Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- macro

- equities

- Food for Thoughts

- sp500

- Central banks

- Bonds

- markets

- bitcoin

- Asia

- technical analysis

- investing

- europe

- Crypto

- geopolitics

- tech

- performance

- gold

- Commodities

- AI

- nvidia

- ETF

- earnings

- Forex

- Real Estate

- oil

- banking

- magnificent-7

- Volatility

- nasdaq

- apple

- emerging-markets

- energy

- china

- Alternatives

- switzerland

- tesla

- trading

- sentiment

- russia

- Money Market

- assetmanagement

- UK

- ESG

- Middle East

- microsoft

- amazon

- ethereum

- meta

- bankruptcy

- Turkey

- Healthcare

- Industrial-production

- Global Markets Outlook

- africa

- brics

- Market Outlook

- Asset Allocation Insights

- Flash

- Focus

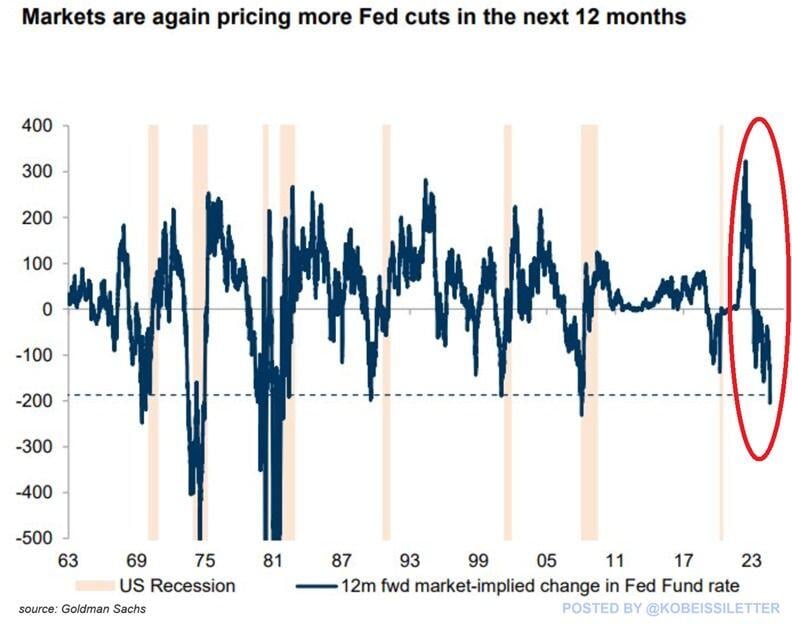

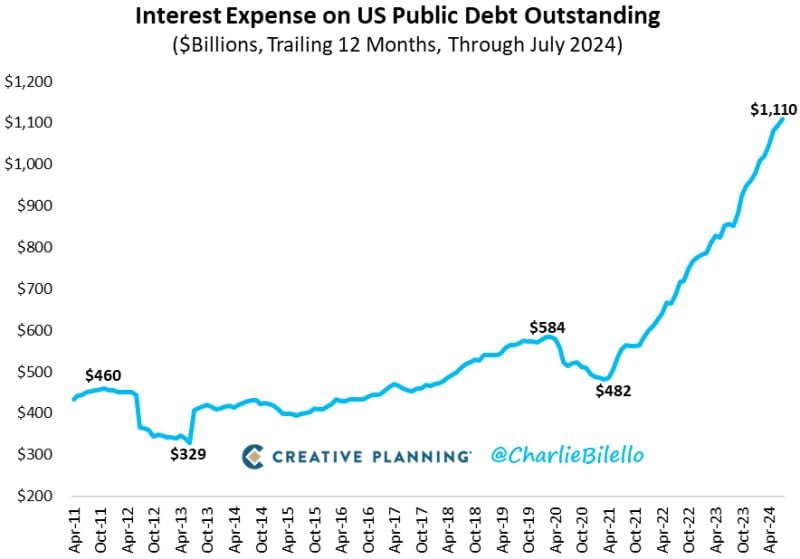

Interest rate futures are now pricing in 8 Fed rate cuts over the next 12 months, the most since the 2008 Financial Crisis.

Market expectations have sharply shifted over the last week toward more cuts in anticipation of economic weakness. Over the last 60 years, every time the market expected 200 basis points of rate cuts, a recession in the US followed within several months. Source: The Kobeissi Letter, Goldman Sachs

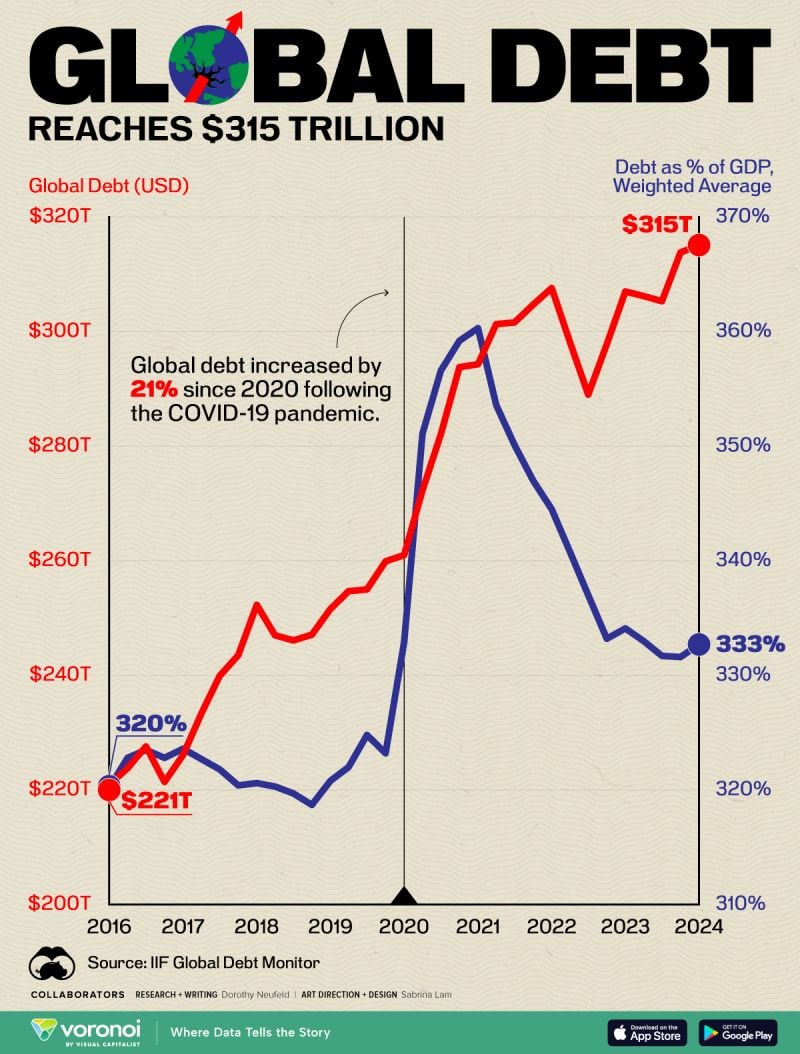

Global debt has officially reached $315 trillion

Source: IIF Global Debt

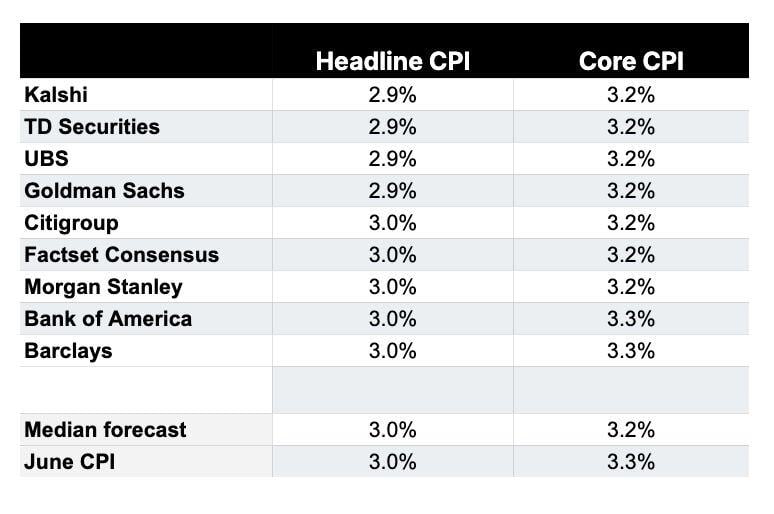

US July CPI inflation expectations:

1. Kalshi: 2.9% 2. TD Securities: 2.9% 3. UBS: 2.9% 4. Goldman Sachs: 2.9% 5. Citigroup: 3.0% 6. Morgan Stanley: 3.0% 7. Bank of America: 3.0% 8. Barclays: 3.0% The median July CPI expectation shows headline inflation at 3.0% and Core CPI inflation at 3.2%. If today CPI inflation comes in at 2.9% or lower, it will mark the first month with inflation under 3.0% since March 2021. Today's CPI report could solidify a hashtag#fed September rate cut. Source: The Kobeissi Letter

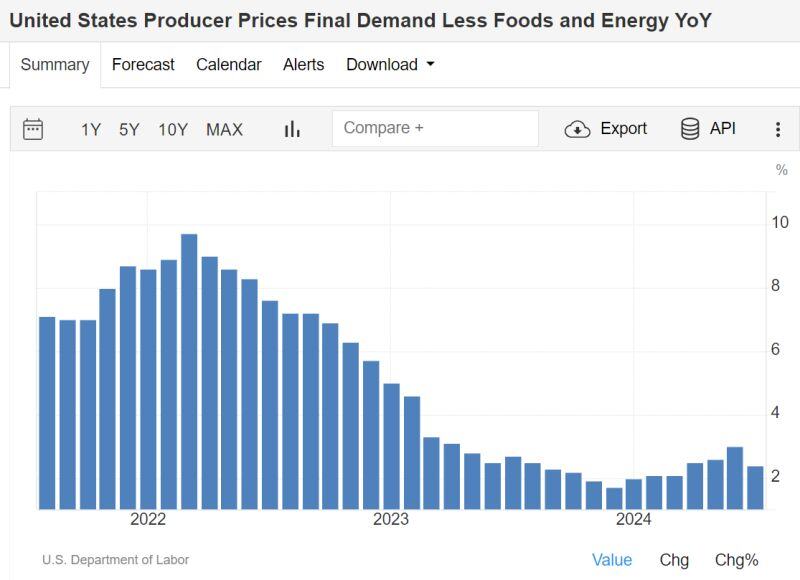

BREAKING: US July PP inflation falls to 2.2%, below expectations of 2.3%

Core PPI inflation falls to 2.4%, below expectations of 2.7%. This is the first drop in Core PPI YoY since December last year... In another constructive sign, PPI inflation is now at its lowest level since March 2024. A September hashtag#fed rate cut seems to be on its way. PPI numbers in a nutshell: - PPI 0.1% MoM, Exp. 0.2% - PPI Core 0.0% MoM, Exp. 0.2% - PPI 2.2% YoY, Exp. 2.3% - PPI Core 2.4% YoY, Exp. 2.6% Source: The Kobeissi Letter, US Department of Labor, Mike Z.

Investing with intelligence

Our latest research, commentary and market outlooks