Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- macro

- equities

- Food for Thoughts

- sp500

- Central banks

- Bonds

- markets

- bitcoin

- Asia

- technical analysis

- investing

- europe

- Crypto

- geopolitics

- tech

- performance

- gold

- Commodities

- AI

- nvidia

- ETF

- earnings

- Forex

- Real Estate

- oil

- banking

- magnificent-7

- Volatility

- nasdaq

- apple

- emerging-markets

- energy

- china

- Alternatives

- switzerland

- tesla

- trading

- sentiment

- russia

- Money Market

- assetmanagement

- UK

- ESG

- Middle East

- microsoft

- amazon

- ethereum

- meta

- bankruptcy

- Turkey

- Healthcare

- Industrial-production

- Global Markets Outlook

- africa

- brics

- Market Outlook

- Asset Allocation Insights

- Flash

- Focus

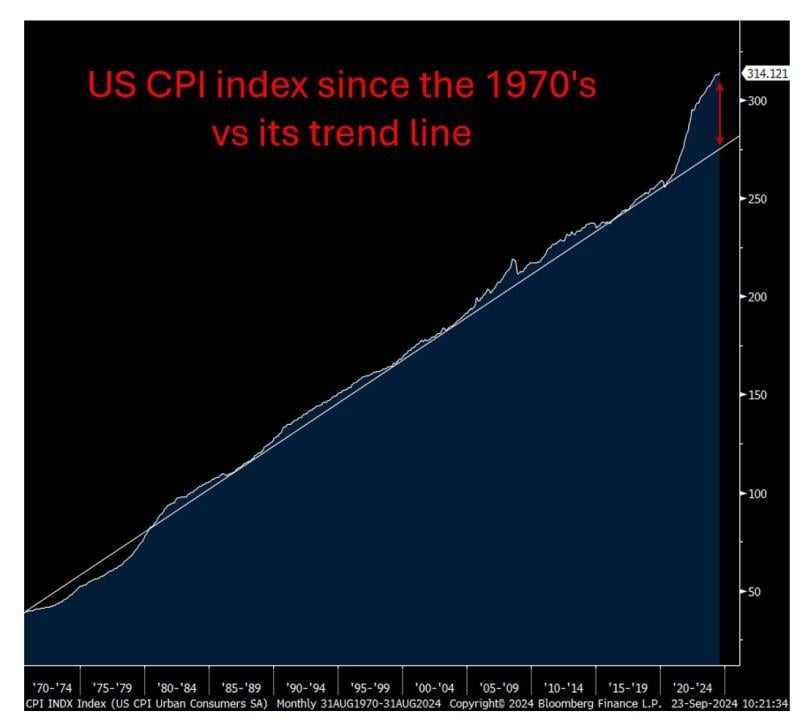

😱 The "shocking chart" of the day !!! 😱 US CPI index since the 1970's vs its trend line.

In order to 'average' out the recent period of high inflation at 2%, the fed would have to tolerate a period of time of deflation. But can they really afford deflation with $33T of debt and persistently high budget deficit? As mentioned by Peter Boockvar on X, once purchasing power is lost, it is lost forever because central bankers won't let you get it back... Last week, Federal Reserve Governor Chris Waller inadvertently made that perfectly clear when he spoke on Friday. He told CNBC in an interview that "What's got me a little more concerned is inflation is running softer than I thought."... Bottom-line: It is very unlikely that inflation will come back to trend line in the foreseeable future. Perhaps the jumbo rate cut was also about making sure that the US economy doesn't fall into a deflationary trap... Welcome to the era of fiscal dominance Source chart: Bloomberg

🚨WHAT? US stocks fell after a 0.50% rate cut?🚨

Markets were very mixed after the Fed 'Jumbo' reduction. Big cuts are not usually a good sign BUT... Day 1 is usually not the REAL reaction. We need to wait 2 more trading sessions to see what's really going on. Market performance today: S&P 500 -0.3% Nasdaq -0.3% Russell 2000 +0.0% Dow Jones -0.3% Bitcoin +0.1% Bank Index +0.4% VIX +4%, front month futures VIX -1% Gold -0.6% WTI Crude Oil -1.3% Source. Global Markets Investor

Live look at JP Morgan after being the only ones who correctly predicted a 50bps cut:

Source: Trend Spider

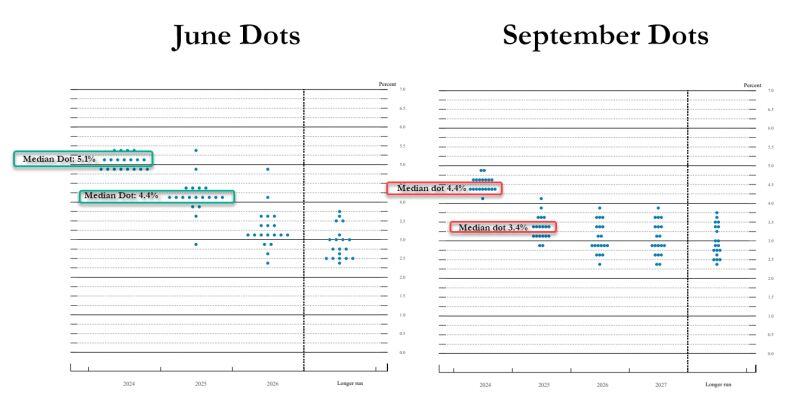

Amazing to see the effect of 818K downward jobs revision on the fed dots...

Source: www.zerohedge.com

Among the reasons why the Fed cut 50bps this week:

1) Inflation risk is LOWER than Employment and Consumer risk 2) The sticky component of inflation is shelter. For shelter inflation to go down we need to see more housing supply and for this we need to get lower mortgage rates = jumbo rate cut does help 3) They MUST get front-end rates lower as this colossal wall of debt matures (source: Lawrence McDonald, Bloomberg)

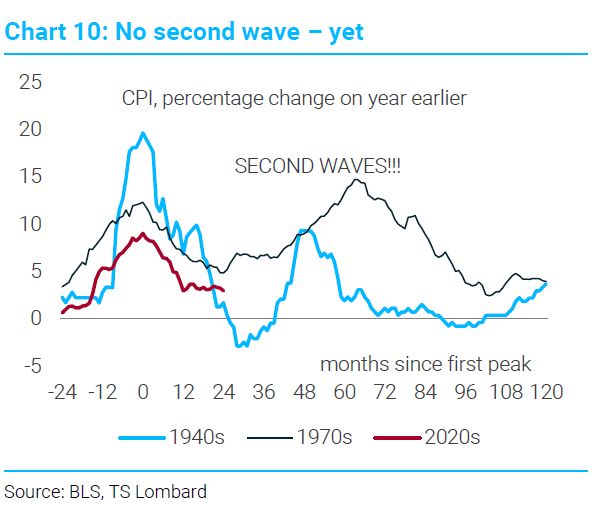

After yesterday jumbo Fed rate cut (days after core CPI MoM reaccelerarting), who doesn't have this chart in mind???

The Second Wave of Inflation. This is what the Fed is thinking but isn't saying out loud. If you expand the dataset to the CPI's of Western economies, 87% of the time there's a second wave. Source. TS Lombard, Eric Hale

FED cuts rates by 50bp to 4.75%-5% range

The Federal Reserve lowered its benchmark interest rate by a half percentage point Wednesday, in an aggressive start to a policy shift aimed at bolstering the US labor market.Committee sees another half-point of cuts in rest of 2024Policymakers penciled in an additional percentage point of cuts in 2025, according to their median forecast.

Investing with intelligence

Our latest research, commentary and market outlooks