Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- macro

- equities

- Food for Thoughts

- sp500

- Central banks

- Bonds

- markets

- bitcoin

- Asia

- technical analysis

- investing

- europe

- Crypto

- geopolitics

- tech

- performance

- gold

- Commodities

- AI

- nvidia

- ETF

- earnings

- Forex

- Real Estate

- oil

- banking

- Volatility

- magnificent-7

- nasdaq

- apple

- emerging-markets

- china

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- russia

- Money Market

- assetmanagement

- UK

- ESG

- Middle East

- microsoft

- amazon

- ethereum

- meta

- bankruptcy

- Turkey

- Healthcare

- Industrial-production

- Global Markets Outlook

- africa

- brics

- Market Outlook

- Asset Allocation Insights

- Flash

- Focus

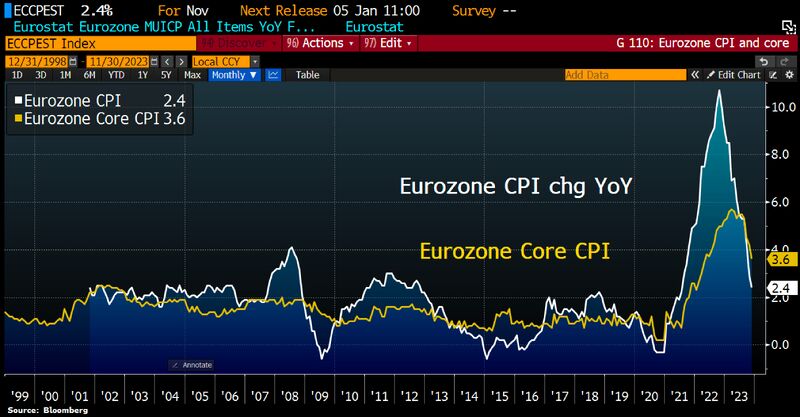

Eurozone inflation cooled more than expected, putting 2% target in sight:

Headline CPI rose 2.4% YoY in November down from 2.9% in October. Core CPI, which excludes volatile components like fuel & food, moderated for a 4th month to 3.6% from 4.2% in October. Markets are now pricing 1st ECB rate cut to take place at the April meeting. Source: HolgerZ, Bloomberg

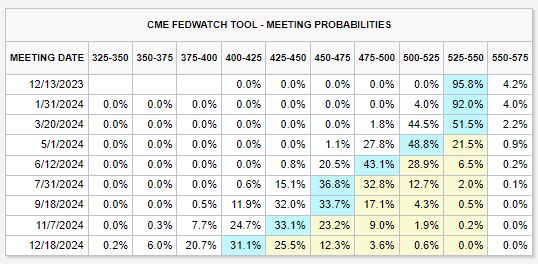

Futures are now showing a ~45% chance that FED rate CUTS begin as soon as March 2024

There's also a growing (but small) chance that rate cuts begin in January 2024, at 4%. Prior to the most recent CPI inflation data, the base case showed rate cuts beginning in June 2024. There was also a 50% chance of another rate HIKE in 2024. This has been a quick turnaround... Source: The Kobeissi Letter

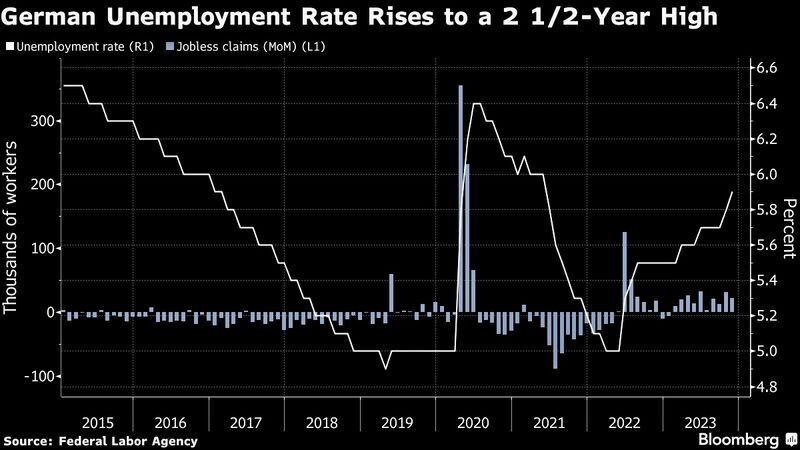

German inflation sinks more than expected as energy retreats & costs of fuels & travel fell sharply from prior mth

Headline CPI slows to 3.2% YoY in Nov from 3.8% in Oct & vs 3.5% exp. Food inflation slows to 5,5% from 6.1%, Core CPI dropped from 4.3% to 3.8%, so a long way to go to 2% goal. Source: Bloomberg, HolgerZ

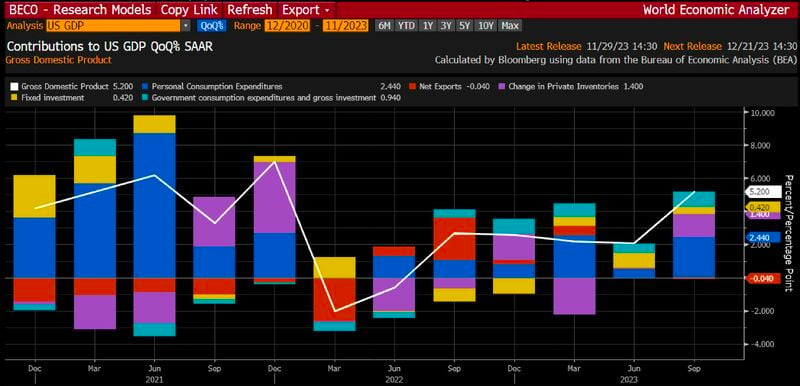

US GDP update shows US economy grew at more robust annualized rate of 5.2% in Q3, revised from +4.9% and after +2.1% QoQ in Q2

The Q3 contribution from inventories was +1.4%, revised from +1.3%, after 0% in Q2. Contribution from consumers +2.4% revised down from prev 2.7%. Contribution from net exports was -0.04%, revised from -0.08%, after +0.04% in Q2. Source: HolgerZ, Bloomberg

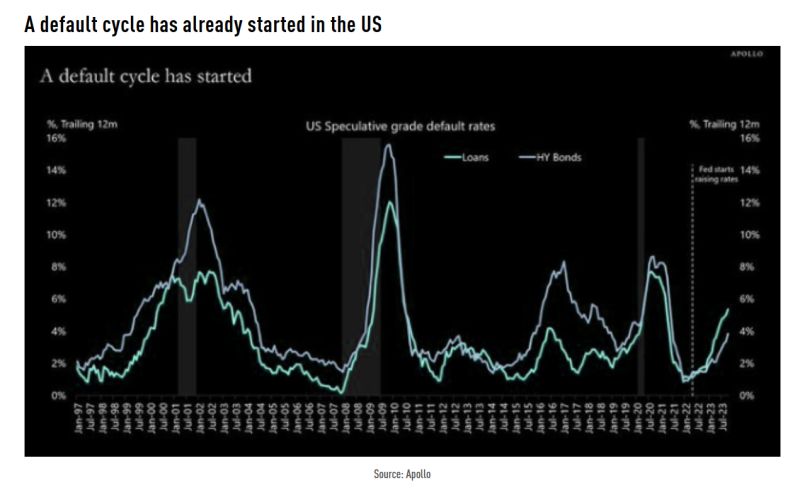

Since the Fed started raising rates in March 2022, default rates have gone from 1% to 5%+

Source: Apollo, TME

Investing with intelligence

Our latest research, commentary and market outlooks