Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Warren Buffett once said: "The ideal business is one that earns very high returns on capital and that keeps using lots of capital at those high returns. That becomes a compounding machine.”

Source: Invest in Assets

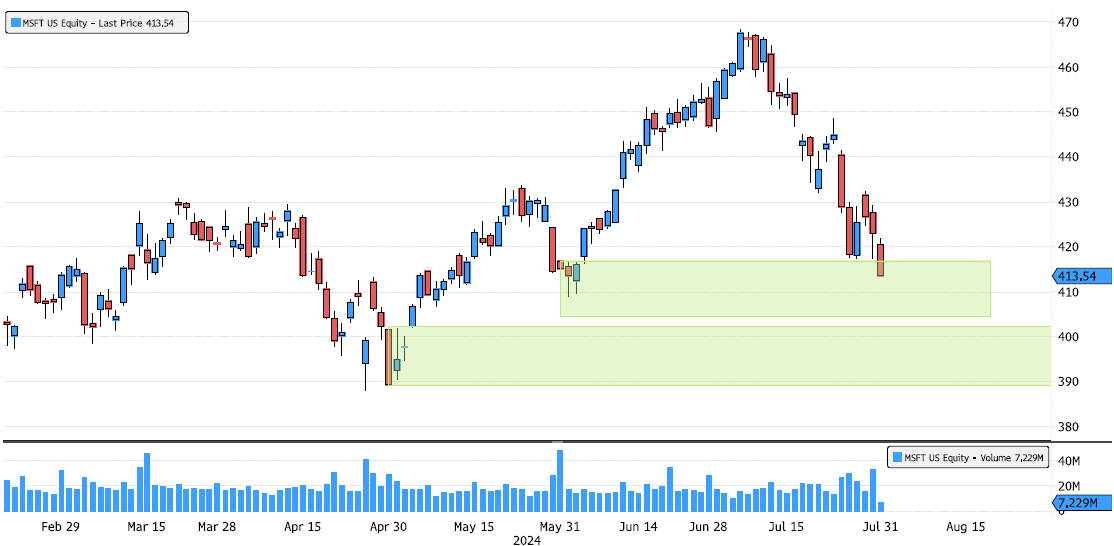

Microsoft Entering Major Support Zone

Microsoft (MSFT US) is under pressure since yesterday's earnings! It's now entering a major swing support zone between 404.51 and 416.75. Keep an eye on whether this level can hold. Source: Bloomberg

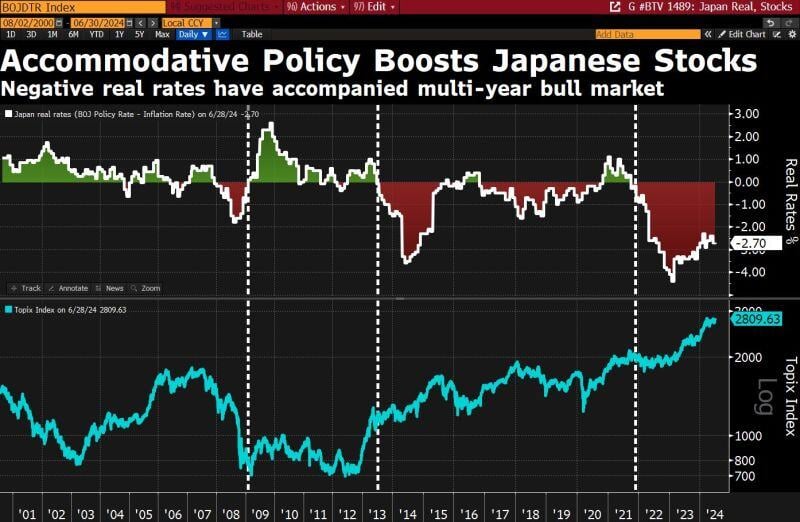

Loose policy = Bull market

Even if the BOJ hikes a few more times, real rates will remain deeply negative, a sign of accommodate policy. Chart tracks Japan real rates & market performance ➡️ 2009 -2013: period of high real rates, languishing stock market🔻 ➡️2013-2021: BOJ floors rates, pushes rates negative and fuels stock rally ✅ ➡️ 2021-2024: inflation picks up, real rates drop even further negative, Topix rallies 50% ✅✅ Source: David Ingles, Bloomberg

📢 One out of every 15 Americans is a millionaire according to a UBS Wealth Report

Source: UBS, Barchart

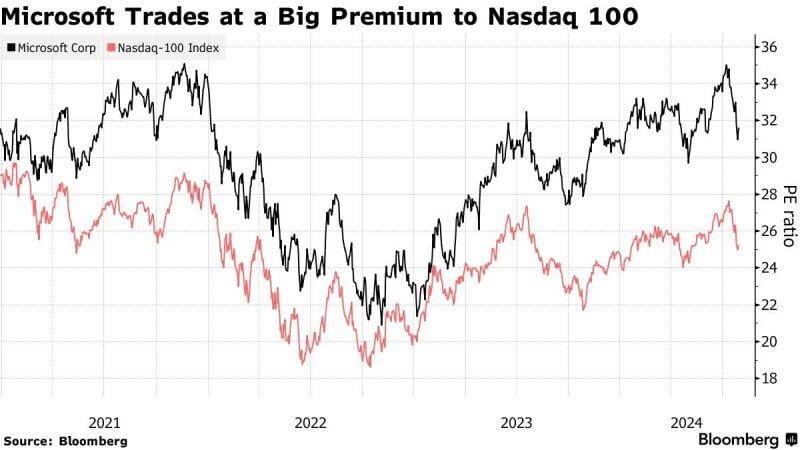

$MSFT trades at quite a large premium to the NASDAQ 100. Will the premium shrink after yesterday's earnings release?

Source: Bloomberg

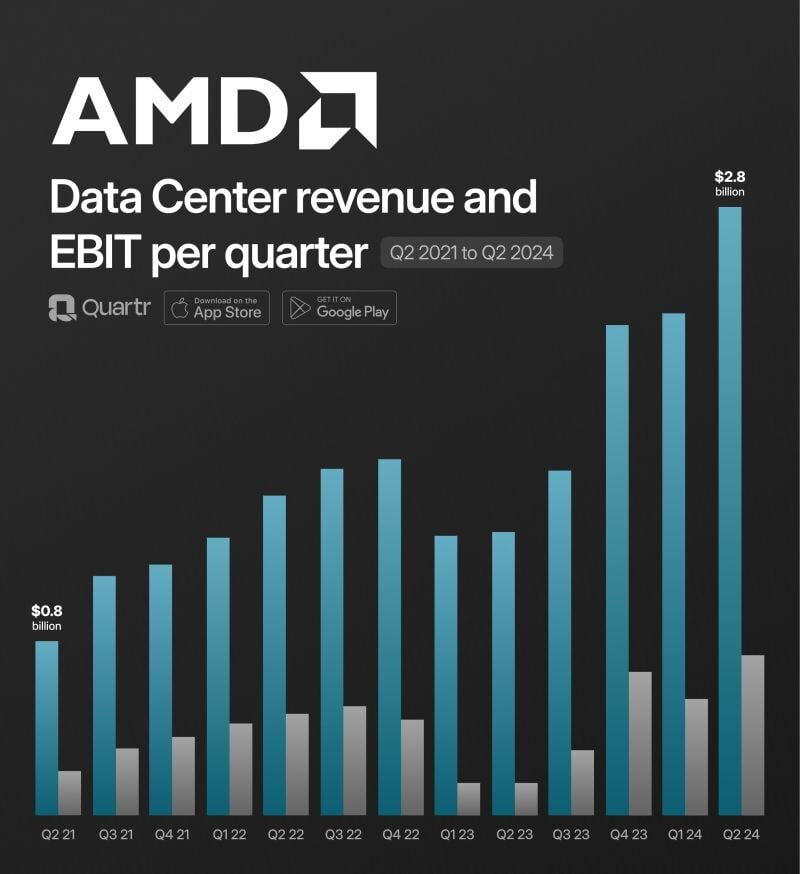

$AMD Q2 2024: "Our AI business continued accelerating and we are well positioned to deliver strong revenue growth in the second half of the year" - Lisa Su, CEO

Details by Quartr: Revenue +9% *Data Center +115% *Client +49% *Gaming -59% *Embedded -41% Gross Profit +17% *marg. 49% (46%) EBIT +1445% *marg. 5% (0) EPS +700%

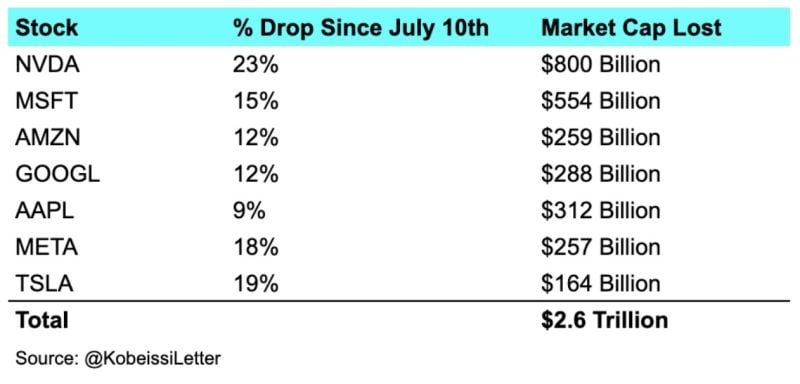

BREAKING: The Magnificent 7 stocks have now erased a combined $2.6 TRILLION of market cap over the last 20 days.

That's an average of $125 billion of market cap PER DAY for 20 days sight. Nvidia, $NVDA, alone has erased over $1 trillion in market cap since its high seen one month ago. In other words, the Magnificent7 have lost as much value as Nvidia's ENTIRE current market cap in 20 days. That's also $200 billion more than every stock in Germany's stock market combined. Source: The Kobeissi Letter

A tough technical picture for Microsoft $MSFT. This is the first 200-Day SMA test since March 2023.

Source: Trendspider

Investing with intelligence

Our latest research, commentary and market outlooks