Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- macro

- equities

- Food for Thoughts

- sp500

- Central banks

- Bonds

- markets

- bitcoin

- Asia

- technical analysis

- investing

- europe

- Crypto

- geopolitics

- tech

- performance

- gold

- Commodities

- AI

- nvidia

- ETF

- earnings

- Forex

- Real Estate

- oil

- banking

- magnificent-7

- Volatility

- nasdaq

- apple

- emerging-markets

- energy

- china

- Alternatives

- switzerland

- tesla

- trading

- sentiment

- russia

- Money Market

- assetmanagement

- UK

- ESG

- Middle East

- microsoft

- amazon

- ethereum

- meta

- bankruptcy

- Turkey

- Healthcare

- Industrial-production

- Global Markets Outlook

- africa

- brics

- Market Outlook

- Asset Allocation Insights

- Flash

- Focus

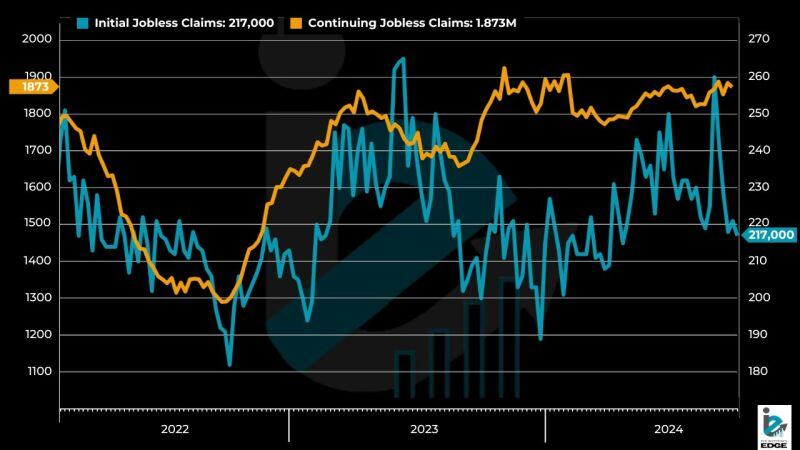

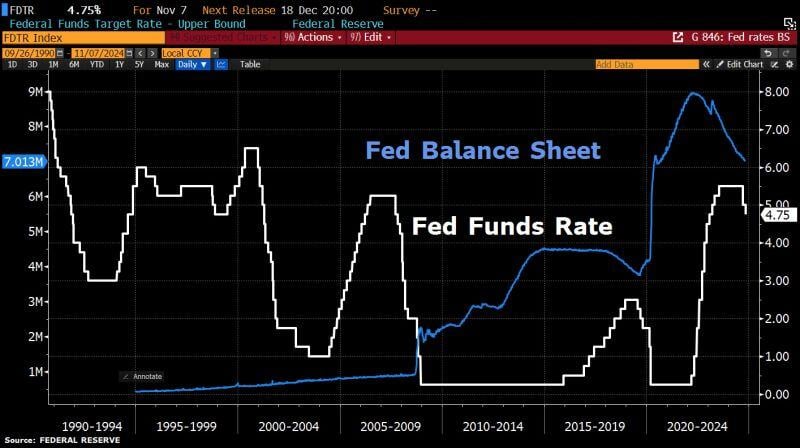

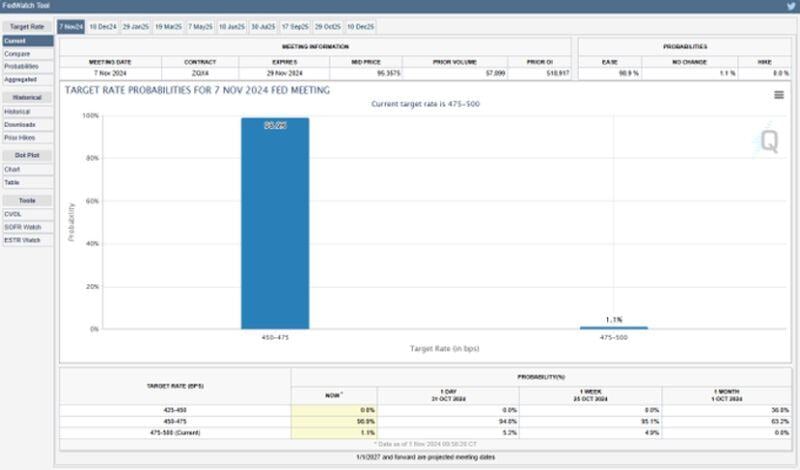

Fed cuts rates by 25bps in unanimous decision as expected. So what did the Fed do?

👉 FED LOWERS BENCHMARK RATE 25 BPS TO 4.5%-4.75% RANGE 👉 FED SAYS RISKS TO GOALS REMAIN 'ROUGHLY IN BALANCE’ 👉 FED: LABOR MARKET CONDITIONS HAVE 'GENERALLY EASED' No dissent on this rate-cut decision. 🚨 Key changes: - Most notably, removing language that Fed has "gained greater confidence that inflation is moving sustainable toward 2 percent". - Adding that labor market conditions have "generally eased" since earlier in the year, replacing "job gains have slowed". Source: Bloomberg, www.zerohedge.com

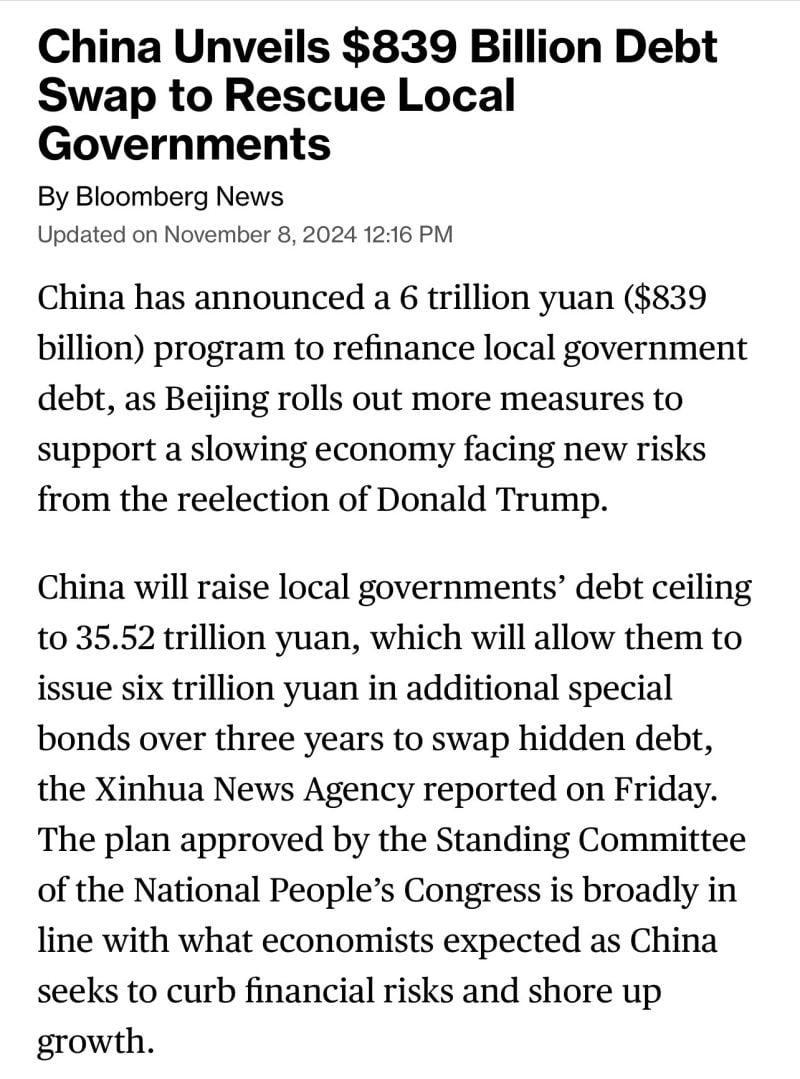

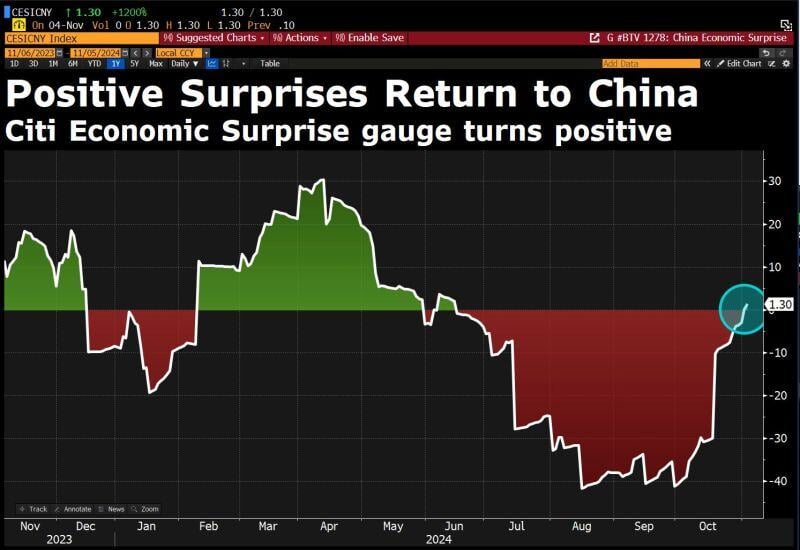

China on Friday announced a five-year package totaling 10 trillion yuan ($1.4 trillion) to tackle local government debt problems, while signaling more economic support would come next year.

The debt swap program, however, fell short of many investors’ expectations for more direct fiscal support. Source: Bloomberg

🚨 THE SHOCKING CHART OF THE DAY >>>

THE FEDERAL RESERVES REVERSE REPO HAS FALLEN TO $155 BILLION WHICH IS THE FIRST TIME WE SEEN THIS LEVEL SINCE MAY 2021🚨 USUALLY WHEN IT FALLS IT LOWERS YIELDS BUT INSTEAD THEY’RE MOVING UP AND 10YR YIELDS FLEW TO 4.3% LAST WEEK. It was initially used to pull money out of the economy to reduce inflation. Then it went back into economy and then into equites. What's next? Source: Mike Investing on X

🚨 There is now a 99% chance of a 25 bps interest rate cut at next week's FOMC Meeting 🚨

Source: Barchart

Investing with intelligence

Our latest research, commentary and market outlooks