Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- macro

- equities

- Food for Thoughts

- sp500

- Central banks

- Bonds

- markets

- bitcoin

- Asia

- technical analysis

- investing

- europe

- Crypto

- geopolitics

- tech

- performance

- gold

- Commodities

- AI

- nvidia

- ETF

- earnings

- Forex

- Real Estate

- oil

- banking

- magnificent-7

- Volatility

- nasdaq

- apple

- emerging-markets

- energy

- china

- Alternatives

- switzerland

- tesla

- trading

- sentiment

- russia

- Money Market

- assetmanagement

- UK

- ESG

- Middle East

- microsoft

- amazon

- ethereum

- meta

- bankruptcy

- Turkey

- Healthcare

- Industrial-production

- Global Markets Outlook

- africa

- brics

- Market Outlook

- Asset Allocation Insights

- Flash

- Focus

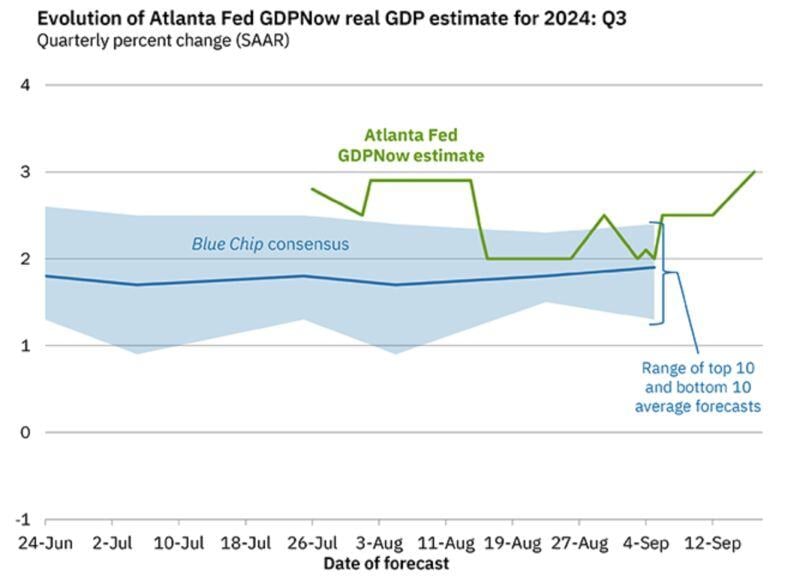

Soft landing? Hard landing? Or no landing?

Atlanta Fed Q3 Real GDP growth Nowcast model just hit 3%...

Safe is risky. #DF24

Source: Vala Afshar @ValaAfshar on X, marketoonist.com

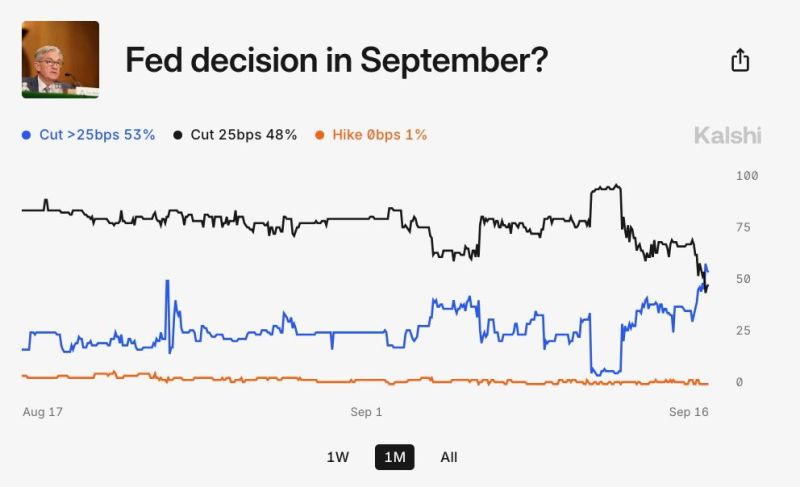

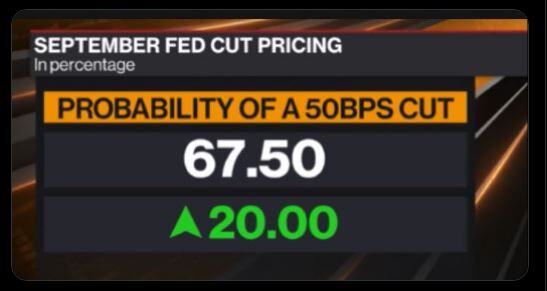

BREAKING: Prediction markets are now pricing-in a 48% chance of a 50 basis point Fed rate cut this week.

Odds of a 50 basis point rate cut have gone from 2% to 48% in just 5 days, according to Kalshi. This will be the first Fed policy decision without a 90%+ consensus since 2020... Source: The Kobeissi Letter

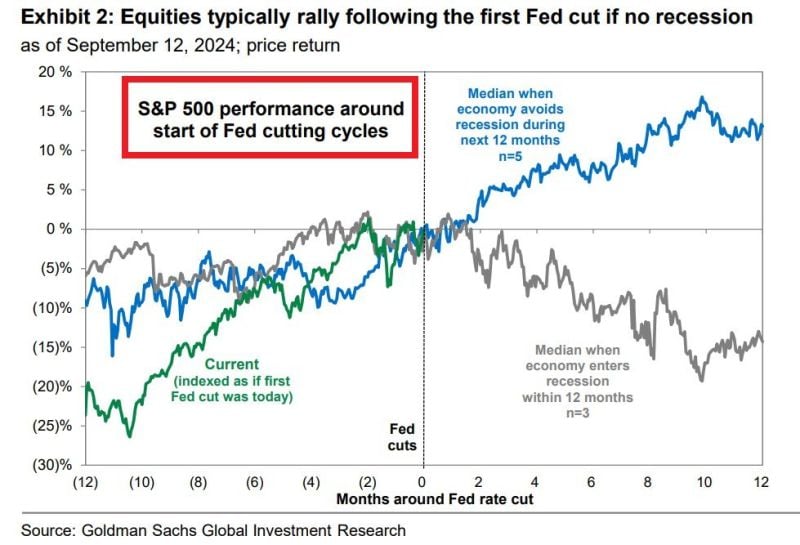

FED WILL CUT RATES ON WEDNESDAY FOR THE 1ST TIME IN 4.5 YEARS Stocks usually fall ~15% within 12 months following the 1st cut if there is a recession

If no recession, stocks rise by >10%. Key caveat is, that we will know if there was a recession a few months after the cut. Source: Global Markets Investor

Market pricing now suggests a 50bps cut from the Fed is now base case (nearly 70% probability)

Source: Bloomberg, David Ingles

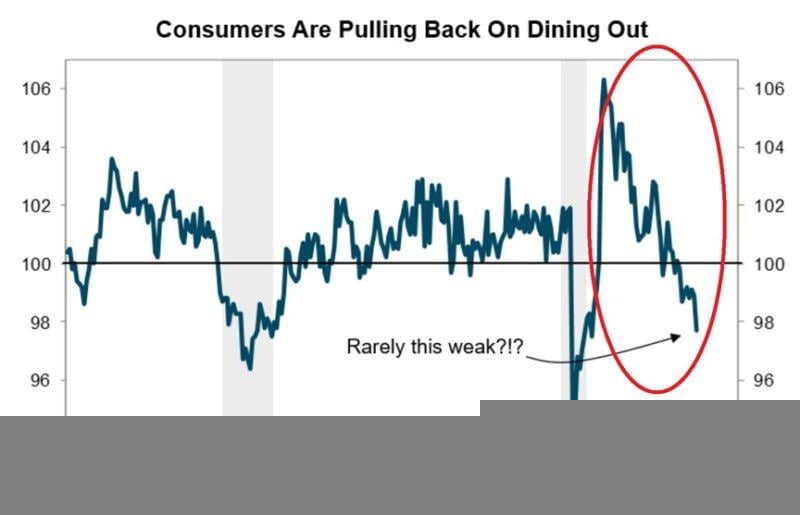

BREAKING: The Restaurant Performance Index (RPI) fell -1.3% in July to 97.7 points, the lowest level since the 2020 lockdowns

This index tracks the health of the restaurant industry in the US by measuring sales, customer traffic, labor, and overall business conditions. Since 2021, this metric has fallen by ~8.0%, marking the largest drop since it was launched in 2002. Such a low level in the index has only been seen during recessions. Americans are pulling back on dining out as prices have been sharply rising and recently hit new all-time highs. Since 2020, food prices away from home have increased by 27.0%, and fast food prices have jumped by 31.0%. Eating out is becoming a luxury... Source: The Kobeissi Letter, Trahan Macro Research

Investing with intelligence

Our latest research, commentary and market outlooks