Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- macro

- equities

- Food for Thoughts

- sp500

- Central banks

- Bonds

- markets

- bitcoin

- Asia

- technical analysis

- investing

- europe

- Crypto

- geopolitics

- tech

- performance

- gold

- Commodities

- AI

- nvidia

- ETF

- earnings

- Forex

- Real Estate

- oil

- banking

- magnificent-7

- Volatility

- nasdaq

- apple

- emerging-markets

- energy

- china

- Alternatives

- switzerland

- tesla

- trading

- sentiment

- russia

- Money Market

- assetmanagement

- UK

- ESG

- Middle East

- microsoft

- amazon

- ethereum

- meta

- bankruptcy

- Turkey

- Healthcare

- Industrial-production

- Global Markets Outlook

- africa

- brics

- Market Outlook

- Asset Allocation Insights

- Flash

- Focus

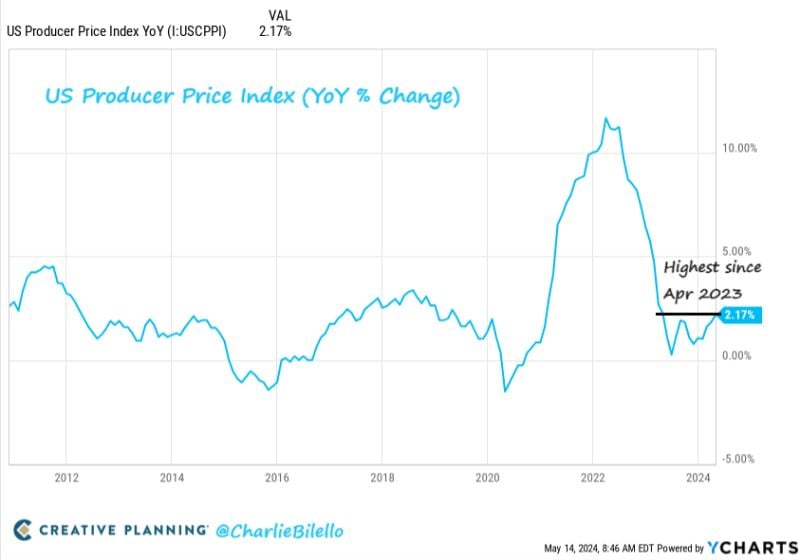

BREAKING: April PPI inflation RISES to 2.2%, in-line with expectations of 2.2%

Core PPI inflation was 2.4%, in-line with expectations of 2.4%. PPI inflation is now up for 3 straight months for the first time since April 2022. This is the highest PPI reading since April 2023. Note that revisions from last month’s PPI left people feeling it wasn’t as “hot” as initially thought on headline numbers. Source: Charlie Bilello

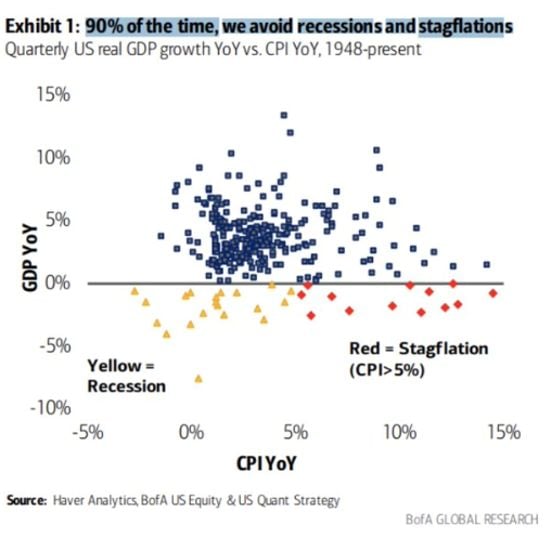

Recession and stagflation don't happen often in the grand scheme of things... 90% of the time we avoid them...

Source: BofA

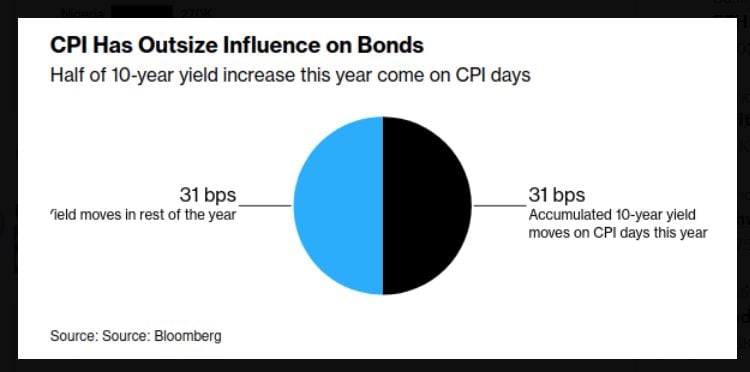

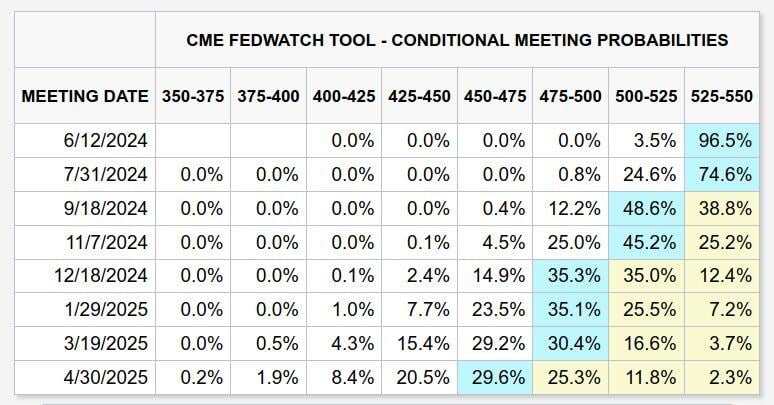

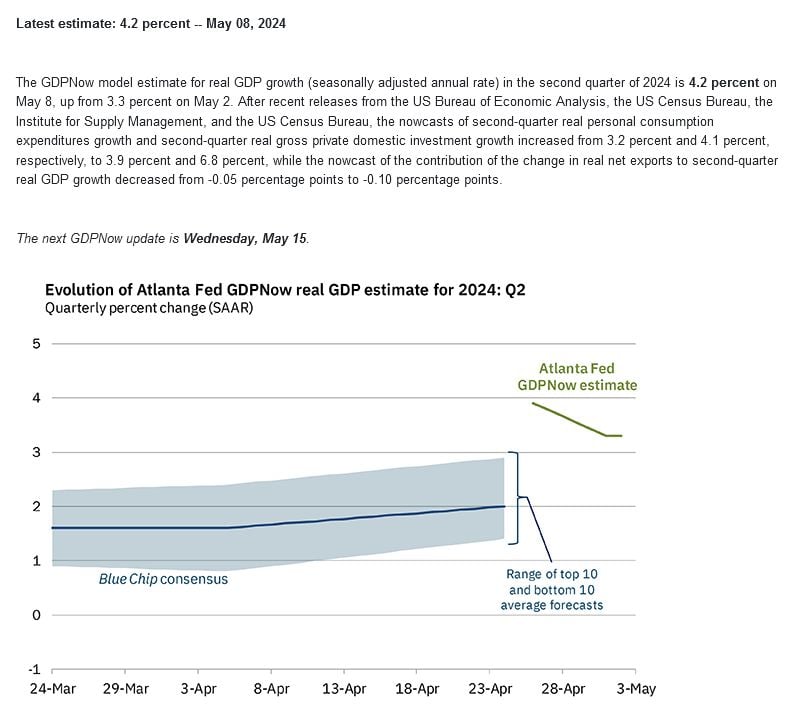

Markets are currently anticipating the first Fed cut in September and a potential second cut in December.

This week's US inflation data could shift these expectations backward or forward depending on how the data comes in. Source: Markets & Mayhem

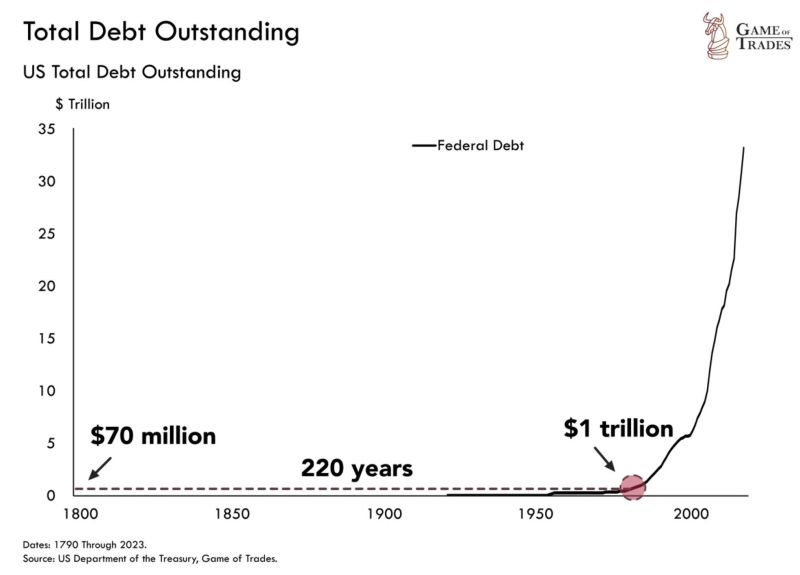

In 1971 the US came off the gold standard

Source: Game of Trades, Michael Burry Stock Tracker ♟

JUST IN: Argentina to print its first 10,000-peso note as a result of hyper-inflation.

Source: Radar

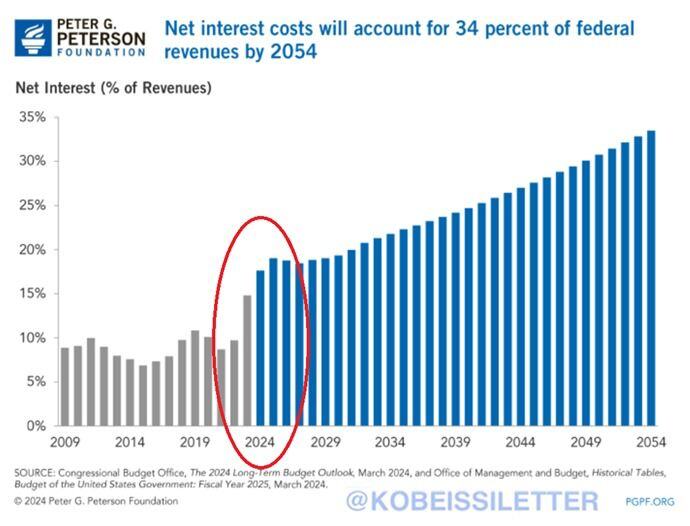

Shocking stat of the day by The Kobeissi Letter:

US net interest payments as a percentage of federal revenues are set to reach 34% by 2054. This means that ONE THIRD of all government revenue would be spent only to service the national debt. Over the past 8 years, the percentage has already doubled to ~15% and is at its highest in 3 decades. Meanwhile, nominal annualized interest payments have crossed above $1 trillion for the first time ever. We could see $1.6 trillion in annual interest expense by the end of the year if the Fed leaves rates steady. The US government needs lower interest rates more than anyone - i.e Fiscal policy leads monetary policy. Source: The Kobeissi Letter, Peter G.Peterson

Investing with intelligence

Our latest research, commentary and market outlooks