Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- macro

- equities

- Food for Thoughts

- sp500

- Central banks

- Bonds

- markets

- bitcoin

- Asia

- technical analysis

- investing

- europe

- Crypto

- geopolitics

- performance

- tech

- gold

- Commodities

- AI

- nvidia

- ETF

- earnings

- Forex

- Real Estate

- oil

- banking

- Volatility

- magnificent-7

- nasdaq

- apple

- china

- emerging-markets

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- russia

- Money Market

- assetmanagement

- UK

- ESG

- Middle East

- microsoft

- amazon

- ethereum

- meta

- bankruptcy

- Turkey

- Healthcare

- Industrial-production

- Global Markets Outlook

- africa

- brics

- Market Outlook

- Asset Allocation Insights

- Flash

- Focus

BREAKING: May PPI inflation was unchanged, at 2.2%, below expectations of 2.5%.

Core PPI inflation fell to 2.3%, below expectations of 2.4%. This ends the first 3 consecutive monthly increase in PPI inflation since April 2022. Another welcomed sign by the Fed after CPI. YoY Growth: PPI (May), 2.2% Vs. 2.5% Est. (prev. 2.2%) Core PPI, 2.3% Vs. 2.5% Est. (prev. 2.4%) MoM Growth: PPI (May), -0.2% Vs. 0.1% Est. (prev. 0.5%) Core PPI, 0.0% Vs. 0.3% Est. (prev. 0.5%)

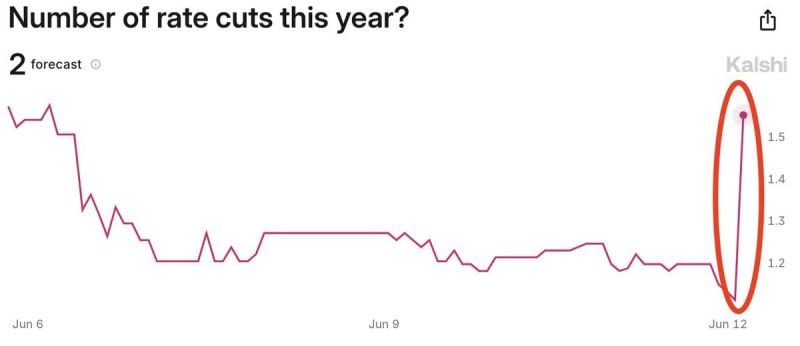

BREAKING: Prediction markets officially price-in 2 interest rate cuts this year after CPI inflation data.

The odds of no cuts have fallen from 33% to 24% over the last few minutes, according to @Kalshi. Meanwhile, market implied odds of exactly 2 rate cuts have spiked from 21% to 35%. Less than 2 months ago, the base case showed 0 rate cuts in 2024 with odds of rate HIKES spiking. 6 months ago, markets showed a base case of 6 interest rate cuts in 2024. Source: The Kobeissi Letter

The global debt crisis: Total world governments' debt hit a whopping $315 trillion in Q1 2024, a new all time high.

In Q1 alone, total global debt increased by $1.3 trillion. At the same time, emerging markets debt hit $105 trillion, rising by ~$50 trillion in just a decade with the biggest increase in China. Across developed markets, the US and Japan have added the most debt. Currently, the global debt-to-GDP ratio has surged to 333%, just below a record high of 362% in 2021. Debt is becoming the global "solution." Source: The Kobeissi Letter

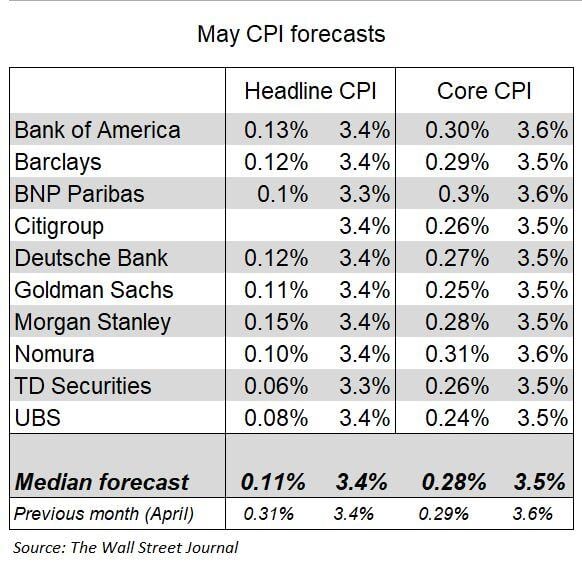

Inflation forecasters see the core US CPI posting roughly a similar increase in May as in April.

An increase of 0.28% in the core CPI would lower the y/y rate to 3.5% Source: Nick Timiraos, Wall Street Journal

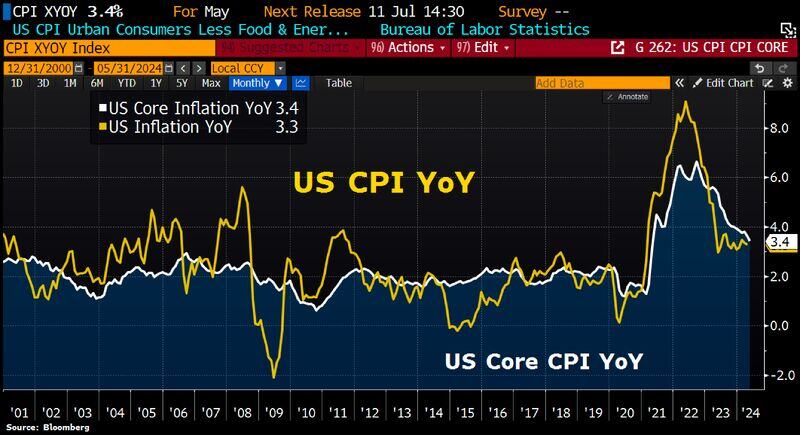

Bonds, stocks, gold and cryptos rally following cooler-than-expected US inflation data.

May headline CPI slowed by 10bps to 3.3% YoY vs 3.4% expected. Core slowed 20bps to 3.4% vs 3.5% expected. Super Core CPI TURNED NEGATIVE (!) -0.05% MoM - its first drop since Sept 2021 (but that left the YoY level still above 5.0%). Details: CPI data for May 2024 • Inflation was softer than expected in May: headline 0.0% MoM vs +0.1% expected; “core” inflation +0.2% MoM (+0.163% unrounded) vs +0.3% expected • As a result, the yearly headline inflation rate is down to +3.3% (after +3.4% in April) and the “core” inflation rate is down to +3.4% (+3.6% in April), its lowest level in three years. • Inflation is still above the Fed’s target of 2% but the trend toward slower inflation has resumed, after the upside surprises of the first quarter of the year. - Housing (shelter) inflation remains firm, but CPI inflation excluding shelter (+2.1% YoY%) is now back (almost) at the level targeted by the Fed. - Inflation in services, that has been strong in the previous months, is finally slowing down (+0.2% in May vs +0.4% in April and +0.5% in March). - Prices of durable and nondurable goods have declined in May (-0.5% and -0.4% respectively). • Those data confirm our scenario of a gradual disinflationary trend at play in the US, as labor market tensions ease and consumer demand loses some momentum. Impact on the hashtag#Fed • Following the release, and ahead of the Fed’s meeting tonight, the probability of a Fed rate cut in September has increased to 62%, • A Fed rate cut at the November meeting (two days after the US Presidential elections) is now fully priced in. • Future markets also fully price a second rate cut at the December meeting. • After the FOMC meeting tonight (no rate cut expected), Fed’s members will update their economic and rate projections. • Those CPI data are probably a relief for the Fed and will likely prevent hawkish surprises and significant revisions to the upside on the expected path of Fed Fund rates in 2024 and 2025. Source: HolgerZ, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks