Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- macro

- equities

- Food for Thoughts

- sp500

- Central banks

- Bonds

- markets

- bitcoin

- Asia

- technical analysis

- investing

- europe

- Crypto

- geopolitics

- performance

- tech

- gold

- Commodities

- AI

- nvidia

- ETF

- earnings

- Forex

- Real Estate

- oil

- banking

- Volatility

- magnificent-7

- nasdaq

- apple

- china

- emerging-markets

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- russia

- Money Market

- assetmanagement

- UK

- ESG

- Middle East

- microsoft

- amazon

- ethereum

- meta

- bankruptcy

- Turkey

- Healthcare

- Industrial-production

- Global Markets Outlook

- africa

- brics

- Market Outlook

- Asset Allocation Insights

- Flash

- Focus

China on Wednesday reported better-than-expected retail sales and industrial data for October, while the real estate drag worsened

- Retail sales grew by 7.6% last month from a year ago, above the 7% growth forecast by a Reuters poll. Retail sales, sports and other leisure entertainment products saw sales surge by 25.7% in October from a year ago, the data showed. Catering, as well as alcohol and tobacco, saw sales surge by double digits. Auto-related sales rose by 11.4% from a year ago. - Industrial production rose by 4.6% year-on-year in October, faster than the 4.4% pace predicted by the Reuters poll. - Fixed asset investment for the first 10 months of the year grew by 2.9% from a year ago, missing expectations for a 3.1% increase. - Investment into real estate fell by 9.3% during that time, a steeper decline than the 9.1% drop reported for the first nine months of the year. - The urban unemployment rate was 5%, the National Bureau of Statistics said. That was unchanged from September. The bureau has suspended reports of the unemployment rate for young people since summer. Source: CNBC

What a day...

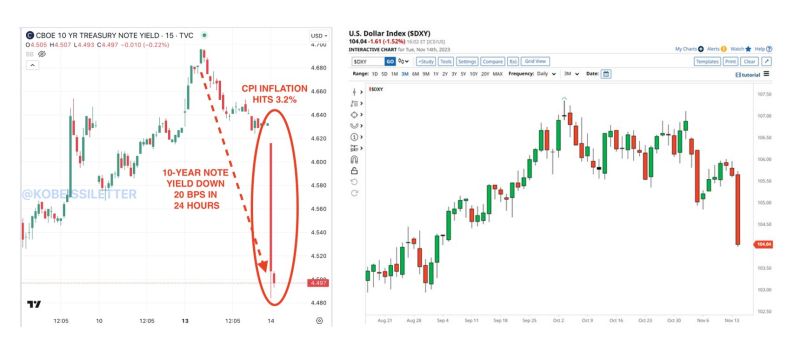

The US 10-year note yield fell sharply to 4.49%, after CPI inflation hits 3.2% in October. The 10-year note yield went down 20 basis points in 24 hours. Meanwhile, the U.S. Dollar Index $DXY had its biggest drop in more than a year. Source: The Kobeissi Letter, Barchart

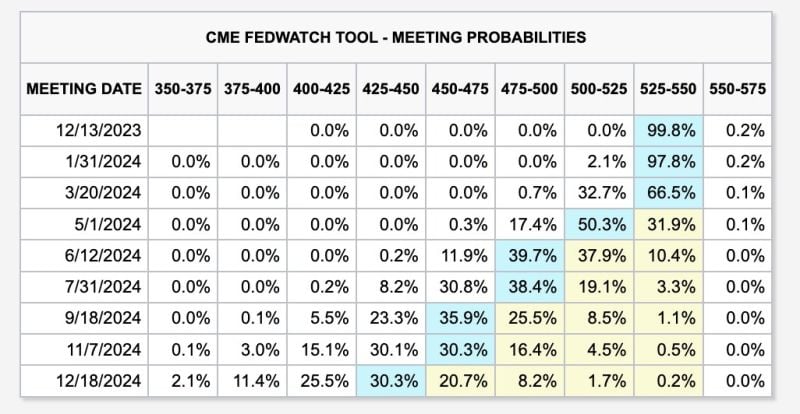

JUST IN: Futures now show a 0% chance of additional rate hikes with rate cuts beginning in May 2024

Prior to today's CPI report, there was a 30% chance of at least one more rate hike ahead. Rate cuts were expected to begin in June 2024. Now, markets are pricing-in at least 4 rate CUTS in 2024. Markets are betting that the Fed is done. Source: The Kobeissi Letter

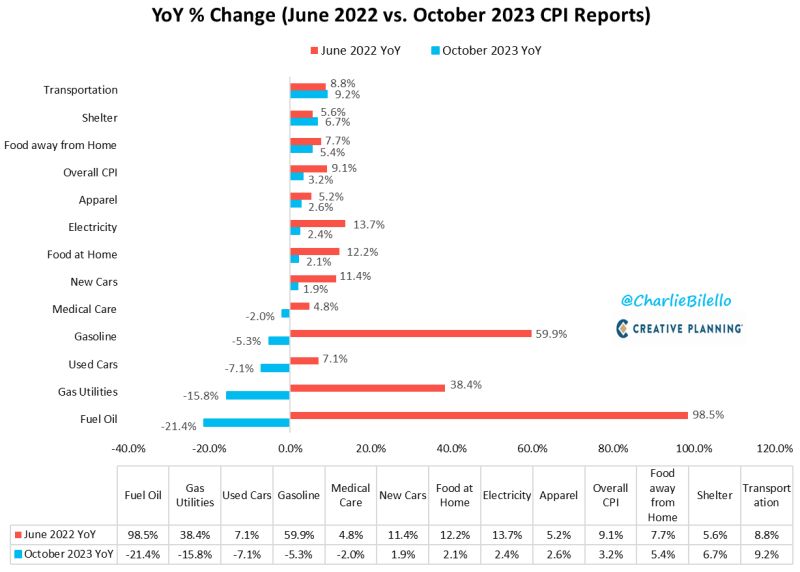

US CPI has moved down from a peak of 9.1% in June 2022 to 3.2% today

What's driving that decline? Lower rates of inflation in Fuel Oil, Gas Utilities, Used Cars, Gasoline, Medical Care, New Cars, Food at Home, Electricity, Apparel, and Food away from Home. Shelter and Transportation are the only major components that have a higher inflation rate today than June 2022. Source: Charlie Bilello

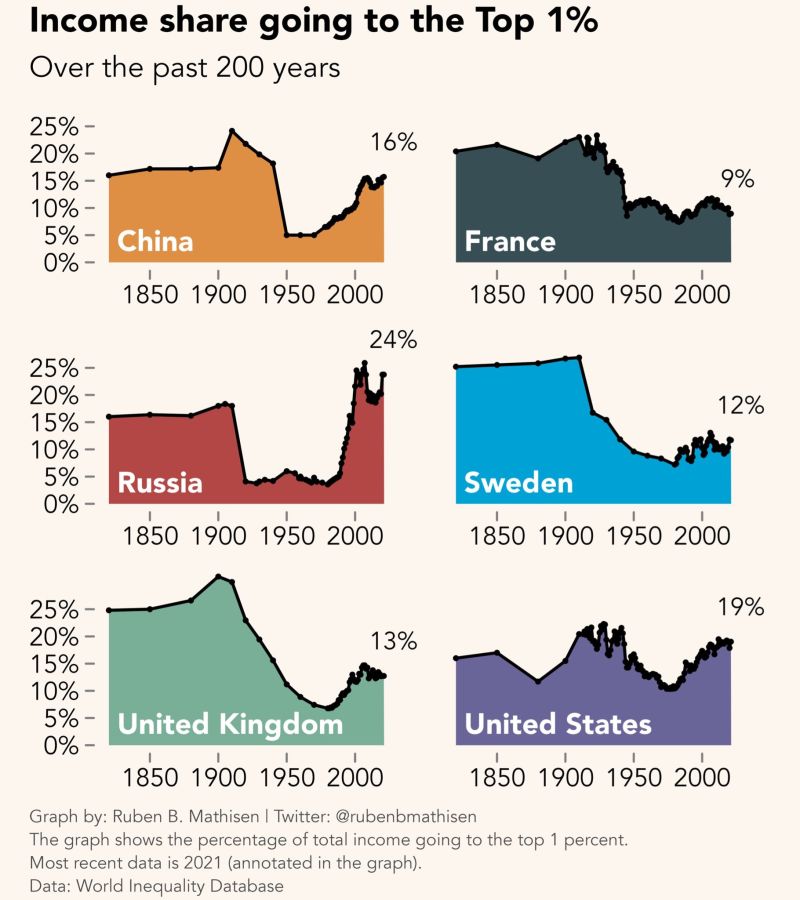

Income & wealth inequality is not just a capitalist country story. Watch Russia and China...

Source: Ruben Mathisen

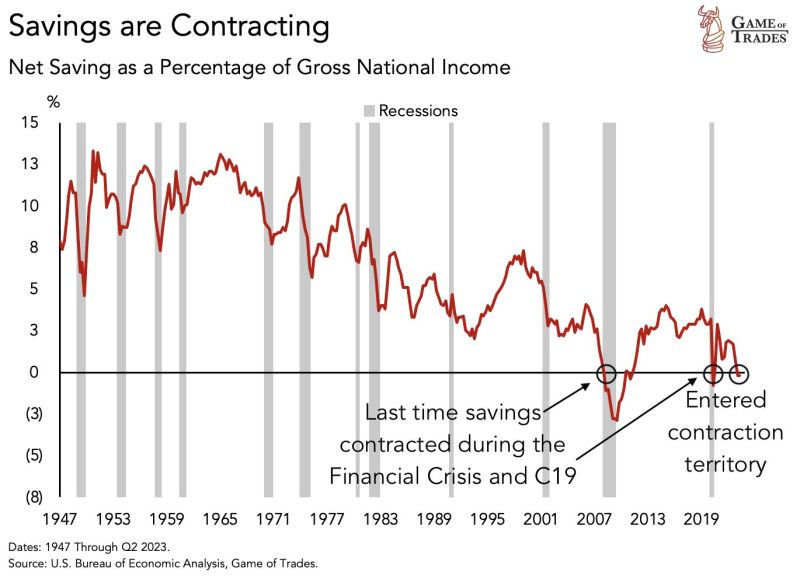

This has happened ONLY 2 times in the last 75 years. In the US, savings as a % of income is now contracting, indicating that people are find it VERY hard to save

The last 2 contractions happened in: - 2008 - 2020 High interest rate + high debt is a MAJOR problem for people Source: Game of Trades

Investing with intelligence

Our latest research, commentary and market outlooks