Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- macro

- equities

- Food for Thoughts

- sp500

- Central banks

- Bonds

- markets

- bitcoin

- Asia

- technical analysis

- investing

- europe

- Crypto

- geopolitics

- tech

- performance

- gold

- Commodities

- AI

- nvidia

- ETF

- earnings

- Forex

- Real Estate

- oil

- banking

- magnificent-7

- Volatility

- nasdaq

- apple

- emerging-markets

- energy

- china

- Alternatives

- switzerland

- tesla

- trading

- sentiment

- russia

- Money Market

- assetmanagement

- UK

- ESG

- Middle East

- microsoft

- amazon

- ethereum

- meta

- bankruptcy

- Turkey

- Healthcare

- Industrial-production

- Global Markets Outlook

- africa

- brics

- Market Outlook

- Asset Allocation Insights

- Flash

- Focus

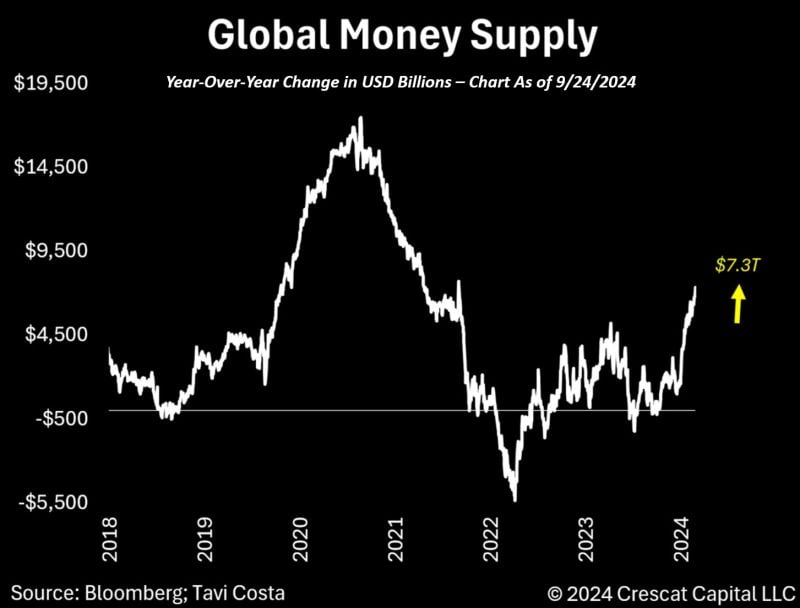

Global money supply is rising once again, having increased by $7.3 trillion over the past year.

That is the highest growth rate in two years. Source: Bloomberg, Tavi Costa

THE WEEK AHEAD...

👉 In the US >>> 🚨 Fed Chair Powell Speaks - Monday September ISM Manufacturing data - Tuesday JOLTs Jobs data - Tuesday ADP Nonfarm Employment data - Wednesday Initial Jobless Claims - Thursday 🚨 September Jobs Report - Friday 👉 In the rest of the world >>> 🚨 October OPEC Meeting - Wednesday In Europe, the flash CPIs will continue to come in for Germany and the Eurozone. Highlights in Asia include the Tankan survey and industrial production in Japan, as well as PMIs in China.

BREAKING: The Richmond Fed Manufacturing Employment Index plummeted to 21 points in September, its lowest level since April 2009.

The index has been in contraction for the majority of 2024 and even sits below pandemic lows. Furthermore, employment expectations for the next 6 months fell to -12 points, the lowest since April 2020. Overall business conditions are now at their worst since May 2020 and second-worst since 2008. Source: The Kobeissi Letter, Bloomberg

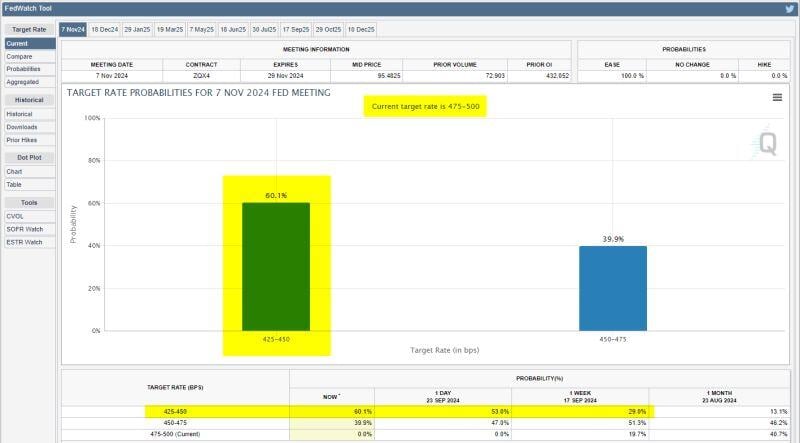

Market pricing for another 50 bps rate cut at the Fed's next meeting two days after the election is now up to 60%.

@CMEGroup

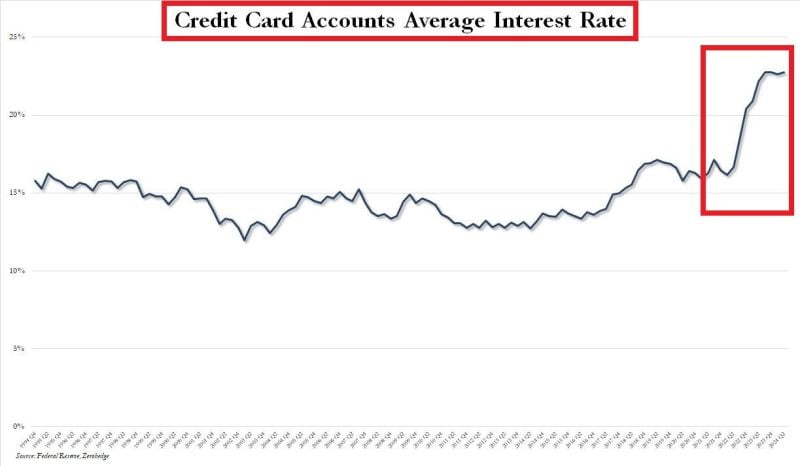

US CREDIT CARD INTEREST RATES ARE AT ALL-TIME HIGHS

US credit card rates remain at record highs of ~22%. US credit card debt is now ~$1.14 trillion, also at an all-time high. This means Americans pay ~$250 billion in average interest payments on credit cards a year. Source: Global Markets Investor

Investing with intelligence

Our latest research, commentary and market outlooks