Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- macro

- equities

- Food for Thoughts

- sp500

- Central banks

- Bonds

- markets

- bitcoin

- Asia

- technical analysis

- investing

- europe

- Crypto

- geopolitics

- tech

- performance

- gold

- Commodities

- AI

- nvidia

- ETF

- earnings

- Forex

- Real Estate

- oil

- banking

- magnificent-7

- Volatility

- nasdaq

- apple

- emerging-markets

- energy

- china

- Alternatives

- switzerland

- tesla

- trading

- sentiment

- russia

- Money Market

- assetmanagement

- UK

- ESG

- Middle East

- microsoft

- amazon

- ethereum

- meta

- bankruptcy

- Turkey

- Healthcare

- Industrial-production

- Global Markets Outlook

- africa

- brics

- Market Outlook

- Asset Allocation Insights

- Flash

- Focus

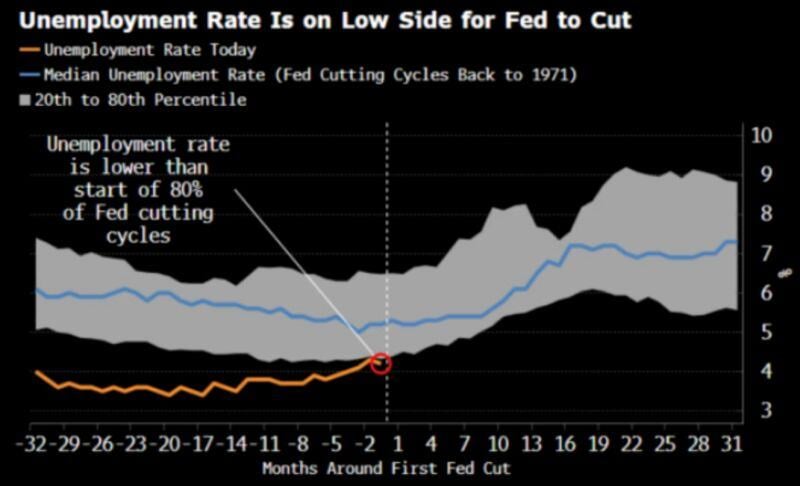

Should the FED cut rates next week, the easing cycle will start with an unemployment rate which is on the low side vs. history

Source: RBC, Bloomberg

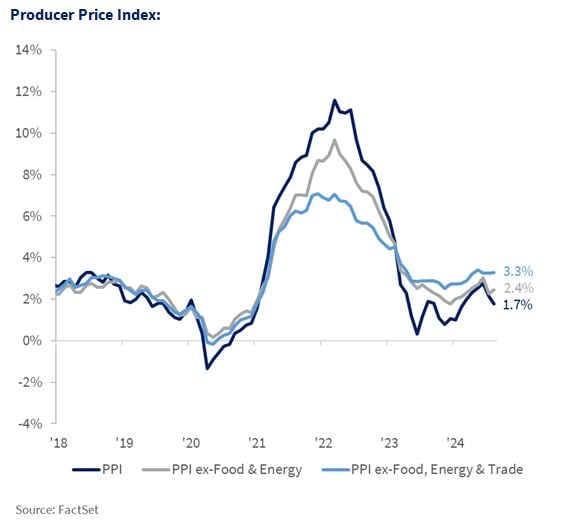

📈 BREAKING: August PPI inflation falls to 1.7%, below expectations of 1.8%.

Core PPI inflation was unchanged, at 2.4%, below expectations of 2.5%. PPI inflation is now at its lowest level since February 2024. On a sequential basis (MoM), the picture is not the same: August's core PPI rose more than expected, driven by higher service prices, while goods prices stayed flat. PPI 0.2% MoM, Exp. 0.1% PPI Core 0.3% MoM, Exp. 0.2% Source: Ali Dhanjion X, Factset

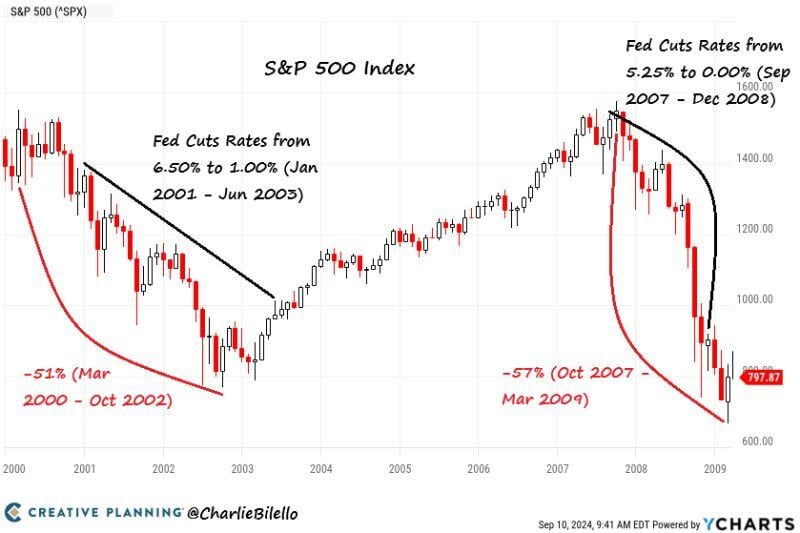

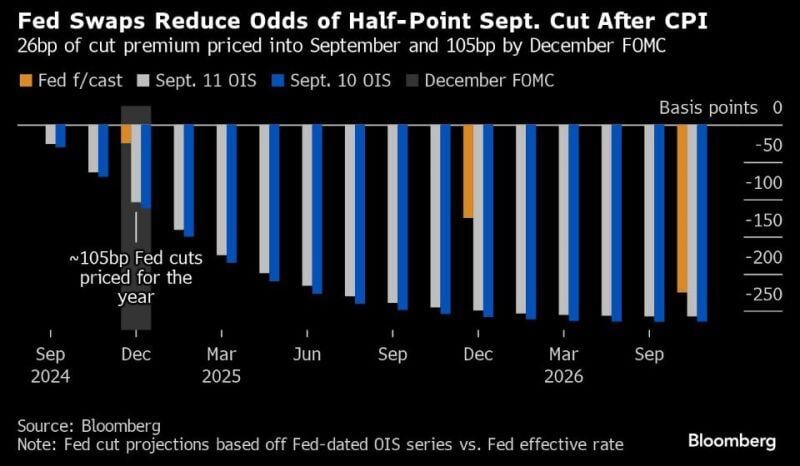

Fed Expected to Cut Rates by 25 Basis Points After Inflation Data; Bitcoin Remains Stable

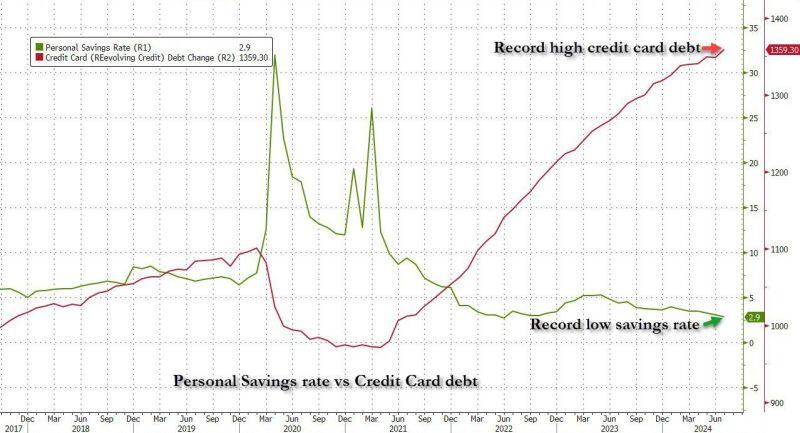

U.S. inflation came in as expected, increasing the likelihood of a 25 basis point Fed rate cut, with market expectations rising to 83%. A 50 basis point cut is now only 17% likely. The bond market now expects a 25 bps Fed rate cut this month, not 50 bps. The 2-year yield hit 3.69%, and the hashtag#Fed's held rates at 5.25%-5.5% since July 2023. Investors eye 140 bps in cuts by Jan '25. Source: Luc Sternberg, coinoptix, Bloomberg

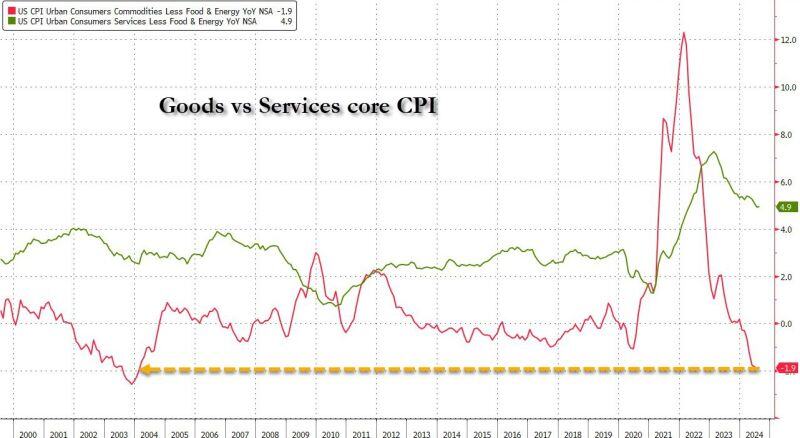

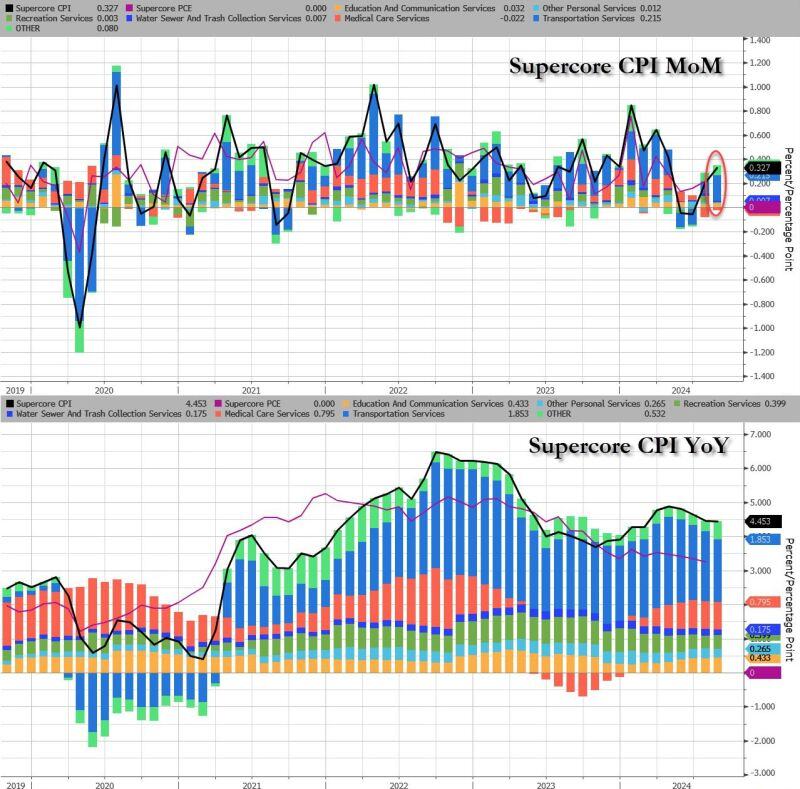

The most important number of the day was US CPI number.

Inflation in August declined to its lowest level since February 2021, according to a Labor Department report Wednesday that also showed a key measure higher than expected, setting the stage for an expected quarter percentage point rate cut from the Federal Reserve. Indeed, while the headline CPI increased 0.2% for the month, in line with the Dow Jones consensus, the core CPI, which excludes volatile food and energy prices, increased 0.3% for the month, slightly higher than the 0.2% estimate. The slight uptick in core CPI keeps the Fed on defense against inflation, likely negating the probability of a more aggressive interest rate when policymakers meet next Tuesday and Wednesday. Here are the details: -> CPI 0.2% MoM (or 0.187% unrounded), Exp. 0.2% - in line -> CPI Core 0.3% MoM (or 0.281% unrounded), Exp. 0.2% - hotter than expected. Note that was the 51st straight month of MoM increases in Core CPI, and a new record high. The annual prints: -> CPI 2.5% YoY, Exp. 2.5% - in line. The annual CPI increase is the lowest since February 2021... -> CPI Core 3.2% YoY, Exp. 3.2% - in line Last, but not least, and perhaps most ominous of all, is that while the Fed is about to start cutting rates, Supercore CPI rose 0.33% MoM (see chart below), the biggest monthly increase since April, driven by continued acceleration in transportation services, which jumped the most in 5 months. Source: www.zerohedge.com, Bloomberg

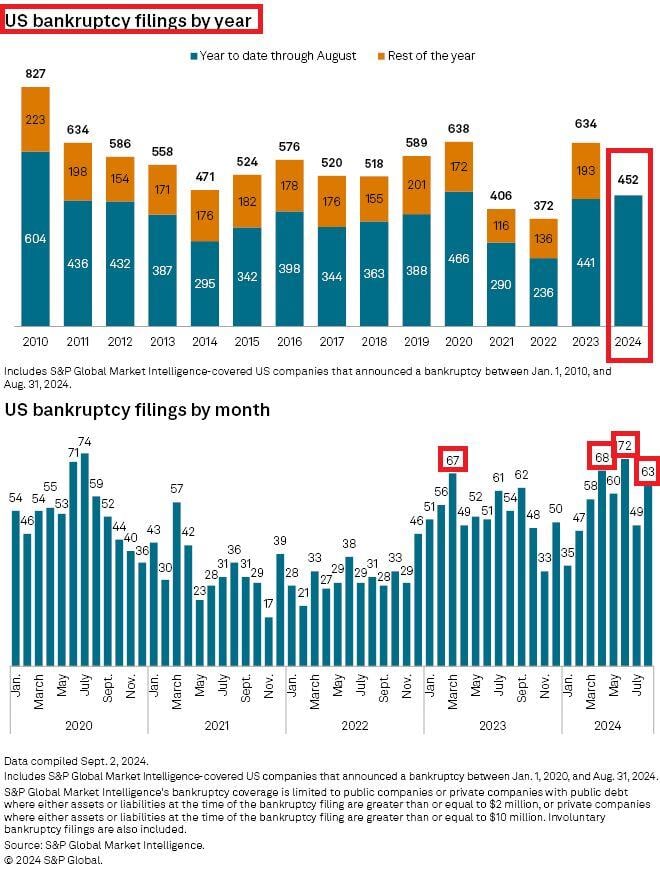

🚨US BANKRUPTCIES ARE ON THE RISE🚨

The number of bankruptcy filings hit 452 year-to-date, the 2nd largest in 13 YEARS. In August alone, 63 companies went under, the 4th LARGEST since the COVID CRISIS. Most bankruptcies have been seen in the consumer discretionary sector. Source: Global Markets Investor

Investing with intelligence

Our latest research, commentary and market outlooks