Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- macro

- equities

- Food for Thoughts

- sp500

- Central banks

- Bonds

- markets

- bitcoin

- Asia

- technical analysis

- investing

- europe

- Crypto

- geopolitics

- tech

- performance

- gold

- Commodities

- AI

- nvidia

- ETF

- earnings

- Forex

- Real Estate

- oil

- banking

- magnificent-7

- Volatility

- nasdaq

- apple

- emerging-markets

- energy

- china

- Alternatives

- switzerland

- tesla

- trading

- sentiment

- russia

- Money Market

- assetmanagement

- UK

- ESG

- Middle East

- microsoft

- amazon

- ethereum

- meta

- bankruptcy

- Turkey

- Healthcare

- Industrial-production

- Global Markets Outlook

- africa

- brics

- Market Outlook

- Asset Allocation Insights

- Flash

- Focus

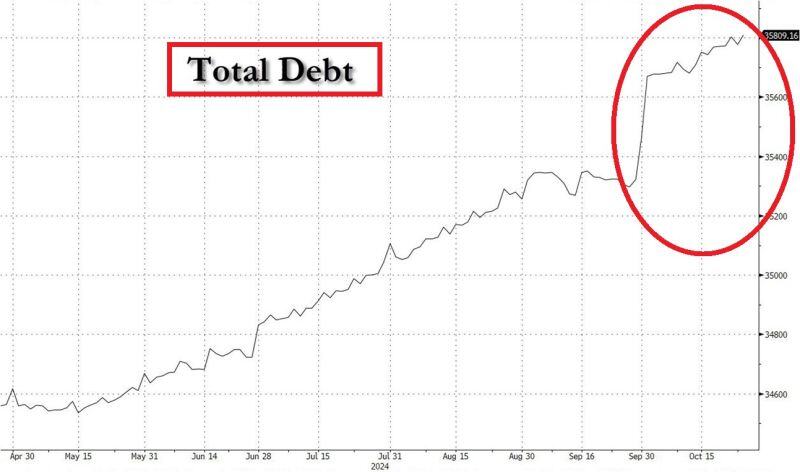

🚨US FEDERAL DEBT IS SKYROCKETING🚨

The US public debt just hit another RECORD of $35.8 TRILLION. In less than a month, the total debt SPIKED by $700 BILLION. This is $23 BILLION A DAY. To make things worse, these forecasts assume lower interest rates over the next year... Source: Global Markets Investor

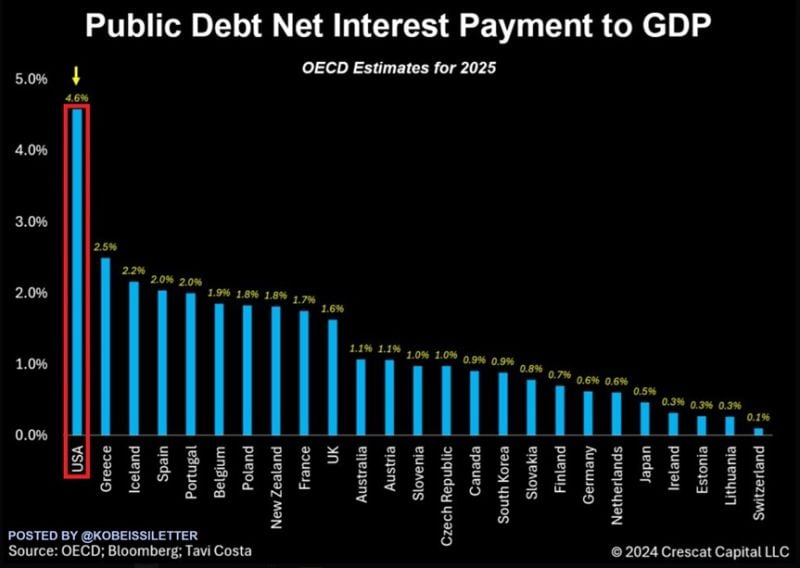

The US public debt situation is going to get worse:

US net interest payments as a share of GDP are expected to reach a record 4.6% next year. That would more than DOUBLE World War 2 levels and exceed the all-time highs seen in the 1990s. This is also much higher than net interest as a % of GDP in all 38 OECD countries. Countries with relatively high interest such as Greece, Ireland, Spain, and Portugal are expected to reach interest-to-GDP ratios that are HALF the size of the US. To make things worse, these forecasts assume lower interest rates over the next year. Source: The Kobeissi Letter, OECD, Tavi Costa

Billionaire investor Paul Tudor Jones today on CNBC:

“All roads lead to inflation. I’m long gold. I’m long Bitcoin. I own ZERO fixed income. The playbook to get out of this [debt problem] is that you inflate your way out.” Source: CNBC

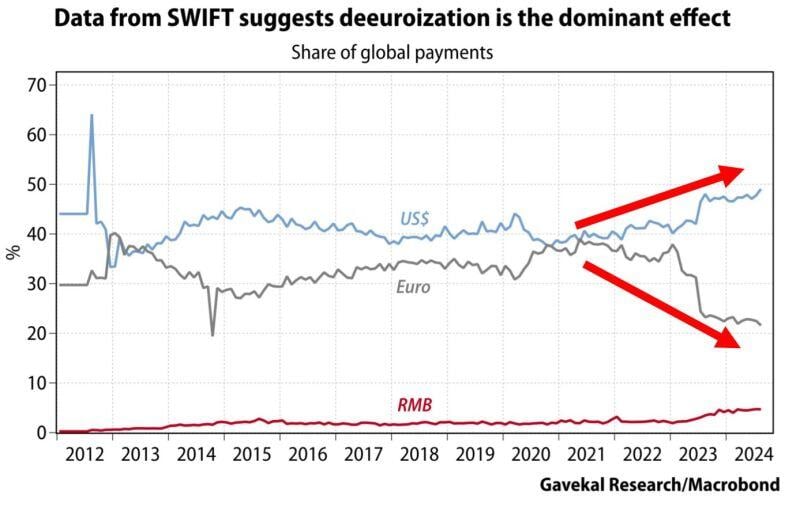

⁉️IS THE US DOLLAR RESERVE CURRENCY STATUS STRENGTHENING⁉️

The US Dollar share in global payments jumped to 49% in 2024 the highest since 2012. This is up from ~40% at the beginning of 2022. The Euro share has plummeted to ~21%. The US dollar fall does not look so imminent. Source: Global Markets Investor

👉 A very important chart about global liquidity...

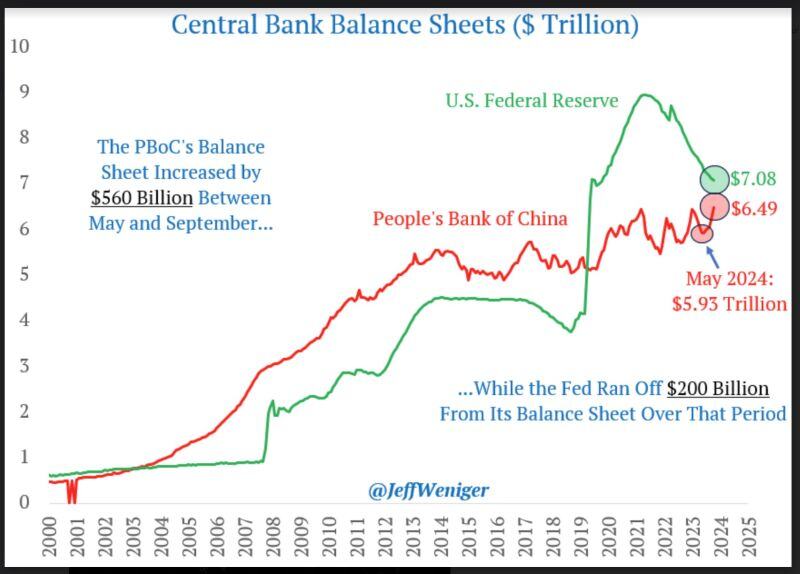

While the fed is still in qt mode (it has decreased the size of its balance sheet by $200B between May and September), the PBOC is in qe mode having increased its balance sheet by $560B between May and September... Ne-net liquidity is increasing. With global central banks cutting rates at the most aggressive pace since the pandemic and with the PBOC expanding the size of its balance sheet almost 3x more than the Fed is reducing it, it will be interesting to see the consequences on inflation + on gold, silver, etc. Source chart: Jeff Weniger

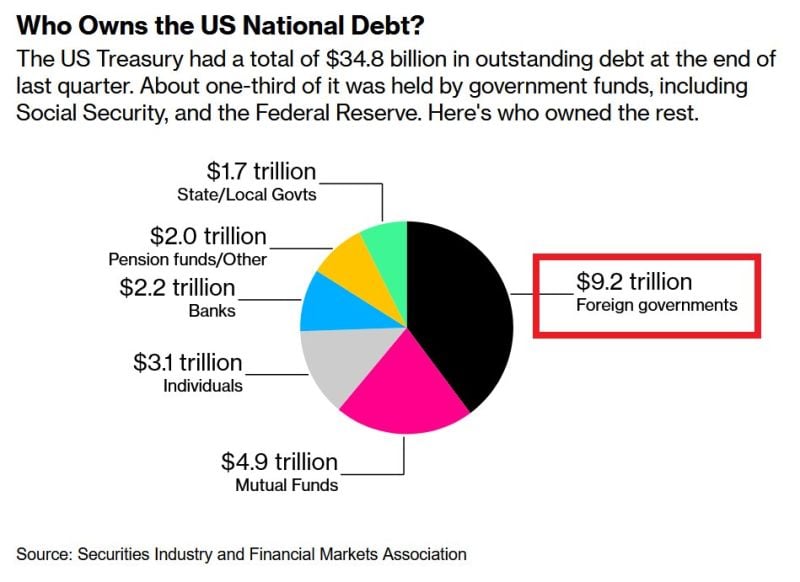

⁉️WHO OWNS THE US PUBLIC DEBT⁉️

~33% of the $35.7 trillion federal debt is held by government funds, including Social Security and the Fed. Over 25% is owned by foreign governments with the most held by Japan and subsequently China. ~15% is held by mutual investment funds. Source: Global Markets Investor

😱 The shocking chart of the day: CHINESE DEBT SIZE IS ABSOLUTELY MIND-BLOWING😱

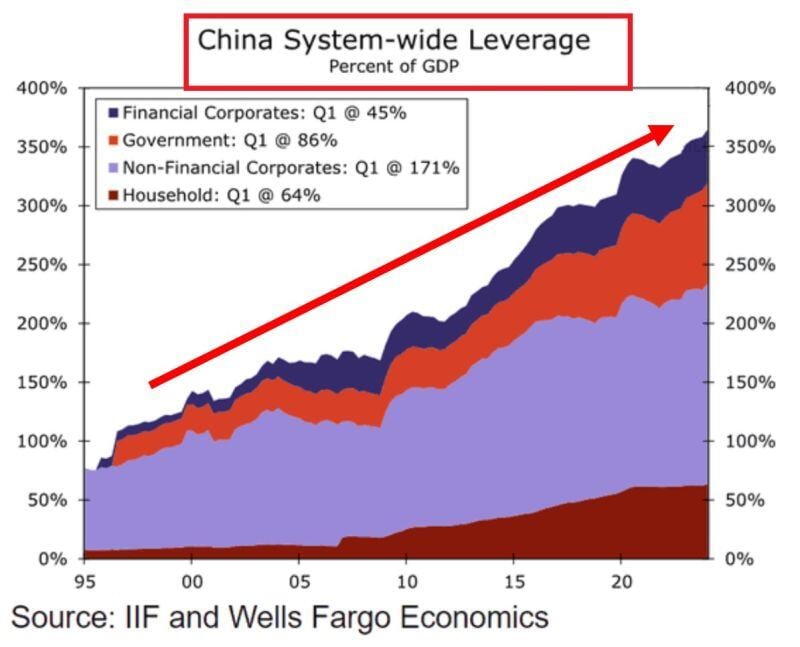

China's debt-to-GDP ratio hit a MASSIVE 366% in Q1 2024, a new record. Since 2008, the ratio has more than DOUBLED. Breakdown: Non-Financial Corporates: 171% Government: 86% Households: 64% Financial Corporates: 45% Even with this huge debt, China cannot achieve a 5% GDP growth target. How much additional leverage do they need to boost growth? And at what cost? Source: Global Markets Investor, IIF, Wells Fargo

Investing with intelligence

Our latest research, commentary and market outlooks