Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

ISM PMI Employment came in at 43.4.

Only time lower: 1) the internet bubble popping. 2) the GFC. 3) Covid-19. Source: James E. Thorne, Bloomberg

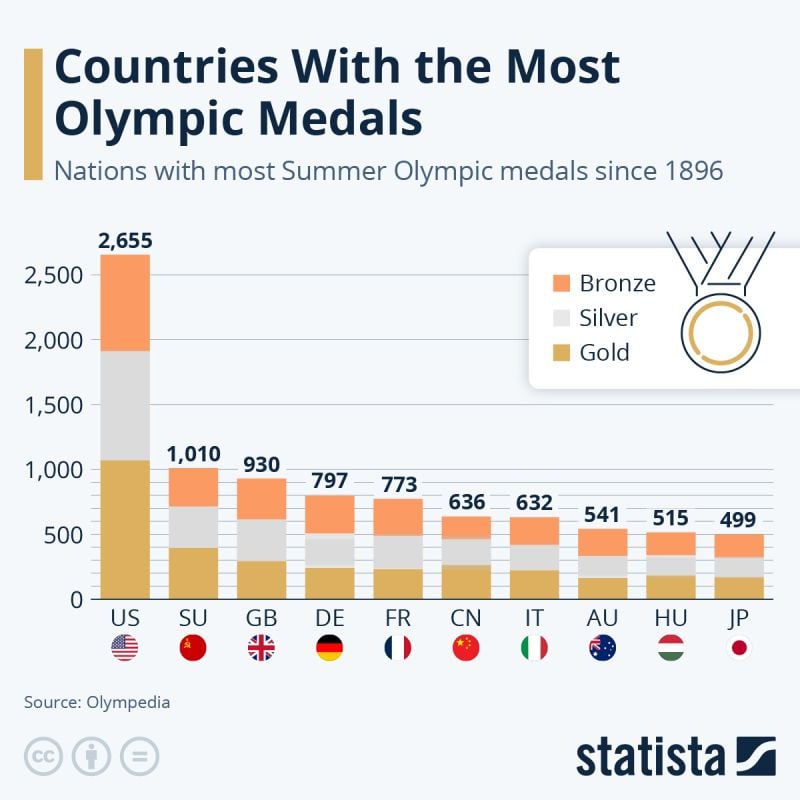

As data compiled by the Olympedia website shows, The United States has won the most medals in the Summer Olympics since 1896.

U.S. athletes have won a total of 2,655 medals - 1,070 gold, 841 silver and 744 bronze. Source: Statista

Since its after hours low seen just 18 hours ago, Nvidia has added $380 BILLION of market cap.

In other words, Nvidia has added as much market cap as the entire value of Costco, $COST, in 18 hours. This comes after the stock erased $1 TRILLION of market cap over the last 5 weeks. Source: The Kobeissi Letter

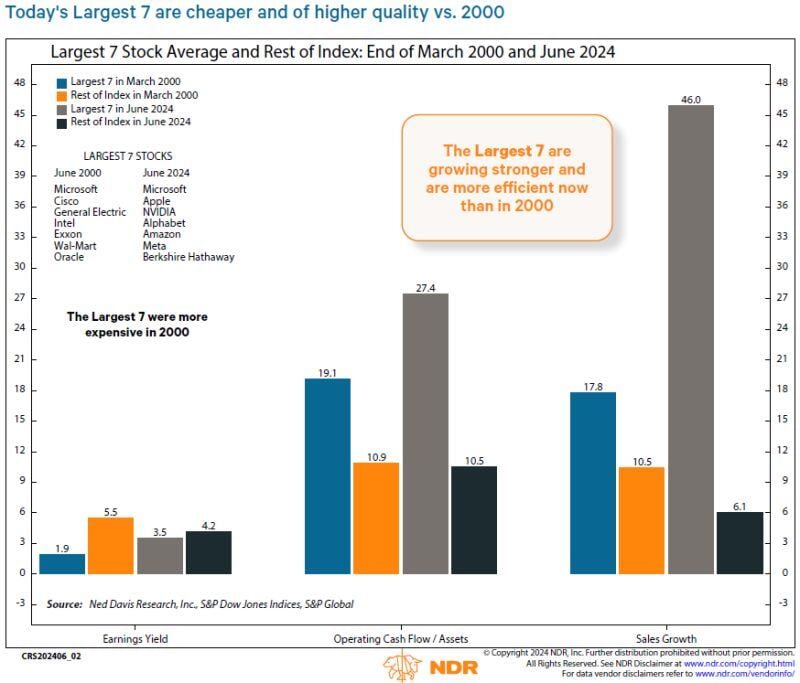

"The Largest stocks today have cheaper valuations compared to the Largest 7 in 2000"

@NDR_Research thru Mike Z.

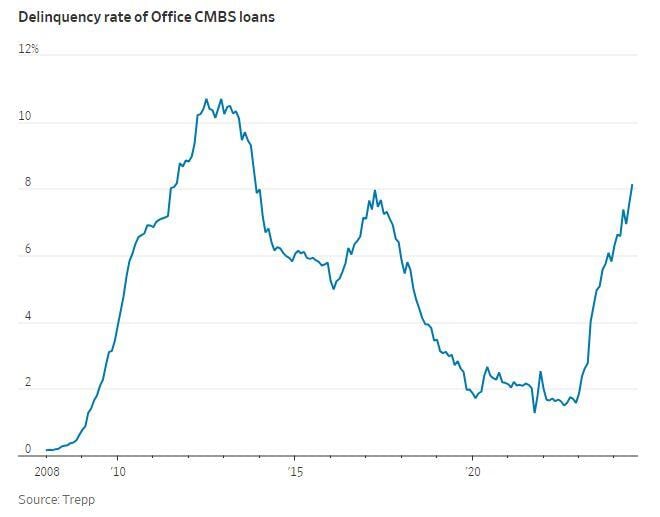

Delinquency rates on Office building loans hit 8.11%, the highest in more than a decade 🚨

Source: Barchart

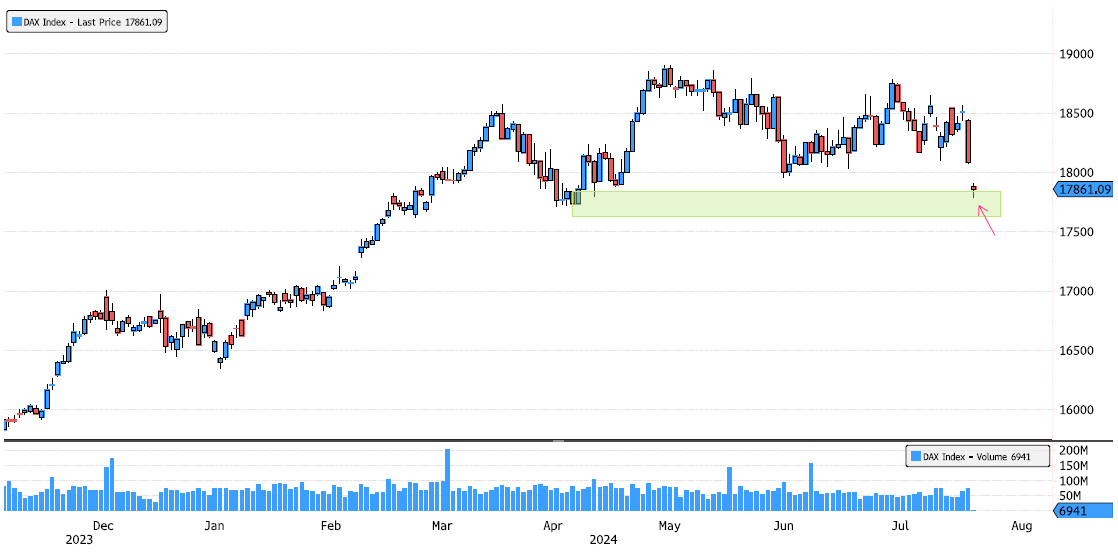

DAX Index Reaching Major Support Zone

The DAX Index is reaching a major swing support zone between 17,626 and 17,834. This level needs to hold; otherwise, the consolidation that started in May could become more complex and last longer. Keep an eye on this development. Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks