Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- macro

- equities

- Food for Thoughts

- sp500

- Central banks

- Bonds

- markets

- bitcoin

- Asia

- technical analysis

- investing

- europe

- Crypto

- geopolitics

- tech

- performance

- gold

- Commodities

- AI

- nvidia

- ETF

- earnings

- Forex

- Real Estate

- oil

- banking

- magnificent-7

- Volatility

- nasdaq

- apple

- emerging-markets

- energy

- china

- Alternatives

- switzerland

- tesla

- trading

- sentiment

- russia

- Money Market

- assetmanagement

- UK

- ESG

- Middle East

- microsoft

- amazon

- ethereum

- meta

- bankruptcy

- Turkey

- Healthcare

- Industrial-production

- Global Markets Outlook

- africa

- brics

- Market Outlook

- Asset Allocation Insights

- Flash

- Focus

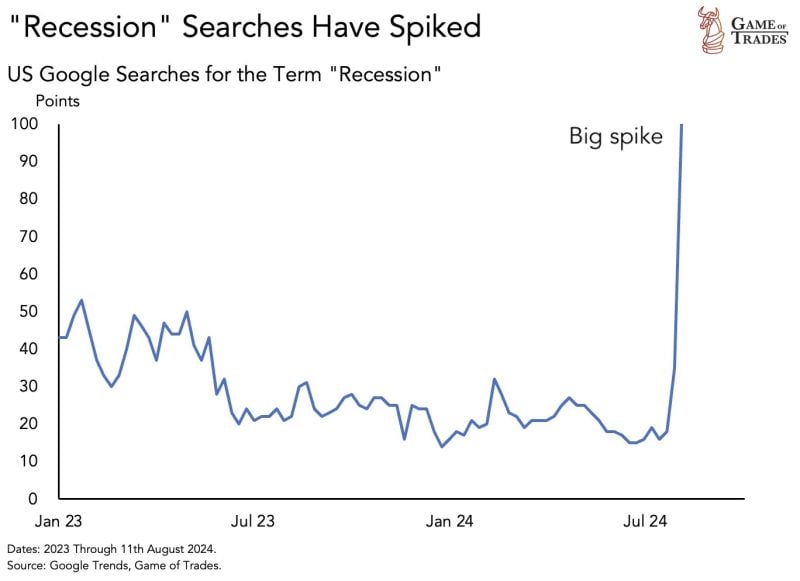

Recession is the talk of the town again

In just 1 week, recession searches have hit record levels. Source: Game of Trades

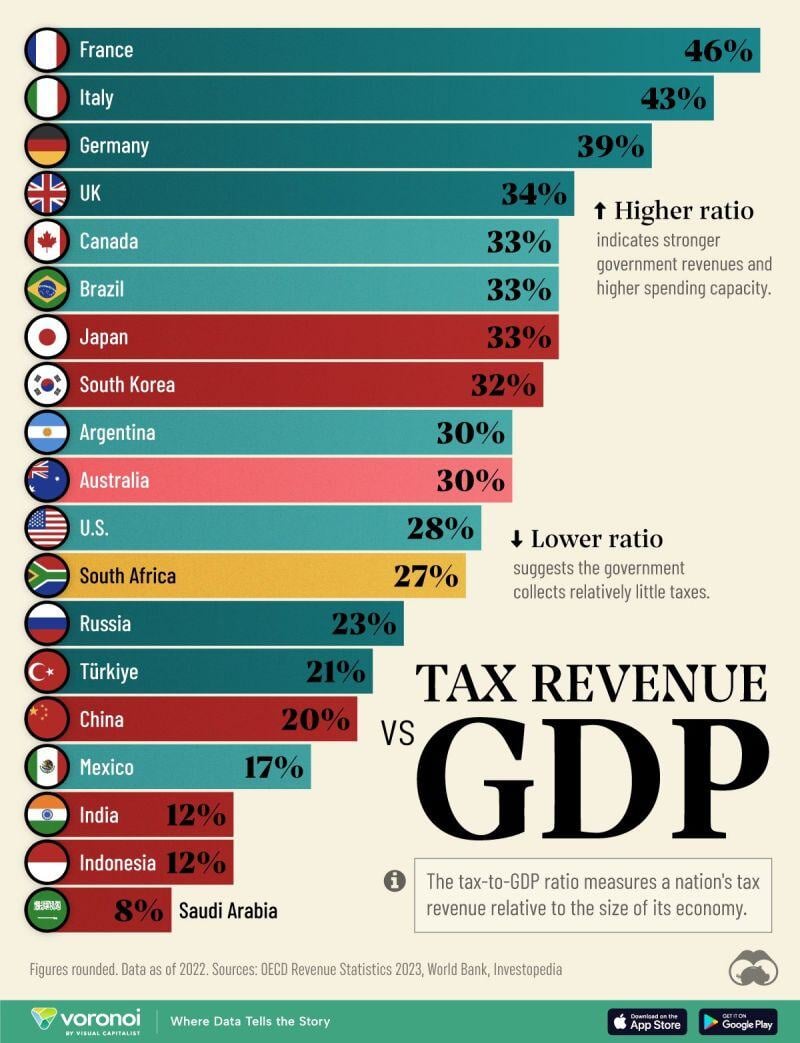

Tax Revenue vs. GDP for Major Countries

Source: Visual Capitalist

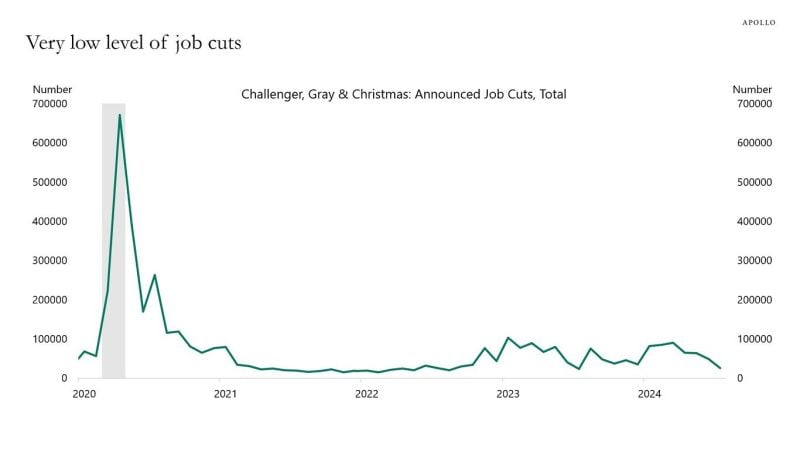

A very important chart which goes AGAINST hard landing scenario

"The source of the rise in the us unemployment rate is not job cuts but a rise in labor supply because of rising immigration. That is the reason why the Sahm rule doesn’t work. The Sahm rule was designed for a decline in labor demand, not a rise in immigration." - Torsten Slok (Apollo) Source: Mike Z. on X

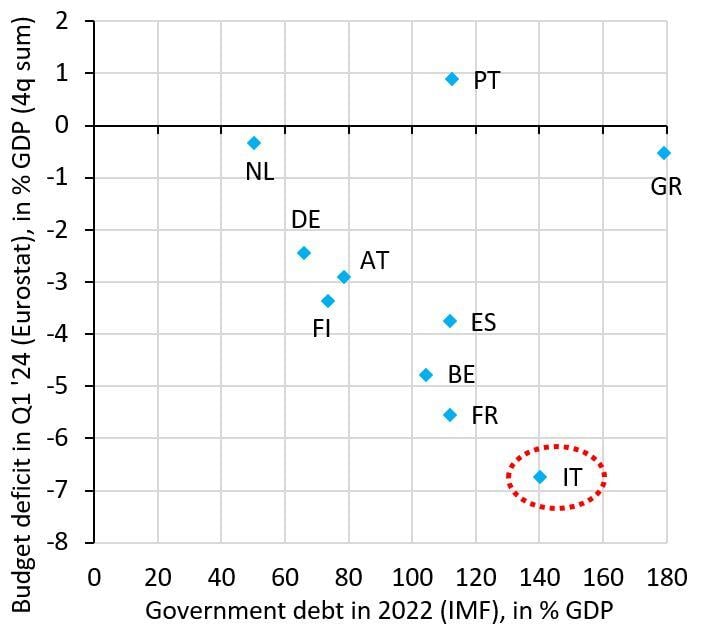

Why the ECB should keep interest rates at the lowest level possible explained in one chart

The Euro zone is an equilibrium where high debt countries like Italy, France and Spain run big deficits. The ECB enables this by capping yields when these spike like they did in 2022. This policy is an implicit subsidy of high debt countries by low debt ones... Source: Robin Brooks

Investing with intelligence

Our latest research, commentary and market outlooks