Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- macro

- equities

- Food for Thoughts

- sp500

- Central banks

- Bonds

- markets

- bitcoin

- Asia

- technical analysis

- investing

- europe

- Crypto

- geopolitics

- tech

- performance

- gold

- Commodities

- AI

- nvidia

- ETF

- earnings

- Forex

- Real Estate

- oil

- banking

- magnificent-7

- Volatility

- nasdaq

- apple

- emerging-markets

- energy

- china

- Alternatives

- switzerland

- tesla

- trading

- sentiment

- russia

- Money Market

- assetmanagement

- UK

- ESG

- Middle East

- microsoft

- amazon

- ethereum

- meta

- bankruptcy

- Turkey

- Healthcare

- Industrial-production

- Global Markets Outlook

- africa

- brics

- Market Outlook

- Asset Allocation Insights

- Flash

- Focus

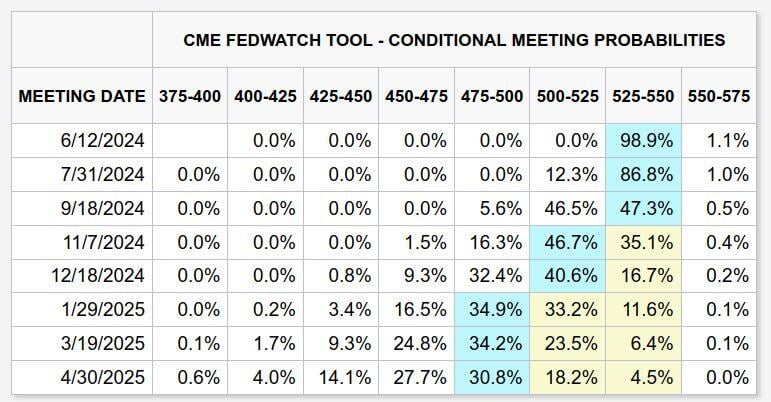

After the hotter than expected Flash PMI prints yesterday, the market is pricing in one cut for this year to occur in November or December, and another in early 2025.

Source: Markets & Mayhem

BREAKING: TANGIBLE SIGN OF US CONSUMER WEAKNESS?

Target stock, $TGT, falls 8% after reporting weaker than expected earnings with a 3% revenue decline due to consumer weakness. Target's CEO said the decline reflects “continued soft trends in discretionary categories.” The company's store traffic fell by 1.9% less quarter and the average amount spent by customer also fell 1.9%. Consumers bought fewer everyday items like groceries along with fewer discretionary goods. Another sign that consumers are struggling. Source: The Kobeissi Letter

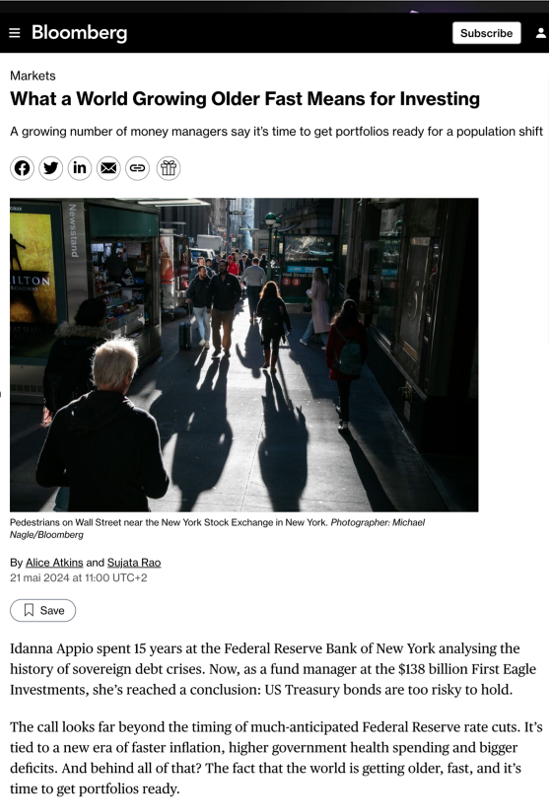

The implications of an aging population for investment strategies

Source: Bloomberg

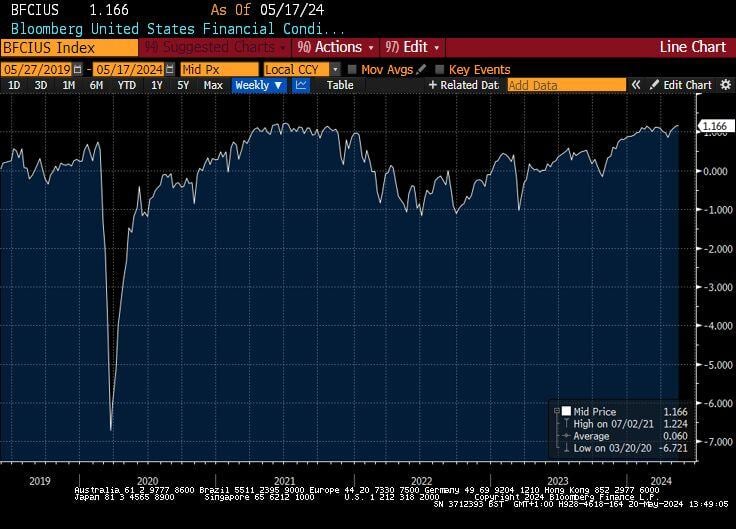

While the FED monetary policy is seen as restrictive, the Bloomberg US Financial Conditions Index is at record highs.

Risk premia in stocks and credit are near all-time tights as commodities are breaking higher. Source: Bloomberg

China may well be the world leader for de-risking trade ties

• Chinese firms have been developing ties with emerging markets over past ten years • This reduces China's reliance on unfriendly markets (🇺🇸🇪🇺), shielding Beijing from geopolitical tensions Source: FT, Agathe Demarais

JUST IN: The Biden administration announces it is releasing 1 million barrels of gasoline from a Northeast reserve.

These reserves were established to supplement in times of a natural disaster. However, the Biden Administration said this is a move to lower gas prices ahead of the summer. The sale, from storage sites in New Jersey and Maine, will be allocated in increments of 100,000 barrels at a time. Energy Department officials said this should help create lower gas prices by July 4th. Energy inflation is still a major issue. Source: The Kobeissi Letter

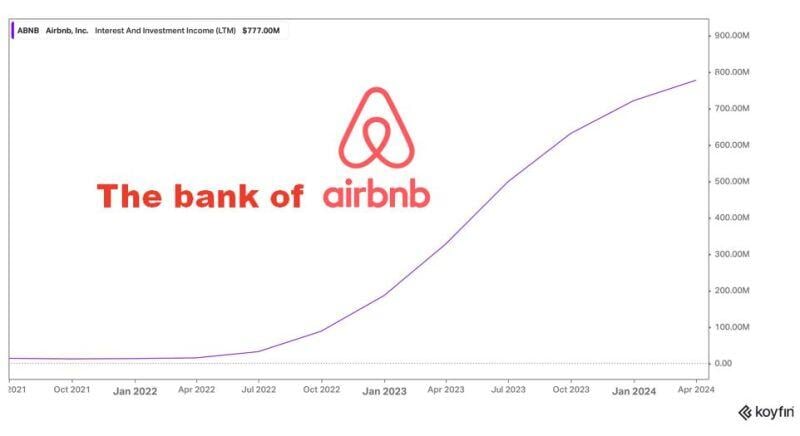

The Bank of Airbnb $ABNB by Wolf of Harcourt Street

ABNB's interest income has skyrocketed to $777 million over the past 12 months. This return is more akin to a bank than a travel company. ABNB benefits from being the Merchant of Record which means that it is the party that processes and distributes the actual payment for a product or service. When a customer makes a booking on Airbnb, Airbnb receives the cash in advance. This cash is held on behalf of the host and paid out once the service has been provided. With the interestrate hikes over the past year, Airbnb was able to benefit from investing the cash in short-term US Treasury bills before paying it out to hosts. Source: Wolf of Harcourt Street

Investing with intelligence

Our latest research, commentary and market outlooks