Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

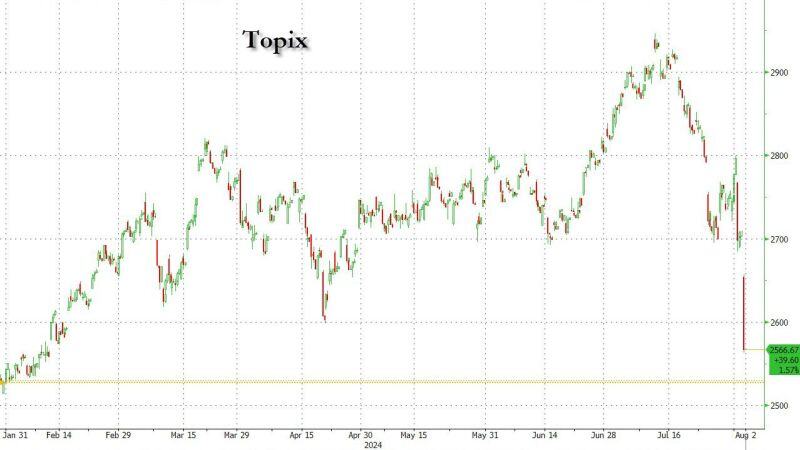

Almost all Japanese stock gains for 2024 wiped out in 3 days...

Today was an absolute chaos in Japan as stocks plummeted more than 6%, the largest decline in 8 years, and experienced 2 circuit breakers during the session... What will the BOJ save first? The Yen, Japanese stocks or the JGBs (of which they already own 50%)? Source: www.zerohedge.com

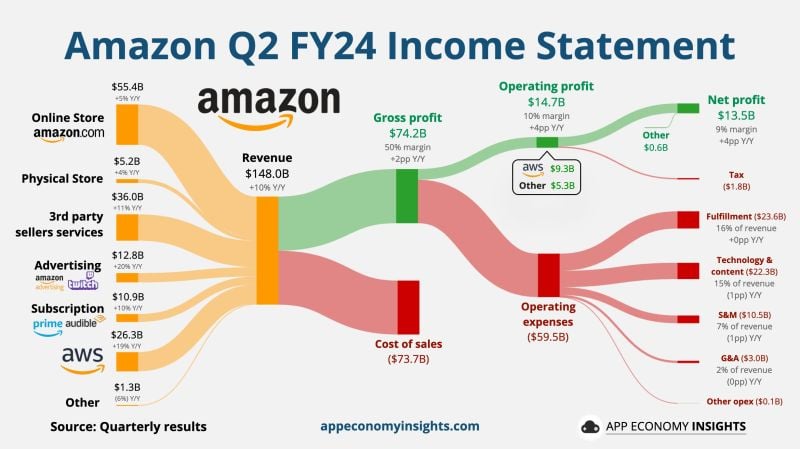

Amazon reported weaker-than-expected revenue for the second quarter on Thursday and issued a disappointing forecast for the current period.

The shares slid as much as 6% in extended trading. Here's how $AMZN Amazon did in Q2 FY24: • Revenue +10% Y/Y to $148B ($0.8B miss). • Operating margin 10% (+4pp Y/Y). • FCF $53B TTM. ☁️ AWS: • Revenue +19% Y/Y to $26.3B. • Operating margin 36% (+11pp Y/Y). Q3 FY24 Guidance: • Revenue ~$154-$158.5B ($158.3B expected).

BREAKING >>> Intel stock, $INTC, crashed over 12% after-hours yesterday evening after reporting Q2 2024 earnings and suspending their dividend.

They reported EPS of $0.02, below expectations of $0.10, on revenue of $12.8 billion, below expectations of $12.9 billion. Intel also announced that they will be laying off 15,000 of their employees. A difficult quarter for Intel. Source: The Kobeissi Letter

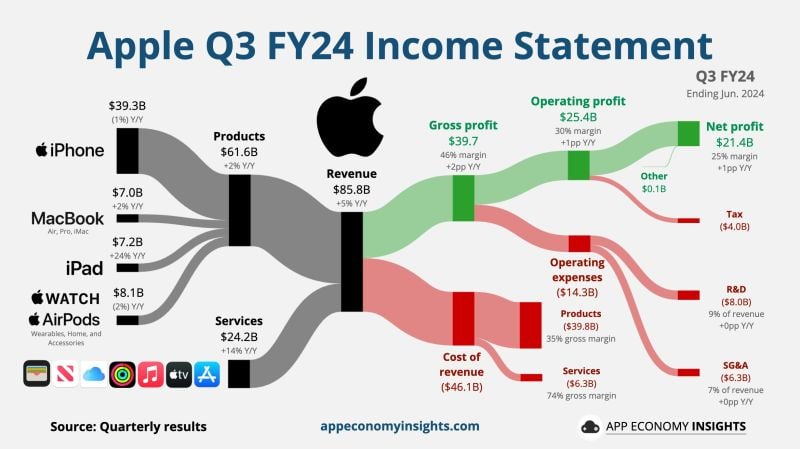

Apple reported fiscal third-quarter earnings on Thursday that beat Wall Street expectations, with overall revenue rising 5%. iPhone, iPad and Services revenue all beat analyst expectations.

Apple's most important business remains the iPhone, which accounted for about 46% of the company's total sales during the quarter. Apple expects similar overall revenue growth in the current quarter, company finance chief Luca Maestri said on a call with analysts. Apple also expects Services to grow at about the same rate as the previous three quarters, which was about 14%. The company sees operating expenditures between $14.2 billion and $14.4 billion in the current quarter, Maestri added, with gross margin of between 45.5% and 46.5%. Apple shares were flat in extended trading. Here's how $AAPL Apple did in Q3 FY24 (June quarter): 💳 Services +14% Y/Y to $24.2B. 📱 Products +2% Y/Y to $61.6B. • Revenue +5% Y/Y to $85.8B ($1.4B beat). • Operating margin 30% (+1pp Y/Y). • EPS $1.40 ($0.06 beat). Source: App Economy Insights, CNBC

BREAKING: The 10-Year Note Yield has dropped below 4.00% for the first time since February 2024.

This comes after the July Fed meeting and ISM manufacturing data came in weaker than expected. Markets expect the first Fed rate cut since March 2020 to come at their next meeting, in September 2024. Over the last week, the 10-Year Note Yield is now down over 30 basis points. Source: The Kobeissi Letter

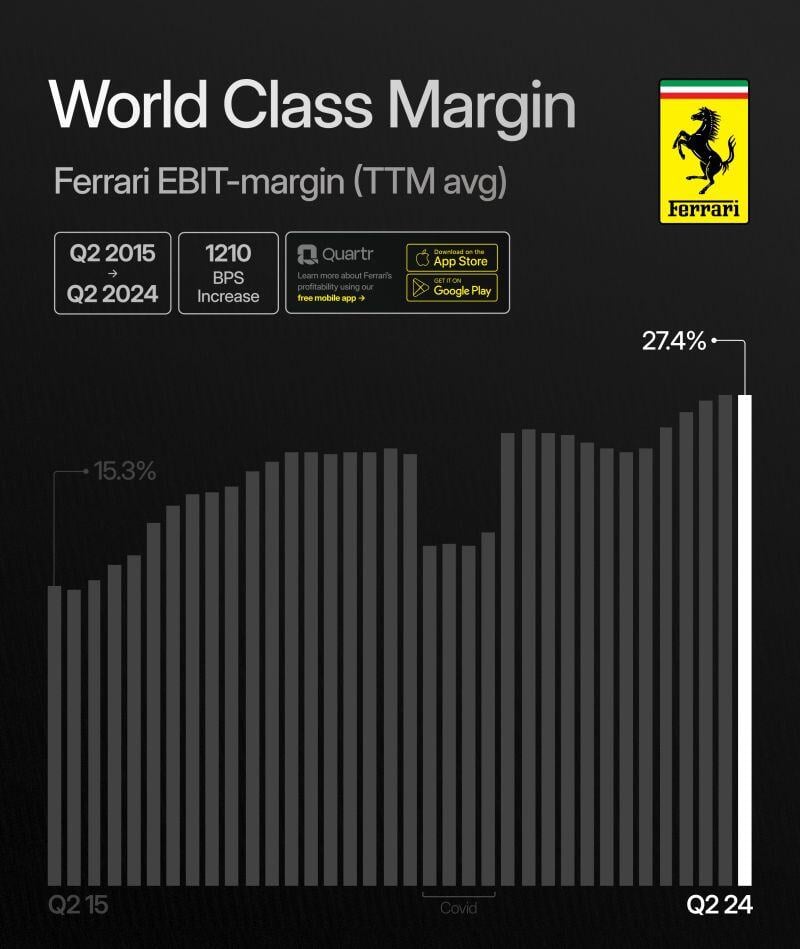

Ferrari (RACE) boosted its full-year guidance when delivering second-quarter results that topped revenue expectations on Thursday.

The Italian automaker now projects 2024 net revenue of more than 6.55 billion euros ($7.07 billion), up from more than EUR6.4 billion, and adjusted earnings per share (EPS) of at least EUR7.90, up from at least EUR7.50. “We are delighted to announce excellent financial results in the second quarter of 2024, which demonstrate again a strong execution and continued growth." – Benedetto Vigna, CEO Ferrari $RACE Q2 2024 in a nutshell: Shipments +3% *EMEA +1% *Americas +13% *Greater China -18% *APAC +4% Revenue +16.2% EBIT +17% *marg 29.9 (29.7) EPS +25% Source: Quartr

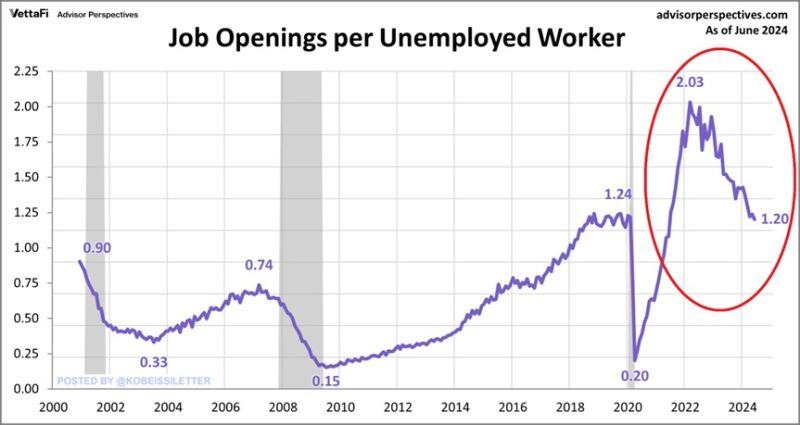

BREAKING: US job openings declined to 8.18 million in June, down from 8.23 million in May, near their lowest level since 2021.

Year-over-year, job openings fell 10.3%, marking the 23rd consecutive monthly decrease, the longest streak since the 2008 Financial Crisis. The ratio of vacancies per unemployed worker, a metric the Fed follows closely, fell to 1.20, the lowest since June 2021. At the same time, the private sector hiring rate declined to 3.7%, the lowest level since April 2020. The private quits rate, measuring the number of people who voluntarily leave their jobs, fell to 2.3%, the lowest since August 2020. This means that Americans are the least confident that they will find a new job since the 2020 Pandemic. => The US labor market is weakening. Source: The Kobeissi Letter

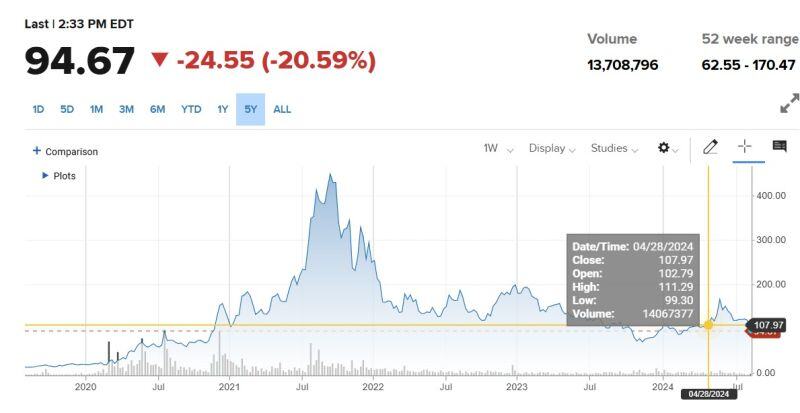

Do you remember Moderna $MRNA ???

Moderna beats estimates but slashes guidance on low EU sales, competitive U.S. vaccine market. It is down -20% today and -79% from its covid all-time-high. Moderna: "Net product sales for Q2 24 were $184M, reflecting a 37% YoY decrease. This reduction aligns with the expected shift to a seasonal COVID-19 vaccine market.." Moderna had $241M in total sales in Q2 and $1.6B in total operating expenses. Adding interest income, they burned $1.27B in one quarter. Cash on balance sheet is down to $2.47B. I fully expect expect them to do large capital raise to dilute shareholders. Source: JaguarAnalytics, The Transcript

Investing with intelligence

Our latest research, commentary and market outlooks