Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- macro

- equities

- Food for Thoughts

- sp500

- Central banks

- Bonds

- markets

- bitcoin

- Asia

- technical analysis

- investing

- europe

- Crypto

- geopolitics

- tech

- performance

- gold

- Commodities

- AI

- nvidia

- ETF

- earnings

- Forex

- Real Estate

- oil

- banking

- magnificent-7

- Volatility

- nasdaq

- apple

- emerging-markets

- energy

- china

- Alternatives

- switzerland

- tesla

- trading

- sentiment

- russia

- Money Market

- assetmanagement

- UK

- ESG

- Middle East

- microsoft

- amazon

- ethereum

- meta

- bankruptcy

- Turkey

- Healthcare

- Industrial-production

- Global Markets Outlook

- africa

- brics

- Market Outlook

- Asset Allocation Insights

- Flash

- Focus

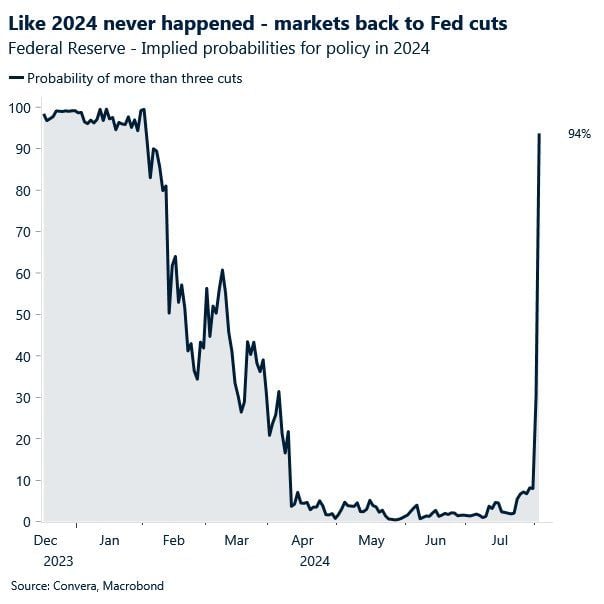

What a chart...

Source. Michel.A Arouet, Ht @MacroKova, Convera, Macrobond

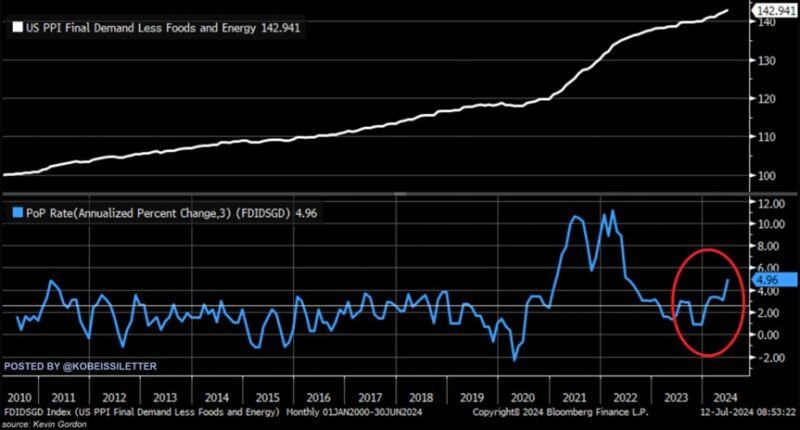

Is inflation in the US reaccelerating?

The 3-month annualized core PPI inflation rose to 5.0% in June, its highest since 2022. This metric has more than DOUBLED in just 6 months. This is also higher than in any period over the last 15 years, except for 2021 and 2022. Something to watch closely. Source: The Kobeissi Letter, Bloomberg

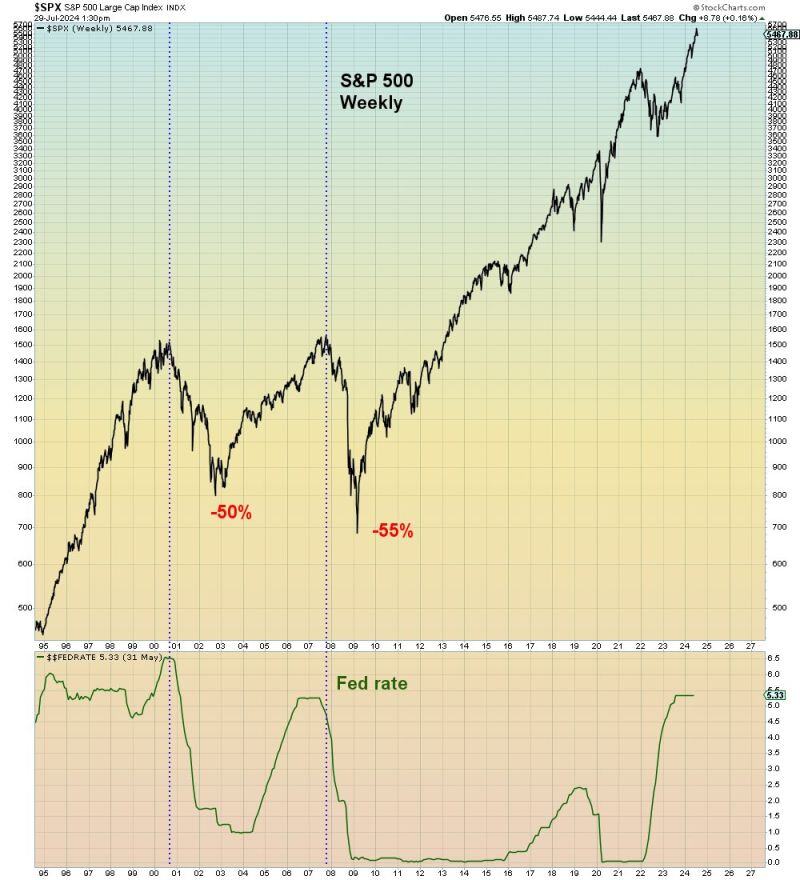

Should the FED wait for a financial accident to happen BEFORE cutting interest rates?

Source chart: Mac10

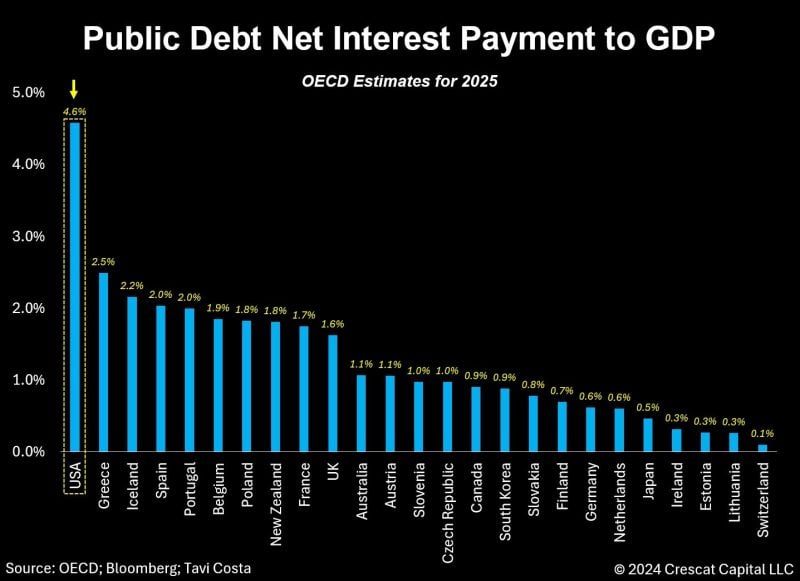

As highlighted by Otavio (Tavi) Costa, the need for the FED to cut interest rates is not driven just by labor data and inflation.

As shown on the chart below, the costs of servicing Federal debt in the US is soaring more than in any other country. Not just once, not twice, or even three times — multiple rate cuts would be needed to bring US interest payments as a percentage of GDP in line with the rest of the world. This is what financial repression is about. Source: Tavi Costa, Bloomberg

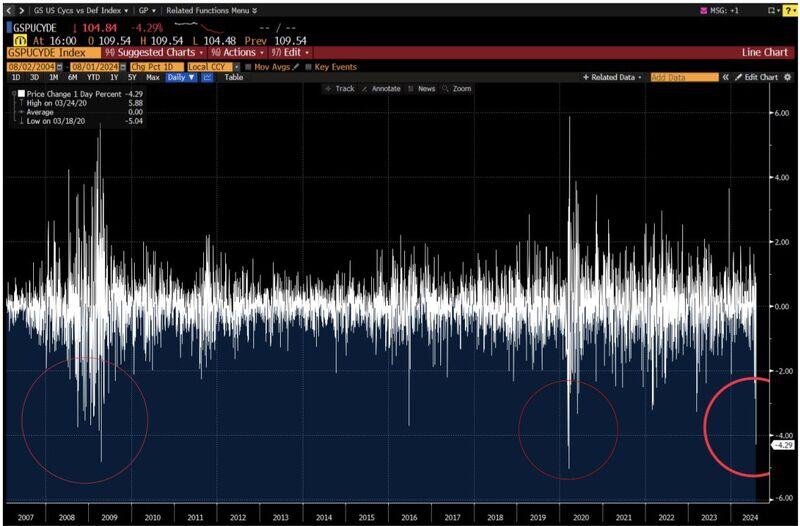

The recessionary trade was in full effect yesterday following weak ISM data.

Cyclicals underperformed Defensives by 429bps, one of the worst days in the last 16+ years. The only other comparable days were during the March 2020 Covid crash and 2008 GFC. $SPY $QQQ $IWM Source: David Marlin, Bloomberg

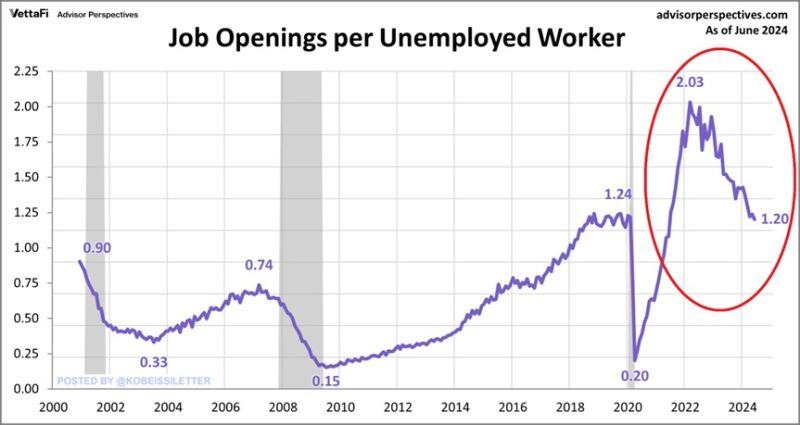

BREAKING: US job openings declined to 8.18 million in June, down from 8.23 million in May, near their lowest level since 2021.

Year-over-year, job openings fell 10.3%, marking the 23rd consecutive monthly decrease, the longest streak since the 2008 Financial Crisis. The ratio of vacancies per unemployed worker, a metric the Fed follows closely, fell to 1.20, the lowest since June 2021. At the same time, the private sector hiring rate declined to 3.7%, the lowest level since April 2020. The private quits rate, measuring the number of people who voluntarily leave their jobs, fell to 2.3%, the lowest since August 2020. This means that Americans are the least confident that they will find a new job since the 2020 Pandemic. => The US labor market is weakening. Source: The Kobeissi Letter

Investing with intelligence

Our latest research, commentary and market outlooks