Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- macro

- equities

- Food for Thoughts

- sp500

- Central banks

- Bonds

- markets

- bitcoin

- Asia

- technical analysis

- investing

- europe

- Crypto

- geopolitics

- tech

- performance

- gold

- Commodities

- AI

- nvidia

- ETF

- earnings

- Forex

- Real Estate

- oil

- banking

- Volatility

- magnificent-7

- nasdaq

- apple

- emerging-markets

- china

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- russia

- Money Market

- assetmanagement

- UK

- ESG

- Middle East

- microsoft

- amazon

- ethereum

- meta

- bankruptcy

- Turkey

- Healthcare

- Industrial-production

- Global Markets Outlook

- africa

- brics

- Market Outlook

- Asset Allocation Insights

- Flash

- Focus

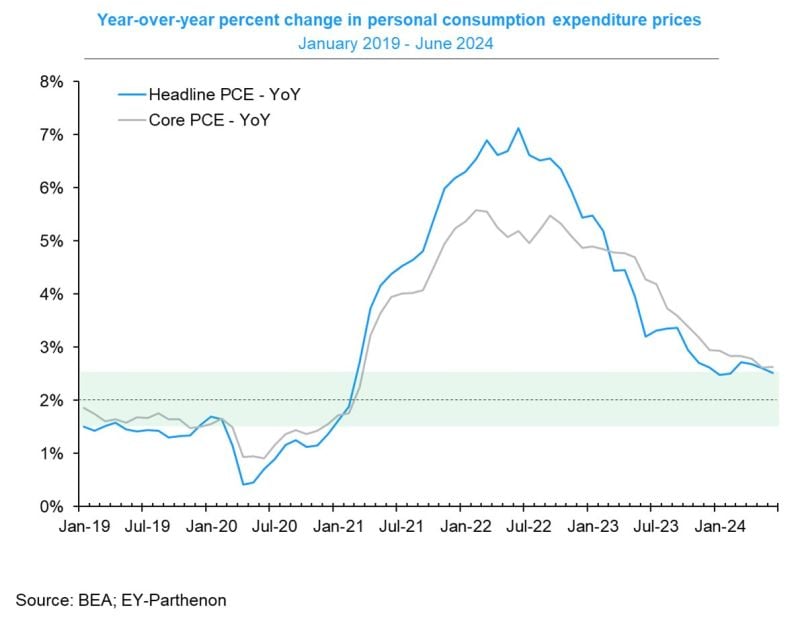

Easing US inflation in June👏

✅Headline PCE prices: 0.1% m/m ✅Core PCE prices: +0.2% m/m 🎯Moving toward Fed's 2% target: ⤵️Headline inflation -0.1pt to 2.5% yoy, IN-LINE with expectations. This is the lowest level since February '21 and down from 7.2% two years ago... ↔️Core inflation is flat at 2.6% yoy, at the lowest level since March '21. This is slightly above expectations (2.5%), which is not such a big surprise as PCE data from yesterday's GDP report revealed a similar picture. Source: Gregory Daco, BEA, EY-Parthenon

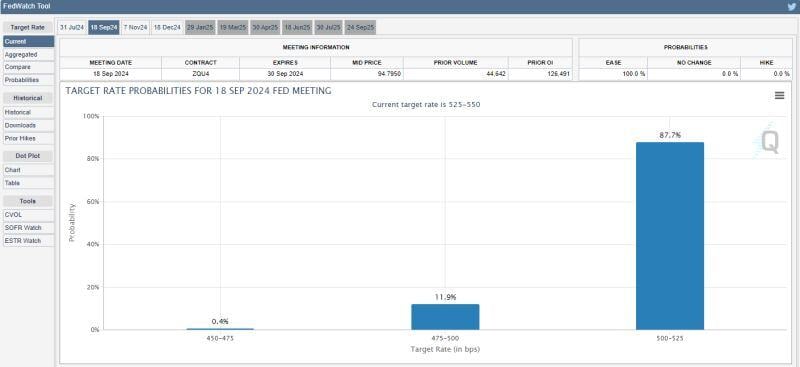

JUST IN 🚨: There is now a 100% chance of a 25 bps interest rate cut by September, according to CME FedWatch

Source: Barchart

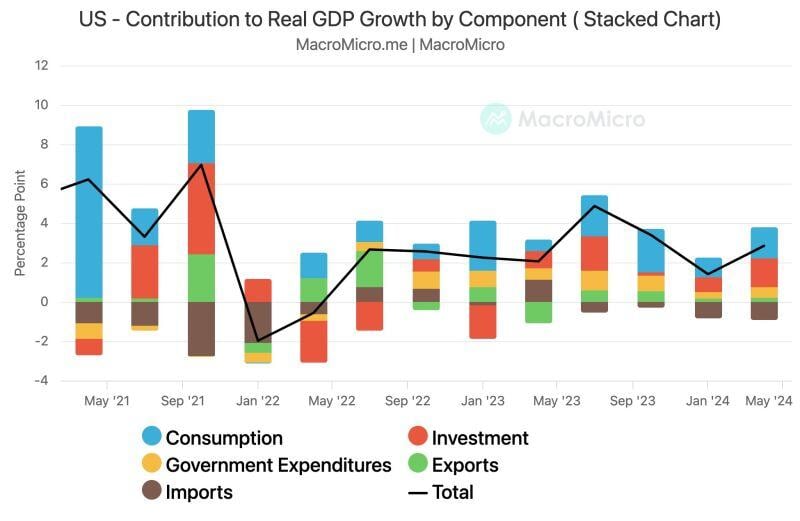

🚨 Breaking! US GDP growth surpasses expectations, hitting 2.8% (est. 2.0%, prev. 1.4%).

GDP Annualized QoQ Contribution: Consumption 1.57 pp (prev. 0.98 pp) Government Spending 0.53 pp (prev. 0.31 pp) Investment 1.46 pp (prev. 0.77 pp) Exports 0.22 pp (prev. 0.17 pp) Imports -0.93 pp (prev. -0.82 pp) Source: MacroMicro

Bulls praying to Lord Powell for a rate cut next week

Source; Barchart

Investing with intelligence

Our latest research, commentary and market outlooks