Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- macro

- equities

- Food for Thoughts

- sp500

- Central banks

- Bonds

- markets

- bitcoin

- Asia

- technical analysis

- investing

- europe

- Crypto

- geopolitics

- tech

- performance

- gold

- Commodities

- AI

- nvidia

- ETF

- earnings

- Forex

- Real Estate

- oil

- banking

- magnificent-7

- Volatility

- nasdaq

- apple

- emerging-markets

- energy

- china

- Alternatives

- switzerland

- tesla

- trading

- sentiment

- russia

- Money Market

- assetmanagement

- UK

- ESG

- Middle East

- microsoft

- amazon

- ethereum

- meta

- bankruptcy

- Turkey

- Healthcare

- Industrial-production

- Global Markets Outlook

- africa

- brics

- Market Outlook

- Asset Allocation Insights

- Flash

- Focus

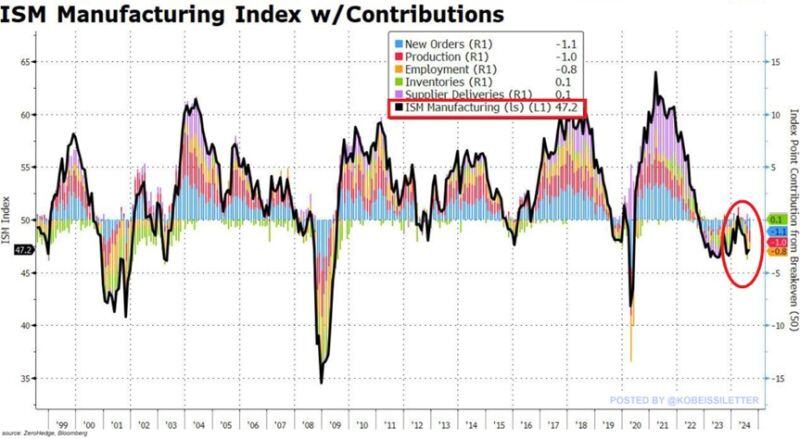

US manufacturing has officially contracted for the 5th consecutive month, to 47.2 points.

The ISM manufacturing PMI index missed expectations of 47.5 points for last month. New orders fell to 44.6 points from 47.4 in July, experiencing contraction for the 3rd straight month. Manufacturing activity has now shrunk in 21 of the last 22 months, extending the second-longest downturn in history. The worst part? The prices paid index jumped to 54.0 points from 52.9 in July, expanding for the 8th month in a row. Rising prices with falling output is rarely a good combo for stocks >>> to be monitored Source: www.zerohedge. The Kobeissi Letter

Is it sustainable?

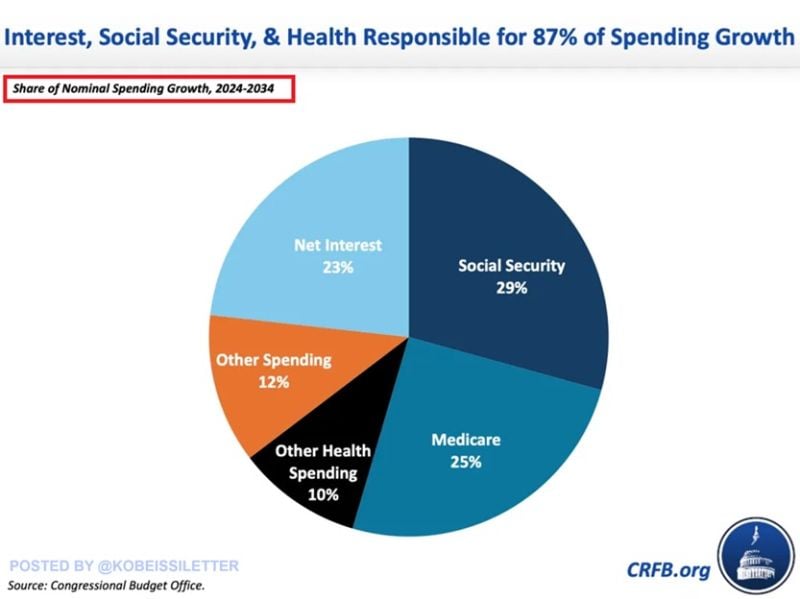

Interest Expense, Social Security, and Health are set to account for 87% of the US government spending growth over the next 10 years. Government spending is estimated to grow from $6.8 trillion in Fiscal Year 2024 to $10.3 trillion in 2034, according to the CBO. $3.0 trillion of the $3.5 trillion increase come from Social Security, federal health care programs, and interest costs on the public debt. Interest costs are projected to be the fastest growing part of the budget, DOUBLING from $892 billion in 2024 to $1.7 trillion by 2034. The net interest share of spending growth could hit as high as 23%. Source: The Kobeissi Letter, CBO

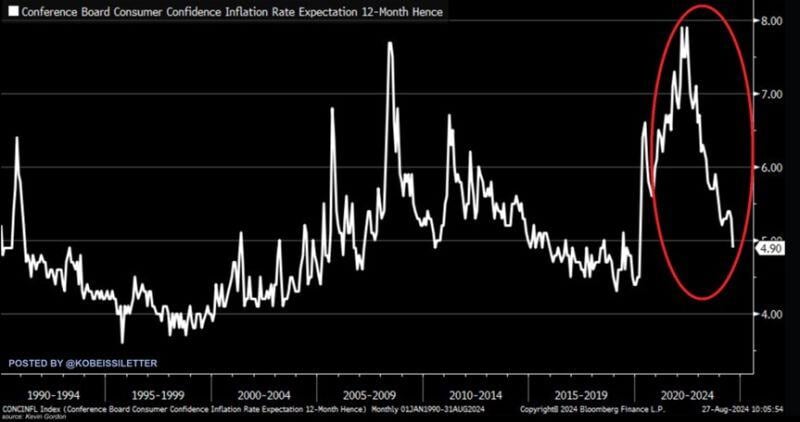

Some good news on US inflation: 1-year inflation expectations declined to 4.9% in August, the lowest since the pandemic in 2020, according to the Conference Board Consumer Confidence Survey.

Over the last 2 years, inflation expectations have fallen from ~8.0% to 4.9%, recording a similar drop as during the 2008 Financial Crisis. As a result, expectations are now at levels seen in the 2015-2019 period. Furthermore, 1-year inflation expectations in the University of Michigan consumer survey fell to 2.8%, the lowest since December 2020. Source: The Kobeissi Letter

BREAKING: 90% of US cities saw a rise in year over year unemployment rates in July, according to the BLS.

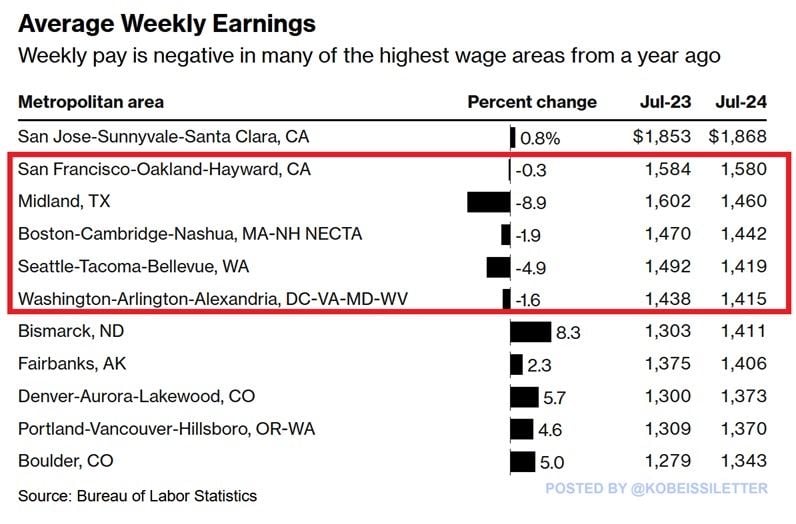

Jobless rates jumped in 350 of the 389 metropolitan areas last month. Additionally, in 8 large metro areas with a population of 1 million or more, FEWER people held a job in July 2024 than in July 2019. At the same time, average weekly wages DROPPED in 43% of the 389 metropolitan areas. In 5 of the 8 highest-paying areas with average weekly wages above$1,400, salaries declined year-over-year. The US labor market is weakening. Source: The Kobeissi Letter

Investing with intelligence

Our latest research, commentary and market outlooks