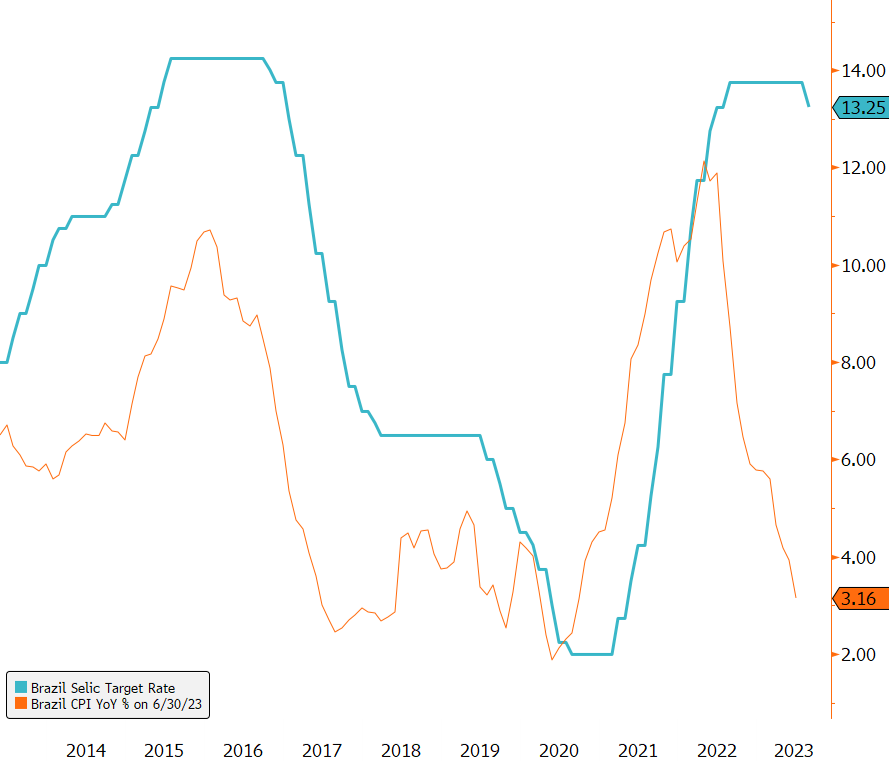

Banco Central do Brazil Surprises with a Larger-than-Expected Rate Cut!

Following the surprising rate cut by 100bps from Chile's Central Bank earlier this week, Banco Central do Brasil (BCB) has also made an unexpected move by announcing a rate cut of 50bps, surpassing market expectations of 25bps. The BCB President, Roberto Campos Neto, reduced the Selic to 13.25% yesterday, with a split decision among board members, four of whom voted for a smaller quarter-point cut. In a related statement, policymakers emphasized the improved consumer price outlook and the decline in longer-term inflation expectations. With Brazil's recent rating upgrade and positive progress in inflation, the country appears well-positioned to continue its path of prudent monetary policy decisions. Could we expect similar rate cuts from Peru and Mexico in the region? In any case, just as at the beginning of the tightening cycle, Latin American central banks are once again ahead of their developed counterparts. Source : Bloomberg.

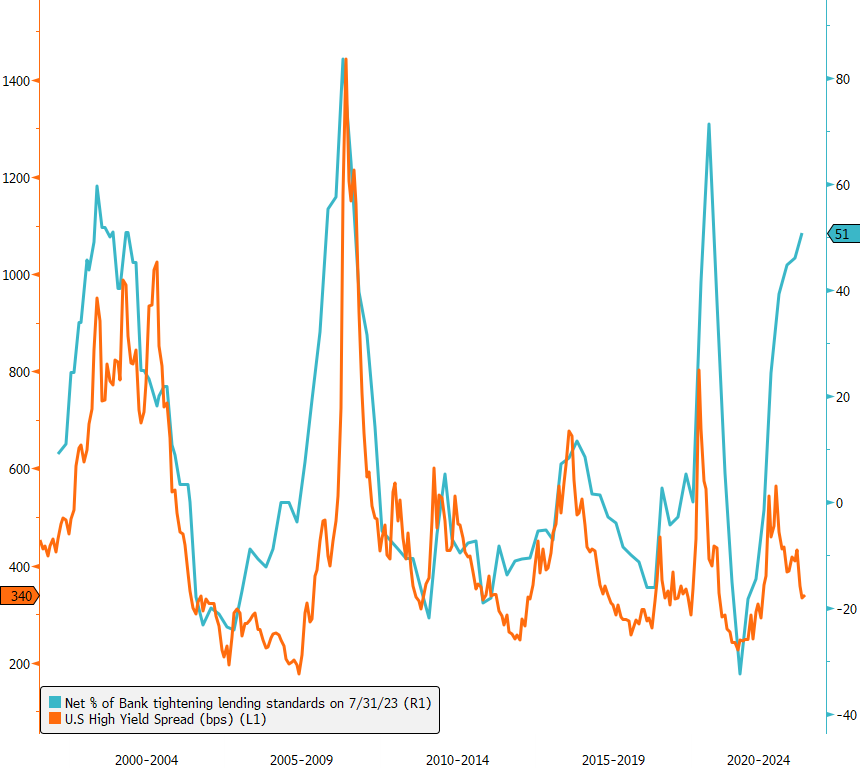

U.S. High Yield credit spreads : time for decompression?

The updated Fed's July senior loan officer survey reveals a notable trend—there's an even higher net share of banks tightening lending standards for C&I compared to the prior survey in April. Historically, this has had implications for US high yield credit spreads. But is this time different? Source : Bloomberg

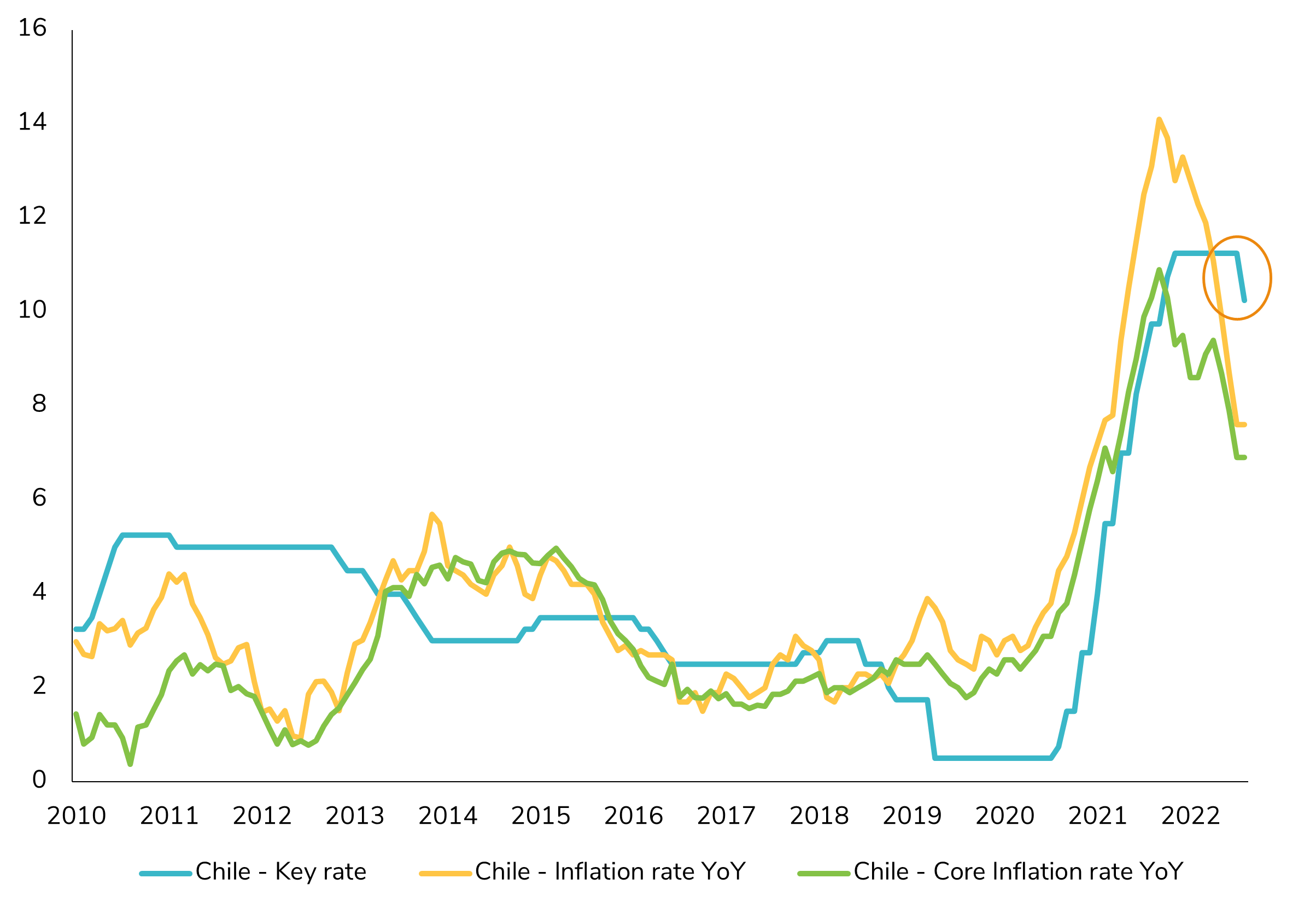

Chile Central bank cut its key rate by 100bps!

Here we go ! The Banco Central de Chile (BCCh) is the first central bank to kick off easing cycle! The Chilean Central Bank made a surprising move by cutting its key interest rate by 100bp to 10.25%, surpassing market expectations of a 50bp reduction. The decision was unanimous, and the BCCh hints at further rate cuts in the near future. This move comes as inflationary pressures ease rapidly, and economic activity weakens. Despite recent challenges, the CLP (Chilean Peso Spot) has shown resilience this year, benefiting from reduced political uncertainty. Policymakers aim to support the #economy amidst deteriorating #sentiment and economic activity. The minutes scheduled for August 14 will provide further insights into the central bank's outlook. Source : Bloomberg

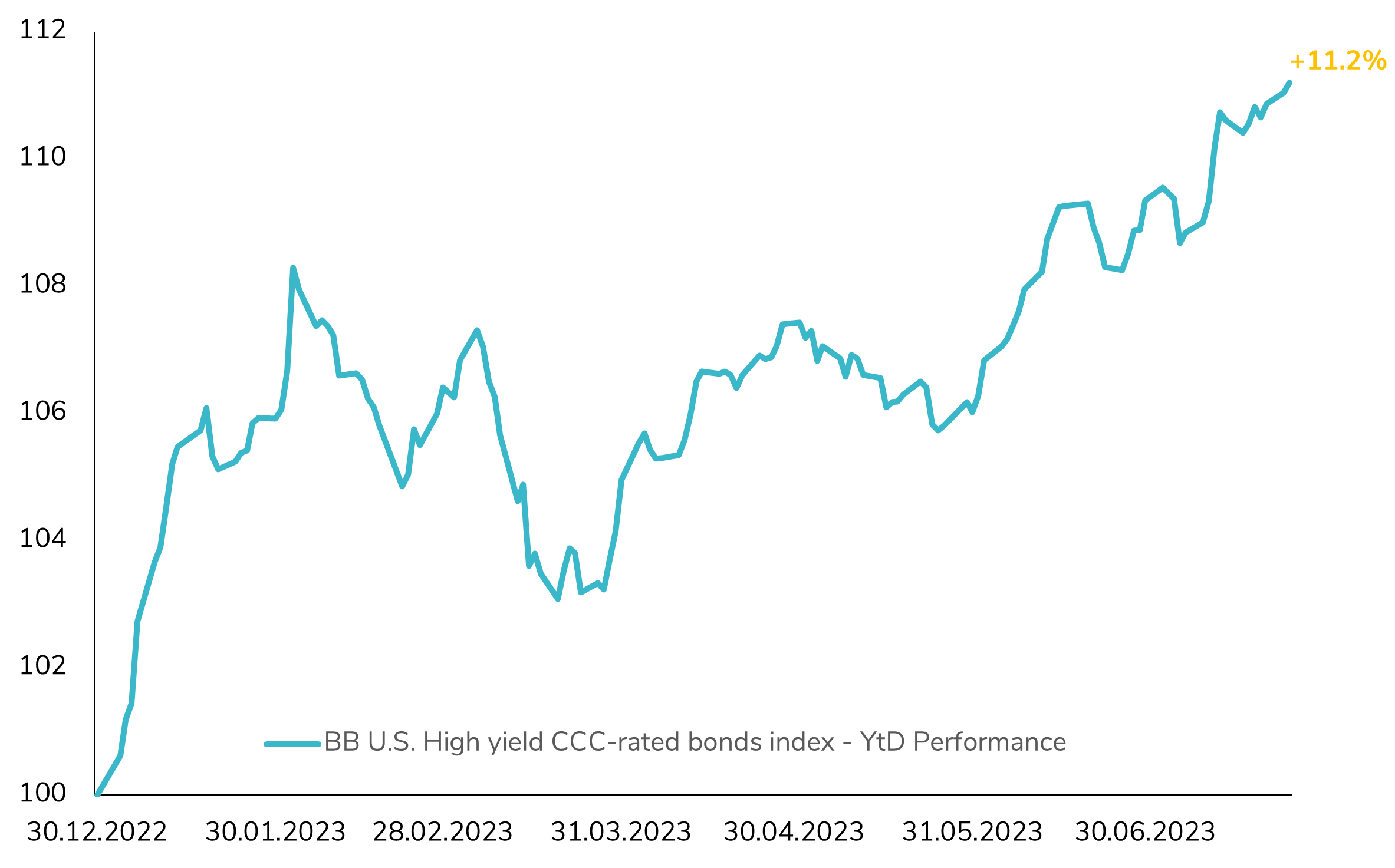

Remarkable Rally Continues in US High Yield CCC-Rated Bonds!

The Bloomberg US High Yield corporate CCC-rated bond index has delivered a staggering return of over 11% in 2023 so far. To put things into perspective, this level of performance has only been surpassed once in the last decade, back in 2016! The impressive rally in this segment can be attributed to the significant tightening of CCC credit spreads, which have contracted by a remarkable 200bps! Additionally, the high carry of the CCC-rated bonds, with an average yield-to-maturity of 13% in 2023, has contributed to the sector's stellar performance. However, as we approach a critical juncture in the economy, with looming concerns over a potential recession, the question arises: can this impressive performance sustain itself? While a soft landing scenario seems currently fully priced in, the possibility of a materialized recession in the coming months adds an element of uncertainty to the equation. Source : Bloomberg

Turkish Central Bank Implements another Significant Rate Hike!

The Turkish Central Bank (CBT) has taken another important step, raising its key rate by 2.5% to 17.5%. Though it slightly missed market expectations (18.5%), the chosen monetary policy path has instilled confidence among investors. This is evident as the 5-year Turkish Credit Default Swaps have hit a new low, not seen since November 2021. Furthermore, Turkish government and corporate bonds denominated in USD have demonstrated an impressive performance, gaining +6% in 2023. In addition to these developments, it is noteworthy that Turkey has recently received substantial economic support from the UAE, totaling more than $50 billion. Could this influx of support help mitigate the sharp weakness experienced by the Turkish Lira? Source : Bloomberg.

Investing with intelligence

Our latest research, commentary and market outlooks