Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

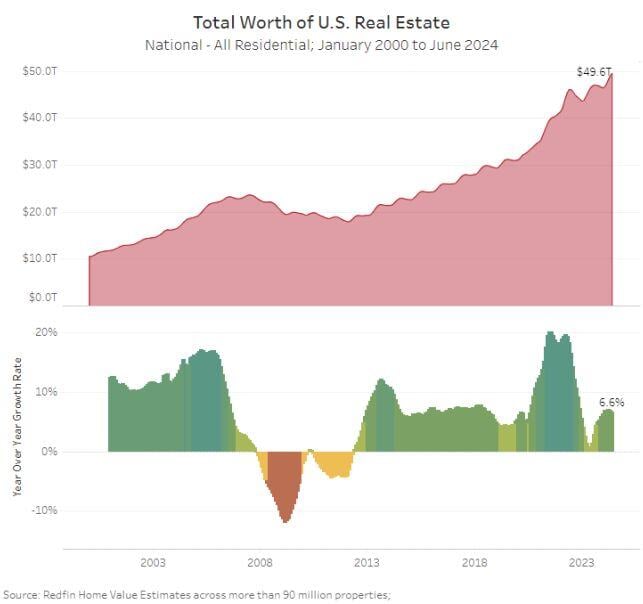

Value of U.S. Housing Market hits all-time high of $49.6 Trillion

Source: Barchart

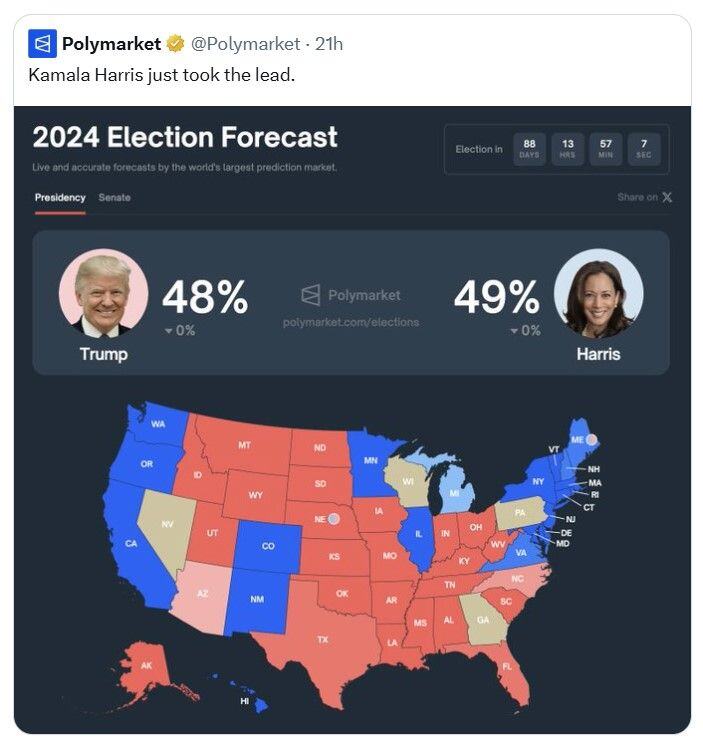

BREAKING: For the first time ever, Kamala Harris is leading Donald Trump in Polymarket's 2024 election odds.

At one point, prediction markets saw a 10+ percentage point lead by Donald Trump. Source: The Kobeissi Letter

This chart suggests that liquidity from the yen carrytrade has flowed into the Mag7

Source: Bloomberg, HolgerZ

"You don't have to be brilliant, only a little bit wiser than the other guys, on average, for a long, long time." — Charlie Munger

Source: Investment Wisdom

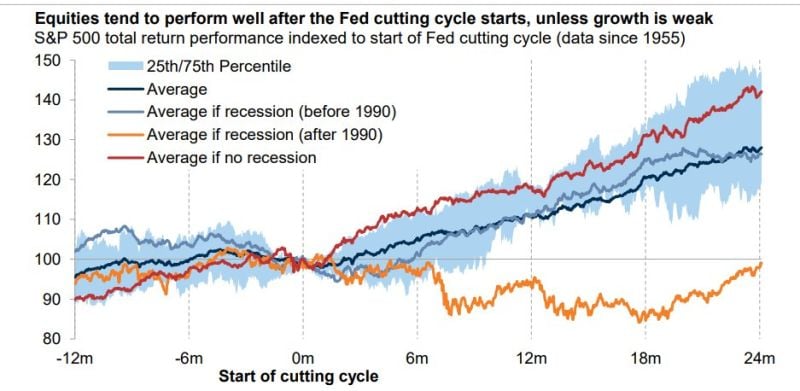

Equities tend to perform well after the Fed cutting cycle starts, unless growth is weak

Source: Goldman Sachs, Mike Z.

There is no free lunch in finance

Funds designed to protect investors from volatility failed to protect investors during periods of high volatility Source: FT, Barchart

Investing with intelligence

Our latest research, commentary and market outlooks