Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- macro

- equities

- Food for Thoughts

- sp500

- Central banks

- Bonds

- markets

- bitcoin

- Asia

- technical analysis

- investing

- europe

- Crypto

- geopolitics

- tech

- performance

- gold

- Commodities

- AI

- nvidia

- ETF

- earnings

- Forex

- Real Estate

- oil

- banking

- magnificent-7

- Volatility

- nasdaq

- apple

- emerging-markets

- energy

- china

- Alternatives

- switzerland

- tesla

- trading

- sentiment

- russia

- Money Market

- assetmanagement

- UK

- ESG

- Middle East

- microsoft

- amazon

- ethereum

- meta

- bankruptcy

- Turkey

- Healthcare

- Industrial-production

- Global Markets Outlook

- africa

- brics

- Market Outlook

- Asset Allocation Insights

- Flash

- Focus

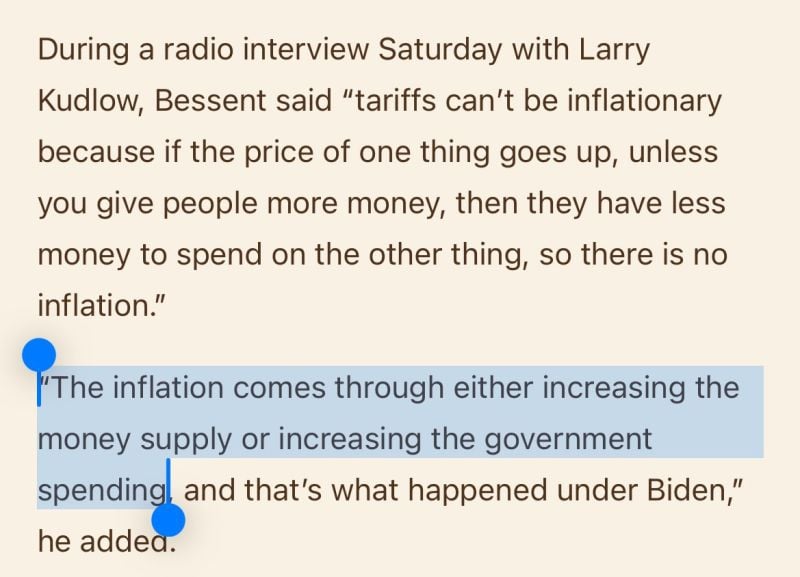

Scott Bessent on tariffs:

"Tariffs can’t be inflationary because if the price of one thing goes up, unless you give people more money, then they have less money to spend on other things, so there is no net inflation.” Source: Geiger Capital

It has been a very quiet year... Can we expect the same in 2025??? (Clone)

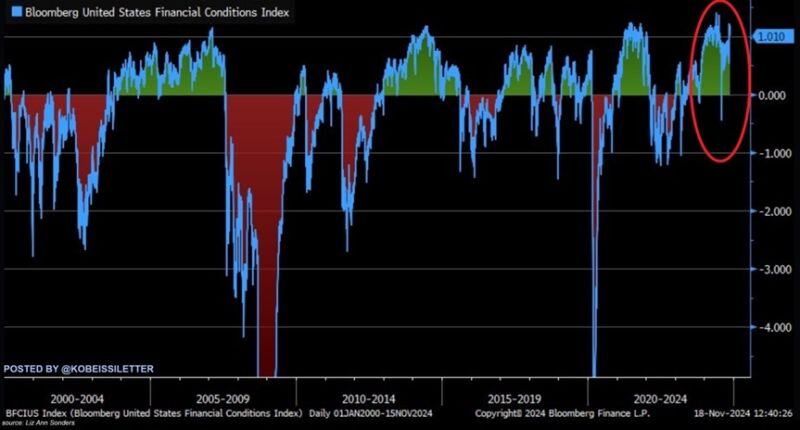

Financial conditions are now even easier than previous records seen in late 2020 and 2021. In fact, this makes financial conditions easier than when the Fed cut rates to near 0% overnight in 2020. Meanwhile, the market is pricing in a 59% chance of another 25 bps Fed rate cut in December. Source: The Kobeissi Letter, Bloomberg

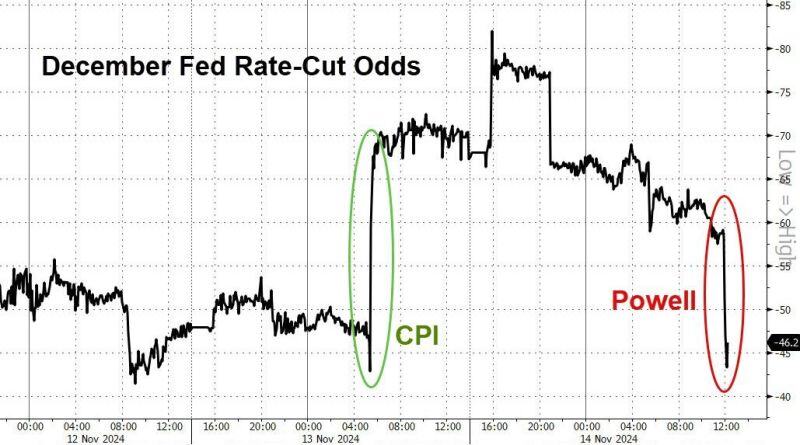

Higher than expected US PPI + Powell's remarks yesterday sent rate-cut expectations notably lower - December less than 50-50 now...

Source: Bloomberg, www,zerohedge.com

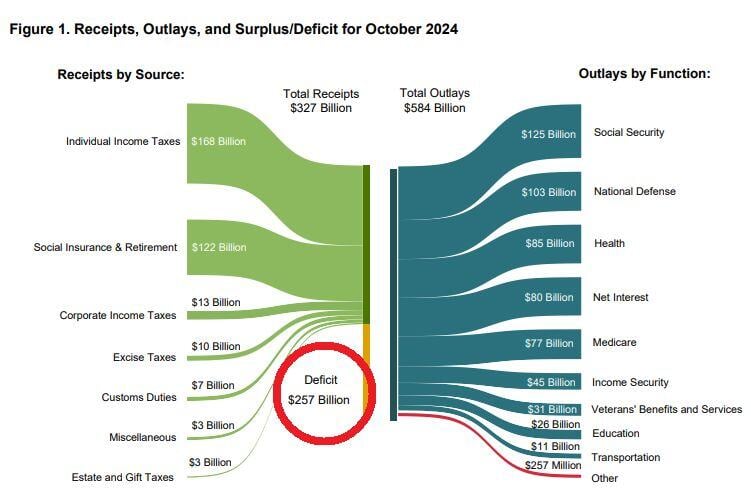

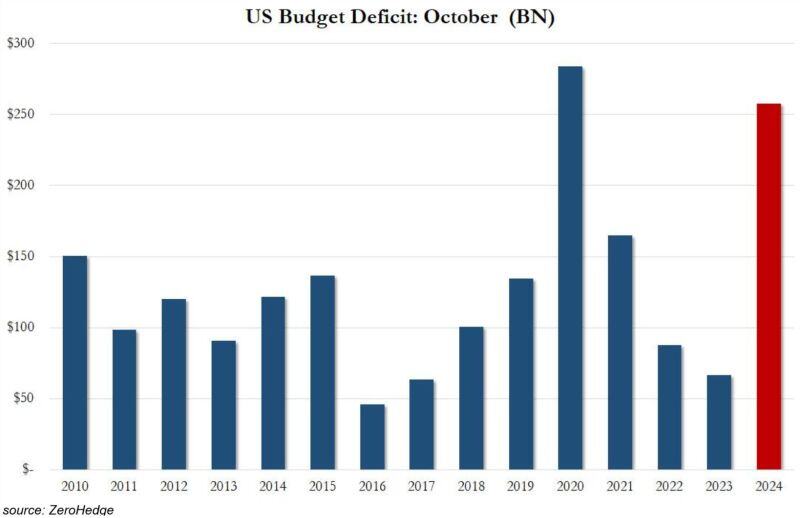

⚠️US GOVERNMENT BORROWING EXPLODED IN OCTOBER⚠️

US budget deficit hit a STAGGERING $257.5 BILLION in October. This is up nearly 400% year-over-year versus $66.6 BILLION last year. This was also the 2nd highest deficit in the entire United States history. Mind-blowing numbers. Source: Global Markets Investor, zerohedge

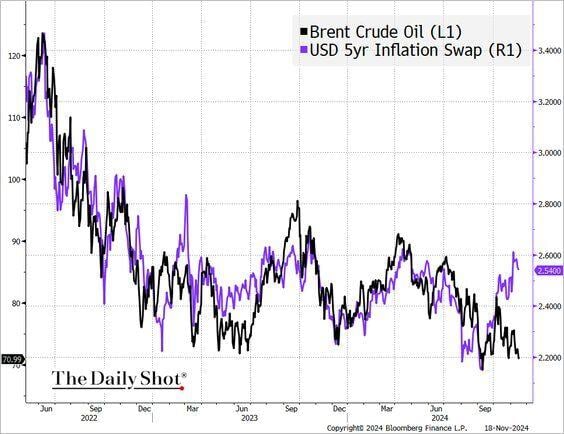

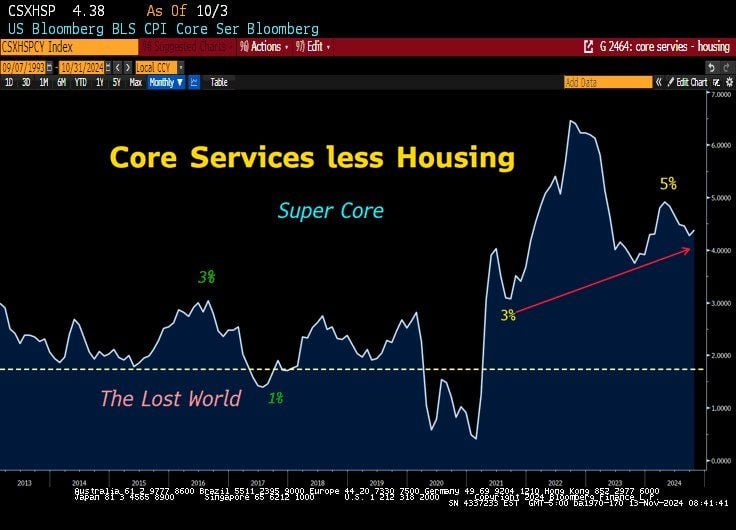

It seems that the FED's neutral rate is higher.

Are they going to throw the towel on the 2% target? Source: Bloomberg, Lawrence McDonald

Investing with intelligence

Our latest research, commentary and market outlooks