Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- macro

- equities

- Food for Thoughts

- sp500

- Central banks

- Bonds

- markets

- bitcoin

- Asia

- technical analysis

- investing

- europe

- Crypto

- geopolitics

- tech

- performance

- gold

- Commodities

- AI

- nvidia

- ETF

- earnings

- Forex

- Real Estate

- oil

- banking

- magnificent-7

- Volatility

- nasdaq

- apple

- emerging-markets

- energy

- china

- Alternatives

- switzerland

- tesla

- trading

- sentiment

- russia

- Money Market

- assetmanagement

- UK

- ESG

- Middle East

- microsoft

- amazon

- ethereum

- meta

- bankruptcy

- Turkey

- Healthcare

- Industrial-production

- Global Markets Outlook

- africa

- brics

- Market Outlook

- Asset Allocation Insights

- Flash

- Focus

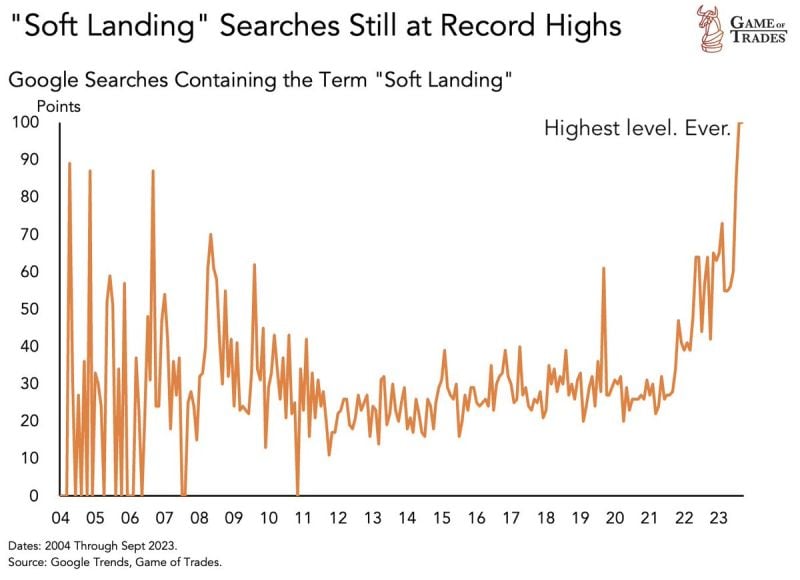

“Soft Landing” is still the consensus. But consensus doesn’t have a good track record...

Source: Game of Tardes

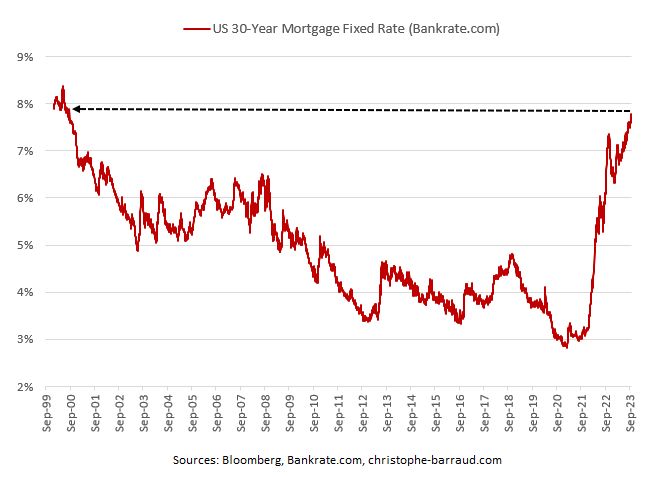

Housing | According to Bankrate.com‘s data, US 30-Year fixed-rate mortgage reached 7.78%, the highest rate since August 2000

*This situation is expected to have a significant effect on closed sales from September to November. Source: C.Barraud

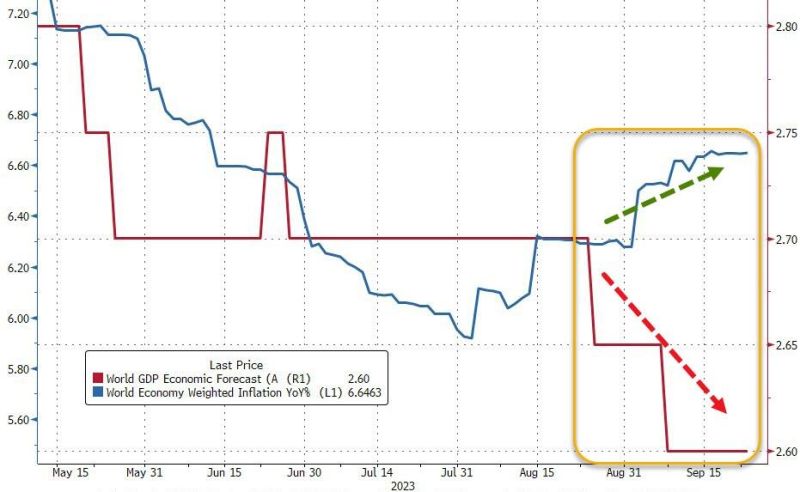

World trade volumes fell at their fastest annual pace for almost three years in July

Closely watched figures signal rising interest rates are beginning to impact global demand for goods. Trade volumes were down 3.2 per cent in July compared with the same month last year, the steepest drop since the early months of the coronavirus pandemic in August 2020. The latest World Trade Monitor figure, published by the Netherlands Bureau for Economic Policy Analysis, or CPB, followed a 2.4 per cent contraction in June and added to evidence that global growth was slowing. After booming during the pandemic, demand for global goods exports has weakened on the back of higher inflation, bumper rate rises by the world’s central banks in 2022, and more spending on domestic services as economies reopened following lockdowns. The about-turn in export volumes was broad based, with most of the world reporting falling trade volumes in July. China, the world’s largest goods exporter, posted a 1.5 per cent annual fall, the eurozone a 2.5 per cent contraction, and the US a 0.6 per cent decrease. Source: FT

Private equity firms are redirecting their focus from mega buyouts to businesses such as private credit as higher interest rates disrupt their strategies

Over the past year, buyouts have been halted due to the impact of higher rates, resulting in private equity firms being burdened with portfolio companies acquired at high prices. In response to this challenging environment, some of the industry’s largest firms are venturing into new areas, including lending to companies, which has become more lucrative as central banks raise interest rates to combat inflation. Top executives from Apollo and Blackstone recently highlighted the potential of private credit and infrastructure investing at the annual IPEM industry conference in Paris. https://lnkd.in/exw5bqWp. Source: https://lnkd.in/eSMS2Q-k

Do you remember what Larry Summers said last year about soft landing?

This story of second marriage and the triumph of hope vs. experience seems to find an echo at the FED level...

Investing with intelligence

Our latest research, commentary and market outlooks