Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- macro

- equities

- Food for Thoughts

- sp500

- Central banks

- Bonds

- markets

- bitcoin

- Asia

- technical analysis

- investing

- europe

- Crypto

- geopolitics

- tech

- performance

- gold

- Commodities

- AI

- nvidia

- ETF

- earnings

- Forex

- Real Estate

- oil

- banking

- magnificent-7

- Volatility

- nasdaq

- apple

- emerging-markets

- energy

- china

- Alternatives

- switzerland

- tesla

- trading

- sentiment

- russia

- Money Market

- assetmanagement

- UK

- ESG

- Middle East

- microsoft

- amazon

- ethereum

- meta

- bankruptcy

- Turkey

- Healthcare

- Industrial-production

- Global Markets Outlook

- africa

- brics

- Market Outlook

- Asset Allocation Insights

- Flash

- Focus

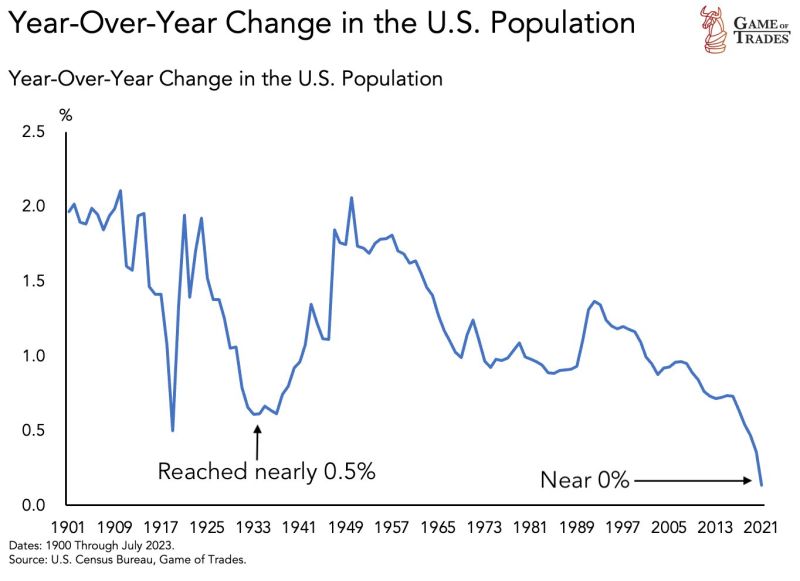

Demographics is becoming a serious issue for US growth

As shown on the chart below, US population growth has collapsed, reaching levels near 0% indicating almost NO growth. This is actually the worst population growth setup seen in over 100 years of US history. Current levels have NEVER been seen in 100+ years. Even during the Great Depression, population growth bottomed out at around 0.5% Source: Game of trades

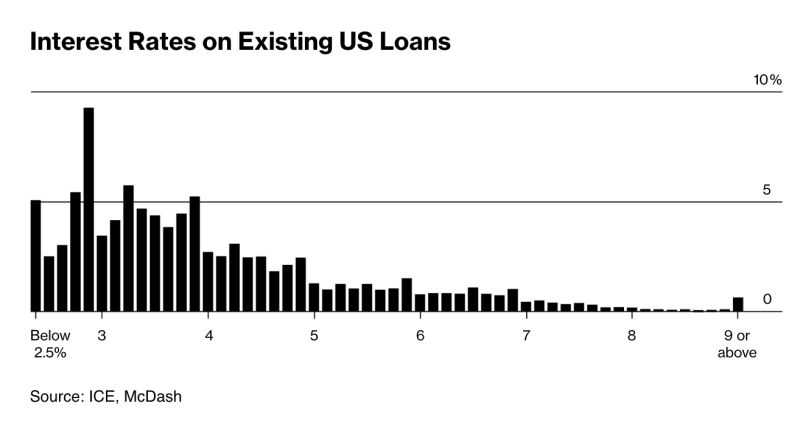

The chart below shows the distribution of interest rates on outstanding US mortgages

Over 30% of borrowers have rates below 3%, up from just ~5% of borrowers prior to the pandemic. Virtually no new mortgages are being taken out at 7%+ interest rates that we currently see. real estate market seems to be frozen Source: The Kobeissi Letter, ICE

China reported a worse-than-expected drop in exports in October, while imports surprisingly rose for the month from a year ago

China’s customs agency said exports in U.S. dollar terms fell by 6.4% in October from a year ago. That’s worse than the 3.3% drop predicted by a Reuters poll. Overall, China’s exports have fallen on a year-on-year basis every month this year starting in May. The last positive print for imports on a year-on-year basis was in September last year. China’s exports to Southeast Asia and the European Union fell by double digits in October, according to CNBC calculations of official data. Exports to the U.S. dropped by more than 8%, the analysis showed. Imports rose by 3% in U.S. dollar terms in October from a year ago. That’s in contrast to the Reuters’ forecast for a 4.8% drop from a year ago. However, China’s imports from the U.S. were down by 3.7% in October versus the year ago period, CNBC calculations of customs data showed. China’s imports from the European Union rose by more than 5%, while those from the Association of Southeast Asian Nations grew by 10.2%, the analysis showed. Source: CNBC

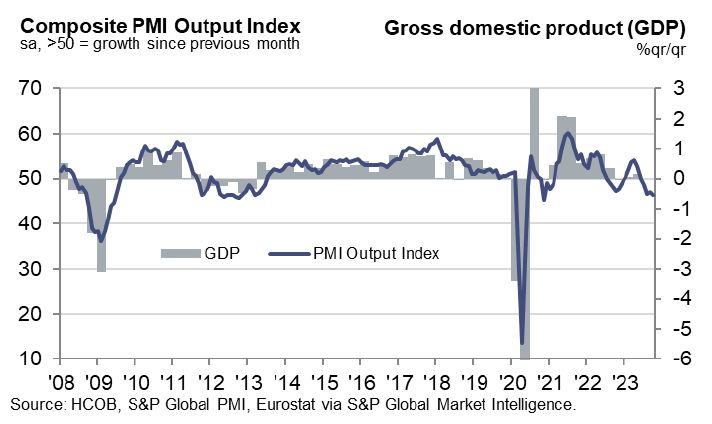

The European composite PMI output index pointed to the sharpest decline in nearly three years

October's data also showed firms in the region cutting staff on a net basis for the first time since early 2021 The region is quite likely to go into a recession. Source: Markets Mayhem

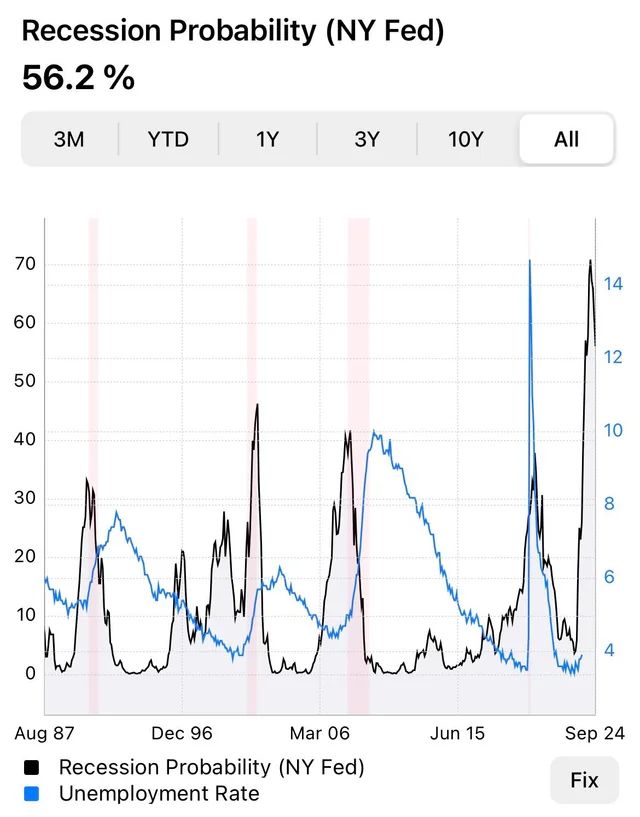

NY FED recession probability is on highs

Unemployment is going up. Similar pattern was right before most previous recessions. Source: Wall Street Silver

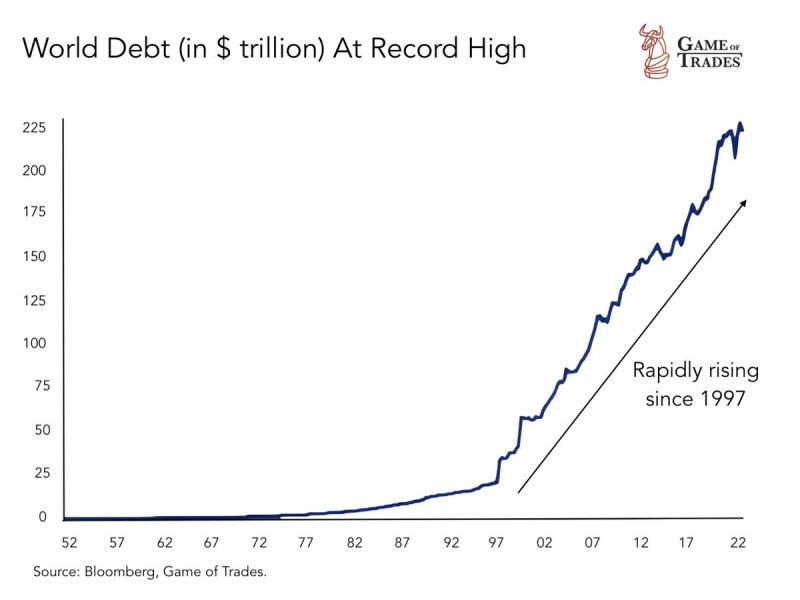

World debt has rapidly increased since 1997. And is now around $225 trillion. Is it sustainable?

Source: Game of Trades

Investing with intelligence

Our latest research, commentary and market outlooks