Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- macro

- equities

- Food for Thoughts

- sp500

- Central banks

- Bonds

- markets

- bitcoin

- Asia

- technical analysis

- investing

- europe

- Crypto

- geopolitics

- tech

- performance

- gold

- Commodities

- AI

- nvidia

- ETF

- earnings

- Forex

- Real Estate

- oil

- banking

- magnificent-7

- Volatility

- nasdaq

- apple

- emerging-markets

- energy

- china

- Alternatives

- switzerland

- tesla

- trading

- sentiment

- russia

- Money Market

- assetmanagement

- UK

- ESG

- Middle East

- microsoft

- amazon

- ethereum

- meta

- bankruptcy

- Turkey

- Healthcare

- Industrial-production

- Global Markets Outlook

- africa

- brics

- Market Outlook

- Asset Allocation Insights

- Flash

- Focus

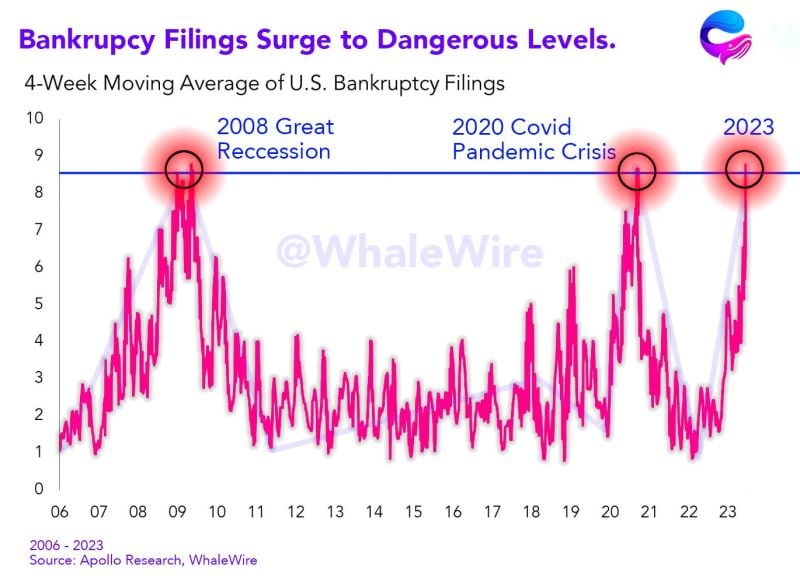

Bankruptcy filings have recently reached levels on par with the 2008 Great Recession and the 2020 COVID-19 pandemic

This indicator often suggests that the economy isn't performing well, and has historically always been followed by massive stock market crashes. Source: whalewire

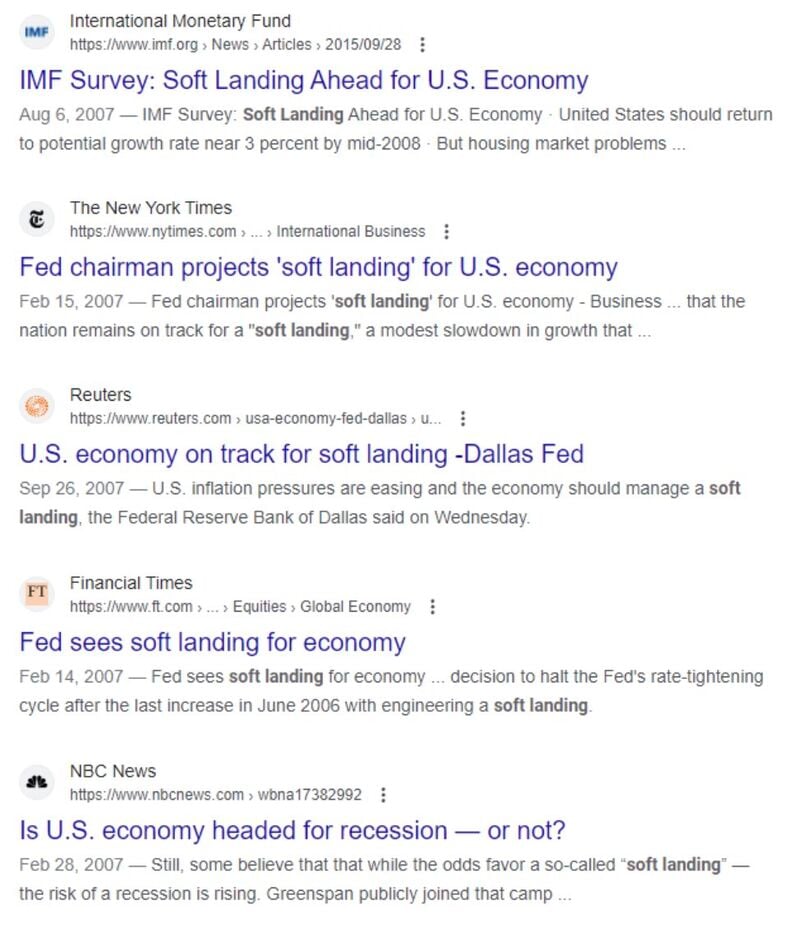

Maybe this is why Powell said that a soft landing is not the core scenario...

Recession confirmed?

Inflation fear is NOT the driver of rising yields

Indeed, 10y real yields (10y nominal yields - 10y inflation expectations) jumped to 2.11%, the highest since 2009. In other words, investors are demanding higher REAL yields in the face of political chaos in Washington and high debt. Source: Bloomberg, HolgerZ

Turkey CenBank raised main interest rate to 30% from 25%, but w/inflation at ~60%, real rates are still very heavily negative

The hike continues what many see as a return to more orthodox monetary policy under Governor Hafize Gaye Erkan, a former executive of First Republic Bank & Goldman Sachs, who was appointed in June after President Recep Tayyip Erdogan won a close-fought re-election. Erkan now hiked rates by a cumulative 2150bps. Source: Bloomberg, HolgerZ

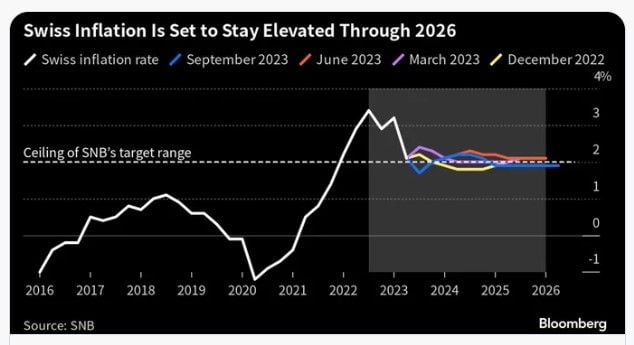

The Swiss National Bank pauses its monetary tightening, defying expectations of another interest-rate hike to avoid adding constriction on a stalled economy

- The SNB left today its key rate unchanged at 1.75%, debunking market expectations of an additional 25bp hike - The slowdown in inflation, the magnitude of the monetary policy tightening already implemented (CHF short term rates were still negative a year ago) and rising risks surrounding the global outlook underpin this decision. - Indeed, as inflation is within the SNB target (1.6%, in the 0%-to-2% target), economic activity is slowing down (0% GDP growth in Q2 2023) and the Swiss franc remains firm, the case for further tightening had turned much less compelling in the past few weeks. Unlike the ECB, forced to hike last week due to an inflation rate still much above its target, the SNB had very good reasons to pause today and adopt a cautious stance. - The SNB doesn’t rule out additional hikes in the future if warranted, but the combination of slowing growth in Europe (likely to dampen underlying price pressures) and of the strength of the currency are highly likely, in our view, to keep Swiss inflation dynamics in check in the months ahead.

Investing with intelligence

Our latest research, commentary and market outlooks