Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- macro

- equities

- Food for Thoughts

- sp500

- Central banks

- Bonds

- markets

- bitcoin

- Asia

- technical analysis

- investing

- europe

- Crypto

- geopolitics

- tech

- performance

- gold

- Commodities

- AI

- nvidia

- ETF

- earnings

- Forex

- Real Estate

- oil

- banking

- magnificent-7

- Volatility

- nasdaq

- apple

- emerging-markets

- energy

- china

- Alternatives

- switzerland

- tesla

- trading

- sentiment

- russia

- Money Market

- assetmanagement

- UK

- ESG

- Middle East

- microsoft

- amazon

- ethereum

- meta

- bankruptcy

- Turkey

- Healthcare

- Industrial-production

- Global Markets Outlook

- africa

- brics

- Market Outlook

- Asset Allocation Insights

- Flash

- Focus

BREAKING 🚨 Jerome Powell will indicate that the Fed is open to a 50 bps rate cut during his speech at the Jackson Hole, according to analysts from Evercore

BULLS, GET EVEN MORE EXCITED... Source: Stocktwits, www.investing.com

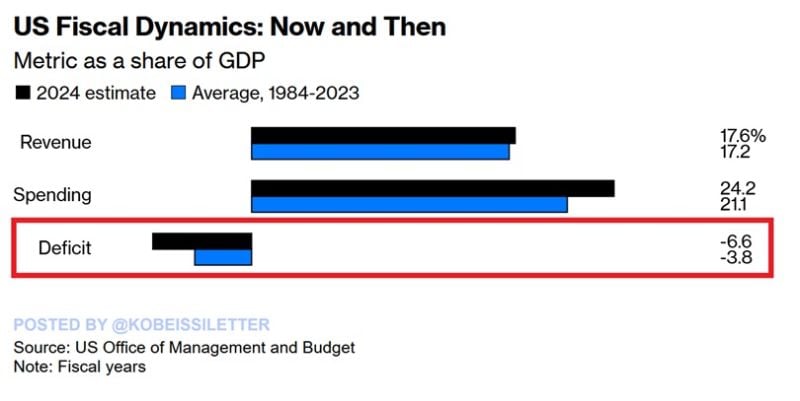

US government spending is expected to hit 24.2% of GDP in 2024, significantly above the previous 39-year average of 21.1%, according to the CBO.

At the same time, revenues are projected to reach 17.6% of GDP, just 0.4 percentage points above the 1984-2023 average. As a result, the US deficit is estimated to hit 6.6% of GDP, almost DOUBLE the 39-year average. In nominal terms, the deficit is set to hit $1.9 trillion in 2024, the highest level since 2021 when the deficit was $2.8 trillion in response to the pandemic. US government spending relative to GDP is expected to rise rapidly while revenue stagnates. Multi-trillion Dollar deficits are the new normal. Source: The Kobeissi Letter

JUST IN 🚨: Odds of a 50 bps interest rate in September has plummeted to less than 25%

Source: Barchart

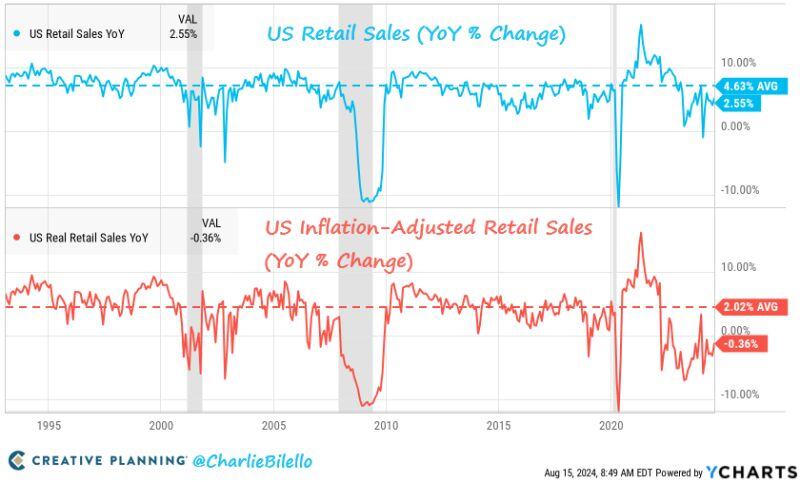

US Retail Sales increased 2.6% over the last year and this number is taken positively by markets

Retail sales came in better than expecting indicating that hashtag#consumers are still strong. Retail Sales month-over-month is the best number since January 2023. There are few caveats though: 1) After adjusting for higher prices they were down 0.4%. 2) Both of these numbers are well below the historical averages of +4.6% nominal and +2.0% real. 3) Previous numbers were revised downward Source: Charlie Bilello

Investing with intelligence

Our latest research, commentary and market outlooks