Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- macro

- equities

- Food for Thoughts

- sp500

- Central banks

- Bonds

- markets

- bitcoin

- Asia

- technical analysis

- investing

- europe

- Crypto

- geopolitics

- tech

- performance

- gold

- Commodities

- AI

- nvidia

- ETF

- earnings

- Forex

- Real Estate

- oil

- banking

- magnificent-7

- Volatility

- nasdaq

- apple

- emerging-markets

- energy

- china

- Alternatives

- switzerland

- tesla

- trading

- sentiment

- russia

- Money Market

- assetmanagement

- UK

- ESG

- Middle East

- microsoft

- amazon

- ethereum

- meta

- bankruptcy

- Turkey

- Healthcare

- Industrial-production

- Global Markets Outlook

- africa

- brics

- Market Outlook

- Asset Allocation Insights

- Flash

- Focus

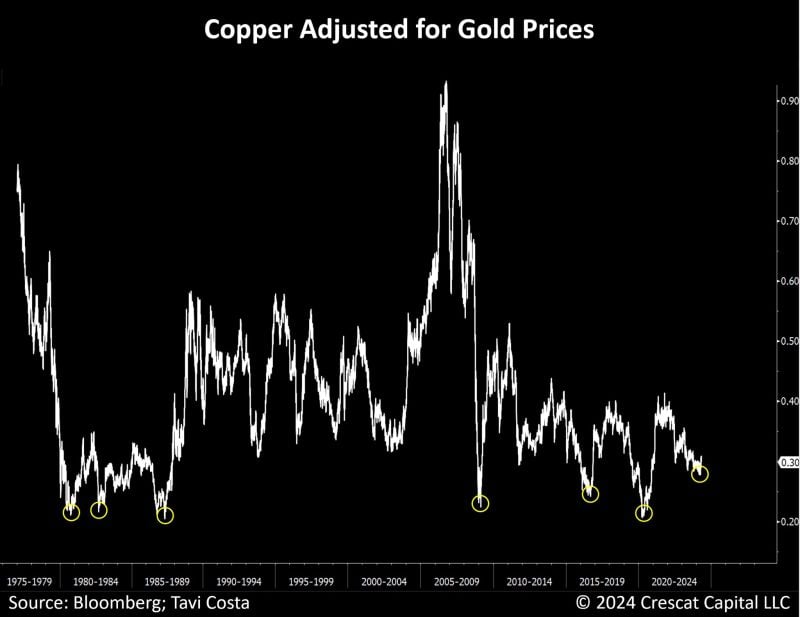

As highlighted by Tavi Costa ->

Despite the recent surge in copper prices, when adjusted for true inflation, the metal is trading at levels we saw in the early 1990s. Will copper prices adjusted for gold still be this low by the end of this decade if we proceed with one of the largest infrastructure developments we've seen in the last 100 years??? Source: Crescat Capital, Bloomberg

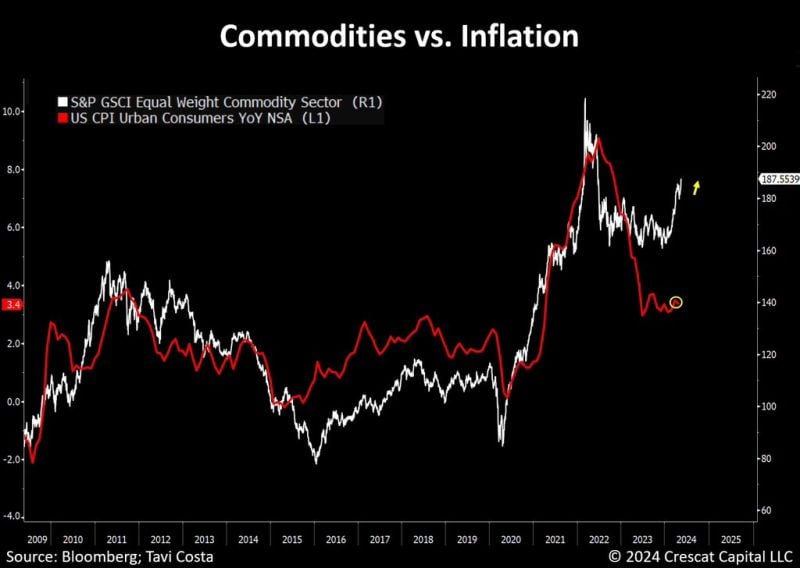

Could headline inflation start following the rebound in commodities prices?

Source: Tavi Costa, Bloomberg

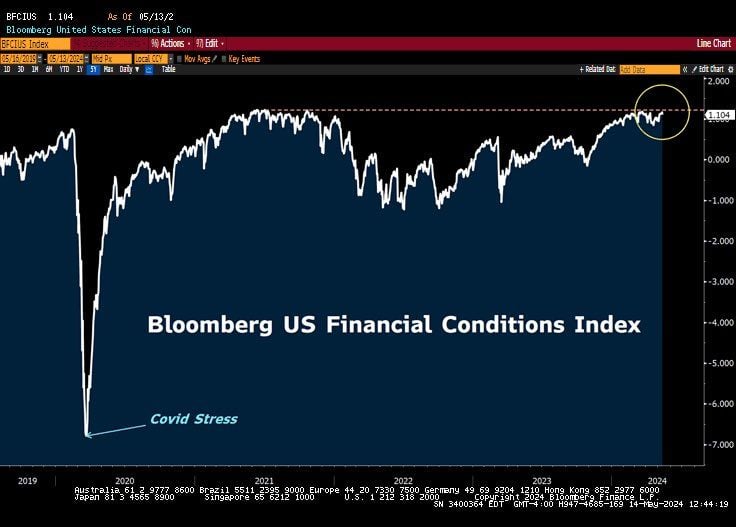

Today’s inflation numbers are seen as a relief by investors… and the FED

Indeed, the just released data shows that US inflation cooled down in April for the first time in 6 months, following several reports of upside surprises. While yoy headline inflation is in-line with expectations (+3.4pct) the positive surprise came from the MoM number (+0.3pct) which is BELOW estimates (+0.4pct). Core inflation number MoM came in as expected (+0.3pct). The core yoy number (+3.6pct as expected) is at the lowest level since April 2021. Bottom-line: this report is bullish equities, bonds, gold and cryptos as it indicated that the disinflation trend might have further to go. Still, we believe that the Fed might wait for some confirmation before turning dovish. We note that the SuperCore (core ex-shelter) rose 0.5pct MoM to 5.05pct YoY. Source: CNBC

“We have to let restrictive policy do its work on inflation.”

Fed Chair Jay Powell Source: Lawrence McDonald, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks