Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

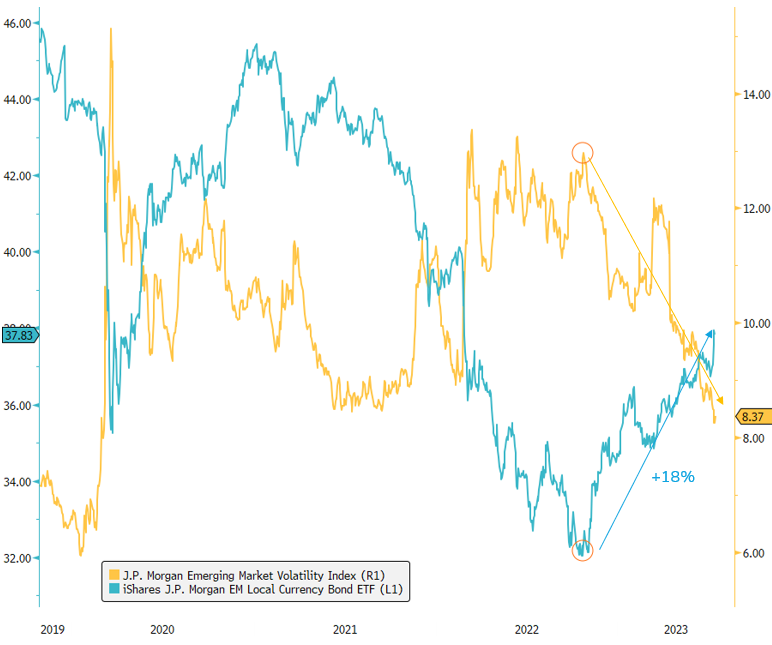

Emerging Market Local Currency Debt: Sustaining the Rally?

Emerging Market local currency debts have proven to be top performers (+18%) since reaching the peak in the 10-year US Treasury yield (4.25%) in October 2022, during this rate hike cycle. This specific segment of the fixed income market has offered attractive real rates, leading to the strengthening of EM currencies against the US Dollar. Notably, volatility in EM currencies has reached its lowest level since March 2020 and the global pandemic. As emerging market central banks prepare for potential monetary policy "pivot" (starting with Chile, Hungary and Brazil?), the question arises: will this trend continue? Or could we see a break in the rally, despite the favorable gap in nominal policy rates between EM and DM, while the gap in headline inflation reaches its tightest level? Source : Bloomberg

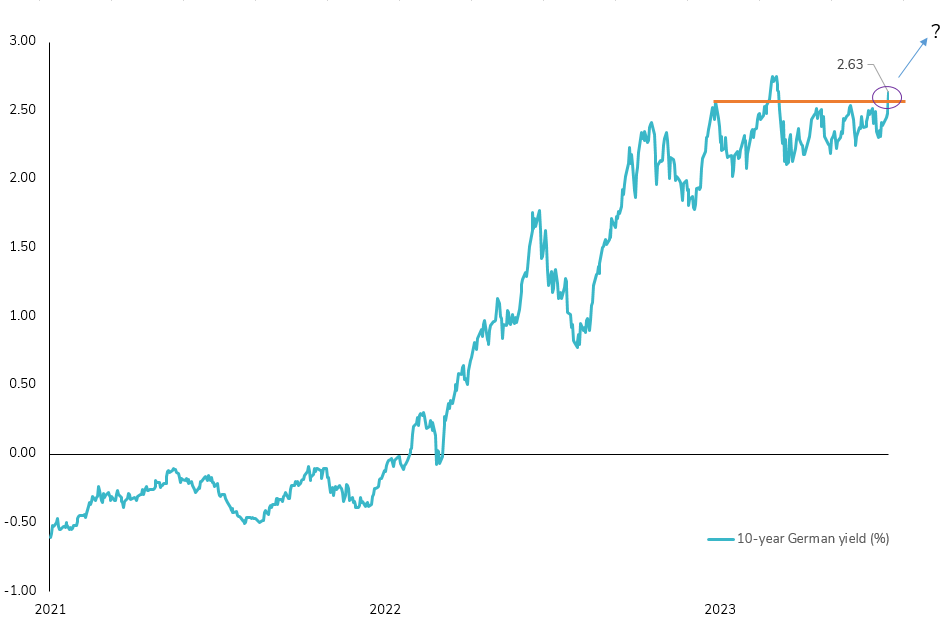

10-year German yield : a key technical breakout triggered?

The German 10-year yield has experienced a significant surge of almost 30 basis points since the start of July, marking a notable technical breakout. This breach of the 2.5% resistance level has the potential to alter short-term market sentiment and pave the way for higher rates. The upward momentum has been fueled by several factors, including the synchronized hawkishness observed in developed countries such as the US, Eurozone, and the UK last week. Additionally, hawkish FOMC minutes (release yesterday) and resilient hard data, including strong employment figures in the US and robust industrial production in Europe, have contributed to the yield's upward trajectory. It is worth noting the emergence of a catching-up effect in soft data, as indicated by the latest report on the U.S. ISM composite index. Tomorrow's release of the June NFP report could further ignite the discussion. Will we test the year's highs (2.75%) in this early summer period?

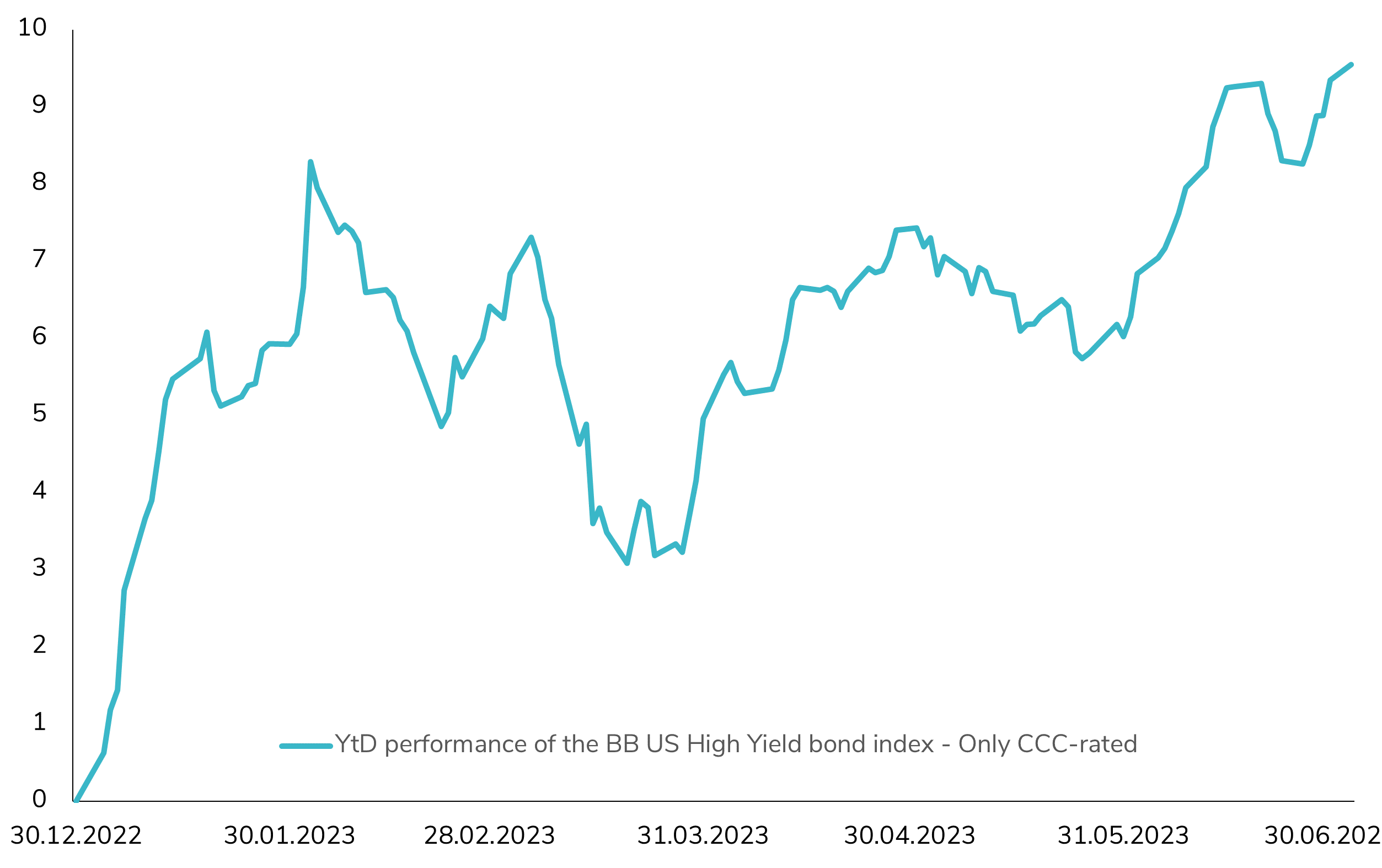

Surprising Performance: U.S. High Yield CCC-rated Bonds up 10% YTD!

The Bloomberg US High Yield CCC-rated bond index has recorded an impressive 9.6% gain in 2023. Despite concerns of an impending U.S. recession, the lowest quality segment of the high yield market has emerged as one of the top performers in the U.S. fixed income space. The resilience of the U.S. economy and robust release of hard data have contributed to a significant tightening of the average credit spread for CCC-rated bonds, reaching a 1-year low of 835bps. This represents a 165bps tightening since the beginning of the year. Notably, CCC-rated credit spreads are currently below the historical average of 925bps, while the average yield remains in line with historical levels at 12.8% compared to 12.7%. Furthermore, it is worth mentioning that less than 2% of the index is set to mature in 2024. The question now arises: will CCC-rated bonds continue to outperform driven by strong technical factors, or have we reached the top? Source: Bloomberg.

Shifting Dynamics in 3-Month US Futures: A Hawkish Turn

The recent shift in the 3-month US futures market has grabbed investors' attention. FED Governor Powell's increasingly hawkish tone has sparked a repricing frenzy, altering market expectations for rate cuts. The latest data shows a significant turnaround, with futures no longer projecting any cuts in 2023 and only one in the first half of 2024. This remarkable repricing indicates a growing sentiment of an extended period of higher interest rates. The resurgence of the 3-month SOFR Future June 24 contract to pre-SVB crisis levels further underscores the market's confidence in this new direction. Source: Bloomberg

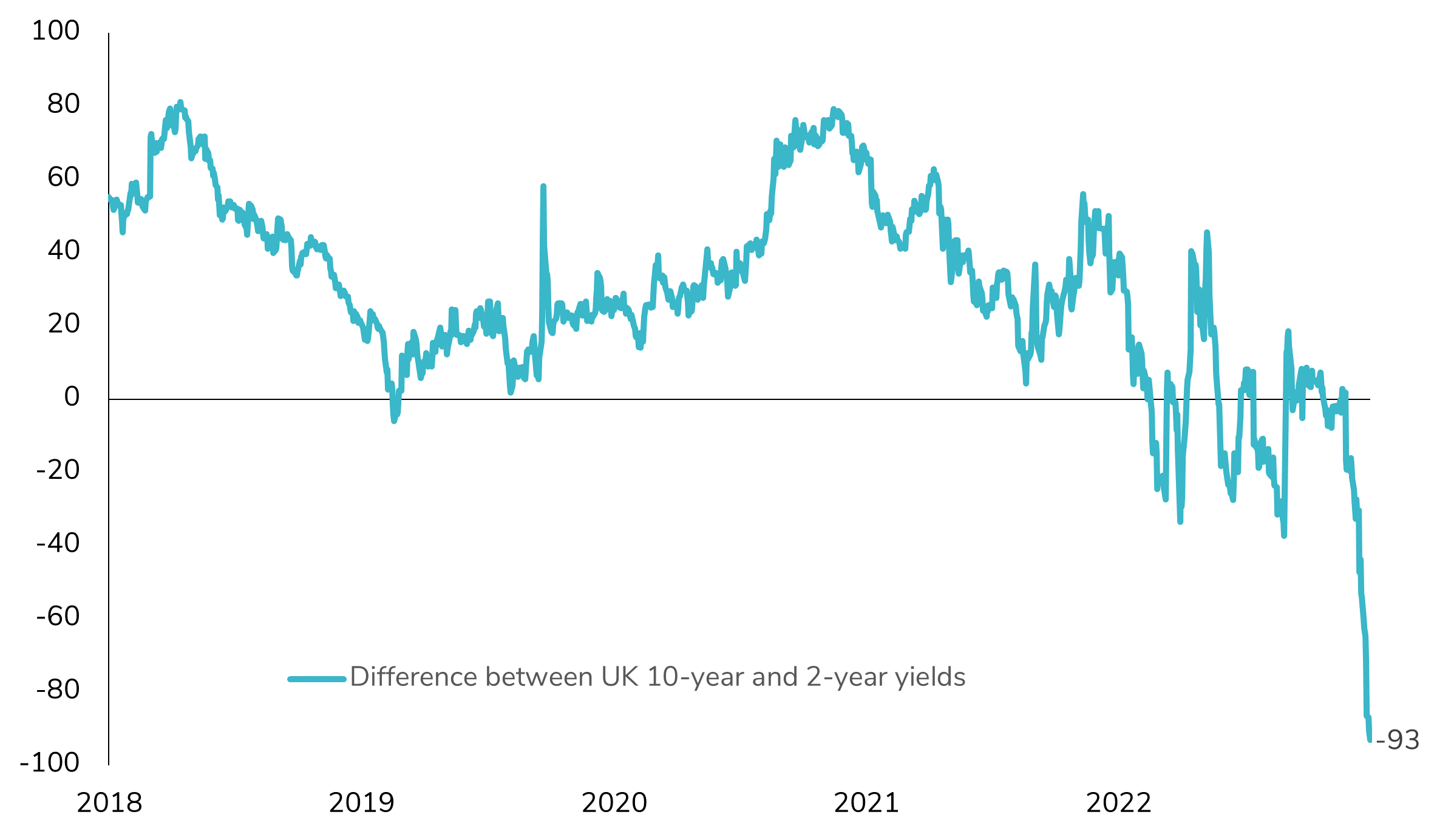

UK bond market is sending a signal!

The recent developments in the UK bond market have caught the attention of investors. In June, the UK yield curve (2s10s) experienced an unprecedented decline, marking one of the steepest drops in decades, and it is now approaching -100bps. This significant shift reflects the market's conviction that the Bank of England (BoE) will take decisive measures to combat inflation. However, it also raises concerns about the potential impact on the UK economy and its medium-term growth prospects. Should the BoE keep pushing the limits (rate hikes) until something breaks?

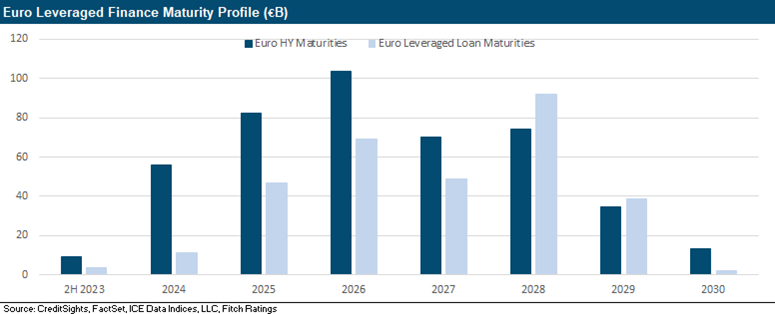

Limited Pressure from Issuance Activity for European High Yield Bonds in H2 2023!

The European high-yield (HY) market is expected to maintain a positive technical landscape in the second half of 2023, as corporate high-yield refinancing needs remain moderate. This favorable dynamic should counterbalance any potential outflows, as observed on the US market where HY funds are recording significant outflows, but offset by sluggish activity on the primary market. Source: CreditSights

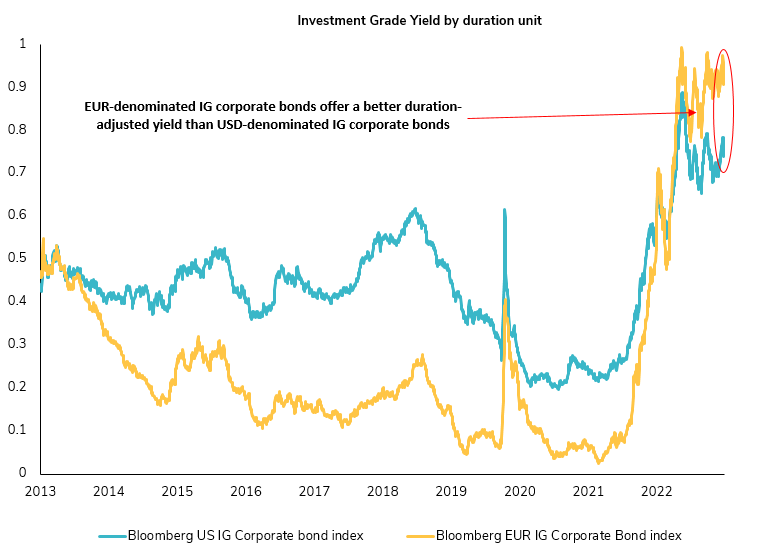

Attractiveness of EUR IG vs. US IG at decade high! 📈💼

🌍 Absolute yields in the global credit market present compelling long-term entry points, especially for high-quality European corporate bonds. Compared to the US market, the attractiveness of EUR Investment Grade (IG) credit is soaring. While concerns about a deeper recession in Europe have caused some turbulence, they have also opened up intriguing investment opportunities. Moreover, the recent Credit Suisse incident has further contributed to the dynamic landscape. 📊🔍 Is it time to seize the potential yield offered by EUR IG bonds? 💡💰 Source : Bloomberg

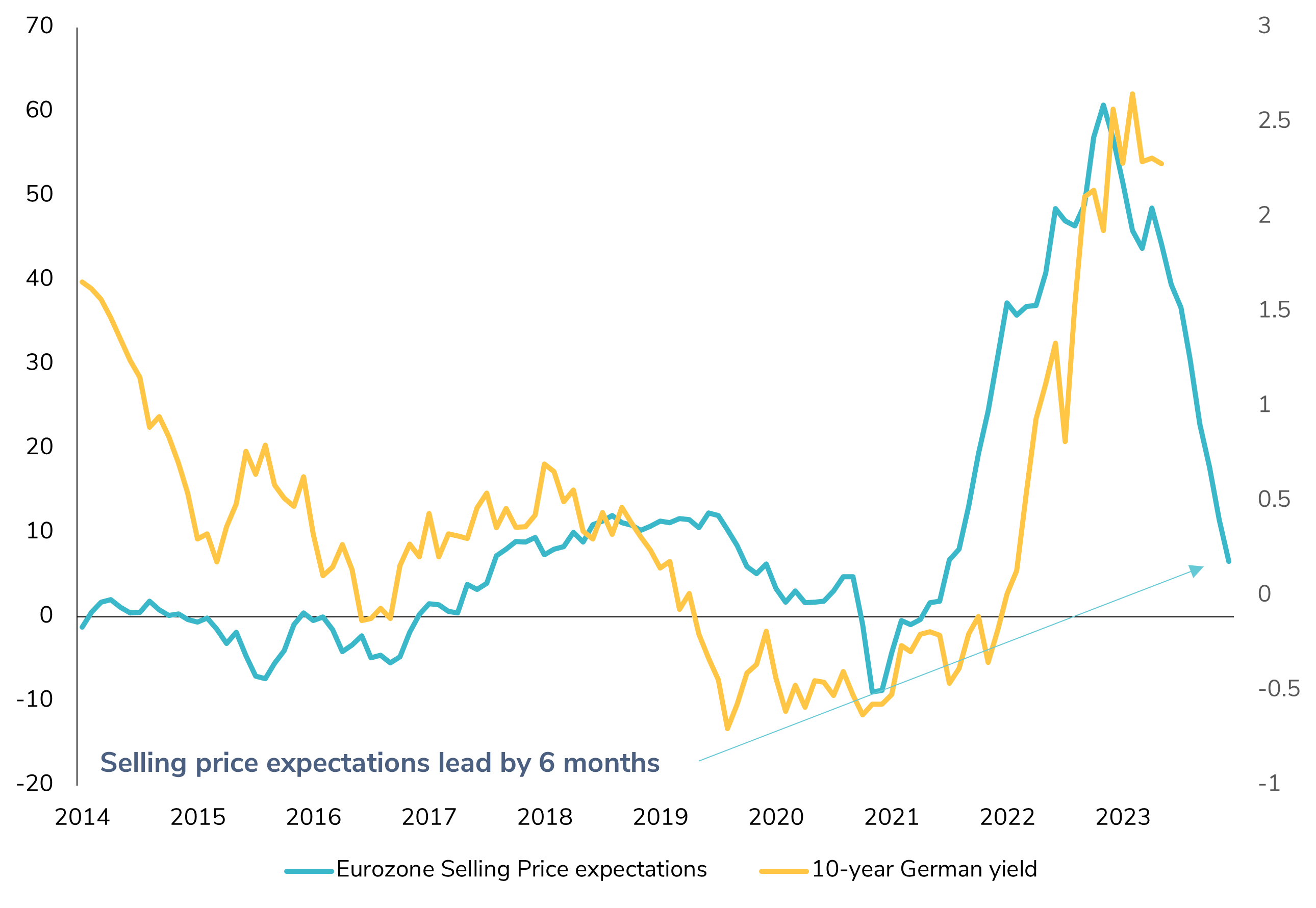

Is it time to increase duration in EUR bonds?

The latest European Commission survey on Eurozone selling price expectations shows a significant decline, suggesting that inflation should continue to decrease in the coming months, alleviating pressure on the ECB to tighten its monetary policy. After a possible one or two final tightening moves by the ECB in June and/or July, is it worth considering a higher allocation to European rates, particularly core bonds? Source : Bloomberg.

Investing with intelligence

Our latest research, commentary and market outlooks